What RPD Bought And Sold In February 2025

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

A moment of fire in the sky.

I have found myself strongly affected by the third anniversary of the Russian invasion of Ukraine. Some related thoughts precede my discussions related to investing.

Much of my attention this past month has been focused on Ukraine, where Russia’s invasion and war crimes have now gone on for three years. The lack of perspective in US and even European reporting is remarkable.

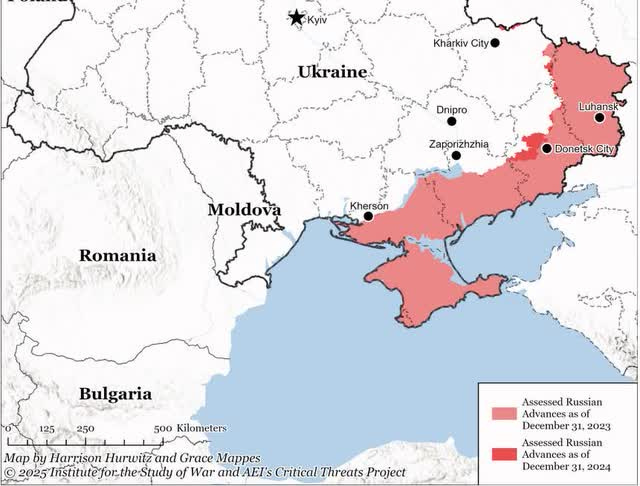

By any historical standard, the Russian invasion is a failure. Since losing most of their initial territorial gains, the Russians have pushed the front forward only incrementally. Here is 2024 vs 2023, from this extensive review by the Institute for the Study of War:

Their summary:

The Kremlin threw everything it had at breaking Ukraine in 2024 and failed. Ukrainian forces held in the face of Russian assaults conducted with a shocking disregard for losses in men and equipment and despite shortages imposed by delays in the provision of Western equipment.

The Russian gains are so small that conquering the country is just not possible. In contrast to reality, the Western press has vigorously pushed the Kremlin-friendly narrative that Ukraine is about to collapse. (See the nice review of this by Phillips O’Brien here).

Despite all that, it has become clear that Ukraine can fight on, without any US aid, for a very long time. And they “are beginning to win on the battlefield.”

The main reason is drones. In 2024 Ukraine produced 2.2 million first-person-view drones and production is only increasing. These are cheap enough to send multiple drones after one soldier yet are deadly to armor including tanks.

Ukraine is also now the world’s largest producer of tactical and long range drones. They have already used them to destroy energy infrastructure and/or military supplies at several hundred locations deep within Russia during 2024.

If you look at what Russia actually is demanding, you will likely be surprised. The Kremlin continues to play the Western Press and President Trump like a violin. As to the debacle in the oval office, the Kremlin got just what they wanted. Here is how Phillips O’Brien, Professor of Strategic Studies at St. Andrews, put it: “Zelensky stood up to Trump's bullying, now Europe must stand up for Ukraine.”

But whether or not he is handed Ukraine on a platter, Putin will not stop. He has been explicit that his goals extend beyond the elimination of Ukraine and Ukrainian culture, to at minimum controlling much more of Europe. Putin will use any extended cease fire to rearm, just as he did from 2014 to 2022.

This is a time for war. They happen.

Putin (or his successors) will be defeated militarily, but in what decade and at what ultimate cost is uncertain. Delay only increases the cost in lives and money.

That last point is what is relevant to investing.

Until Putin is eventually defeated militarily, investments in Eastern Europe, especially in the energy and materials sectors, will carry high risk. Be careful.

Companies are not Fungible

Turning fully to investments, stocks as such are somewhat fungible. You can sell one and buy another easily.

But companies are not fungible at all. Consider that when you buy a stock you buy ownership in a company. Your stock portfolio is made up of such holdings and you should understand its profile.

Among REITs, you may hold, for example:

REITs with very strong balance sheets and business models that can sustain dividends and grow even through deep recessions.

REITs with strong balance sheets that still cannot grow per-share cash earnings without favorable stock-market conditions.

REITs with weak balance sheets, either in Debt Ratio or in maturity ladder, who will be forced to cut their dividend and perhaps dilute shareholders in deep recessions.

REITs in stronger or weaker positions regarding tenant concentration, geographic concentration, or dependence on technologies that could be disrupted.

REITs that own and operate properties as opposed to those operating an ordinary business that uses properties.

If you sell your share in some company of one type and buy into a different type of company, you change the risk profile of your portfolio. I find it strange that chat-room investors rarely seem aware of this. They speak of selling one stock and buying another without showing any understanding of what this would do to their portfolio prospects and risk.

Perhaps this would make sense for a short-term momentum trader. But if you are a value investor then you only win if your value-driven gains outweigh your risk-driven losses. So you also should be aware of changes in risk.

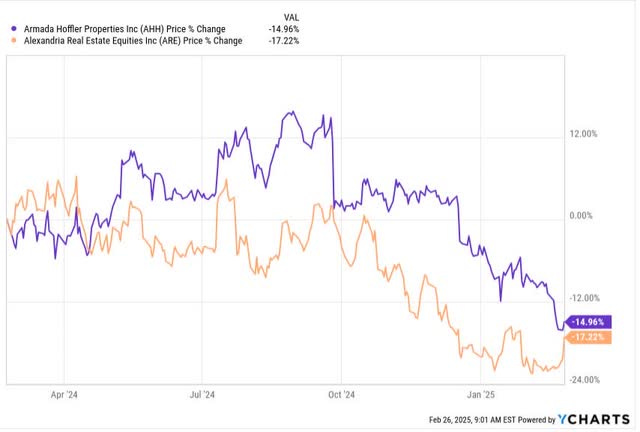

There happens to have been a fair bit of discussion lately involving both Armada Hoffler (AHH) and Alexandria Real Estate (ARE) in the same paragraph, without qualifications. These thoughts may be driven by the reactions to earnings for the two stocks:

So sure, you could react by swapping ARE into AHH. But doing so would weaken your portfolio:

ARE is a BBB+ level investment grade firm, AHH is trying to improve, but is still junk per the big agencies.

ARE has much broader geographic diversification.

ARE has solid dividend coverage while AHH will not cover their dividend in 2025.

Questions for ARE are about leasing in 2027, while for AHH they are about whether 2025 proves to be the earnings trough they predict.

ARE can grow per-share earnings more rapidly than AHH today, although both REITs are limited by current stock, property, and debt markets.

So what are you doing if you swap ARE for AHH?

You are increasing the risk profile of your portfolio.

In return for that you get 350bps more yield, with dividends that will grow little any time soon.

You get different potential upside.

The point is not whether or not an exchange would be a bad decision. What matters is what makes sense for your own portfolio and your own needs. What matters is a lot more than superficial recent stock-price variations.

Update on My Context, Portfolio and Trades

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.