TRADE ALERT - Retirement Portfolio November 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

TRADE ALERT - Retirement Portfolio November 2024

Important Note:

Before going into this update, please note that I am not trying to be political. There are pros and cons to both parties and their proposed policies and I am simply analyzing how these policies could affect various REITs. Thank you for your understanding!

----------------------------

President-elect Trump just the election and it is causing a lot of volatility in the financial market. Some of our positions like RCI Hospitality (RICK) are surging, while others like NNN REIT (NNN) are taking a hit from it.

We are working on a detailed update that will explain what this election outcome means for REITs and hope to have it ready for you early next week.

Today, we want to take advantage of this volatility and increase the size of our position in NNN REIT (NNN). We just bought another 100 shares of the company, increasing our position size by 20%:

Earlier this week, we explained that if Trump wins the election and implements his tariff proposals, it could have a significant impact on certain good-importing retailers, many of which occupy net lease properties.

Therefore, it could lead to some volatility in the net lease space and potentially lead to some buying opportunities.

That's exactly what has happened. On the day of the elections, net lease REITs like Realty Income (O) and NNN REIT (NNN) dropped by 3-4%, materially more than other REITs (VNQ). Moreover, they had already dropped significantly leading up to the election as betting markets were showing growing odds of a Trump victory:

The market fears two things here:

Firstly, the tariffs could hurt certain retailers, lead to growing store closures, and vacancies for these REITs. According to our analysis, the most impacted would be dollar stores because they focus mainly on low-income consumers, import a lot of goods from China, and are facing growing competition from larger peers.

Secondly, the market also fears that the tariffs could lead to rising inflation, which would then reduce future rate cuts. This is evident if you look at the rising long term interest rates:

These fears, coupled with disappointing quarterly results, caused NNN REIT's share price to drop by 16% in recent weeks.

We think that this is an opportunity because NNN has close to no exposure to dollar stores, it has one of the safest balance sheets in its peer group, and its quarterly results weren't particularly bad either.

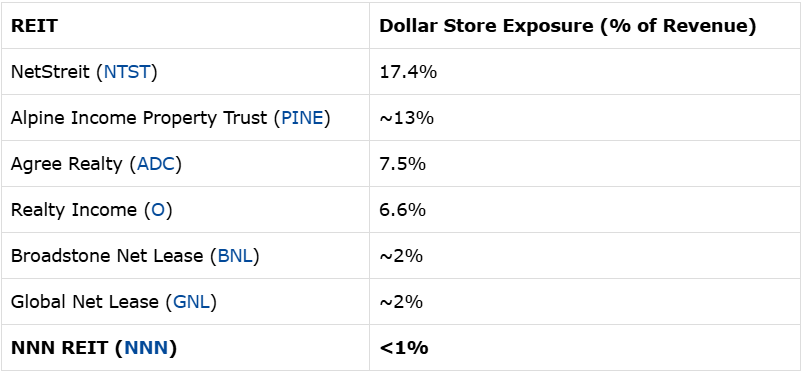

Here is the exposure of various net lease REITs to dollar stores, which are expected to face growing difficulties if tariffs are implemented:

To be clear, this does not mean that NNN REIT won't face growing credit losses if significant tariffs are implemented, but at least, it isn't heavily exposed to what could be the weakest segment of the retail net lease market.

NNN REIT focuses mostly on service-oriented net lease properties such as convenience stores, automotive services, and restaurants, which we expect to be less impacted:

NNN REIT also has one other major advantage relative to other net lease REITs. It has a very long average debt maturity of 12.3 years. Therefore, even if interest rates were to remain higher for longer, it would be less impacted than most of its peers. Here is how it compares to them:

Finally, while its Q3 results were disappointing, they don't change the long-term trajectory of the company.

What the market disliked is that they expect to face above-average credit losses in the near term. They always have about 100 basis points of such losses built into their guidance, but they expect these losses to be a bit above that in the near term as they face a few tenant issues.

The first one is Badcock Furniture, which has filed for bankruptcy. It represents 0.6% of their rental income and they expect to get back those properties.

The second one is Frisch's. It represents 1.5% of their rental income and they only paid half of their rent in Q3. The management did not give details on their plan just yet.

But is this really such a big deal?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.