What Austin Bought And Sold In August 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on September 9th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

What Austin Bought And Sold In August 2024

This is the next installment in our monthly series on the portfolio of our macro analyst, Austin Rogers. Please note that our main focus will remain on the HYL Portfolios, but since many of you have expressed interest in knowing how Austin manages his portfolio, we are posting this to give you extra value.

If you're not confused, you're not paying attention. -- Tom Peters

Don't get me wrong. There's always uncertainty about the future and even about the present. (Heck, sometimes there's uncertainty about past events, too.)

But today, there seems to be lots of contradictory and confusing signals. Such is to be expected in so massive and complex an economy as the one we've got.

It's exciting to live in interesting times like these, but as always, I'm left wishing for more certainty, more confidence in my vision of the general path forward that the economy and stocks will tread.

I want to delve into three particular areas of uncertainty and debate today:

Are stock indices expensive or reasonably valued?

Can the economy please make up its mind about whether to have a recession?

How bad off is office real estate?

That's what's on my mind this month, so come along for the ride, if you'd like. After discussing these three topics, I'll do my usual top 10 stock holdings and portfolio recycling discussions.

Stocks: Expensive Or Reasonably Valued?

Stock indices have remained pretty resilient and bullishly inclined in recent months. As someone in the "recession is likely" camp, it's hard for me to understand this level of bullishness.

Right now, according to the Conference Board, investor optimism that stock prices will be higher 6 months from now has reached a peak seen only about a dozen times since 1987.

This level of confidence that the economy will achieve a soft landing, Fed rate cuts will fuel further stock price gains, and earnings growth will continue unabated gives a recessionista like me pause.

Am I missing something that the rest of the investing community isn't? Are they seeing something I'm not?

I get that things aren't that bad, but I don't see the case for things being that good either.

The S&P 500 (SPY) P/E ratio is over 29x today, although the forward P/E ratio is something like 22.5x. But the CAPE ratio (cyclically adjusted price-to-earnings using trailing 10-year earnings) is back up at nosebleed levels.

Maybe there's some structural reason stock valuations are and will remain permanently higher going forward? Maybe AI is completely changing the economy and creating huge winners that indefinitely command higher valuations? Maybe a ton of wealth has accumulate in the top echelon of society and has nowhere else to go besides the stock market?

Here's one clue that the frenetic stock rally may be petering out: Corporate cash levels have declined to a relatively low level, diminishing dry powder available for buybacks.

Given that corporations themselves have been among the biggest sources of buyer demand for stocks, the loss of buyback capacity should portend less upside to stock prices.

Then again, analysts estimate continued growth in S&P 500 operating earnings (non-GAAP):

All else being equal, if this estimate is at least directionally accurate, higher earnings should translate into higher stock prices.

Moreover, simply taking hyperscalers like Microsoft (MSFT) and Google (GOOGL) at their word, the US is on the cusp of a multi-year AI capex cycle that should continue to have positive ripple effects across the economy.

AI skeptics ask what exactly the transformative uses will be for this new technology, likening it to crypto -- innovative but ultimately limited in valuable uses.

Hyperscalers are forging ahead, though, and project confidence that their AI programs will find numerous transformative applications across the economy.

At the end of the day, REIT investors can take comfort in knowing that REITs have solidly outperformed over the last three months in the face of a definitive Fed pivot toward near-term easing.

I think that REIT rally should continue. The more interest rates and bond yields decline, the more attractive REITs will look as an alternative income option for the average investor.

Recession Or No Recession?

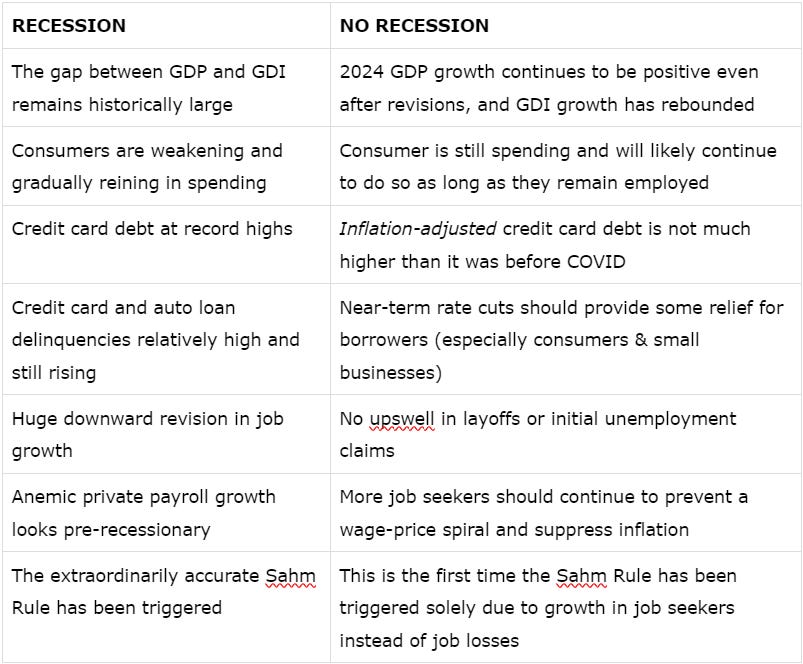

The following table could be a mile long, but let's look at just some of the data points for and against an oncoming recession.

Right now, the labor market seems to be the locus of the recession debate.

The recently released downward revision in past employment numbers has provided a lot of fodder for debate and a check in the "recession is coming" column.

My understanding is that this magnitude of downward revision was due to a disconnect between the birth-death model's prediction of job growth versus actual data on job growth collected over time.

(Nothing is more eyeroll-worthy, in my opinion, than the conspiracy theory that government employment data has been purposely inflated in order to lend support to the current vice president in her presidential campaign. If that was true, why would the BLS release this [highly publicized, at least in the financial media] huge downward revision three months before the election?)

It is striking that this is the biggest downward revision in employment data since 2009, which, as you may recall, was a period of extraordinary economic weakness. The period being revised was basically from Spring-2008 to Spring-2009, the peak of economic destruction during the financial meltdown.

That said, this year's downward revision didn't cause our backwards view of job growth to turn negative. Job gains were just less strong than initially reported.

That's one reason why we're seeing the current upward swell in unemployment, which is contributing to a rapid shrinking of the gap between unemployment and job openings.

Like so many other charts, this one seems to be a Rorschach Test.

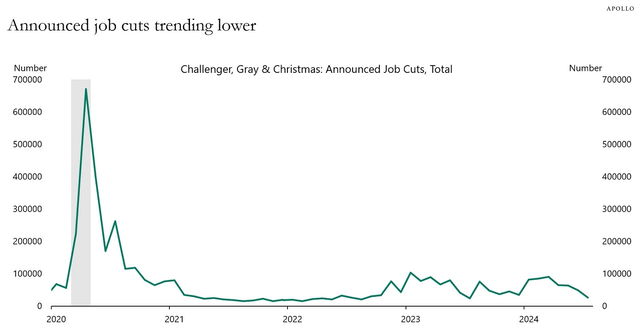

Economy bulls say that the labor market has come back into balance without huge layoffs or job losses. By the very fact that the economy has held together without such job losses, the likelihood that there will be a big swell in layoffs in the months and quarters ahead is diminished.

After all, with interest rates on the decline, what exactly would catalyze big job losses?

Economy bears would say that steadily weakening trends in consumer spending and employment are unlikely to simply plateau in a soft landing. A trend, once in motion, is hard to stop. Falling wage growth, rising delinquencies, and increasing bankruptcies are creating a vicious and self-reinforcing cycle that historically results in recession and job losses.

Before layoffs, employers typically resort to cutting back worker hours. That is exactly what we've seen in recent months:

The "recession" vs. "no recession" debate continues.

I fall into the "mild recession" camp, but then again, I've been forecasting that for a while. At the beginning of 2024, I thought we'd be in a recession by now.

Just How Bad Off Is Office?

The basic facts that the highest quality, best located Class A office buildings are doing fine to great while most of the rest of the office sector is struggling are not really disputed.

The real debate is about just how bad off the majority of office buildings that are not Class A+ are.

It has to be acknowledged that remote work, while down from its peak, remains about 50% higher than its pre-COVID level.

Office bulls may point out that fully remote workers make up only a very small share of white collar employment. Fair enough. But hybrid work arrangements do not require as much office space as traditional, 5-days-a-week work arrangements.

That fact has been borne out in 3+ years of tenant downsizing, which has resulted in a steady rise in office vacancies.

Moody's foresees the vacancy rate rising from 1/5th of total space in 2024 to about 1/4th of total space in 2026.

Long-term leases are rolling over slowly, dragging out the pain of this tenant downsizing process.

Not to mention the pain of the office property re-valuation process! The bid-ask spread remains huge in the office sector, and in some cases, there basically is no bid.

Post-COVID office utilization has peaked and plateaued, says a recent article from Sherwood Media. The article cites a report by XY Sense that shows North American office utilization topping out this year at about half the level it was prior to the pandemic.

Moreover, in hybrid work arrangements, the actual use of office spaces have evolved. To quote Sherwood Media:

When people do go into the office, meeting spaces are much more in demand. On average, time spent using collaborative spaces like conference rooms (4 hours a day) was 54% higher than individual desks (2.6 hours), and lack of communal space has become a big pain point for companies. Meanwhile XY Sense found that half of office desks were utilized for less than one hour per day, while 30% were never used at all.

But, of course, there are still some companies that require employees to come in to the office full-time -- somewhere between 1/4th and 1/3rd, depending on the source.

That, I think, is what explains the difference in performance between top-tier and lower-tier office properties.

Effective rents are inclusive of both contractual rent bumps and amortized rent concessions granted upon signing.

As you can see, although top-tier offices did see slightly negative effective rent growth last year, top-tier buildings have enjoyed much stronger performance than lower-tier buildings since 2021.

Quoting CBRE:

This continues a pattern of effective rent growth for top-tier office buildings exceeding that of lower-tier buildings since 2021. Many occupiers have focused only on the best amenity-laden buildings in the most convenient locations for their employees.

CBRE articulates the bullish case for office by saying that once prime office space is fully leased, tenants will progressively move down the quality spectrum to fill lower-tier spaces.

I'm not convinced. There remains a lot of tenant churn, and space demand remains 1/4th to 1/3rd lower today than pre-COVID.

I think most office real estate is going to struggle for many years to come. And though I haven't done a deep dive on office REITs in a while, I highly doubt any of them own nothing but the top-tier, Class A buildings soaking up all the tenant demand right now.

My Top 10 Holdings

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.