What RPD Bought And Sold In October 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on October 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

What RPD Bought And Sold In October 2024

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

Any investment author worth their salt stresses that individual context is an essential element of portfolio construction and investment decisions. My own personal context has changed this year.

It makes sense to do some focused thinking about that change, which is why this is the topic for the present update. One takeaway for you is that when your financial context has changed, it is time to re-examine your approach.

Overall, though, my perspective on being a retired investor has not changed.

In summary:

You cannot trust total return to sustain your ability to draw income, because in some decades market earnings multiples drop substantially.

Beware of financial engineering, because in some periods the Fed will be unwilling or unable to bail you out.

Focus on companies paying sustainable dividends with robust business models, able to grow those dividends at least with inflation.

Within that constraint and within your circle of competence, buy where Mr. Market offers you higher yields.

One can seek to grow income by taking advantage of those opportunities that Mr. Market presents. This can be done with income positions and with positions selected for upside. I do both.

It took me time to reach this perspective. The past five years have seen a lot of evolution for me:

Five years ago I felt forced to retire for health reasons.

Financially my resources fell short of what I had planned, leading me into investing, with a first goal of achieving that plan.

Starting in late 2018 I developed deep expertise in REITs. The reasons are that both match well with my background and both are niche markets where it can be easier to find mispricing of stocks.

My portfolio approach also evolved as it moved from holding many companies only somewhat understood to holding a lot fewer understood pretty well.

I transitioned three years ago to my present approach — a portfolio dominantly focused on reasonably secure dividends likely to grow modestly.

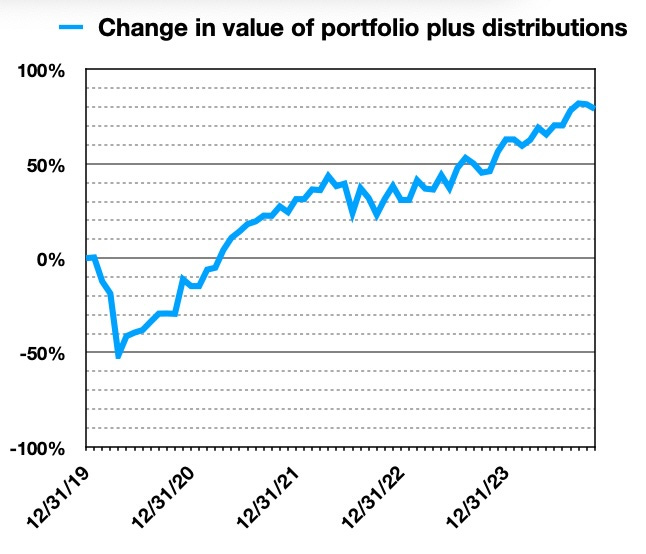

The outcome was huge gains in 2021, survival in 2022, and a slow upward grind since then. My portfolio holdings have set new highs several times this year. The sum of holdings plus funds distributed for spending, a good indicator of success, is up about 80% since the start of 2020:

Beyond all that, I made some decisions over the past year that reduced my future spending needs. This included establishing some annuities at the peak in interest rates, buying a new car with cash, paying off a mortgage, and topping off my donor advised charitable fund.

Before those actions, I had been drawing at intervals from my dividend income. Today:

My projected 2025 income, including dividends, substantially exceeds projected spending.

If my “outside” earnings disappeared, I would still need less than half my current dividends to support such spending.

In short, my personal context has changed because my financial goals are met. That leads to a question: What the hell do I do now?

What is the Goal?

It seems to me that there is a time to re-consider one’s goals, and a moment of achievement is one of them. I apologize if what follows seems to be excessive navel-gazing.

That said, verbalizing these things about myself really does help me set directions. Maybe you should try it too.

Several issues matter.

Constraints: While I would love to return to spending a lot of time teaching Alpine Skiing and going on ski trips, that is not in the cards. More generally, my focus has to be something I can achieve on the computer and online.

Purpose: The question here is what sort of impacts I want to have going forward. There are lots of options.

I could seek to grow much more wealth, taking more investment risk for higher gains.

I could seek to broaden my life experiences and invest more safely in order to put more attention elsewhere.

I could seek the reward of helping others. I’ve been doing a lot of that with my investment research, writing, and chatting. Or I could do something very different such as active online fundraising for causes I value.

Enjoyment: Whatever I do, it matters to find a direction such that I enjoy the process and not only the endpoints. This pretty much steers me to some kind of analysis, seeking to figure out complex systems.

Intangible Value to Me: There are some people who are happy as a clam if they just pursue a process they enjoy every day. I rather envy them, but that is not me.

Others find tangible achievements, such as having more money, sufficient motivation. That too is not me.

At my 70th birthday celebration last weekend, I overheard a woman who has known me professionally for decades tell someone “everybody loves Paul.” Of course that is not true and being loved like that was never my goal. But the overarching context was that my actions have positively impacted many people and this does matter to me.

Having a long-term, positive impact on those around me has long been something I value a lot. And looking back on my years of investment writing, the most intense moments of joy have occurred when a reader told me that my writing had made an important difference for them.

So the goal(s) that make sense to me are these:

Invest wisely, with eyes on sustaining my required dividend support and on growing my legacy.

Share my thoughts and the results of my research, to help others achieve their own success. That is what I will continue to do here.

All the above is not written to provide a template but rather an example. Knowing yourself and finding your direction is your problem. Don’t just ignore it.

Investment Implications, Update on Portfolio, and Trades

As you likely know, my active-investing portfolio has in recent years included an income bucket intended to throw off growing dividends, an upside bucket intended to increase portfolio growth, and an illiquid bucket of long-term, private investments made years ago.

Even for the upside bucket, and especially for the income bucket, I have wanted a probability of substantial loss per year for any position to be less than 1%. This was intended to enable rapid growth of the portfolio while maintaining low risk.

It is time to rethink that.

One thing that is clear is that seeking more upside with some small riskier positions now makes sense. I’ve already started doing some of that, notably with Orion Office (ONL).

A couple other themes have been running through my thinking. These relate to having a dividend focus and to desiring a more comprehensive view of dividend security within the portfolio.

Dividends are the goal but we also know that chasing yield is a losing game. And we know that growth of market value can be a path to affording larger dividends.

How to display this is a bit of a conundrum. I tried one approach below. Let me know if it seems helpful to you.

My Context

I detailed this above. A regular summary will return next month.

REITs this Month

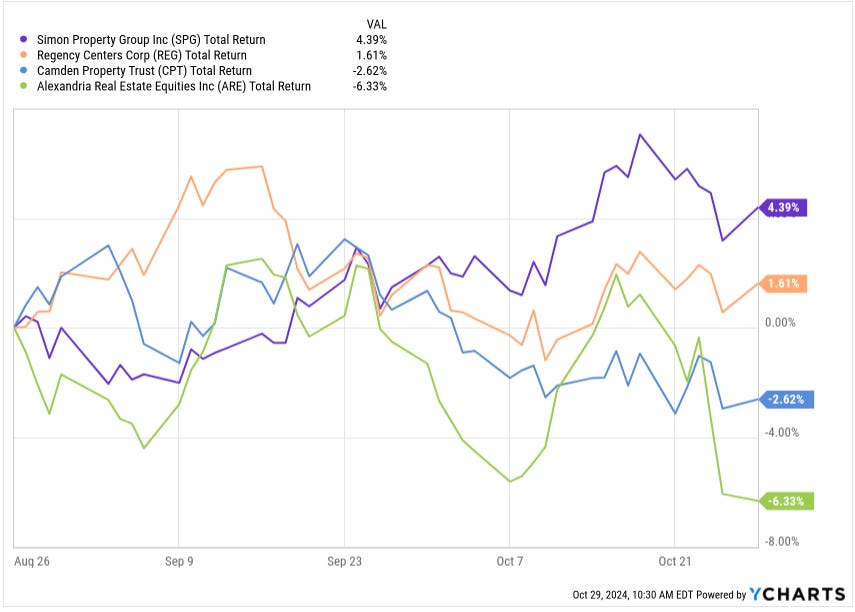

Here is the 2-month price action of four REITs I own:

These have been more or less flat since the nice increase in the run up to the Fed rate cut in early August. Simon Property Group (SPG) has continued recent strength. Alexandria Real Estate (ARE) continues to lag. Both trends to me seem like voting; they run in parallel with ongoing media narratives.

ARE might be the REIT with the largest upside to fair value. But the market may not see it until the media narrative that all new life science buildings are empty fades.

It still seems to me that many REITs have priced in the interest-rate cuts that have already happened, and maybe a few more. Going sideways from here for several months would not surprise me. Valuations overall seem high to me for today’s interest rates.

Trades this Month

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.