TRADE ALERT - Retirement Portfolio November 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

TRADE ALERT - Retirement Portfolio November 2024

Transaction:

We bought another 70 shares of W.P Carey (WPC), increasing our position size by 15%.

-----------------------------------------------

After performing exceptionally well for the past year, the REIT market suffered a little dip in recent weeks, and as a result, quite a few of them have become opportunistic again.

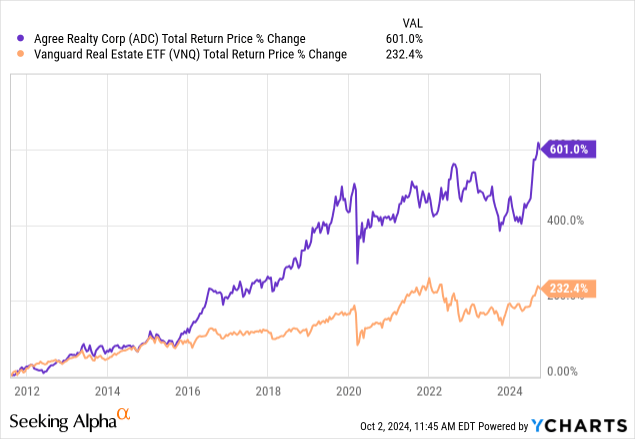

One in particular that comes to my mind right now is W.P Carey (WPC), which just crossed the 6% yield level after its recent dip:

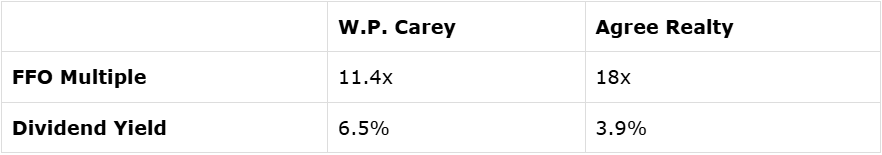

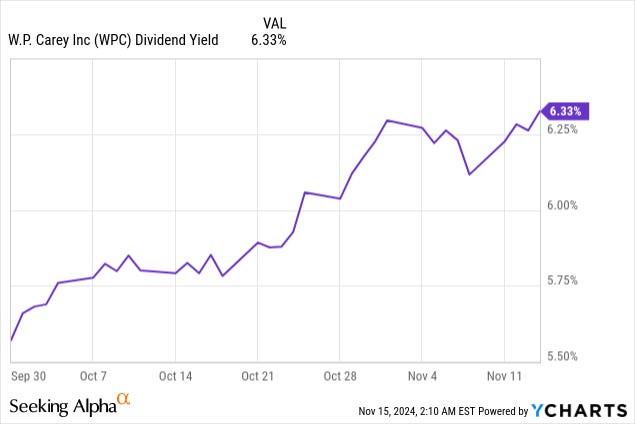

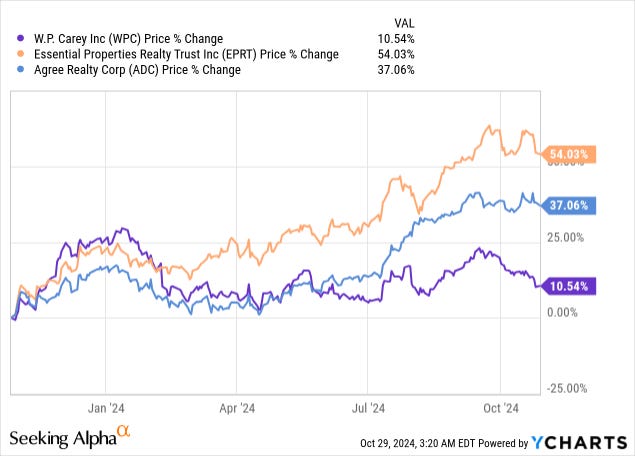

W.P. Carey is a net lease REIT just like Essential Properties Realty Trust (EPRT), Agree Realty (ADC), and others, but it has mostly missed out on the rally and as a result, it has now become far cheaper, relatively speaking:

We believe that this is an opportunity and we are today buying another 70 shares of the company, increasing our position size by 15%:

(I placed a limit order to execute at market open due to the significant time difference here in Asia. I’ll add a screenshot of the transaction later.)

We don't think that this massive underperformance is due to fundamental reasons. On the contrary, we think that W.P. Carey is better positioned than ever, and a Trump presidency should favor it relative to its peers given that it owns mainly industrial properties that benefit from onshoring and it enjoys CPI-based rent escalations. In comparison, most its net lease peers own retail properties and are more exposed to the risks of tariffs and higher inflation.

So we don't think that the fundamentals justify such a big discount.

Rather, we think that its recent underperformance is because the company's recent transformation led to a dividend cut and this continues to hurt its market sentiment.

As a reminder, earlier this year, W.P. Carey decided to spin-off most of its office properties into a separate REIT in order to refocus primarily on industrial properties, deleverage its balance sheet, and lower its payout ratio.

The thought here is that this would accelerate their long-term growth prospects and lower risks, which would eventually be rewarded with a higher valuation multiple.

But W.P. Carey was mostly owned by dividend-oriented investors and they did not take kindly to the dividend cut. They felt betrayed by the company, which so far, had consistently grown its dividend for 25 years in a row. They lost trust in the management, sold their shares, and this continues to hurt the company's market sentiment to this day.

But I think that this is just temporary.

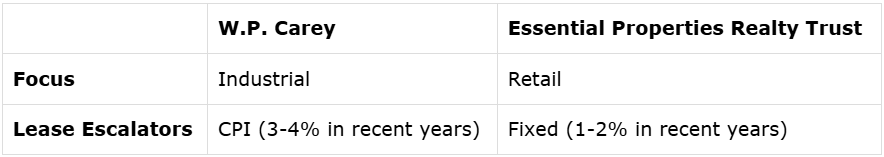

W.P. Carey's situation today reminds me a lot of Agree Realty (ADC) back in 2011. It was facing some tenant issues and it forced it to cut its dividend. This then depressed its market sentiment and it was one of the cheapest net lease REITs, despite owning strong assets for the most part.

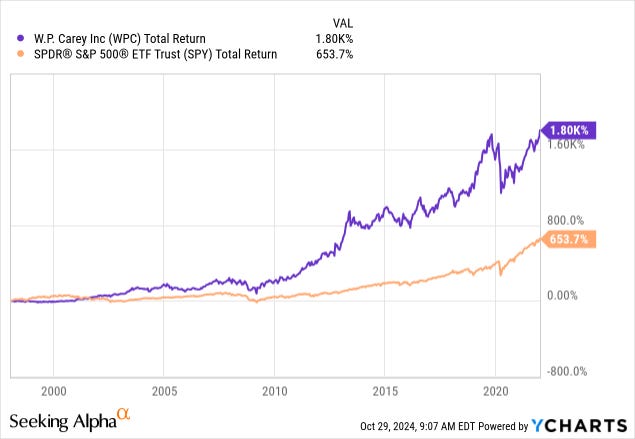

But it then rebuilt from a lower base and as it fixed issues and returned to growth, it became the single most rewarding net lease REIT in the following decade, easily outperforming its peers like Realty Income (O) and most other REITs:

I think that W.P. Carey finds itself in a similar situation today.

Its market sentiment just took a big hit due to the dividend cut and the market has low expectations for the company.

But in reality, W.P. Carey is now much better positioned with mostly industrial assets that enjoy long leases with CPI-based escalators and the REIT retains a significant portion of its cash flow to organically grow its portfolio.

The market has priced W.P. Carey for no growth, but as its proves it wrong, and returns to growth in the coming years, I would expect those dividend-oriented investors to eventually get replaced by total return-oriented investors like us, and this will then lead to a recovery in its market sentiment and valuation multiple.

As the management told us in a recent interview:

"Closing that [valuation] gap comes down to execution. We’ve now completed the office spinoff and repositioned ourselves as a predominantly industrial and warehouse REIT, so we’re in a much better place to demonstrate consistent AFFO growth. With a stronger portfolio mix and a clear growth trajectory, we believe the market will reward us as we execute on our strategy.

The next few years will be about meeting and exceeding expectations, driving acquisition volume, and showing that we can deliver low double-digit total shareholder returns between our dividend and growth. It’s going to take time, but we’re confident that as we execute, we’ll see that valuation gap narrow."

I think that investors should give them the doubt because outside of this recent hiccup, W.P. Carey has historically executed really well and achieved one of the best track records in the entire REIT sector:

Now, they arguably own the best portfolio in their entire history, and yet, the market has priced it at one of its lowest multiples due to the dividend cut, which will likely eventually be forgotten.

In that sense, we think that W.P. Carey is today the Agree Realty of 2011. Expectations are low and its market sentiment can only improve from here as they return to growth.

One last point that I want to make here is that 1/3 of W.P. Carey's assets are in Europe and this could provide an additional catalyst for them in the coming years.

In our recent meeting with the CFO of Realty Income (O), we learned that they were considering to seek a separate listing for their European entity in Europe because they believe that this would afford them a much lower cost of equity.

There are very few such vehicles in Europe and the few that exist today are trading at relatively rich multiples because European investors are starved for yield.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.