What RPD Bought And Sold In September 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on September 9th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

What RPD Bought And Sold In September 2024

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

Here we share, in his words, some philosophic considerations for investments and retirement income, his portfolio actions this month, and his thoughts about them and the future.

My Biggest Weakness?

A commenter asked me to identify my biggest weakness as an investor. After some thought, here is my take.

My biggest (self-perceived) weakness is a common one for smart people: I believe my own narratives too strongly. This is especially true if they are based on calculations.

A classic example is Safehold (SAFE). The assets of Safehold are ground-lease contracts. These specify escalating rents for many decades.

This is the primary source of value in Safehold. There are two others.

One is likely growth, once real estate construction resumes. The other is the value of the structures on the land, which pass to Safehold in the event of default or upon expiration of the lease. We will ignore both of these here; they are certainly small at the moment.

There are uncertainties in the value of the company. One source of uncertainty is the eventual rate of default by their tenants. Moody’s thinks this is small, having given them an A3 credit rating.

This is no surprise since the typical ratio of loan to value for their leases when written is 25%. Even if there is a 25% decrease in total property value, that fraction only goes to 33%.

I thought about defaults and modeled them here. My view is that the cumulative, 10-year loss rates will still be tiny (1%, maybe less). There have been none so far, but we will have a better read when the present cycle of debt problems is over.

A second source of uncertainty is the cost of refinancing the substantial debt Safehold carries. Safehold debt has a 20.7 year weighted average maturity (as of Q2). The cost of that refinancing does have a material effect on the Net Present Value (NPV) of their leases.

The 10-year Treasury rate, for which there is data, has been below 5% for 70 years over the past century. The 30-year period of higher rates is centered on the massive spike in 1982, produced to squash inflation. My view, perhaps correct, is that we are unlikely to see such a long and high spike again, for a bunch of reasons.

For the debt of 30 years or longer maturity Safehold is likely to place (they would hope for much longer), a rate of 6% seems a conservative estimate. They might have to work around a period of higher rates, which should be feasible in the context of their weighted average lease terms above 90 years.

I have a model of the Safehold rents and debt that was current a year ago. These have not changed much since 2021. Using the data on 30-year rates, that gives the NPV shown here along with the daily price of SAFE:

Things to note:

The correlation is remarkable. It is highly likely that the stock price is responding to interest rates, which are what drives variations in the model.

SAFE appears underpriced compared to the model by about 20% through 2022 and 50% since.

If you use a smaller default rate the modeled price goes up significantly.

Before 2022, those other sources of value modeled to be more significant than they are today, so SAFE appeared even more undervalued.

This plot and similar ones reflects why my view throughout has been that the market is pricing SAFE below fair value. Here are results of asking what the market might be discounting for.

During 2022, the market price was what you would expect for a 4.8% (BBB-) cumulative default rate. Today the price is too low even by that comparison. Alternatively, the price early this year is consistent with a refinancing rate of 8% and the A- level default rate.

In short, you can justify the market-price history in the model using a variable combination of a higher anticipated default rate and a higher anticipated refinancing rate. The required higher rates seem excessive to me.

So I don't understand why the market has not priced SAFE higher than it has.

However, had I just asked how likely the market was to change its mind amidst the rapid rate increases of 2022, I might have done the sensible thing and taken my losses that summer. Instead, believing my models too much, I held.

Why sell then? Even though I thought interest rates would come back down, history says that this takes time. And long rates need to get back near 3% to support even those mid-2022 prices, as you can see here:

In mid-2022 there were other great opportunities in REITs. At minimum, I should have given a lot more consideration to selling than I did.

Smart people can use math to figure out many things that can produce gains in investing. But they can certainly also fool themselves, as I did in this case. Never hesitate to ask me whether I am thinking broadly enough about the bigger picture.

My Context

This section includes some repetition of past material, with minor updates. This should help new members.

I am retired with spending needs that exceed incoming secure revenue from outside my investing portfolio. Those secure revenues include a combination of a pension, social security, and annuities. Here is a ballpark display of how it fits together for 2025.

So long as my various work continues, I won’t have to withdraw anything from the portfolio.

What I will do, though, is to begin giving the kids some pre-inheritance funds. All three are standing on their own feet financially, which was my first goal for their adulthood.

So now help from me will enable luxuries by whatever definition they apply. This feels really good.

Tracking Portfolio Progress

Let’s start with a bit on tracking progress in retirement portfolios. One obvious measure is how much money is sitting there. It provides the resource that will generate future distributions.

But that does not tell you how you performed as an investor. As an investor, you also (hopefully) generated the gains that supported whatever was distributed for spending or other purposes.

It makes sense for that reason to track the sum of present portfolio value plus distributions as a primary measure of investment performance. This matters for me, especially this year since I made what should be my last big withdrawals in preparation for long-term retirement.

Here is the history of the total portfolio performance relative to January 2020. I don't separately track the REITs.

My portfolio plus distributions were essentially flat month over month, with a new all-time high in between. What is satisfying is that everything I intended to fund by age 70 is now funded, despite having been forced to retire at age 65. Withdrawals seem likely to be smaller until if and when I stop working for some income.

REITs this Month

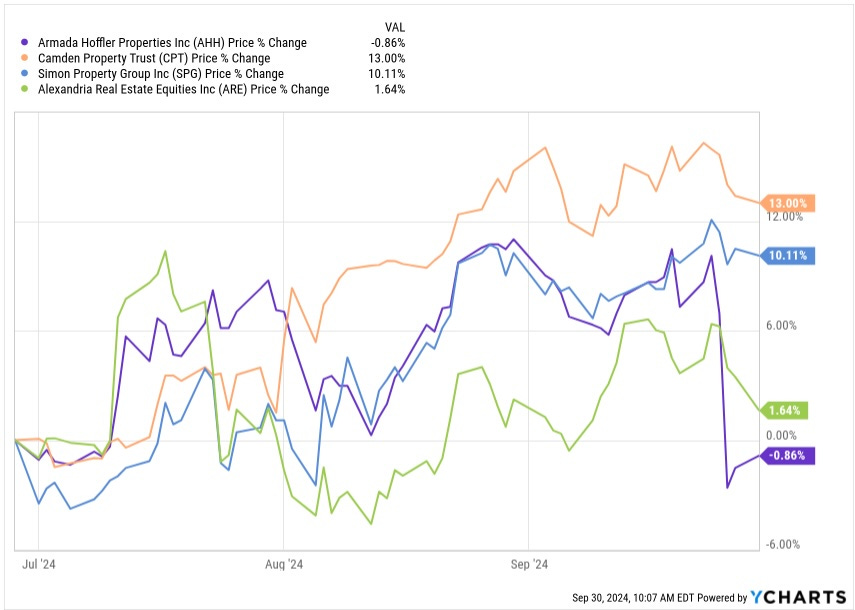

Here is the 3-month price action of four REITs I do or would own:

Three of these advanced 10% or more from July 1 through August 1. Camden Property Trust (CPT) and Simon Property Group (SPG) have been flat since. Armada Hoffler (AHH) followed the same pattern until its big drop, discussed below.

In contrast, Alexandria Real Estate (ARE) stayed flat. That might be the REIT with the largest upside to fair value. But the market may not see it until the media narrative that all life science is empty fades.

It seems to me that many REITs have priced in the interest-rate cuts that have already happened, and maybe a few more. Going sideways from here for several months would not surprise me.