What Austin Bought And Sold In July 2024

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

Greetings, fellow landlords and Jussi Askola-devotees! I hope everyone is enjoying their summer. Here in central Texas, we are enjoying quite a mild summer, especially compared to last summer's scorcher.

I have maintained for longer than I can recount that the economy is weakening and trending toward recession. There is mounting evidence to support this thesis, but it is taking a long time to play out. There has been no sudden drop in economic growth and dynamism. Rather, it's been more of a slow, downward grind as the post-COVID boom fizzles out.

To quote Kathy Bostjancic, chief economist of Nationwide Mutual, from a recent FT article:

[I expect] consumers to rein in their spending as we head through the second half of this year [because] pandemic savings [are] depleted, lower-income households increasingly maxed-out on credit and... employment growth will continue to cool.

That's exactly what I've been saying for a while.

Lots of major public companies from McDonald's (MCD) to Starbucks (SBUX) to Visa (V) to Whirlpool (WHR) to Diageo (DEO) have commented recently on weakening consumer spending.

The common narrative holds that consumers are protesting high prices, implying that they could pay these higher prices, they just don't want to.

I object. This is perhaps true for affluent consumers, but for the majority of Americans, the ability to keep spending as they have been over the past several years is literally hitting a wall.

That's why the US personal saving rate is so low...

...and also why US credit card debt and delinquency rates have been rapidly rising:

The idea that most Americans can keep spending like they have over the last few years but are just disgruntled about the high prices is ludicrous. The data completely contradicts it.

As I've said in the past, the ~60% of Americans who live paycheck-to-paycheck ("P2P") are increasingly running out of steam and financially hurting. They still have jobs, which mitigates a lot of the pain, but they will still have to rein in their spending going forward.

Consider a few points.

First, Money Management International, one of the largest consumer credit counseling agencies in the US, saw a 52% increase in client demand in the first half of 2024. Almost half of these new clients seeking help with mounting debt are what most would consider "middle class."

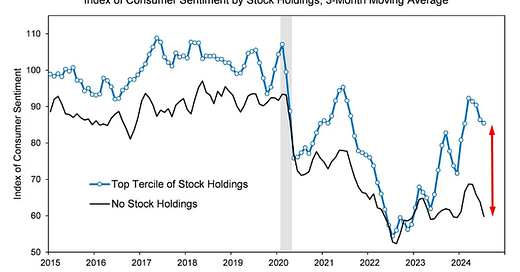

Second, the University of Michigan's consumer sentiment survey shows the consumer mood sliding rapidly back toward recessionary levels.

In 2022, consumer sentiment plumbed new depths because of the massive spike in inflation. But today, inflation is falling off a cliff. Truflation puts US consumer inflation at 1.5% right now.

So with inflation back to ultra-low levels, why are consumers so blue?

Well, even with wage growth now higher than inflation, the combined effect of cumulative price hikes and consumer debt servicing together mean that P2P consumers can no longer spend money like they have over the last few years. During the stimulus-fueled post-COVID boom, P2P consumers got used to an artificially high standard of living that was not sustainable.

Now the realities of stimulus-driven inflation and debt are yanking away that artificially high standard of living. Their real (inflation-adjusted) consumption is falling, and they don't like that. Who would?

Here's a chart I've shown before: real US retail sales.

Is real retail consumption higher in the US today than before COVID-19? Yes.

But has real retail consumption been falling since the stimulus-fueled post-COVID days of 2021-2022? Also yes.

The same thing has been happening in the restaurant space: Higher prices driving higher nominal sales/spending accompanied by falling volumes of units (menu items) actually being sold/consumed.

A lot of affluent folks have trouble understanding this, because they have the ability to absorb price increases much more easily and continue to enjoy a rising real standard of living.

If you break out consumers into the top 1/3rd of stock owners vs. those with no stock ownership (basically: Affluent vs. P2P), you'll find that consumer sentiment is much higher among the affluent than the P2P crowd.

Again, this shouldn't be a surprise. Generally speaking, stocks are the ultimate luxury good. People invest in stocks when they've got lots of excess income.

Folks with lots of excess income may gripe about higher prices at restaurants and stores, but ultimately, they can absorb those prices while still buying the same volume of stuff. Their standard of living can continue to rise.

P2P folks can't do that. For a somewhat brief period, their standard of living shot up from stimmy money. It stayed high for a while from wage increases and mounting credit card debt. Now, wage growth is cooling, and many P2P credit cardholders have reached the end of their rope.

Where does the economy go from here?

The prevailing belief is that the US simply "normalizes" back to its pre-COVID state, and a "soft landing" is achieved.

The market view represents the collective thinking of a lot of smart people, so disagreeing with it shouldn't be taken lightly.

But I do disagree. I think the odds of a recession are way higher than the market believes.

Newton's Third Law of Motion states that every action has an equal and opposite reaction. I think something similar happens in economics. We had a huge shock from 2020-2022 -- a tidal wave, if you will. And the waters have been receding from that tidal wave in 2023-2024.

The "soft landing" narrative posits that the "water levels," so to speak, will simply go back to where they were before COVID-19. But consider also Newton's First Law of Motion: an object in motion remains in motion unless and until resisted by external forces or objects.

Here's the economic translation: Economic trends continue until something stops them.

Consumer spending growth continues until consumers run out of spending power.

Once consumer spending power is tapped out, consumption stalls out or outright declines until spending power begins to grow again because of rising employment, wage growth, falling debt levels, etc.

Right now, the trends in the labor market and consumer financial landscape both continue to favor lower consumption.

This creates a negative feedback loop, in which less consumption feeds into the labor market in the form of lower demand for workers, which then leads to lower wage growth and job gains, which leads to even less consumer spending power, and so on.

I think this process most likely leads to recession. Clearly, I don't know when. At the end of 2023, I thought we'd be in recession by now.

But even though I don't know when a recession will arrive, I believe the evidence is overwhelming that the economy is experiencing a late-cycle slowdown that will at some point become a recession.

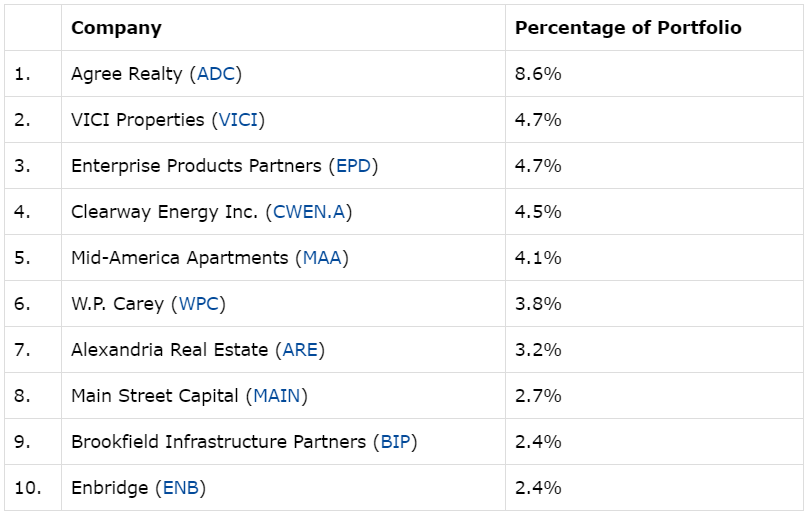

Top 10 Holdings

There hasn't been much of a shift in the top 10 holdings constituency in recent months, because almost all of them have rebounded in price as Fed rate cuts finally appear to be visible.

That said, after accumulating more shares over the course of this year, the rally in Agree Realty (ADC) has caused my position in the stock to surge to 8.6%. I don't mind. I ain't selling.

ADC makes a perfect portfolio anchor, in my opinion. Its sweet monthly dividend provides a nice, steady stream of cash to reinvest into more opportunistic stocks.

HYL's Core Portfolio, which is more focused on maximizing total returns than income growth, exhibits the same philosophy with Essential Properties Realty Trust (EPRT), which makes up 11% of the portfolio as of this writing. EPRT makes a fantastic anchor holding for both total returns and dividend growth.

It is my 12th largest position, and I'd add to my position on a big pullback. But I would like to see how EPRT performs through a more traditional recession.

Portfolio Recycling

I did virtually no portfolio recycling in July, outside of trimming a small portion of a regional bank stock after it ran up ~20% in a month in order to reinvest in a few opportunistically priced names.

BHB yielded about 3.75% at the price where I sold it, while the three stocks into which I reinvested yielded between 4.4% and 5.9% at the time.

BHB has a track record of raising its dividend 7% annually for the better part of a decade and has a 20-year dividend growth streak.

But the weighted average yield of the other three came to 4.8%, and I am estimating a forward dividend growth rate of 5.5%.

Extrapolate these yields and dividend growth rates out 10 years and you end up with a higher 10-year yield on cost for the reinvested names than for BHB.

3.75% x 7%^10 Years = 7.4% YoC

4.8% x 5.5%^10 Years = 8.2% YoC

That was basically my reasoning for trimming BHB and reinvesting it elsewhere. But keep in mind that the amount I sold was only about 7.5% of my total holding. I trimmed the share count to an even number (because I'm OCD like that), and I'm not going to trim any more.

As things stand in the portfolio right now, I can't see myself selling or trimming anything in August. But hey, never say never. We'll just have to wait and see what kind of pitches Mr. Market throws our way this month.

Sincerely,

Jussi Askola & Austin Rogers

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.