What RPD Bought And Sold In August 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on September 9th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

What RPD Bought And Sold In August 2024

This is the next installment in our monthly series on the portfolio of our retired author, R Paul Drake (“RPD”). This series is mainly targeted at our retired members to give them a retiree perspective on REIT investing. If you are not a retiree, you may still find value in this series as it often discusses many of our individual holdings.

Here we share, in his words, some philosophic considerations for investments and retirement income, his portfolio actions this month, and his thoughts about them and the future.

Effort, Luck, and the Limits of Success: Lessons from Malcolm Gladwell, Warren Buffett, and Value Investing

In his book “Outliers,” Malcom Gladwell makes a compelling case that accidental circumstances have a dominant impact on success at the highest level. My view is that he overdoes it in denying credit for such success, because it does not happen without intense and persistent effort (as in his 10,000 hours). One of his examples is the Beatles.

But still many people do put in that sustained effort without achieving success at the highest level. What bothers me in Gladwell’s stories is the “highest level” part.

Success at some level follows intense and persistent effort more reliably. Even so, one must avoid a variety of self-defeating attitudes and behaviors, but we won’t go there today.

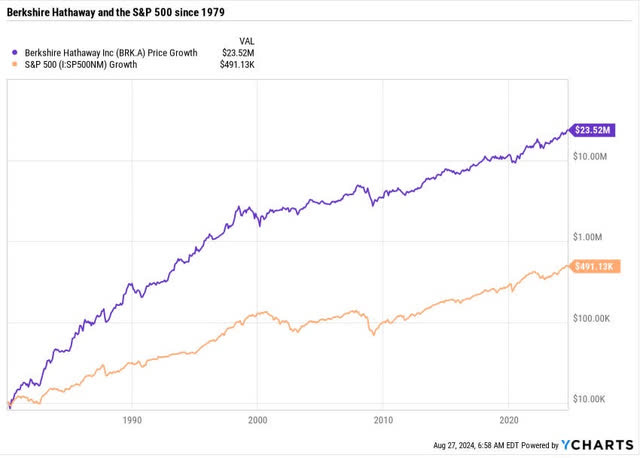

This lets me take us to value investing. My view is that value investing, done well, is highly likely to be successful. But value investors cannot expect to achieve the success of Warren Buffet.

In 1984, Buffet put a piece in the magazine of the Columbia Business School, Hermes, entitled “The Superinvestors of Graham and Doddsville”. There is a good summary in Wikipedia, but the original is really delightful, if you can find it.

Quoting that summary:

Buffett starts the article with a rebuttal of a popular academic opinion that Graham and Dodd's approach ("look for values with a significant margin of safety relative to [stock] prices") had been made obsolete by improvements in market analysis and information technology. If the markets are efficient, then no one can beat the market in the long run; and apparent long-term success can happen by pure chance only. However, argues Buffett, if a substantial share of these long-term winners belong to a group of value investing adherents, and they operate independently of each other, then their success is more than a lottery win; it is a triumph of the right strategy.

Buffet then provides nine examples of highly successful disciples of Graham, investing in very different contexts. None of them, however, achieved the ultimate level of success that Buffet (and Munger) did.

It is no surprise that the idiots in academia have ignored this article and tried to explain away Buffet’s success as random. As usual, they are lost in a world of their own making.

Seth Klarman, in his 1991 “Margin of Safety,” wrote this great description: “Buffett's argument has never, to my knowledge, been addressed by the efficient-market theorists; they evidently prefer to continue to prove in theory what was refuted in practice.”

Still, one can ask whether Buffet and Munger were better investors than anybody else over the past several decades. My view would be that they were outstanding investors who also got lucky.

Of course, one can get unlucky too. Buffet and Munger have argued that you only needed to own three good companies to support long-term success. My view is that this might work, but only if you do not get unlucky. One reason to diversify beyond three holdings is to protect yourself.

REITs

One thing to like, a lot, about REITs is that they do not tend to fail (if you stay away from high leverage). They may or may not grow earnings well, but are really unlikely to see the value of the properties collapse.

This, however, is not certain. The demise of many malls with lower sales proved too much for a few moderately leveraged REITs that owned such properties. In contrast, those who invested in the one true blue-chip in that sector, Simon Property Group (SPG), and added wisely, have done very well.

And more recently, the pandemic-induced rise of work for home has rendered a lot of lower-quality office buildings non-economic. Even so, the best REITs in that sector have come through well, and even provided good investment opportunities along the way.

In short, my view is that one can avoid capital destruction in the REIT sector by applying understanding and good judgement to where one invests. We don’t have time today for details, but I think one can invest with similar safety today in midstream energy and even some upstream energy firms.

This was not true, though, before about 2020 and it may not stay true forever. One must pay attention.

In all these areas, one can get gains from dividends and gradual increases in value of the firms (when the market recognizes it). This may be all the “success” you need. And it most certainly is not accidental.

The potential for larger gains comes from identifying and exploiting market mispricing. Doing so certainly has been lucrative for me with the aforementioned SPG.

It is not hard to buy low when using a quantitative understanding of a firm’s business model to assess its value. So how much of my gains in REITs across the last two bear markets could be accidental? Some certainly but not most, in my view anyway.

My Context

Included is some repetition of past material, with minor updates. This should help new members.

I am retired with spending needs that exceed incoming secure revenue from outside my investing portfolio. Those secure revenues include a combination of a pension, social security, and annuities. Here is a ballpark display of how it fits together for 2025.

So long as my various work continues, I won’t have to withdraw anything from the portfolio.

What I will do, though, is to begin giving the kids some pre-inheritance funds. All three are standing on their own feet financially, which was my first goal for their adulthood.

So now help from me will enable luxuries by whatever definition they apply. This feels really good.

REITs in August

We have just come out of the Q2 earnings season and another round of Fed watching. For REITs generally earnings news has been strong. And it has increasingly looked like interest rate cuts would begin soon.

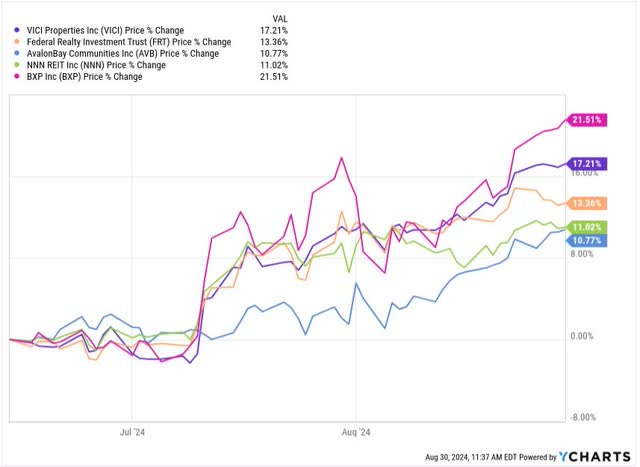

REIT prices have responded. Here are the prices of quality REITs from several sectors, since mid-June, to illustrate:

These all increased. Coastal multifamily REIT AvalonBay (AVB) was on the low end. Office REIT BXP (BXP) increased the most, as their news in particular and news out of high-quality office properties in general showed more recovery than many were expecting.

Still one should ask whether this jump of 15%, more or less, might have priced too much good news. With REITs off by a third, getting back to the same earnings multiples requires a 50% upside.

Perhaps these REITs are roughly a third of the way there. But interest rates were pushed up 500 bps. We don't seem likely to recover a third of that during 2024, if ever.

My take, for most REITs, is that if you buy here do so with only long-term expectations. And don't be surprised if these REITs fall back some later in the year. Might, might not. No one can time the market.

Trades this Month

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.