TRADE ALERT - Retirement Portfolio January 2025 (New Investment Opportunity)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on January 6th, 2025, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

TRADE ALERT - Retirement Portfolio January 2025 (New Investment Opportunity)

Innovative Industrial Properties (IIPR)'s biggest tenant, PharmaCann, failed to pay its rent in full in December.

It is a very big tenant, representing 16.5% of IIPR's rental income, so naturally, this is concerning the market.

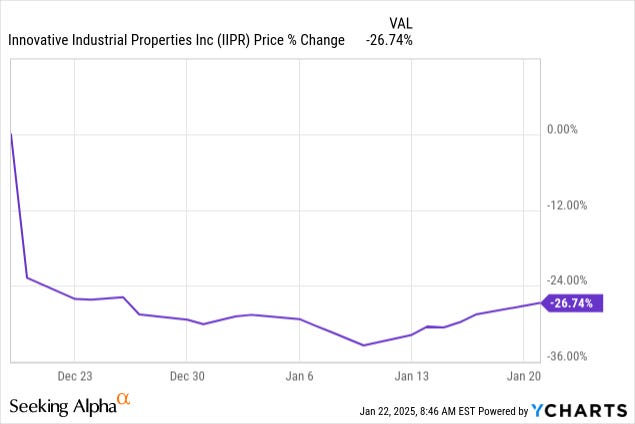

It has caused IIPR's share price to crash by 27% following the news:

We have no interest in the common equity of the company, especially not for our Retirement Portfolio. The cannabis property sector is just too risky.

However, the company also has some preferred equity and we find it very interesting because it has crashed despite offering significant margin of safety.

It is now offering a 9% dividend yield and we think that it is ideal for our Retirement Portfolio, which is seeking to maximize safe income. For this reason, we are today initiating a small position, representing ~3% of the Portfolio:

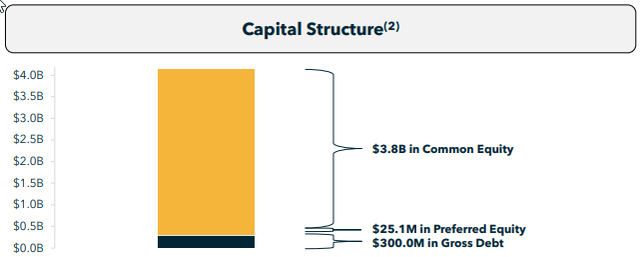

What's unique about IIPR is that it has very little debt.

It only has $300 million of debt, which represents a very low 11% LTV, and the company enjoys a 17x debt service ratio.

It is so low that the company could repay almost all of its debt in just one year if it stopped paying its common dividend and used its cash flow for deleveraging. It also has $130 million of cash and equivalent right now and an additional $87.5 million of liquidity via its credit facility.

Therefore, we think that a bankruptcy is extremely unlikely in the case of IIPR.

Yes, this is a risky property sector and IIPR is facing major tenant issues, but it is very hard to go belly up when have very little debt.

Even if IIPR faced a cascade of tenant bankruptcies and had to release its properties at materially lower rent levels, the debt could still be easily serviced and the preferred equity would still enjoy significant coverage.

This is exactly what you want when you invest in the preferred equity of a REIT. You want the REIT to have low debt and the preferred equity to only represent a small slice so that it enjoys a big common equity buffer.

If this was any other property sector, the dividend yield on this preferred equity would be closer to 6% with such a strong balance sheet.

Yet, it is 9% today.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.