What David Ksir Bought And Sold Over The Past 90 Days (Q2 2024)

Important Note: We recently welcomed David Ksir as a new member of our research team. David has a private equity background with experience working for Penta Real Estate, which is one of the biggest real estate investment firms in Poland, the Czech Republic, and Slovakia. He brings a private equity approach to REIT investing and will be especially helpful as we expand our coverage of European opportunities.

Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how David manages his portfolio, we are posting this to give you extra value.

You can read David’s original thesis for investing in REITs by clicking here.

You can read Q3 2023 installment by clicking here.

You can read Q4 2023 installment by clicking here.

You can read Q1 2024 installment by clicking here.

Market Outlook

I have grown increasingly bullish over the second quarter of the year, not only on REITs and other interest rate-sensitive stocks, but on the market as a whole. Therefore, in today's piece, I want to spend most of the time discussing my (updated) outlook for the market.

First, I want to recap some near-term catalysts that I believe have a high likelihood of unfolding before the end of this year that could drive the market materially higher. Then, I want to touch on some longer-term risks that the broader stock market is likely to face and suggest a prudent way of diversifying into sectors where this risk is much lower.

Near-term bullish catalysts

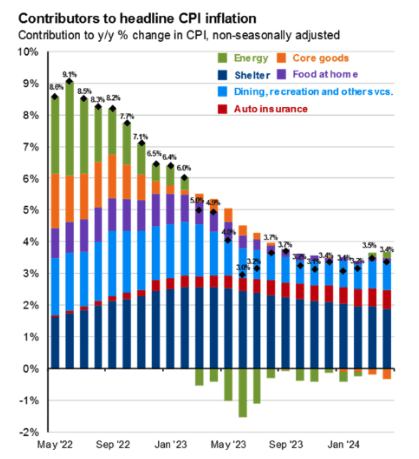

Most are probably tired of hearing about inflation at this point. After all, it is a topic that most headlines have focused on for the past two years, and frankly, there has been very little change in the reported headline numbers lately as June CPI came in at 3%, marking a 12th consecutive month of 3-3.5% (annual) inflation.

But it is usually times like these, when the crowd stops paying attention because a topic gets boring, that we should care the most, because a turnaround may be close.

Indeed, I believe that there are two reasons why a substantial drop in inflation to <2% is just around the corner.

First, and we've touched on this many times, shelter CPI continues to be reported at 5.2%, despite real-time data for rents being down by 0.7% over the past 12 months and median sale prices of houses declining by as much as 2% over the past year. We know by now, that this is entirely a result of the methodology used for the CPI calculation which makes the headline measure lag by as much as 12 months.

Second, auto insurance most recently reported inflation of 20%+ which, despite a somewhat low weighting of under 3%, added as much as 0.6% to the headline CPI number. It is true that car insurance prices across the board have skyrocketed recently. But here's the thing. Insurance policies are generally closed for a period of one year. When a policy expires, it gets re-priced based on the value of the vehicle at the time. This creates a meaningful lag between inflation in the price of used cars and insurance policies. Since the price of used cars peaked about two years ago, and used car inflation is now being reported at negative 9.3%, I think it's only a question of time before prices of auto insurance stabilize or perhaps even decline.

In absence of a black swan event, it seems likely that inflation should decline meaningfully in the second half of 2024 as we work through the lag in shelter and auto insurance CPI, perhaps even below the Fed's 2% target.

Declining inflation combined with slowing GDP growth reported at 1.4% in Q1 2024, and a (slightly) rising unemployment at 4.1%, form a very good basis for the Fed to loosen its monetary policy.

Currently, there is a 100% probability (implied by trading activity) that the Fed will cut rates by at least 25bps in September. Beyond that, there is a 63% probability of at least three cuts by the end of the year.

So clearly, the market is already expecting some cuts. But I'd argue that if inflation declines as I expect or if the economy softens further, the Fed could easily cut more than is currently expected. This seems especially likely in light of the approaching election which generally results in a liquidity boost in an effort to make voters happy.

Beyond a (very likely) decline in rates, there are two factors that could positively impact liquidity towards the end of the year:

The reverse repo is almost drained which means that the Fed is running out of easily sellable securities, hindering its ability to suck liquidity out of the system.

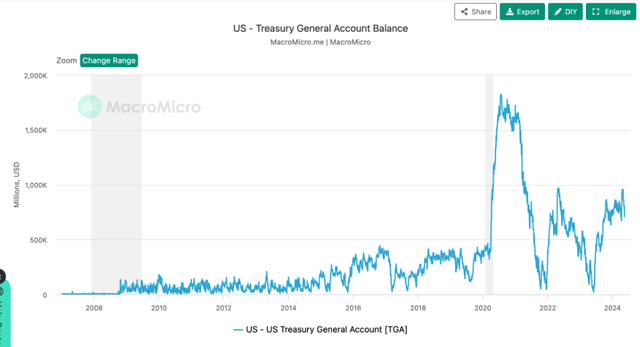

Janet Yellen's treasury general account is approaching a Trillion dollars as taxes have been collected in the spring, but the money hasn't been spent. I'm speculating here, but it would not surprise me if the current administration decided to spend as much of this money as possible just before the election to "buy" voters, significantly boosting liquidity in the market.

Higher liquidity (i.e. money supply) inevitably leads to higher asset prices and the correlation is staggeringly high at 97.5%!

In light of everything discussed, it should be obvious that I am really quite bullish on the second half of 2024. Beyond this year, however, I do see some risks in the market.

Longer-term risks

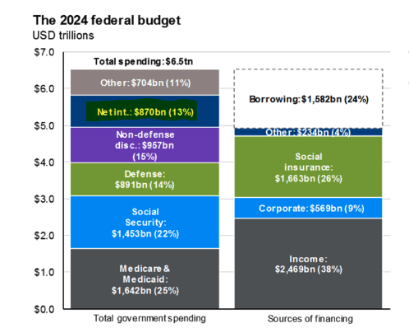

First and foremost, I worry about the ever growing level of national debt, especially because the U.S. has an ageing population which (1) will likely not be able to support GDP growth above 2% per year, and (2) which is likely to require the country to run a large deficit in order to support the ever-growing social security.

Combine this with (1) public debt already at 100% of GDP, (2) debt servicing costs (i.e. net interest) which now account for 13% of the total federal budget, and (3) the fact that as much as 38% of U.S. Treasury debt will be refinanced before 2026, and you have a recipe for interest payments spiralling out of control.

Second, after the recent AI-driven market rally, the market has become very concentrated in just a handful of very large companies. Take the S&P 500, where the top 10 companies account for 35% of the whole index, and eight from these come from the same sector - you guessed it, technology.

This concentration has obviously worked very well historically, but I suspect that many of the so called mega caps have got too large for their own good.

Broyhill Asset Management has done an interesting study which found that in competitive markets the top performers generally have a tendency to underperform and only a very small portion of companies are able to maintain 20%+ revenue growth and 50%+ EBIT margins for more than a couple of years. This to me is a good remainder that although companies like Nvidia (NVDA) currently seem to be headed for the moon, history is NOT on their side.

And finally third, we should not forget that as a direct consequence of high exposure to expensive tech stocks, the market as a whole is quite expensive. The S&P 500 now trades at a forward P/E of 20.5x and that, historically speaking, is very unlikely to generate positive returns over the next several years, let alone generate alpha.

Implications for what to buy

To conclude the market outlook section, here are the conclusions I have come to:

I want to be fully invested because I am bullish on the rest of this year for both interest rate sensitive stocks and broad market indices

I see interest rate sensitive stocks (especially REITs) as very well positioned to benefit from declining inflation and interest rates

I'm keeping my S&P 500 position for now, but am adding a position in a dividend ETF - Schwab U.S. Dividend Equity ETF (SCHD) to diversify away from the heavily concentrated S&P 500 and to somewhat benefit from value being historically cheap relative to growth.