What Austin Bought And Sold In January 2025

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

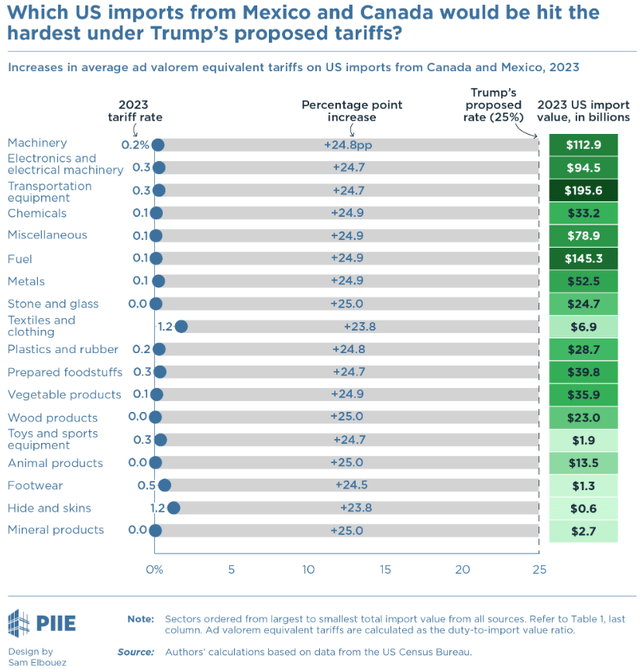

As I write this on Friday, January 31st, the stock market, including REITs, are selling off in the wake of the announcement that tariffs will be imposed on Mexico, Canada, and China.

Those are America's three largest trading partners, together accounting for about 40% of total goods imports.

I don't know how these new trade wars will end, or if they are just the beginning of an indefinite change in US trade policy, but I am assuming that they will be significantly disruptive.

I've written about the negative consequences of tariffs so many times, my brain might self-destruct in protest if I force myself to do so again here.

Tariffs are bad for REIT stock price performance, because they are inflationary and therefore put upward pressure on interest rates.

However, as pointed out in the first article linked above, this does have a paradoxically positive effect on REIT fundamentals, because higher interest rates and construction costs (as a result of the tariffs) should extend the current period of depressed construction starts. That means less supply of competing buildings to come and faster rent growth in future years.

REIT investors should brace themselves. If double-digit tariff rates are kept in place for an extended period, the CPI and PCE will almost inevitably remain above the Fed's 2% target this year, and the Fed's rate-cutting pause will be extended. REITs likely won't like that.

Stay focused on the fundamentals.

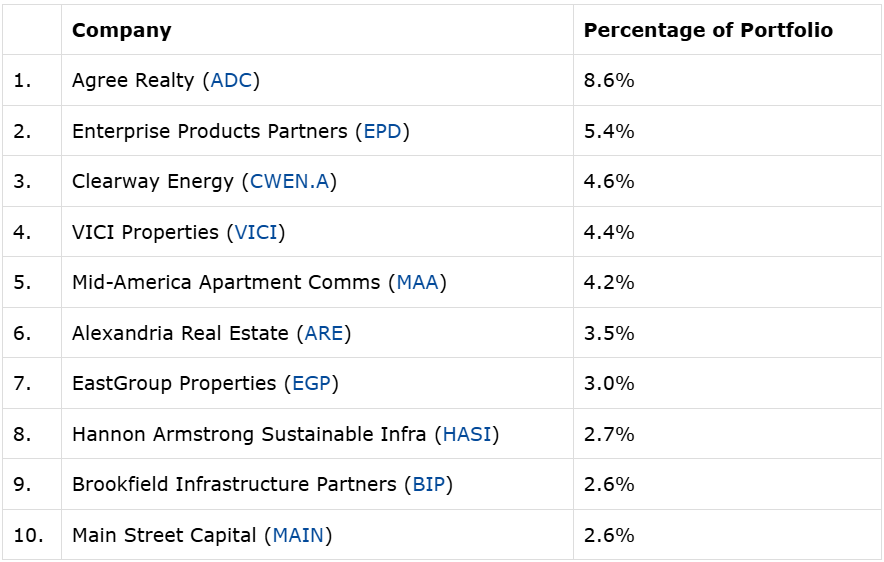

Top 10 Holdings

Fortunately, I am very comfortable and happy with the fundamentals of my top 10 holdings, which together account for almost 42% of my total portfolio.

BIP recently reported Q4 2024 earnings results, hiking its dividend by 6% and highlighting its substantial investment pipeline in its data segment, including data centers, cell towers, and fiber networks. BIP's management remain confident in the long-term demand outlook for data centers. And the midstream segment also performed quite well and should continue to be a major asset going forward as US natural gas exports increase.

ARE also recently reported Q4 2024 earnings, and though the market didn't seem impressed, I came away reaffirmed by the REIT's enduring quality and leadership in the life science real estate space. Despite huge amounts of competitive supply in the top R&D markets, ARE is capturing an outsized share of tenant demand.

Here's CEO Peter Moglia on the Q4 conference call, commenting on new supply in the Greater Boston market:

JLL indicated that there is a flight to quality for both geography and ownership. 40% of all Urban lab leases signed in 2024 were in Kendall Square, 33% were in Watertown, 21% were in Fenway and Seaport, Alexandria's Urban submarkets, meaning that only 6% of leases were transacted in other submarkets. According to JLL, 1/3 of the leasing deals were signed by Alexandria and another experienced owner. This is proof that location and sponsorship really matters.

... JLL estimates that at least 1/3 and probably closer to 40% of today's available lab space is made up of zombie buildings. Meaning the building is un-leasable because it's either a bad office conversion, undesirable location, and or an inexperienced owner further proof that location quality and sponsorship matters.

Somewhere in the neighborhood of 33% to 40% of all available lab space in the Greater Boston market is "zombie buildings" that won't appeal to biotech and pharma tenants. The amount of available space that is truly competitive with ARE's portfolio is far lower than the total amount.

My Full REIT Portfolio

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.