TRADE ALERT - Retirement Portfolio February 2024

Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

TRADE ALERT - Retirement Portfolio February 2024

Today, we continue to take advantage of the volatility that's caused by the market's excessive focus on short-term results.

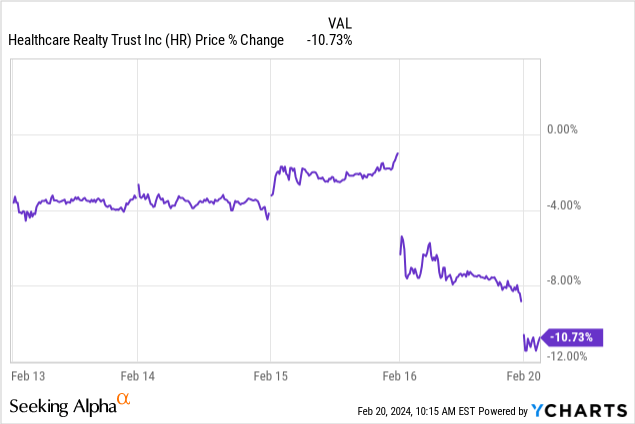

Healthcare Realty (HR) just announced its 4th quarter results and its share price dropped by ~10% in the following days of the announcement:

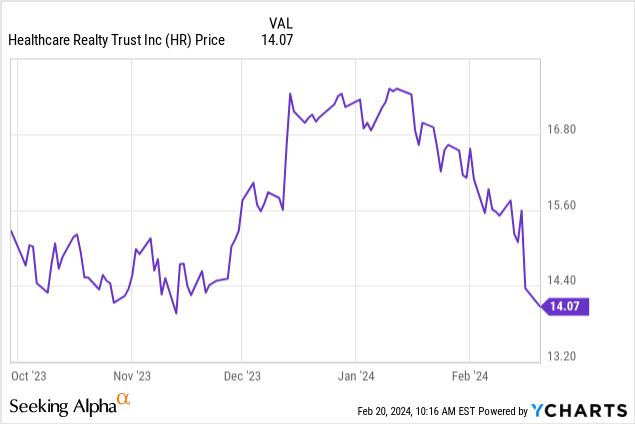

As a result, it is now again where it traded back in October 2023. It essentially missed out completely on the recent market rally:

If you had told me in late 2021 that we would soon get the opportunity to buy Healthcare Realty (HR) at a 9% dividend yield, 9x FFO, and 11.9x FAD, I wouldn't have believed you.

But here we are.

HR is today probably the highest-yielding REIT that has an investment grade rating. It has a strong BBB rated balance sheet with a 35% LTV and no major maturities until 2026.

Moreover, it is the leader in the medical office space and its portfolio is performing well. Same property NOI grew by nearly 3% in 2023 and the growth is expected to continue in 2024 and even accelerate to the 4-6% range in 2025.

So what's to worry about?

Well, the market is nervous about the dividend, and to be fair, there are good reasons to be concerned about it.

The payout ratio based on its FFO is reasonable at 80%, but based on its FAD (deducts capex, TI, straight-line rents, etc.), it is too high at ~107%. Moreover, the company guided for essentially no growth in 2024 so the dividend will not be covered again this year. Their rents are growing at a good pace, but they expect two buildings to be vacated and they also recently entered a new interest rate swap that provides protection, but it comes at a cost.

The market now fears that the dividend will be cut and investors are trying to exit the stock ahead of others, fearing that a cut will cause the stock to drop even further.

But here's why I think that this is an opportunity.

First of all, even if they cut the dividend, it wouldn't be the end of the world. The dividend is just a capital allocation decision and it has no impact on the value of the underlying assets. A dividend cut could lead to near-term volatility, but the company should ultimately be valued on its cash flow and its assets, not its dividend.

Secondly, the management remains confident that they won't need to cut the dividend. They explain that the dividend coverage will remain tight in 2024 because they are investing in tenant build-outs to increase occupancy, but the payout ratio will come back down in 2025 once they fully realize the NOI of this new occupancy.

Here is an interesting exchange from the recent Q&A. I abbreviated the responses and added the emphasis:

Analyst: Michael Griffin

I think if you look at guidance for both normalized FFO and CapEx, it implies about 107% payout ratio for 2024. I know the guidance has been elevated for some time and you talked about maybe being able to grow into a healthier payout ratio. But at some point, could a potential cut be warranted? And any color around that would be helpful.

CEO: Todd Meredith

Sure. Michael, we've certainly said that for a while that we think that as we ramp up our absorption and invest in TI... We expect a similar payout ratio in '24 as '23, kind of in that 107-110% range and we're comfortable with that because we know we're investing the capital that will generate the NOI that will flow through to FFO and FAD afterward. And so we really see '25 as an important transition in that. So we're very bullish on what we see.

Obviously, we'd love it to happen sooner, like everyone, but we think the key is that operational improvement and investing in that capital to generate the NOI. So our view is we feel very comfortable. As Kris remarked that we can get there in '25. And so certainly, we're not thinking about a cut. The board is not thinking about that at this point. And obviously, we can't control all market conditions, but our view is, operationally, we can deliver the NOI that will improve that ratio.

Analyst: Michael Griffin

Yes. And just a follow-up on that. I mean what kind of payout ratio are you comfortable with? And how long would you kind of have to keep that as is until you would grow into the cash flows?

CEO: Todd Meredith

Yes. I mean I think our view is that, again, 2024 looks a lot like '23 in terms of the payout ratio, but we think '25 starts to drive towards that covered dividend level. And obviously, what we like long term obviously is drive much lower than that into the 90% or even below 90% level. So that's certainly the path that we see. We know it's -- we'd love to see it sooner, but we think that starts to take shape in '25.

Another analyst then asked if their long-term growth expectations have changed and they answered they still expect to reach 4-6% same property NOI growth in the coming years - which should translate into 5-7% annual FFO per share growth, subject to interest rates:

Analyst: Juan Sanabria

Very helpful. And then I just wanted to kind of try to square things as the message has evolved over the last few quarters. If I look back to the first quarter '24, you kind of talked about a baseline '24 FFO growth of 5% to 7% and same-store NOI growth of 4% -- 4% to 6% for the whole company, not just multi-tenant. I guess, it sounds like there's some single tenant expirations that maybe weren't factored in there, may have been a bit of a surprise. But just curious if you could try to talk through what's changed over the course of the year. Can you -- the leasing pipeline you guys have been talking about has been robust for a while. You started to see some of that benefit come through in the fourth quarter. So just -- if you could just kind of square those 2, that would be super helpful as we're definitely getting at that on our end.

CEO: Todd Meredith

Sure. Juan, I think just big picture, we -- a year ago did talk about that 4% to 6% growth. And I think what you're seeing in our bridge that we laid out last quarter and sort of reiterated and updated this quarter is really getting that multi-tenant throughout the year, as Rob described it. Obviously ramping up in the second half, just some of that due to expiration patterns. You saw it started to come through in the fourth quarter and really continuing to contribute throughout '24.

So it's putting all those pieces together to get to -- at the back half of the year, we show growth that starts to get into that 5% range, plus or minus. Obviously, we'd love to do it sooner...

... But we see the momentum and really driving towards that same goal at 4% to 6% multi-tenant growth goal and getting there throughout the course and really by the end of '24.

So while their growth will disappoint in 2024, it should accelerate in 2025. This was later confirmed on the call by the CFO who said that they expect their NOI growth to accelerate, which will generate "a strong FFO exit velocity going into 2025."

Then a third analyst asked them to clarify what growth rate they are expecting for 2025. They did not provide guidance at this point, but it seems that the growth rate is likely to be mid-to-high single digit in 2025:

Analyst: Michael Gorman

Just wanted to maybe synthesize some of the questions here. Obviously, one of the questions on the dividend and then thinking about the 2024 outlook earlier last year. And as we start to think about how '24 plays out and going into '25. I just want to make sure if I'm doing my math correctly, the implication here is that if you kind of move towards dividend coverage in 2025, it's kind of in that 6% to 8% FAD growth in '25 is what would be implied. I know you're not giving guidance, but like is that the way to think about how '24 plays out is that the run rate by the end of the year is going to be such that kind of mid- or even upper single-digits FAD growth is what we're looking at in the out years?

CEO: Todd Meredith

Mike, I would say you're directionally headed the right way. I think it's early to be calling that for sure, for '25 and an earlier question was asked about we're obviously very bullish on our multi-tenant side. And our single-tenant side is fine. The retention rates are strong, but backfilling single tenant vacates have typically a lag effect. And so we don't have perfect visibility into expirations for single tenant as an example, in '25.

So it's early to call the net number, if you will. But you're right in terms of what the implied math, implied dividend coverage would suggest in terms of the growth potential in '25. So we're certainly bullish on that and see a very strong uptick going into '25. Now like everyone, we're watching interest rates.

So with that in mind, it seems unlikely to me that they would cut the dividend. It is true that the dividend currently isn't covered by FAD, but this is in large part because they are currently incurring a lot of capex/TI to lease vacant space. Once that space is leased, it will start generating NOI and their capex/TI will go down. There is a timing issue that's causing the payout ratio to be over 100% in 2024, but they expect to bring it back below 100% in the near term.

Therefore, I trust the management on this one and agree with them that the dividend should be sustainable unless something dramatic changes. I personally wouldn't mind a cut if it allowed them to return to faster growth, but I don't expect one at this point.

The bottom line is this:

Healthcare Realty is the leading medical office REIT.

It owns mostly Class A properties in medical clusters of growing markets.

Its leases enjoy ~3% annual rent escalators and its occupancy is rising.

They expect to reach 4-6% same-property NOI growth in the coming years.

This could result in up to 6-8% FAD growth in 2025 and beyond.

It has a BBB rated balance sheet with no major maturities this year.

The FFO payout ratio is reasonable, but the FAD payout ratio is tight as they heavily reinvest in their assets to increase their occupancy rate.

The dividend yield is 9% and the management thinks that it is sustainable, but even if it was cut, it would not be the end of the world.

We estimate that it is priced at 9x FFO, 11.9x FAD, and a steep discount to its NAV. Welltower offered to buy it out at $31.75 a few years ago and it trades today at just $14 per share. Property prices have come down a bit since then, but the discount is still around 40%. That's the lowest valuation of any REIT with a >BBB rated balance sheet and such growth prospects.

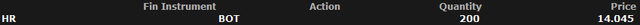

For this reason, we are today buying the dip with another 200 shares of the company, increasing our position size by ~20%:

You can read our last update on the company by clicking here. It provides further discussions on the assets and the balance sheet of the company.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.