Updates On Our Central/Latin American Top Picks

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 3rd, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Updates On Our Central/Latin American Top Picks

Something unique about High Yield Landlord is that we don't cover just US REITs, but we also cover foreign markets.

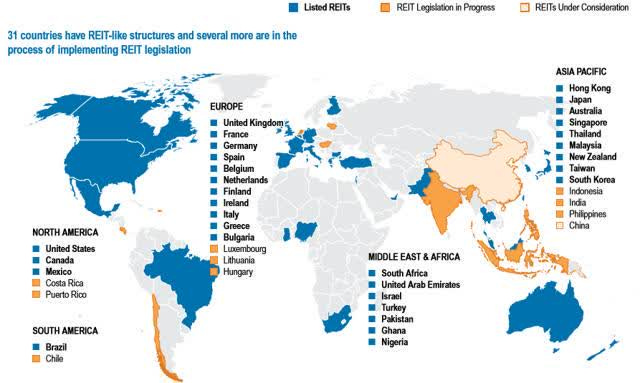

Today, over 30 countries have adopted the REIT regime, providing a lot of opportunities for us to evaluate:

Our International Portfolio is optional and intended for investors who want greater diversification to boost risk-adjusted returns.

Personally, I aim to invest at least 25% of my REIT portfolio in non-US markets. Some members may prefer to allocate a higher weight to international opportunities, while others may ignore them altogether. It comes down to your personal preferences, risk tolerance, and return objectives.

The goal here is to provide you with the information and tools needed so that you aren’t just limited to US markets. It will allow you to identify and research new investment opportunities in Canada, Europe, South America, Asia, and even Africa from the comfort of your home.

The Portfolio currently holds 18 positions - out of which 8 invest in Europe, 5 in Canada, 2 in Central/Latin America, 1 in Australia, 1 in Asia, and 1 in Africa:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.