TRADE ALERT - International Portfolio November 2024

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Important Announcement

Our analyst, Austin, will have a call with the CEO of Agree Realty (ADC) on Monday. Let us know if you have any questions for him.

We will share the interview with you next week. Stay tuned!

=============================

TRADE ALERT - International Portfolio November 2024

One of my favorite investment themes for the coming decade is self storage in Europe.

The reason why I like it so much is that the European self storage market is today about 20 years behind the US, and we have the benefit of insights, knowing that US self-storage REITs were exceptionally rewarding investments over the past decades:

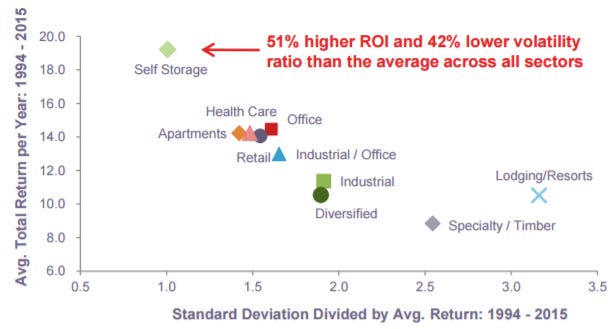

It was by far the most rewarding REIT property sector, earning near 20% average annual total returns, and we think that this exceptional performance is the result of three economic advantages:

Superior spreads: They were able to develop new properties at very high yields relative to their cost of capital.

Strong organic growth: Their large scale resulted in significant competitive advantages as they could develop valuable brands, implement sophisticated pricing systems and national advertising campaigns.

Recession resilience: Unlike other property owners, they kept earning steady returns throughout the cycle. Businesses and households will typically seek to downsize during recession and will then rent storage space for the extra stuff.

But now the US self storage market has become much more competitive and the future growth prospects for these REITs is more limited.

But the European market is still in its early days, and I expect European self storage REITs to now replicate these exceptional returns over the coming decade.

The same demand drivers exist in Europe (Divorce, death, moving, etc.), but people tend to live in smaller homes in more urban environments with less storage space. Moreover, a growing number of people now want to make space for a home office in the post-covid world, and as a result, the concept of self storage is now rapidly growing in popularity in Europe.

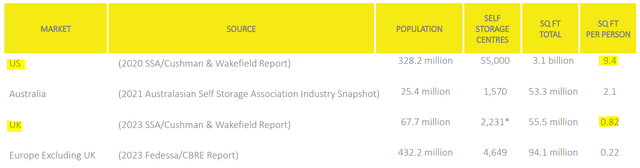

Despite that, there is still today about 10x to 20x less square foot of storage per capita than in the US:

This puts the European REITs in a strong position to capitalize on this growing demand by hiking rents and developing new properties at large spreads over their cost of capital.

This brings me to today’s opportunity.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.