What Austin Bought And Sold In December 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on December 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

What Austin Bought And Sold In December 2024

I am grateful to each of the High Yield Landlord subscribers who read these monthly portfolio updates, and I'm grateful to Jussi for allowing me to share them.

2024 was a difficult year with some notable setbacks for my investment portfolio. And yet, it could've been much worse, and my portfolio income has returned to a growth trajectory, as I'll get to below.

I have a lot to cover in this end-of-year portfolio update, so without further ado, let's get to it.

December Portfolio Recycling

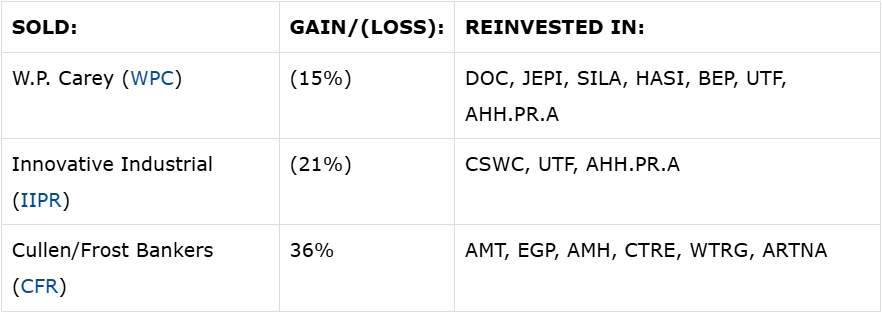

In the month of December, I sold three stocks, one of which was a very large position and two of which were smaller.

Sold W.P. Carey. I really wrestled with this decision.

On the one hand, the bulk of WPC's portfolio remains in single-tenant industrial properties acquired via sale-leasebacks. This, I think, is the REIT's core competency and where they are most skilled at capital allocation.

On the other hand, they are now pushing into US retail and buying properties in what appears to be a "shotgun" approach -- anything that offers a sufficient spread above their cost of capital. Like Realty Income (O), WPC is so big that they have to reach outside of their traditional sphere of competency to generate external growth.

As a younger investor more interested in long-term dividend growth, I'd rather focus on companies that I believe can generate strong and steady growth within their sphere of competence.

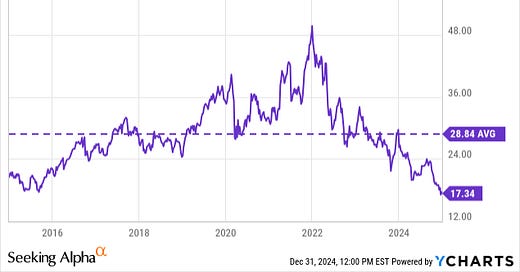

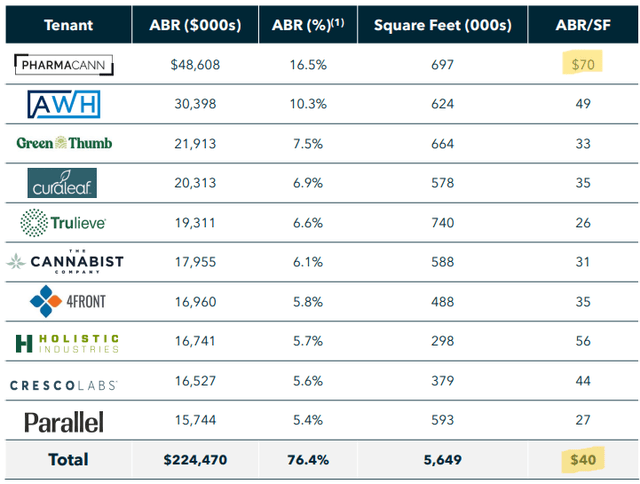

Sold Innovative Industrial Properties. I did not see the PharmaCann default coming. Previously, it was one of the largest and strongest multi-state operators ("MSOs"), but now it has defaulted on 6 of its 11 leases with IIPR, is closing at least some stores, and is engaging in layoffs. And for some reason, PharmaCann's ABR per square foot of $70 in IIPR's leases is significantly higher than the REIT's average ABR psf of $40.

If leases were renegotiated or re-tenanted at $40/sf instead of $70/sf, it would shave down IIPR's total revenue by 10%.

The cannabis industry is suffering not only from a higher cost of capital but also oversupply in several states (and this oversupply cannot legally spill over across state lines) and fierce competition from the black market.

Unless there is some regulatory/legislative or cost of capital relief soon, there could be more cannabis operator defaults to come.

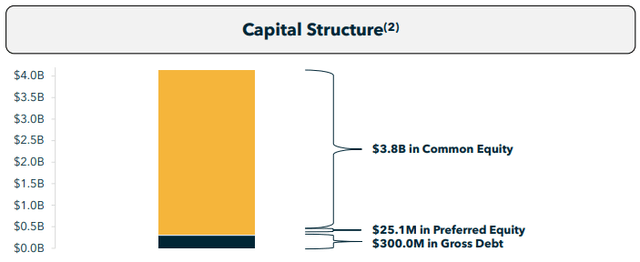

I am interested, though, in IIPR's Series A preferred stock (IIPR), which offers a 9% coupon at par value and recently dipped below its $25 redemption price for the first time ever.

IIPR.PR.A is a tiny portion of IIPR's total capitalization, and there isn't much debt senior to it.

I've got this 9%-yielding pref on my watchlist and will continue to monitor it.

Sold Cullen/Frost Bankers. The investment thesis for CFR never changed. It just seemed to get ahead of itself once it hit around $140, which I thought was an overreaction to Trump's electoral victory. It's a great bank, but it didn't become over 30% better overnight.

The stock is on my watchlist to buy back at a later date if the stock price dips back into buy territory.

End of Year Portfolio Review

Regular readers know that my primarily investing goal is not to beat the market but rather to generate the largest, safest, and fastest growing portfolio income stream possible.

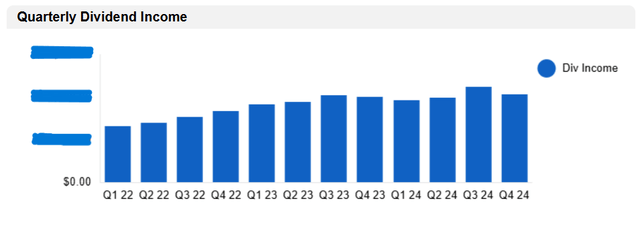

My primary way of measuring that is the quarterly dividend income registered in my brokerage account.

In Q4 2024, my portfolio income was down 8.6% quarter-over-quarter but up 2.9% year-over-year.

There are a few reasons why it's down QoQ. The primary reason is the particular portfolio recycling I've done the last few months, wherein the timing of dividend ex-dates and payouts happened to translate into lower Q4 income. The other reason is that the distributions from BEP and BIP (relatively big sources of income in my portfolio) were scheduled to be paid December 31st but actually won't hit my account until January 2nd.

As recently highlighted in a public article titled "8 Stocks I'm Buying As I Hone My Buying Strategy For 2025," I aim to focus on building my positions in "rowers" (high-quality dividend growth stocks) this year instead of "sails" (high-yielding securities of various kinds).

One reason for this is the portfolio income chart above.

My Q4 2024 portfolio income was basically flat with where it was in Q3 2023. There are multiple reasons for that, including WPC's ~25% dividend cut and selling losers at a loss.

One thing that has become clear to me is that in this new era of higher interest rates (however long it lasts), high-yielding fixed income securities (such as preferreds) are preferable to high-yielding common stocks.

A high yield on a common stock is basically tantamount to a high cost of capital.

And unless interest rates significantly decline, high-yielding common stocks not only have a high cost of equity but also a relatively high cost of debt to deal with.

Companies become more fragile, and dividends more at risk, when their weighted average cost of capital stays too high for too long.

To revive my portfolio income growth, I am going to concentrate all my incremental buying power on "rowers" -- or high-quality compounders that have a strong cost of capital and ability to grow the bottom line both organically (within the existing portfolio) and inorganically (via M&A).

The good news is that assuming zero further portfolio recycling, sequential income growth should return to growth going forward.

I should see a new record quarter of portfolio income in Q1 2025, as long as there are no dividend cuts or needs to sell holdings at big losses.

*Fingers crossed*

Biggest Realized Winners & Losers of 2024

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.