TRADE ALERT - Retirement Portfolio October 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on October 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

TRADE ALERT - Retirement Portfolio October 2024

Last month, we sold our position in the Series F preferred shares of Arbor Realty (ABR.PR.F), earning us a 23% return and unlocking $14,000 of capital to reinvest elsewhere.

In the following weeks, I spent a lot of times studying other preferred share opportunities. I even had a call with the management of Gladstone Commercial as I was considering to double down on its Series O preferred shares (GOODO), which we own already. (Stay tuned for our Interview!)

But ultimately, I concluded that Rexford Industrial Realty (REXR) likely remains the best opportunity in our Retirement Portfolio and therefore, I have decided to buy another 100 shares of it:

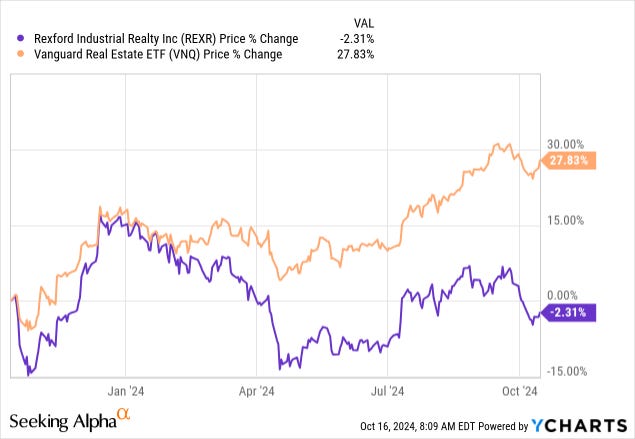

It is one of a few REITs that has missed out on the recent rally and remains very opportunistic:

I think it may have missed the rally because most REIT investors rely on surface figures. If you look at REXR's valuation, it doesn't seem particularly cheap, trading at 19.5x FFO.

But this is shortsighted because its current lease rates are deeply below market.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.