What RPD Bought And Sold In February 2024

What RPD Bought And Sold In February 2024

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

Here we share, in his words, some philosophic considerations for investments and retirement income, his portfolio actions this month, and his thoughts about them and the future.

Philosophy Corner: How You Should Imitate Jussi

Jussi gave us all a big gift and a little gift this month. The big gift was My Biggest Losses & Lessons and the little gift was My Biggest Wins & Lessons.

Why that order? Because the first priority in investing is to minimize losses of principal.

Despite being successful overall, Jussi decided to review his investment performance and the reasons for losses and wins, in order to improve his outcomes going forward. The result was those two articles.

There is an important learning aspect here. Humans only really learn something when they figure it out for themselves, often from their own experiences.

A learning experience that might stick.

It never ceases to amaze me that one country is rarely able to learn from what happens in another country. Likewise one state can’t learn from another state and one town can’t learn from the next town over.

So as a (presumably) human investor, it matters a lot to apply yourself to learning from your experiences. It is likely that you have actually learned little or nothing from all the good advice that you have read.

Now that advice and theory may give you a needed context for interpreting and learning from your own experience. But you have to do the work.

And by the way, this is not unique at all to investing. It is the same, for example, in science, among many other places.

Then, later, we find out whether or not we really learned those lessons. We will see over time, and likely in a next review by Jussi in a few years, how well he does at that.

But here’s looking at you. You should apply an honest, introspective review to your own investing wins and losses just as Jussi did. (It has been great to see some members dig in and start doing it already!)

Do you have a list for each year of your closed positions and their net result? If not you should make one. Every year.

Next, you should thoughtfully consider each one.

When doing this, work hard to avoid hindsight. It does not matter whether some stock you sold soared or cratered after you sold it.

If a closed position was a gain, ask why you sold. Then ask if you are satisfied with the reason.

If a closed position is a loss, ask first why you bought it. In retrospect, was that decision a reasonable choice and if not why not?

Then, for that position that was a loss, ask the same question about why you sold it.

This is very key: What matters is the quality of your approach and the quality of the decisions you make, not any one outcome.

Now you may indeed learn something from a bad outcome that leads to better decisions later. Or that bad outcome may be one of the random things that happens when investing. Try to decide which.

Above all, do whatever you must to avoid big emotions about your results. Channel Kipling:

If you can meet with Triumph and Disaster And treat those two impostors just the same; … Yours is the Earth and everything that’s in it,

The RPD Retirement Income Approach

This section is to set the context for new members and/or refresh it for prior readers. It may help to emphasize how different the context is for me vs Jussi.

Jussi has a steady stream of savings, and these usually enable him to add to his holdings weekly, which you see in his Trade Alerts. In contrast, I’m retired with no new savings and an increasing need over time for income from my portfolio.

This difference in context ends up meaning that Jussi and I often make different choices. We hope that the comparison will be useful for members.

Here are my portfolio and income streams for 2024, after adjustments described in recent updates.

My secure income from various sources will substantially cover essential expenses. I started Social Security a bit early, following this thinking. For now that lets me reinvest more dividends.

In late 2021 I increased the fraction of my holdings that are focused on dividend income supported by solid financials. Then in late 2022, following my analysis of the risks for me associated with earnings multiples, I further increased this fraction.

Going forward, the dividends from my portfolio should support all (or nearly all) spending into my 90s, if I live that long.

REITs Still Sideways

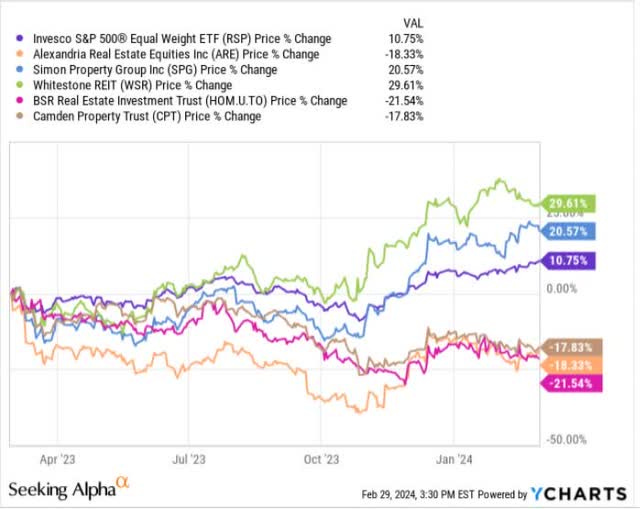

Here is a comparison of some REITs from the CORE portfolio, plus Camden Property Trust (CPT), across the past year. Also shown is the equal-weighted S&P 500 index, as followed by the Invesco ETR (RSP).

Note first that a flat January was followed by a flat February. All that sound and fury about the Fed has not translated into big moves in any direction.

Note second that two of my own selections for upside, Alexandria Real Estate (ARE) and CPT, would have to move up 30% to 40% to match the RSP or Simon Property Group (SPG).

For me, a strange event this month followed my “Buy” article on ARE, where I shared why my enthusiasm has gone down. Various readers interpreted that as a “ bearish” take.

When a mere “Buy” instead of a “Strong Buy” is bearish, I take that as a sign of market euphoria. It might mean look out below.

Almost Sitting There

This seemed to me a good month for waiting as we watch the trends just discussed play out. This past month I did make one small trade.

Mid-month EPR Properties (EPR) had dropped to about $42 and the yield was climbing well above that of TC Energy (TRP). Now I do think that TRP is undervalued by some tens of percents.

But the portfolio fractions were comparable for both TRP and EPR and I had higher confidence in EPR. So I sold a 1% chunk of TRP and used the funds to buy EPR.

Other than minor tweaks like that one, I likely will do little else until whenever the markets really move one way or another.

My REITs Today

My REIT portfolio has two buckets. The comparatively small Upside Bucket is intended to add a few percent per year to portfolio growth.

The size and need for my Income Bucket was discussed here and in articles linked from there. Its purpose is to secure the income I need for retirement spending even if we get a decade that rhymes with the 1970s.

Based on thinking discussed here in recent months and in some public articles, it no longer makes sense to me personally to be invested in growth positions. In contrast, my view is that younger investors and some older investors should be.

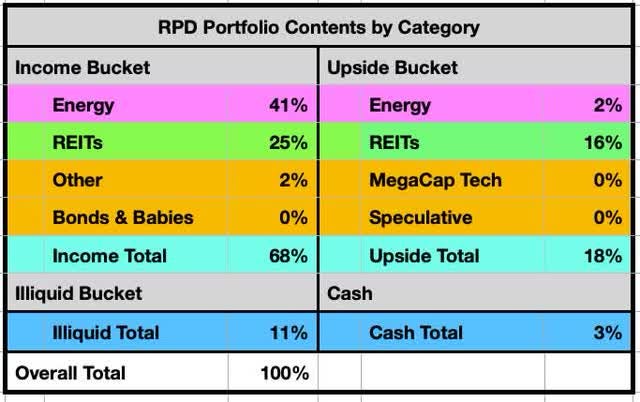

Here are the REITs today. The totals for my energy positions are also shown:

Three months ago my Upside Bucket had dropped to a 10% fraction, as I was not finding opportunities with enough margin of safety for me. But as a result of happenings in recent months, my upside fraction is up to 18%. This is getting near my 20% target.

Recent market action has also moved my weighted average gain in that bucket up from -11% last month to -7% now. We are not yet reaping gains, but it is nice to see movement.

If you exclude SAFE, the other three are already up close to 10%. I bought ARE too soon, CPT a bit early, and CCI with perfect timing. So far, anyway.

As to the Income Bucket, the only change was the small one discussed above. Overall, the distribution and position sizes please me today. I expect to keep the SPG position larger than the rest, having high confidence in that REIT.

If and when the EPR yield comes down into the range of the others, I will probably pull that down some. And when we get big upward repricing of everything, it will be time to spread the funds more broadly in preparation for the next bear market.

My Portfolio Today

Long-term members know that my portfolio overall is also divided between REITs and energy. These days, the energy holdings are providing a lot of welcome dividends. I did add one upside position in energy late last year.

Within the Income Bucket, the higher income generation from the energy midstreams pulls some funds that direction. Today the relative distribution within the Income Bucket is 37% in REITs and 61% in energy.

I hold in that bucket EPD and TRP which are in the HYI portfolio, among other things. The holdings in the Income Bucket are not cyclic plays as such.

Managing that portfolio will involve a primary focus on the ability of its holdings to continue growing their dividends. A secondary focus will be to broaden the sources of income in good times so as to be able to pursue opportunity when prices of some holdings drop, perhaps in the next bear market.

I also have 10% of the portfolio in Private Equity and other positions. Here are the overall portfolio contents by category.

The dividend yield of the Income Bucket is 7.7%. That of the full portfolio is 5.9%.

November saw the market looking ahead to interest rate cuts. The market value of the full portfolio jumped by more than 7%, setting a new all-time high.

Since then it has been down and back up. It is now less than 200 bps below the all time high.

Here is a plot of the Fidelity part over the past two years. The maximum is 40% larger than the minimum, and during this interval I pulled out about 4% to cover expenses.

I suggest you look at something similar for your own portfolio. The main point is that it is silly to get excited about moves of 10% or even 20%. As John D. Rockefeller and many others have said about predicting the markets: “They will fluctuate.”

Let me re-emphasize this. If I wasted my thinking time on the nonsense that so many investors spend time and energy on, my portfolio would not be where it is. Focus on the important stuff, folks.

Looking Ahead

My view today remains that interest rates are very likely to come down a lot well within a year. I explained why in this article. But I could be wrong, though not for any of the reasons seen in the mainstream media.

If I am right, REIT prices will respond favorably. That does not guarantee a return to 2021 highs, though.

Between getting more income than I need from dividends, and having a few positions with good upside potential, things seem good to me. I can wait if and as needed.

This would also be a good time to examine your own preparedness. What will you do if the market turns around and crashes hard again? If it just drifts? Or if the REITs finally take off and fly?

RPD is long all the REIT positions disclosed in this article.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola & R. Paul Drake