What Austin Bought And Sold In September 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on September 9th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

What Austin Bought And Sold In September 2024

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

I am determined not to be one of those financial writers / pundits who simply ignores all of his past calls that didn't turn out as expected.

If anything, I think it would be better for me to rub my own nose in my faulty calls so as to ensure I learn my lesson and hopefully help others learn from my mistake (or give readers a chance to say "I told you so," as the case may be).

I've been saying a recession is coming for a long time now. To be clear, I still think a recession is coming in the near future. But when exactly I envision the "near future" to be keeps getting pushed back. Originally it was a vague "sometime in 2023," and then it got pushed to late Spring or early Summer of 2024, and then it got pushed to Fall or Winter of 2024. And now?

Ah, who knows.

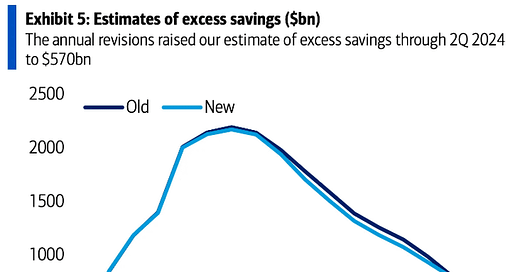

My best guess is that the economic expansion has been extended (and thus the recession delayed) by the fact that it has taken much longer than most people expected (including me) for the pandemic-era excess savings to be fully deployed into the economy.

Even Bank of America's estimates of excess savings are turning out to be too pessimistic.

(I would contend, however, that all pandemic-era savings have been wiped out for at least 60% of US consumers and what's left is almost entirely in upper-income households.)

In any case, as Howard Marks once quipped, "Being too early is indistinguishable from being wrong."

Well, sort of.

The goal of my macroeconomic analysis isn't to completely reshape my portfolio depending on what I see coming in the next few quarters or so. Not at all. It's mostly to identify what stage of the cycle we are in as a way to gain some rough idea of where the economy (and, by extension, stock market) is likely to go in the near future.

Really, the only actionable conclusion to be reached from this macro analysis is whether to keep investing 100% of investable cash into the best available deals at the time or to raise cash in anticipation of better deals to come in the relatively near future.

Right now, I'm in semi-cash-raising mode, as I explained in "Raise Cash And Sell Trash."

That is because I'm still of the view that we will get a mild recession at some point in the relatively near future that will likely render better deals in the stock market than are currently available today.

But, at the same time, there are still some buyable dividend stocks.

To my mind, this noncommittal, "one foot in, one foot out" approach is the best strategy to employ in the current market.

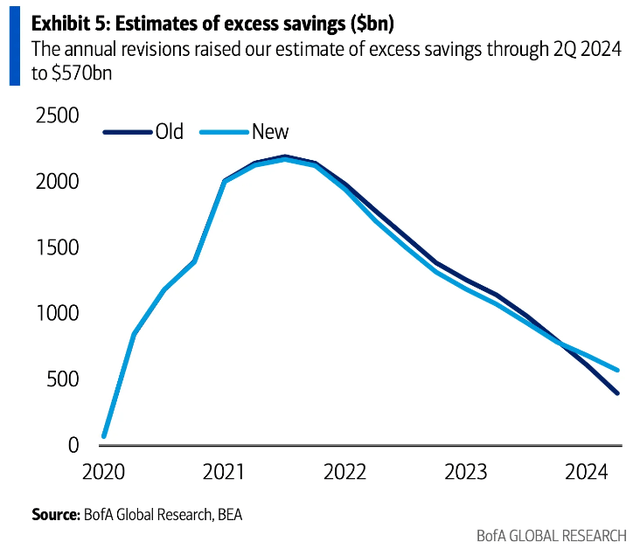

But there is sharp disagreement about where the economy is headed from here.

Fund managers are of the overwhelming opinion that the US will enjoy a "soft landing" and avoid recession -- and that this Fed rate-cutting cycle will be one of those rare ones not accompanied by a recession.

This is partially a learned response. It pays for fund managers to remain bullish and long stocks. The ones who get bearish and start playing defense too early underperform and lose assets under management to the perma-bulls.

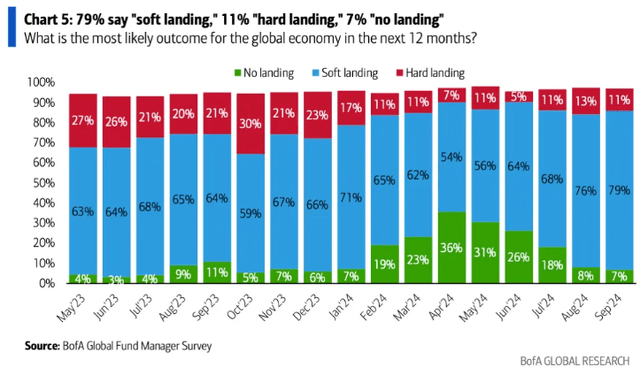

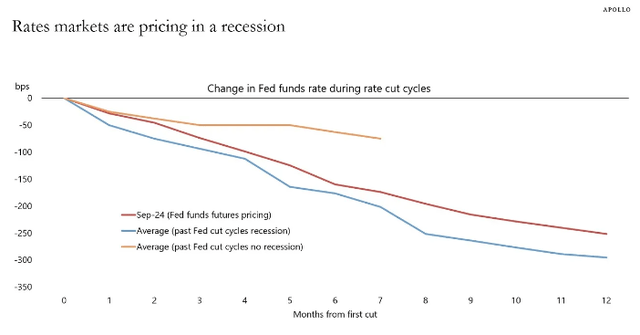

Perhaps a better picture of the market odds of recession or soft landing come from SOFR futures, which show that recession by June 2025 is basically a coin flip.

How does this SOFR futures thing work?

Well, the idea is that recessions typically see much steeper Fed rate cuts (and thus drops in SOFR) than soft landings, which typically see much shallower Fed rate cuts.

It depends on who you ask, of course, but the SOFR futures market seems to be pricing in greater odds of recession than not within the next 12 months.

This should matter to REIT investors.

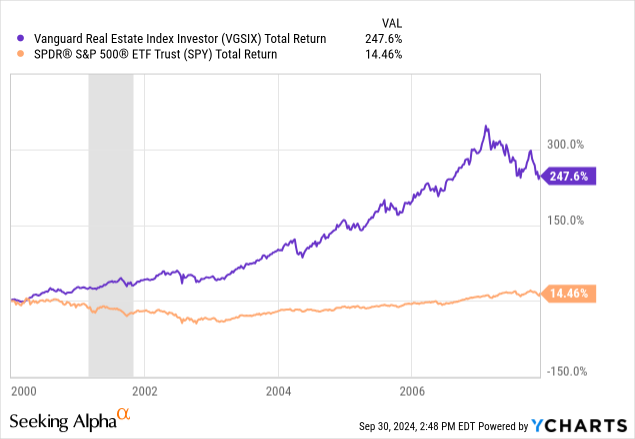

REITs have already enjoyed a nice, market-beating rebound rally since the June 2024 CPI report showing a sharp drop in YoY inflation. But will it continue into a multi-year bull market?

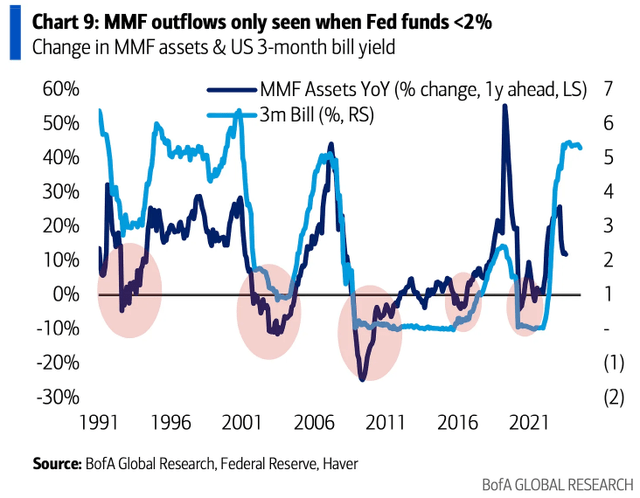

Jussi and I have argued in previous articles that the $6+ trillion in money market funds are a mountain of dry powder that is likely to be partially deployed into high-yielding stocks like REITs once the Fed gets far enough into their rate-cutting cycle.

But here's the rub: Money in MMFs is pretty sticky. As long as the MMF yield is beating inflation, investors don't typically pull money out of them. Historically, MMFs only begin to see meaningful outflows once the Fed Funds Rate drops below 2%. That's apparently when most MMF holders begin to see dividend-paying stocks like REITs as more attractive than MMFs.

A moderate or severe recession would likely result in the Fed Funds Rate going below 2%, but in a mild recession or soft landing scenario, likely not.

Yikes. Does that mean REIT investors should be rooting for a bad recession so that the FFR comes down below 2%?

No, I don't think so. Keep in mind that most REITs tend to perform just as bad as the rest of the stock market during bad recessions. And unless the Fed Funds Rate stays ultra-low for a long time, as it did after the GFC, we aren't likely to see the same degree of MMF outflows into REITs as we saw in the 2010s and after the early 2000s recession.

That doesn't mean REITs are likely to perform poorly going forward. They may still beat the market for a number of years. But it may not be the same degree of mega-outperformance seen after the 2001 recession:

For more income-oriented investors, like me, I think the coming years will see a return to very nice levels of dividend growth as the cost of capital comes down, acquisitions ramp back up, and the pockets of oversupply are absorbed.

Top Ten Holdings & Q3 Dividends

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.