Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on October 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

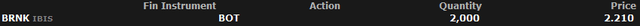

TRADE ALRT - International Portfolio October 2024

I have grown increasingly confident that Branicks (BRNK) will survive this crisis and eventually recover, leading to substantial gains, and as a result, I am today buying another 2,000 shares of the company to average down my cost basis:

Keep in mind that this remains a highly speculative investment and the company could still very well end up in bankruptcy, which would lead to a complete wipeout of our investment. For this reason, we are keeping our position size at less than 5% of the International Portfolio. If the worst case scenario plays out, it will be painful, but I will still bounce back from it.

However, if my base case scenario plays out, this is an easy triple and I think that the likelihood of it happening has risen significantly in recent months, but the share price hasn’t changed by much.

Before going into this update, I would recommend that you read our last update by clicking here in case you are not familiar with the story.

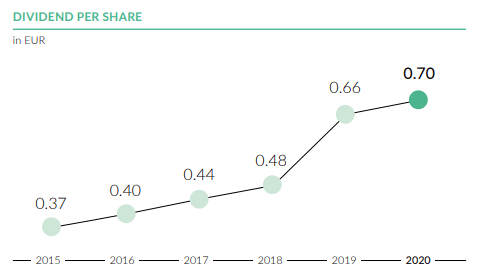

In short, Branicks is a German real estate asset manager that was doing very well up until the pandemic. At one point, it was actually one of our most successful investments. It was growing its assets under management at a very rapid pace, and it was leading to rapid growth in its cash flow and dividend payments. In 2019 alone, it nearly doubled our money as its valuation surged to reflect this rapid growth.

But then came the pandemic.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.