Join the #1 REIT Newsletter

High Yield Landlord is the largest online community of REIT investors, with over 100,000 followers of our free research and more than 2,000 subscribers to our premium newsletter. While we occasionally share free insights, if you’re ready to take your REIT investing to the next level, sign up for a 14-day free trial of our premium newsletter to gain instant access to my complete REIT portfolio, real-time trade alerts, exclusive CEO interviews, and much more:

Below, we provide more details about High Yield Landlord:

Why Now? The Biggest Opportunity of 2026

Imagine being able to invest in top-quality real estate at an unbeatable price of just 50 cents on the dollar. It sounds too good to be true, right? But what if I told you that this incredible deal also comes with passive income, liquidity, diversification, limited liability, and highly efficient management? That's exactly what the REIT market is offering today.

REIT share prices have crashed, and they are now priced at steep discounts relative to the fair value of the real estate they own.

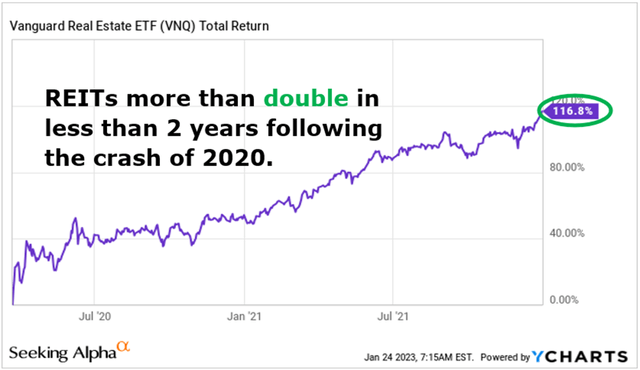

The last two times they were this cheap were following the Great Financial Crisis and the pandemic. Both times, savvy investors made fortunes in the aftermath, as REITs nearly tripled in less than two years following the Great Financial Crisis and more than doubled in just over a year following the pandemic:

Today’s market conditions mirror those of 2009, with REITs trading at steep discounts and offering the potential for substantial returns in the years ahead:

The opportunity is so significant that even the most sophisticated private equity players, such as Blackstone and Starwood, are heavily investing in them. Over the past few years, they have bought tens of billions of dollars' worth of REITs.

"The best opportunities today are clearly in the public markets on the screen and that's where we're spending a lot of time." Jonathan Gray, President/COO, Blackstone

"By the way, when credit comes back, you are gonna see REITs take off... There are some unbelievable bargains in REITs. We did the same thing during the pandemic. We bought a dozen stocks all over the world and we had a 70% IRR on that stuff. We are already buying some stuff in the public market..." Barry Sternlicht, CEO/Chairman, Starwood

"If only," you might say, "there were an easy way to efficiently invest in the best and most opportunistic REITs, selected by experienced professionals who handle the time-consuming work of in-depth research and analysis." Well, read on — that’s exactly what we are here for.

High Yield Landlord is the largest and top-rated community of real estate investors on Seeking Alpha, with more than 2,000 members and a 4.9/5 rating from over 500 reviews. We dedicate thousands of hours and over $100,000 annually to uncover the most profitable REIT investment opportunities — and we share the results with you at just a fraction of the cost.

You could invest in a REIT ETF and call it a day, but you might be leaving a lot of money on the table. As discussed in our REIT investing course, ETFs have several flaws. They are heavily exposed to overpriced large-cap REITs, include many poorly managed REITs with conflicting interests, and blindly allocate funds to struggling sectors such as retail, office, and hotels.

At High Yield Landlord, we aim to do better by being very selective. Out of more than 300 analyzed opportunities, we have cherry-picked the best to maximize long-term returns:

Our unique strategy for achieving long-term outperformance involves several factors:

Overweight Small-Cap REITs: Smaller and lesser-known REITs trade today at much lower valuations than their larger peers. This discount gives us a head start as we earn more cash flow and dividends for every dollar invested.

Invest in Resilient Sectors: Instead of indiscriminately investing in retail, office, or hotel properties, we take a strategic approach by prioritizing sectors with stronger, more resilient fundamentals. Our portfolio emphasizes investments in e-commerce warehouses, data centers, and even farmland — assets that offer greater stability and growth potential.

Skip Poorly Managed REITs: We understand that many REIT suffer significant conflicts of interest. That’s why we steer clear of unreliable options and focus on owner-operated REITs with strong track records of success and integrity.

Buy Below Net Asset Value: We steer clear of overvalued REITs by carefully analyzing their net asset value. Our strategy focuses on securing great deals by acquiring real estate at a significant discount to its fair value.

High Yield Focus: We recognize that real estate is primarily an income-driven investment. That’s why we go beyond the modest 3-4% dividend yields of typical ETFs, targeting a robust and sustainable 6-8% yield to provide strong income as we wait for long-term appreciation.

We call this the “landlord approach to REIT investing” because we treat buying REITs like purchasing rental properties. Our focus is on securing high, sustainable income while always seeking a great deal. The key to success lies in buying below fair value, where money is made at the time of purchase. From there, we patiently hold these undervalued REITs, collect strong income, and wait for long-term appreciation.

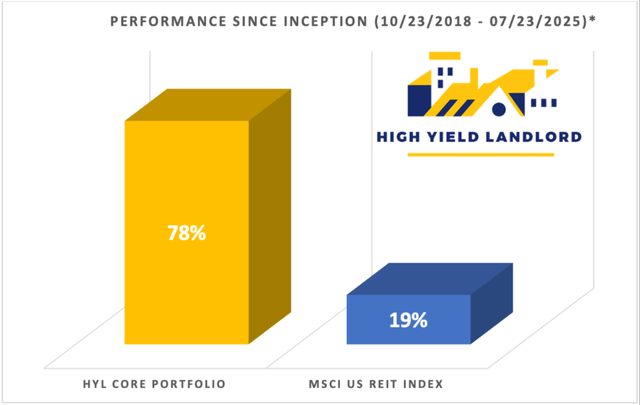

This approach has proven highly successful for me — so much so that I eventually chose to leave my career in private equity real estate to focus entirely on REIT investing. In late 2018, I launched the Core Portfolio of High Yield Landlord, and despite REITs facing a quasi-bear market for much of the past five years, it has still delivered a 78% total return. That performance is particularly impressive given the challenging backdrop: rising interest rates, valuation compression, and sector-wide underperformance have weighed heavily on listed real estate.

For context, our sector benchmark returned just 19% over the same period.

In other words, we earned over 4x more than the market.

Without a prolonged bear market, our returns would likely have been much higher—but this still shows our ability to outperform and deliver strong results even during one of the most difficult five-year stretches in REIT history. As the cycle turns, we expect our results to accelerate and outperformance to widen.

This success inspired me to launch High Yield Landlord to help investors:

(1) Identify the most profitable real estate opportunities.

(2) Earn a high dividend yield alongside long-term appreciation.

(3) Minimize investing fees and other frictional costs.

To my surprise, we grew to become the largest online community of REIT investors, with over 2,000 members on board. While past results don’t guarantee future performance, our members have consistently expressed satisfaction with our strategy. In fact, we are proud to be the highest-rated REIT newsletter, boasting a 4.9/5 rating from over 500 reviews:

We are excited to welcome you to our investment community! Below is a summary of everything included in your membership:

With Your Membership, You Get:

Access to Three Portfolios:

Core Portfolio (Our Main Portfolio): A $800,000 real-money portfolio designed to maximize total returns by focusing primarily on smaller, lesser-known REITs trading at significant discounts.

Retirement Portfolio (Our Secondary Portfolio): A $400,000 real-money portfolio designed to maximize safe income by focusing on large, well-capitalized REITs and real asset-backed preferred shares.

International Portfolio (Our Optional Portfolio): A $400,000 real-money portfolio designed to offer global diversification by focusing on real estate opportunities in Canada, South America, Europe, Asia, and even Africa.

Exclusive Features:

Timely BUY & SELL Alerts: We send alerts every time we make changes to our portfolio, making it easy for members to emulate. We provide full transparency, sharing details such as where we invest, in what quantity, portfolio weightings, when we sell, and where incoming dividends are reinvested.

CEO Interviews: We regularly conduct exclusive interviews with REIT management teams to gain unique insights and stay ahead of the market. So far, we have shared interviews with companies such as VICI, EPRT, O, WPC, ADC, RICK, GOOD, UMH, DEA, VNA, NLCP, and many others.

Market Updates: We publish regular macroeconomic analyses to keep you informed about the broader economic climate and the factors influencing our investment strategy. These insights are essential for supporting your portfolio, especially as we navigate increasingly volatile market conditions.

REIT Market Intelligence: This exclusive tool provides a comprehensive list of REITs categorized by property sector, complete with all the key information you need to make informed decisions: NAV estimates, FFO estimates, FFO growth, FFO multiples, payout ratios, credit ratings, dividend yields, and much more.

Course to REIT Investing: The HYL Course to REIT Investing consists of 10 comprehensive modules designed to provide you with the knowledge and tools needed to become a more confident and successful investor. This course, valued at the cost of membership alone, is offered to all our members at no additional charge.

24/7 Live Chat: Our live chat room is the hub of the HYL community, where members come together to share market news, exchange investment ideas, and support new members. It’s a space where you can ask questions and receive prompt, detailed answers from fellow REIT investors, our dedicated team, and me personally.

Portfolio Tracker: This tool is exclusively designed for High Yield Landlord members, allowing you to easily track all your investments in one place with a clear and simple format.

What are the Differences Between is "High Yield Landlord" and our Free Articles?

High Yield Landlord gives you full access to our investment strategy, emphasizing concise, actionable, and real-time insights.

While our free articles provide general market information, they do not offer the tools to emulate our portfolio strategy. The most valuable features of the service — such as the Portfolio, Trade Alerts, Market Updates, CEO Interviews, Investment Tracking, and Live Chat — are exclusively available to members.

A Team of Five Dedicated Analysts

High Yield Landlord is run by investors with 'real-life' experience in real estate investing rather than by self-proclaimed experts.

Jussi Askola, CFA, is a former private equity real estate investor with experience working for an $800 million investment firm in Dallas, Texas, and acquiring properties in Germany and Estonia. Today, he is the President of Leonberg Capital, a boutique investment firm that specializes in real estate securities. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from the University of Nürtingen and a BSc in Construction and Property Management from the University of South Wales. He has authored award-winning academic papers on REIT investing, been featured in numerous financial media outlets, has over 60,000 followers on Seeking Alpha, and has built relationships with top REIT executives.

Austin Rogers is a licensed Texas real estate agent who splits his time between a residential management company with over 1,000 units under management, a family office with 50 net lease properties, and REIT research for High Yield Landlord. He began writing for the site a few years after graduating from Western State Colorado University with an M.F.A. in Creative Writing, combining his passion for writing with his real estate career.

R. Paul Drake is an award-winning physicist and a former professor at the University of Michigan who brings a retiree perspective to our group of authors. After investing through employer tax-deferred plans for several decades, he has, in recent years, broadened his focus to include a variety of more targeted investments. Paul is a lifelong reader of works on economics, finance, and investment. This has led him to embrace the value-investing approach we follow at High Yield Landlord. He brings substantial experience in research, and in understanding and developing models of uncertain systems, from his decades working as a physicist. Among other degrees, he holds a Doctorate in Physics and a Bachelor's in Philosophy.

David Ksir is a former private equity investor with experience working for Penta Real Estate, one of the largest real estate investment firms in Poland, the Czech Republic, and Slovakia. He brings a private equity approach to REIT investing, with a primary focus on European real estate investment opportunities. He holds a Bachelor's degree in Economics and Finance from McGill University.

Samuel Smith is the Vice President at Leonberg Capital and leads non-real estate high-yield research at our sister service, High Yield Investor. Samuel holds a B.S. in Civil Engineering and Mathematics from the United States Military Academy at West Point, a Master’s in Engineering from Texas A&M, and is a licensed Professional Engineer. His background includes experience in real estate land development and serving as a lead analyst for several income-focused investment research firms.

How Do I Know It is Good?

First, I have approximately 50% of my net worth invested in the REITs featured at High Yield Landlord. This aligns my interests directly with yours — we’re in the same boat. When you win, I win; and when you lose, I lose. My financial future is tied to the success of our recommendations, giving me a strong incentive to deliver my absolute best.

Second, we are proud to be the #1 rated service on Seeking Alpha, with a 4.9/5 rating from over 500 member reviews. We have earned this distinction by consistently providing far more value than what our members pay for. Our team dedicates thousands of hours and invests over $100,000 annually into market research to uncover the most profitable opportunities—and we share those insights with you at just a fraction of the cost.

Time is money, and if you value your time at $30 per hour, for the cost of just one hour of work, you can access a full month of in-depth research from five expert analysts at High Yield Landlord. Achieving this level of analysis on your own would be impossible at such a low cost.

You can read all our reviews by scrolling down, but here are a few recent ones:

Ready To Get Started? Join Us For A Risk-Free Trial

We are currently sharing all our Top Picks for 2026 with members of High Yield Landlord, and you can access them for free with our 2-week trial! We are so confident in what we offer that we let you join and decide during your trial whether this service is right for you.

You have everything to gain and nothing to lose. You won’t be charged a penny if you cancel during your free trial. If you are still unsure, scroll down to see what our members have to say about High Yield Landlord.

---

Disclaimer: Past performance is no guarantee of future results. Data is provided by Interactive Brokers. Our portfolio may not be perfectly comparable to the relevant index as it is more concentrated and may occasionally use margin and/or invest in companies not typically included in REIT indexes. High Yield Landlord® does not consider your specific objectives or financial situation and does not provide personalized investment advice. High Yield Landlord is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.

All Reviews (570): 4.9/5.0 ⭐⭐⭐⭐⭐

⭐⭐⭐⭐⭐ New to REIT investment • REITValueInvestor • Aug. 27, 2025 4:36 PM

I wanted to know more about REIT investment with a view to commencing my investment journey. I got 2 weeks free trial to test out what was being offered by High Yield Landlord. The choices of investment combined with investment thesis I found out was very good. Furthermore real time alerts from High yield landlord, especially from Jussi prompts me to check and take stock on my investment. Jussi recently introduced zoom interactive session along with Q&A was excellent. I am looking forward to continue to build my portfolio.

⭐⭐⭐⭐⭐ Quality REIT Investments • koloajack • Aug. 18, 2025 5:21 PM

Outstanding information about various REITS with information to backup their positions. The analysis is in-depth and I love that they provide 3 different portfolios (Core, Retirement and International). Long time subscriber and I see no need to go anywhere else for my REIT info.

⭐⭐⭐⭐⭐ Fenomenal experience with Jussi and his team! • AntonioMMSR • Jul. 30, 2025 10:46 AM

I absolutely recommend this service. Jussi and his team offer very detailed information, continuous updates and comparisons between a selected group of REITS. They group them in three cathegories, main, international and retirement portfolio that can fit every investor preference depending on their risk tolerance. The chat offers very good daily conversations and they solve your questions within a day or two. I feel Jussi and his team are very approachable and transparent with every investment decision. Thank you guys!

⭐⭐⭐⭐⭐ Deep research • kei472 • Jul. 28, 2025 4:09 AM

Look at every investment deeply and thoughtfully

⭐⭐⭐⭐⭐ After 20 years of ignoring dividends, Jussi Askola smacked me in the face! • Aurence • Jul. 27, 2025 8:53 PM

That's right! I was your typical weekend investor for 20 years, hoping and expecting to ride with the herd to riches. Oh, some of the Stansberry publications had some winners, but I didn't have the discipline at the time. I also didn't have a strategy or unifying thought process. It was just one hit or miss after another. The I came across Jussi's High Yield Investor just as my retirement was beginning. I finally had the time to sit and READ and THINK about why I wasn't getting very far chasing one hit wonders. Jussi showed how my adequate, but modest retirement accounts could be bringing in, regularly -- monthly and quarterly, the extra cash to enjoy retirement without ever having to touch principal. (Cue the celestial chorus). I still have an account to chase my mystical unicorn of riches, but that's just mostly for fun now. The real heavy lifting for day to day retirement living are my 8% to 12% dividend winners. High Yield Investing doesn't play around. It truly helps get you to where you need to be to make the rest of your life that much easier on your finances. Let Jussi help get you on the right path to a comfortable retirement, and enjoy the checks coming in. Laurence Rosenberg ---------------------- PS - Is Jussi Askola related to Joni Askola? Slava Ukraini!!

⭐⭐⭐⭐⭐ excellent value and income real estate stock investing service • whitlog01 • Jan. 27, 2025 2:12 PM

Timely updates and discussion about portfolio moves. Discussions about successful investments and also when things don't go as expected. The advice and outlook and investing perspective is consistent and logical and often with a contrarian value slant. Recommended.

⭐⭐⭐⭐⭐ The subscription pays for itself • User 59471695 • Dec. 05, 2024 5:32 PM

If you are thinking about investing in REIT's you would be fool to not sign up for this service. Jussi's picks speak for themselves. With returns that almost double the benchmark the service pays for itself in no time. He explains in detail with conviction and eloquently why various REIT's make sense over others. The guy knows what he is talking about. I thought I'd try it out for 2 weeks and then stop. After I saw the value I decided to try for a year and then cancel. After a year I've decided I am a subscriber for life. Give High Yield Landlord a chance and I bet you will also be a lifer!

⭐⭐⭐⭐⭐ No BS, just hard work and straight talk • Robert Palm • Nov. 22, 2024 9:07 AM

Jussi and team have put together some of the most thoughtful and candid research - definitely an asset when trying to filter out the junk and find the gems.

⭐⭐⭐⭐⭐ Great Service...Even better person.. • BLegacy • Oct. 27, 2024 10:56 PM

Jussi is an excellent analyst. His information is insightful and timely. I learn about REITs and I learn about investing too. Good combo. Jussi's support of important causes is also worth the cost of the subscription.

⭐⭐⭐⭐⭐ Simple, Effective, Worth it • angel.svirkov • Oct. 19, 2024 11:21 AM

The key ideas are presented well and on point. There is a huge transparency in Jussi's actions. Overall, I believe, the investment into the service and knowledge is worth it. I am looking forward to see if the high quality will consistently be met in the mid to long-term, as well.

⭐⭐⭐⭐⭐ Excellent • Peter Palya • Oct. 13, 2024 7:56 AM

Thoughtful and clear analysis of REITs. Very methodical and rational portfolio allocation optimised to maximise risk adjusted returns. Highly recommend to people who are seeking to be 'passive' and who just want an expert to follow, mirroring and factoring positions to their portfolio size. Normally I don't use stock picking services and with the few that I have tried I've barely bought any of their recommendations as I haven't had confidence in their methodology. With HYL, I quickly became comfortable with their approach and I'm happy to use it as if were and actively managed fund (ignoring individual returns and looking at the portfolio return as a whole). This is what I was looking for.

⭐⭐⭐⭐⭐ Very satisfied • Driestaelman1991 • Oct. 06, 2024 9:16 AM

I had been interested in building a REIT portfolio for a long time. However, knowledge and insight into the market was difficult for me to obtain as a European. HYL has given me the necessary tools to invest decisively in the REIT market

⭐⭐⭐⭐⭐ REIT Mentorship • GinoMarioPoli • Oct. 01, 2024 5:40 PM

I view Jussi Askola as my REIT mentor. I have learned extensively from him by immersing myself into his exhaustive researc and content. I have applied much of what he has taught me into my investing strategy. This has yielded excellent results in my REIT portfolio. I recommend his strategy, education, and invaluable research to anyone interested in taking their investing to the next level.

⭐⭐⭐⭐⭐ When Investing in REITs..... • RayJay2022 • Sep. 30, 2024 11:54 AM

Once in a while you get an opportunity to buy world class companies at unreasonably depressed prices..... As a result of the spike in interest rates, COVID and the remote work trend, many high quality REITs fell from grace, even while delivering fabulous results! Buying under loved and under valued REITs was one of those huge opportunities that doesn't come along every day, year or decade! One of those hold your nose and press BUY trades! Ok, so lets buy REITs.....!! The question was, what REITs should we buy? And along came some guy named Jussi! High Yield Landlord is a value added service that helped me decide what REITs to buy and which REITs to avoid, resulting (so far) in anywhere from a 15% to 40% rate of return for my clients. And they continue to add value with their great communication and updated recommendations. HYL is SIMPLY THE BEST!!!!!

⭐⭐⭐⭐⭐ If You Want Successful REIT Investments, Follow This Guy!!! • jimpy • Sep. 26, 2024 10:53 AM

Highly recommend!! I'd been reading some of Jussi's articles on S.A. and knew very little about REITs, so I signed up for his advisory service and am very glad I did so. Now 50% of my portfolio is REITs and soaring upward! I have learned so much!! Jussi is forthright, spends time/travel/$$ doing the research, writes in simple & understandable language, is mostly correct in choices & forecasts, and also readily admit when some choice was an"oops" and goes on to explain why it did not work out. I find the HYL service valuable, user-friendly, good accuracy, and worth the fee. Jussi also lets us know when he feels something has reached full value. Finally, Jussi does good humanitarian work in Ukraine...thank you Jussi!! I recommend the HYL services for whoever wishes to develop a stable portfolio filled with REITs! - Jim

⭐⭐⭐⭐⭐ HYL best tool for REIT investing • dividendmarket • Sep. 26, 2024 10:36 AM

I have learned a lot from HYL. What is the best REITs, where to invest and not to buy bad REITs. All HYL recommended investments are UP (ADC, EPR, ARE, Vici, WPC etc). Nr1 investing group here in SA

⭐⭐⭐⭐⭐ Excellent Service • Jambr403 • Sep. 23, 2024 1:20 PM

HYL is a great service that does all the REIT heavy lifting for you. Have had very good success and found many REITs that were completely off my radar before.

⭐⭐⭐⭐⭐ Great insights and advice • TheTomppeli • Sep. 23, 2024 8:51 AM

I got curious about REITS a few years back, and have been following Jussi for a little while now. Finally subscribed to the HYL group and am very happy with the service. Great insights and advice that have already helped me with my portfolios.

⭐⭐⭐⭐⭐ Solid tool for REIT investors • User 52256083 • Sep. 22, 2024 1:12 AM

Very pleased with my subscription to HYL. Excellent information, solid research, shared portfolio with real time trade updates, along with reasoning behind each. This is such a bargain for what you get, very happy to have found it.

⭐⭐⭐⭐⭐ Great investment group • robertRS • Sep. 21, 2024 3:17 PM

I recommend HYL to everyone, especially the people who don't have enough time to do proper research (like me). The investment theses are well justified not only on their own, but I consider also the weight of the investments within the portfolio(s) in reasonable proportion. However, the investment ratio of each individual investment must be decided by everyone based on their relationship to risk and investment horizon.

⭐⭐⭐⭐⭐ Good deep dive & structure • Oliver Duschek • Sep. 21, 2024 11:57 AM

I really like the structure of the model portfolio and it's a great help for my REIT selection. So far it paid off pretty well for me.

⭐⭐⭐⭐⭐ Great investment group • igargari • Sep. 21, 2024 10:48 AM

Been here for two years. I am happy with the returns thus far.. I always wanted to own property, but after so many of my friends had mismanged properties either from themselves or property managers. I decided to go against it. This is the next best thing to build your wealth while doing no research.

⭐⭐⭐⭐⭐ Great value and proper understanding of business and investing • BiggMike • Sep. 21, 2024 7:05 AM

I'm a subscriber for some time already and really appreciate Jussi's insights on REITs. I save a lot of time and made a lot of good investments thank to his research (couple of bad ones, too, but this is part of the game - all in all this has been a tremendous value add to my portfolio mgmt). plan on staying subscribed for the long term and looking forward to more insights. cheers

⭐⭐⭐⭐⭐ #1 for a reason • QuadCasa • Sep. 21, 2024 1:21 AM

I've tried 10 different investing groups since I started using Seeking Alpha a couple years ago. This is the first investor group where I really feel like I've gotten my money's worth, and then some. Jussi and his team are forthright, honest, and their investment theses are always thoughtful and well researched. I'll be a subscriber for the foreseeable future. Thanks guys!

⭐⭐⭐⭐⭐ Satisfied subscriber • jeremyaa • Sep. 20, 2024 11:56 PM

I have been very satisfied with HYL since I signed up a few months ago. Beyond the great performance, I have appreciated the depth and clarity of the analysis, Jussi’s responsiveness and candor, and the coherent philosophy behind the investment approach.

⭐⭐⭐⭐⭐ Glad I Subscribed to HYL! • Will2 • Sep. 20, 2024 9:46 PM

I have used the HYL service for the last couple of years and seen high returns from most of the HYL recommendations that I incorporated in my portfolio. They provide in depth analysis on REITs, have an easy to understand system for building an REIT portfolio and have always answered my questions and addressed my concerns. Also, Jussi encourages his team to express their own views and opinions even if these contradict his own, allowing the investors to use these varied viewpoints in their own investment decisions. Good work guys!

⭐⭐⭐⭐⭐ Excellent service • Pjtoppin • Sep. 20, 2024 6:11 PM

I have been investing for the last 4 years. So far High Yield Landlord has been the best service that I have subscribed to. There have been very few bad investment recommendations. I have found the information clear and well presented. REITS was become a key part of my portfolio.

⭐⭐⭐⭐⭐ Give HYL a try, I’m sure happy I did. • legoabs1 • Sep. 20, 2024 5:05 PM

I have invested in stocks for many years but wanted to try REIT, something I knew very little about. I then researched a few REIT services that I can try but I’m very happy I chose Jussi’s HYL board. The free trial was a no-brainer. HYL research is through and actionable, trades are live, more so, HYL portfolios are visible to all members. Previous articles and trades are there to review, plus there is a REIT course for new REIT investors like me. I’m new to the service, but know I will stay for a while, since there is lots to learn and Jussi does most of the work/screening for you. Give it a try, I’m sure happy I did.

⭐⭐⭐⭐⭐ Love HYL • rjain10 • Sep. 20, 2024 4:28 PM

I absolutely love Jussi's work here at HYL. It is thoroughly researched, easy to follow, and Jussi responds to your specific questions promptly when you have them. My portfolio is better because of this service.

⭐⭐⭐⭐⭐ I recommend HYL • joseph amos • Sep. 20, 2024 3:52 PM

I recommend this service for good analysis and helpful chat forum

⭐⭐⭐⭐⭐ Nicely informative value-oriented REIT newsletter • Atlanta investor • Sep. 20, 2024 3:09 PM

There are a few high-yield and dividend-oriented services that specialize in REITs, but I found Jussi's value-oriented approach as the best for my investment framework. He is focused on REITs that sell at significant discounts to the underlying real estate, not necessarily on the highest-yielding ones, and I find that this makes a lot of sense over time. He has three portfolios, a core one, a retirement one that is more yield-focused and conservative, and an international one. The international one is honestly the most interesting with picks that are a bit riskier but also can have very high returns. It's something you don't find elsewhere. If you want to get a sense of his approach, it is definitely worth watching his YouTube videos, and that will give you a taste of his views.

⭐⭐⭐⭐⭐ GAME CHANGER • lukchw • Sep. 20, 2024 1:46 PM

Since joining the High Yield Landlord Investment Group, my approach to investing has completely transformed. Not only have my results significantly improved, but I've also gained confidence and peace of mind knowing that my decisions are based on solid analyses. In investment groups, the most important factors are professionalism, trust, and access to reliable information. High Yield Landlord excels in all these aspects. The accuracy of their analyses and their cool-headed, objective view of the market allow me to make informed and thoughtful decisions. Jussi's expertise is truly the key to success. His deep knowledge and experience open doors to opportunities I hadn't even considered before. The community support and the ability to share experiences with other investors further enrich this exceptional experience. I recommend High Yield Landlord to anyone who has doubts or is looking to improve their investment results. It's an investment that not only pays for itself many times over but also educates and inspires. In a world full of uncertainties, this group is a true treasure and a solid foundation for future success.

⭐⭐⭐⭐⭐ High Yield Landlord does the legwork • Hrsesser01 • Sep. 20, 2024 12:51 PM

I am very pleased with the my High Yield Landlord subscription. Jussi does a good job of narrowing the field and allows me to hone in on the REITs that might be appropriate for me. I also like that he not only analyzes the public date, but he often can gain an audience with some of the REIT officers and can ask them direct questions.

⭐⭐⭐⭐⭐ I Am Favorably Impressed • MoreBob • Jul. 23, 2024 12:57 AM

Congratulations also. I believe having substantial skin in the your recommendations makes you vastly more creditable. Having a script for your videos is very welcome, thanks. I dislike videos because I make notes on written information that I get. Highdyk's comments said most of what I wanted to say. I dislike repeating what others have said. I clicked on his 'like'.

⭐⭐⭐⭐⭐ For those looking for both income and appreciation, Jussi's is one of the best advisory services… • Riverbum9 • May 23, 2024 3:00 PM

I subscribe to several investment advisory newsletters and services, but for those looking for both income and appreciation, Jussi's is absolutely one of the best. I particularly appreciate his detailed and thorough analysis and his exposure to non-US based equities, which provides considerable diversification and stabilization of total portfolio value. That's important to me because I manage several family portfolios for both income and growth.

⭐⭐⭐⭐⭐ Game Changer • bmmkdividends • Feb. 03, 2024 10:21 AM

Before signing up for HYL, investing felt random or undisciplined. With HYL, investing feels intelligent, strategic, and a confident pursuit! I would have never trusted myself to assume REITs were a great investment over the last few years, as prices were driven down so far, but I learned about REITs, the Real Estate market, how different REITs are structured, and how I can confidently profit from both cash flow and appreciation over time. It was with HYL that I saw my portfolio surpass $100K for the first time ever! Without Jussi and his team here on HYL, I really don't believe I would be anywhere near that because I'd still just be randomly picking stocks with no real mission behind it. It's been worth every penny!

⭐⭐⭐⭐⭐ All Good So Far • User 57876118 • Oct. 28, 2023 2:20 PM

The REITs suggested aren't all winners—nobody's perfect—and I'm not expecting to find the high risk 10 baggers here, either. I don't act on every suggestion. But then, I like stability and I've always loved dividends. This newsletter has helped me to think about REITs differently and, really, has given me new insights into stocks and stock picking in general. It's too soon to tell if I'm making the best choices—I won't know that until the market turns up again—but I am making my decisions with confidence. Here's what I know for sure. My pre-HYL portfolio is not doing as well as my HYL portfolio. Overall, I'm still very pleased that I decided to join, and I've suggested the services to several friends.

⭐⭐⭐⭐⭐ REIT blackbelts • drcapari • Oct. 28, 2023 9:32 AM

In recent times, I have listened to hundreds of hours of audiobooks from the best authors, examined and tried several investment advisory services, and completed several courses on ETFs, stocks, bonds, and REITs. The deeper one delves into a subject, the more one realizes how little they actually know about it. One of the key factors for maximizing my cash flow is to do it in my field of expertise. I've realized that as a veterinarian, I don't have the time or energy to deeply analyse individual companies, which even for a professional can take several days of work and carries a high risk of error. Even if one does find a good investment opportunity, it's not enough to buy it at the right time and price; you also need to know when to sell, how long to hold it, and this requires constant attention, which is almost a full-time job for a portfolio containing 20 REITs and companies. I've come to the conclusion that it's best to entrust this work to experts and find 1-2-3 services that best suit your goals. Of course, there's still a need to make individual decisions and shape the portfolio correctly. It's not easy to find service providers in this digital noise who are experts in a particular topic, diligently invest their time and energy in analysis, and, moreover, put their skin in the game. I've been interested in the REIT asset class for a long time, and I'm very glad that after much research, I found Jussi and his team, who are true professionals in the field. If you want to day trade, achieve serious success and returns in a few weeks, I do not recommend Jussi's team or the stock market at all. For those who want to generate good returns in the long run, patiently wait for the necessary time, and build significant wealth over 5-10 years, or simply preserve the purchasing power of their money against inflation, you are in the right place... with the best REIT expert team!!! These guys are professionals, and they also promptly answer all your questions... On the other hand, it seems that the current economic situation presents a historic opportunity for generating significant returns in the REIT sector. It would be a waste to experiment when Jussi and his team are offering the best investment opportunities on a platter.

⭐⭐⭐⭐⭐ Thanks to HYL I've now got my REIT portfolio • Francois007 • Aug. 14, 2023 3:35 PM

It’s been quite a while I had wanted to invest in REITs. But I didn’t know where to start, and I didn’t understand the specifics about REITs - FFO, etc… Then I stumbled on an article from HYL explaining that it was THE time to start thanks to REITs low valuations due to high interest rates. I subscribed to the service, and I started the training course. Very clear, very concise, always to the point : quick to go through, and providing all necessary concepts to understand HYL analysis. Then I looked at the 3 portfolios. The spreadsheets are very well organised, with links to relevant articles and analysis to understand each line of the portfolio, and to make one’s own selection based on risk appetite, real estate knowledge, etc… 2 weeks later, I had my REIT portfolio up and running. 1 month later, its value increased by +15%. Very happy about the service. And enjoying every cents of the quarterly revenues !

⭐⭐⭐⭐⭐ Good customerr service • fred04 • Jul. 24, 2023 8:08 AM

Customer service

⭐⭐⭐⭐⭐ INSIGHTFUL, DATA DRIVEN, PROFESSIONAL • Karlos44 • Jul. 12, 2023 10:02 AM

HYL provides very insightful analyses and strategic rationale for the moves in the portfolio. I am very positively surprised with Jussi's knowledge and the overall dynamics invoved in leading his group of investors. I very much recommend HYL's services.

⭐⭐⭐⭐⭐ Clarity, depth, and consistency • Green Orchid • Jul. 06, 2023 12:24 AM

If I had to name a single reason why I subscribe to both HYL and HYI, it would be trust. I trust the quality, depth, and consistency of the analyses provided. I can’t say that about many authors on SA — over time, I have dwindled to a few that I find offer a clarity and depth of insight that is truly value-added to my investment decisions. I have high regard for each of the authors on the team; each adds a genuinely different and useful perspective to the larger context as well as specific investments. So why do I have trust in what they write and recommend? First, there is a clear underlying model for evaluating companies. The portfolio choices are explicit in their criteria and the levels of risk. Second, the authors consistently apply those criteria and offer distinct pros/cons, possible trajectories, and their personal conclusions. The articles are a presentation of information rather than a sales pitch. Quite clear and concise too. Third, they go deeply into the candidate investments and re-evaluate (rather than defend) their theses. Evolution with new information is increasingly rare. Fourth, the depth — particularly the interviews with management — provides me with a stronger level of conviction in the initial investments, and buy-sell decisions. I have high value for their regular interview transcripts. After two decades in Silicon Valley and observing the world of private equity, I have come to appreciate how significantly the quality of management influences the outcomes for companies; much more so than just numbers would tell you on where a business is headed. What would be areas where I don’t align? One would be the level of risk on some of the investments. I don’t mirror their entire model portfolios and pick the best matches for my goals. In fact, despite my age, I lean more heavily on the more conservative “retirement portfolio” for steady performance and select from their “core portfolio” for greater risk/upside. Second, I am not as dismissive of technical analysis as some of the authors. While I’m a long-term investor, not a trader, I do see some value in technical considerations for buy-sell timing.

⭐⭐⭐⭐⭐ Great Find! • peterjfisher79 • Jul. 03, 2023 5:45 PM

As a Seeking Alpha subscriber, I stumbled across High Yield Landlord and started to read the articles. I found them to be very well thought out and written. I decided to sign up for the newsletter and couldn't be happier so far with the great research and frequent articles. While early, I couldn't be happier to leverage Jussi and his team's insight to guide my REIT investments.

⭐⭐⭐⭐⭐ The best REITs research service I know • Ivan.S • Jul. 02, 2023 11:01 PM

I've been a subscriber of HYL for two years now and I have to say I've learnt a lot not just about REITs but investing overall. This service provides very deep research on REITs. You can simply copy their portfolio or decide what you like to buy.

⭐⭐⭐⭐⭐ Get the Knowledge to Invest with Confidence • imccoy • Jul. 02, 2023 7:33 PM

Excellent service. I'd been researching REITs for a while and never had the confidence to pull the trigger. After going thru his course, I have started to build my REIT portfolio with confidence and knowledge.

⭐⭐⭐⭐⭐ A satisfied investor. • EverythingisCool • Jan. 10, 2023 1:05 PM

High Yield Landlord has provided me with a fundamental education in REIT investing. I am very new in this investing environment. This service has helped to understand some of the detailed analysis that a serious investor really needs to know. The model portfolios are of particular interest. I have used this information to help govern my investing and am very satisfied with the results.

⭐⭐⭐⭐⭐ REIT landlord • AllMight888 • Dec. 21, 2022 5:26 PM

Become a high yield landlord without the troubles of doing property management. It has respectable investment portfolios. The monthly portfolio review is extensive and covers the details to keep you up to date on each stock.

⭐⭐⭐⭐⭐ Great analysis, low volatility • ptor • Nov. 20, 2022 7:58 PM

Great analysis, diversification geographic, in depth explanation on the why to get in the companies. I started slowly and now this service is about half my income portfolio. This is NOT a get rich quick losing money service. This is the opposite, steady income and steady build up in value. The volatility is very low vs regular stocks and I'm on my income portfolio up even in the worse market.

⭐⭐⭐⭐⭐ . • DV80 • Sep. 25, 2022 12:01 PM

Great REIT analysis including many REITs outside the U.S.

⭐⭐⭐⭐⭐ Stoykitsan@gmail.com • THEODOROS ORDOULIDIS • Jul. 13, 2022 11:04 AM

THEODOROS ORDOULIDIS

⭐⭐⭐⭐⭐ Excellent Value! • monkey's uncle • Jul. 09, 2022 2:26 PM

I especially appreciate the detailed REIT database that is available through this service.

⭐⭐⭐⭐⭐ A Real Estate Professional's Point of view • bobmaccullochYL • Jun. 29, 2022 7:03 PM

I am totally satisfied with the analysis, research and recommendations I get from Jussi and his team. As a 40 year Real Estate professional and investor, I find his thoughts on RIETS to be very helpful and profitable. Glad I found you!!

⭐⭐⭐⭐⭐ Must have for REIT investors • Sebastian Jammer • Jun. 24, 2022 12:31 AM

Great service and analysis. It fits well with my investment style and philosophy which is based on value and fundamentals.

⭐⭐⭐⭐⭐ Happy Customer • petetheone1 • Jun. 20, 2022 7:59 PM

I am extremely happy with my HYL subscription! Even with the recent price drop I am way ahead since 2020.

⭐⭐⭐⭐⭐ You Will Get Your Money's Worth...I Did! • User 54527324 • May 09, 2022 1:25 PM

I have been transitioning from owning 14 single-family rentals for 20 years to Jussi Askola's High Yield Landlord and it has been working out for me just fine. I believe in real estate investment, but am getting tired of this new generation of less responsible tenants. Jussi works hard at researching the right REITs in which he invests his OWN $ and that makes me feel more trusting of his recommendations than just a financial writer (there are too many of those). I've been investing in stock and mutual funds for about 30 years, but was unsure about REITs until I read through his 10 module REIT investing course (free to subscribers). Would I re-subscribe? YES

⭐⭐⭐⭐⭐ Straightforward and never had a reason to distrust. No rationalizing aka backpeddling. I could never say that about my financial advisors. • tim_k • May 07, 2022 7:32 PM

My large well known ETF brokerage financial advisor created a portfolio for part of our retirement funds. On inspection it was identical to the targeted retirement fund comprised of their ETFs. One of the ETFs was the VNQ. But I have to believe that it is possible to pick the best 20 of the 164 in the VNQ thereby reducing risk. I don't have that expertise but this team does. Plus they lay out the rationale and stay on top of all the individual Companies. All the shareholders calls, the financials and the public sentiment. So sure - ETFs diversify. But why invest in all the REITS? Better to pick the best in class and buy under the recommended buy price. Just like buying individual properties yourself, the money is made based on your purchase price. They do an excellent job of describing a price at which the REIT makes sense.

⭐⭐⭐⭐⭐ Just Great! • chris.baer • Apr. 29, 2022 7:24 AM

Jussi and the other authors of HYL offer a fantastic service in the REIT space. Even if they have different opinions of some stocks, it is the biggest strength. Therebis no blind folowing. Cant highlight HYL enough!

⭐⭐⭐⭐⭐ I recommend HYL • ralfel • Apr. 22, 2022 4:16 PM

HYL is very informative and financially rewarding. The message board is always active and when asking questions I have always gotten a quick response. In addition to High Yield Landlord I would recommend subscribing to High Yield Investor to round out the higher dividend portion of a portfolio.

⭐⭐⭐⭐⭐ Great service dedicated to REITs. • Indigo_SA • Apr. 22, 2022 8:17 AM

We are in a very challenging market, thanks to HYL I'm well informed and find great value with live updates/discussion to stay ahead of the street.

⭐⭐⭐⭐⭐ Built a Diversified and Winning REIT Income Generating Portfolio • User 55589264 • Apr. 20, 2022 5:38 PM

As a REIT newbie, HYL has provided me with the education, framework, analysis and information alerts to build an income generating portfolio.

⭐⭐⭐⭐⭐ Highly Recommended • Magoo1 • Apr. 18, 2022 7:47 AM

Jussi has compelling reasoning to invest in what he recommends. I also liked his Course to REIT investing and the general format of the website.

⭐⭐⭐⭐⭐ HYL Highly Recommended !!! • Traderdog1 • Apr. 15, 2022 4:05 PM

Before joining High Yield Landlord I had been a member of 2 other services and had tried a couple of 2 weeks trials. I was not ever all that impressed with my previous experiences. I kept seeing these articles by Jussi Askola and decided to finally read one. The article was about a REIT called VICI Properties. I have to omit that it was the best article that I had ever read on Seeking Alpha. I was hooked from then on. It took me a few months to get acclimated to the ways that everything was presented. I have found a home. REITS make sense to me. I love collecting rent! The chat room has great members who help each other. RP Drake is the room moderator and is a fantastic source of knowledge. I can’t say enough about Jussi. He cares about his members and has created a fantastic service. I highly recommend this service.

⭐⭐⭐⭐⭐ Highest recommendation!! • Andrew_Malik • Apr. 14, 2022 2:09 PM

I’m member of HYL for 1 year and I’m read Jussy’s articles for almost 2 years. The HYL team does excellent company analysis, they introduced me to REIT and I am very grateful to them for that. no inconsistencies or lies were ever noticed in their articles. 50% of my portfolio is invested in stocks on the advice of HYL and I have complete confidence in them. I'm always interested in reading their articles, they do detailed analysis. also jassi always responds to private messages, it's very nice. I think that instead of a thousand words, you just need to subscribe for a trial period and you can see for yourself that this is an excellent service. many thanks to Jussy and the whole team.

⭐⭐⭐⭐⭐ Solid REIT subscription service • Big Goose • Apr. 11, 2022 11:59 AM

I am somewhat of a new REIT investor. What I like about HYL service is the write-ups are understandable and informative. I also like the transparency they offer. They share successes and those REITS that have not been as successful. Let's face it, every investment service has winners and losers and we know that. I like the information and all the tools the service provides. While I am only a few months into the service, I give it 5 stars so far!

⭐⭐⭐⭐⭐ Highest recommendation! • proactiv • Apr. 10, 2022 4:44 PM

Have been a member of HYL for less than a year and can say I have received great advice and have invested significantly based on the great articles and recommendations. HYL and Jussi both have my highest recommendation.

⭐⭐⭐⭐⭐ Excellent Research and Transparency • mantonini • Apr. 07, 2022 2:51 PM

HYL provides excellent research and has guided me in a sector I don't have the time to fully learn. The transparency provided is refreshing. As I look for a replacement for Bloomberg when I retire from bond trading, Seeking Alpha in general, and HYL specifically are providing value to my portfolio.

⭐⭐⭐⭐⭐ Great Service • Genghis_Khan • Apr. 07, 2022 12:07 PM

The approach fits me perfectly, I like Jussi 's perspective, international knowledge and the way he studies each ticker within its sector. I have not had this service for even a year, but confident it will be succesful. Thank you.

⭐⭐⭐⭐⭐ Few better, if any, places to go for investment advice. HYL will make you money if you follow. • RZappone • Apr. 07, 2022 10:08 AM

I have been hugely impressed with High Yield Landlord and Mr. Askola. The investment advice and in depth analysis is worth every penny I spend for them.

⭐⭐⭐⭐⭐ Subscribing is the best decision I made this year • Alnoor Ramji • Apr. 06, 2022 11:06 AM

Well researched recommendations. One has the option to dig deeper into the rationale for recommendations made. I liked the service so much that I also subscribed to their sister service High Yield Investor. Incidentally there is a chat room and an opportunity to have your questions addressed. No one can be right 100% of the time but this service comes as close to perfection as humanly possible. Appreciate the spreadsheet where I can follow my portfolio

⭐⭐⭐⭐⭐ Love it! • rffpgadsp • Apr. 05, 2022 9:58 PM

Great service. Passionate about REIT and very professional

⭐⭐⭐⭐⭐ Very happy, worth every cent • Chefgram911 • Apr. 05, 2022 7:02 PM

Very happy with the incredible research and diligence that Jussi and crew undertake daily. I have 23% of my portfolio in REIT's, and Jussi personally helped me analyze my picks. He answers all questions promptly and thoroughly. I will hold REIT's, in some capacity, forever and will surely look to HYL to help guide me in the right direction.

⭐⭐⭐⭐⭐ Great Value • jay98 • Apr. 05, 2022 6:47 PM

In the past, I’ve spent a lot more for a lot less. These guys are really taking that “teach a man to fish” mantra to heart. It’s greatly appreciated and more than worth the cost.

⭐⭐⭐⭐⭐ Great job Jussi • hi.yall.64 • Apr. 05, 2022 2:08 PM

I have been a part of HYL for several months now, and I feel that it is a very good service that is run very well. Jussi has everyone's best interest at heart it seems, and he delivers many, many good ideas that one can monitor and decide how best to use them. The other contributors that post have been very good and helpful as well. I would definitely recommend this service to others.

⭐⭐⭐⭐⭐ Let Jussi do your REIT heavy lifting • atomiceco • Apr. 05, 2022 11:10 AM

I recommend the High Yield Landlord service for anyone looking to invest in the REIT space. The HYL portfolios (core/retirement/international) with their recommendations are valuable right off for increasing your REIT exposure with new picks that fit your portfolio. However, the real value for me comes from the trading alerts and in-depth articles that save me a lot of work that I would probably not have the time or attention to do myself. The chat is great and there seems to be a good amount of active subscribers posting there.

⭐⭐⭐⭐⭐ Worth the money! • goothoudt • Apr. 04, 2022 7:52 PM

HYL does a great job on many fronts! They provide regular updates that include current information on existing recommendations as well as new research and recommendations on new companies.

⭐⭐⭐⭐⭐ Quality analysis and active chat group • WheelerA • Apr. 04, 2022 2:49 PM

I am pleased with HYL. The analysis is easy to understand and thorough. An excellent resource for REIT investors

⭐⭐⭐⭐⭐ Good and balanced approach to investing • Green Capital • Apr. 04, 2022 2:27 PM

When logging in the first time I was very positively surprised: high quality research and lots of sense making involved, transparent discussions. Frankly, I wish I would have found this team earlier.

⭐⭐⭐⭐⭐ Excellent service in good and bad times.... • Lenseri • Apr. 04, 2022 2:13 PM

Excellent service and in depth analysis which gives high credibility. Jussi is for every person always available and follows his proposed investments all the time. No interruption. That makes me confident.

⭐⭐⭐⭐⭐ Insightful and timely investment recommendations with perspectives from multiple investors • Eric Kennedy • Apr. 04, 2022 12:51 PM

The timely investment recommendations from High Yield Landlord have already paid for the annual membership in 3 months. Unlike other services, HYL also includes a chat system to discuss investment ideas with the multiple authors who run HYL and also other subscribers. Hearing multiple perspectives on investing in REITs helps identify companies to buy and those to avoid.

⭐⭐⭐⭐⭐ Solid picks • walter kramer • Apr. 04, 2022 11:37 AM

I like the service. It doesn’t push stocks indiscriminately, only after solid research.

⭐⭐⭐⭐⭐ Excellent service and great explanation of the investments thesis • mhfernan • Apr. 04, 2022 6:48 AM

In just few months I could realize the great quality of the service. The thesis of the recommendations are well explained and we can see some results even in the short run.

⭐⭐⭐⭐⭐ Excellent Service • Ernest1955 • Apr. 04, 2022 1:38 AM

Excellent Service for REIT investors, discussing not only US REITs, but REITs from many countries world-wide. Highly recommended.

⭐⭐⭐⭐⭐ Excellent service, highly recommended • Greyhound20 • Apr. 04, 2022 1:23 AM

Truly great service based on profound knowledge and experience. Combined with a highly responsive team and a great member community. I am glad to have finally joined the service and can only recommend it!

⭐⭐⭐⭐⭐ Great Service for REIT investors. • Evaluation • Apr. 04, 2022 12:12 AM

Excellent resource for REIT investing. Jussi provides great insight and recommendations for US and foreign REITs. I have subscribed for just a few months, and have achieved excellent results. His customer service is terrific, responding to inquiries quickly. Overall, I am extremely pleased.

⭐⭐⭐⭐⭐ Couldn't be More Pleased • williamstj99 • Apr. 03, 2022 10:38 PM

I've been a member of HYL for approximately 4 months and have initiated four positions based upon Jussi's research. All four positions are up between 5 and 20 percent and that's not counting dividends. Regardless of short term performance I find his advise extremely well thought out and actionable. I sleep better at night knowing regardless of the short term market gyrations I have a reliable income stream. WilliamsTJ99

⭐⭐⭐⭐⭐ Great Team and Service! • Hank222 • Apr. 03, 2022 8:23 PM

I became a member over a month ago, and have been enjoying the service from day one. Really appreciated the profseeionalism the team has shown to its members, and not to mention the superb performance comparing to the market. Expect to be a long term member:-)

⭐⭐⭐⭐⭐ excellent Service and great resources • Josepe34a • Apr. 03, 2022 7:24 PM

I have been using High Yield Landlord just for last two weeks and I really very Happy with the REIT resources provided by this service.

⭐⭐⭐⭐⭐ The HYL team is very active in chat and has great well thought out articles. They have really helped me up my investing game and profitability. I highly recommend to anyone investing in REITs.• Agent0071 • Apr. 03, 2022 7:11 PM

Great value!

⭐⭐⭐⭐⭐ High Yield Landlord Review • JBworstever • Mar. 27, 2022 10:03 PM

High Yield Landlord is an outstanding service that offers profitable actionable ideas.

⭐⭐⭐⭐⭐ My Sleep Well Portfolio is Complete with HYL! • Dayboat • Mar. 21, 2022 10:09 PM

I have been a member for two years now and I have to say Jussi and the team do a fantastic job providing me with the knowledge I need in my early retirement to put hard earned money to work! I have always held physical properties but through High Yield Landlord I am able to continue to invest in real assets without the day to day headache of taking care of rental property. I am so pleased to part of this group and use it daily to make investing decisions. My gains over the last two years are much more than I ever expected and my portfolio is well diversed thanks to the research through HYL!!

⭐⭐⭐⭐⭐ Income Investor - valuing the HYL service • Macdouglas22 • Mar. 02, 2022 3:37 PM

I've just transitioned to being a Income investor and have been using HYL for 5 months now. I'm pleased with the service. In particular, I like the in-depth analysis of each holding, knowing someone is watching this segment of the market full time, receiving timely buy/sell advice, knowing he has his own money on the line, following a strategy of buying undervalued companies with good dividends and growth prospects, and the Google sheet spreadsheet that updates market prices real time (I've modified it to show me annual total ROI). While the market is in correction, I'm confident that returns will be very good in the mid to long term

⭐⭐⭐⭐⭐ Great Resource on REITS Universe! • tim.riley • Jan. 26, 2022 11:21 AM

Good research, not the party line on REIT's (don't always agree), user friendly and organized so I can quickly assess along several important metrics, saved me HOURS building a dividend income producing sleeve, and has paid for itself in multiples.

⭐⭐⭐⭐⭐ Definitely worth the cost of admission • quasimora • Jan. 10, 2022 12:33 PM

Jussi has created an excellent real-esta investing interface (reii) based on his system of identifying promising reits. I've used it for 18 months or so and the results have been quite rewarding. Jussi and other members are very responsive to questions and have even created a learning program. Highly recommend the reasonable cost of investing in this service.

⭐⭐⭐⭐⭐ Excellent service with very accessible authors • Phildutch • Jan. 06, 2022 4:30 AM

Best service in REIT land: Great and frequent recs, concise and accurate articles, and authors that are very accessible when using the Chat part of the service. Keep up the good work guys!

⭐⭐⭐⭐⭐ Happy with this service • Dropo catala • Nov. 29, 2021 1:04 PM

The service presents 3 different and updated portfolios and gives clear indications on the buying price (buy below), the expected/fair value (always with a security margin) and the yield that we will get while waiting the company to reach the fair value. It presents monthly investment thesis so Jussy is doing the toughest part for us (research of new opportunities), however it's up to the member to do his own due diligence and to invest or discard the company. Jussy and Paul are always available in the chat to answer the questions from the community.

High Yield Landlord recently transitioned from the “Seeking Alpha” platform to “Substack.” You can read all 500+ reviews of High Yield Landlord on our landing page at Seeking Alpha. The service offered on Seeking Alpha remains the same, but it is more expensive than on Substack due to Seeking Alpha’s higher revenue share.