TRADE ALERT - International Portfolio July 2024 (+ Video Of Trip To Ukraine)

Hey,

This is Jussi.

Before I go into today's Trade Alert, I wanted to give you a quick update on my recent trip to Ukraine.

Together, our community raised a total of $116,084.65 and we used these funds to buy 6 trucks equipped with drone jammers, night vision, and mud tires. We then drove these trucks to Ukraine and donated them to the units that needed them the most.

The trip took place one month ago, and the video of us handing out the cars to the different military units is now available. You can watch it by clicking here.

Thank you so much again to all of you who donated!

We also had four members of High Yield Landlord join this convoy. It was the second trip for two of them.

I expect my next trip to take place in early December. If any of you are interested in joining us to help Ukraine, please send me an email at jaskola@leonbergcapital.com

=============================

TRADE ALERT - International Portfolio July 2024

REITs have been surging in the last few days.

It appears that our thesis is finally starting to play out. The market is realizing that it had overreacted to fears of rising interest rates, and REITs are now recovering as the narrative shifts to that of cooling inflation and lower interest rates.

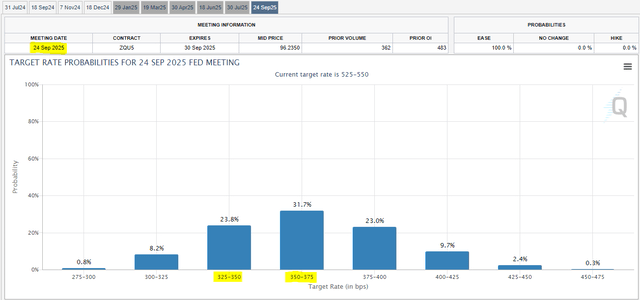

The debt market is now pricing a near 100% chance of at least one rate cut in September. Even more interestingly, the market expects interest rates to be about 2% lower by October next year:

That's very significant!

It seems that we are now rapidly going back to the pre-covid world of low inflation / low interest rates and this is amazing news for REITs.

They crashed due to the surge in interest rates and therefore, it would seem logical for their recovery to continue as interest rates are gradually cut to lower levels.

But now we are faced with a different issue.

REITs are rising and that makes it harder for us to allocate capital. Opportunities remain abundant, but no one likes to buy something that just recently surged by 10-20%.

As a result, many of you have asked me...

What are the best REITs to buy following the recent volatility?

... and it is not an easy question to answer because it of course depends on what you are looking for.

But if you expect interest rates to now gradually return to lower levels, and your goal is to maximize returns in the recovery, then you would want to buy REITs that:

Are more heavily leveraged,

Have strong businesses,

trade at low multiples of their cash flow.

One great example of that right now is:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.