TRADE ALERT - Core Portfolio September 2024

Transaction: We bought another 900 shares of Armada Hoffler Properties (AHH), increasing our position size by 60%.

-------------------------------------------------------------------------

We are today presented with an opportunity to buy the dip in one of our Core holdings.

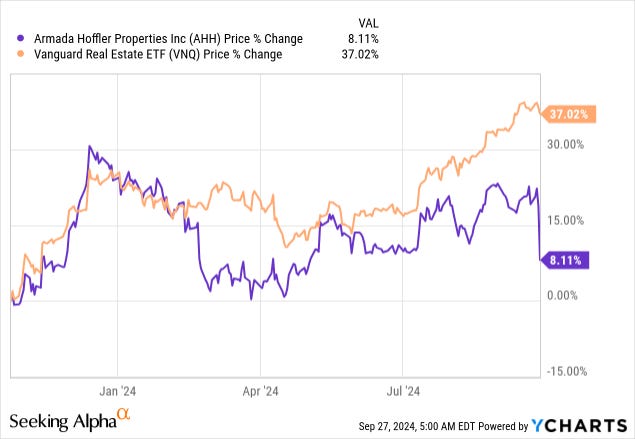

Armada Hoffler Properties (AHH) just announced a new equity offering and it caused its share price to drop by 8%. As a result, it is back to where it traded at a year ago and has essentially missed on the recent rally of the REIT sector:

We think that this is an opportunity so we just bought another 900 shares of the company, increasing our position size by 60%:

Such negative reactions are typical to equity raises, but if this capital can be put to good use, it will eventually create value for shareholders.

AHH plans to use this equity to deleverage the balance sheet and fund its development pipeline, which has historically yielded very high returns on its invested capital. As a reminder, AHH is an active developer that owns land in prime locations and it even has its own construction arm, which allows it to build at a lower cost than most other developers.

So I see this is as a case of short-term pain for long-term gain.

I of course wish that their equity was priced at a higher level to limit the dilution, but they have quite a bit of leverage, and paying some of it off will lower risks and prepare the company to fund the next phase of its growth.

It is important to keep in mind here that AHH is not buying stabilized assets with this cash, which would be much more dilutive. It is paying off some debt in preparation of new development projects. They are building at a cost that's far lower than the stabilized value of the assets. So I expect this to reduce the leverage of the balance sheet without suffering significant dilution in the end.

AHH has a great track record so I trust their judgement. Here is how they performed from the day they went public up until the pandemic, which is when their market sentiment took a big hit:

Ignoring this short-term bumpiness, we think that is a great opportunity for long-term oriented investors.

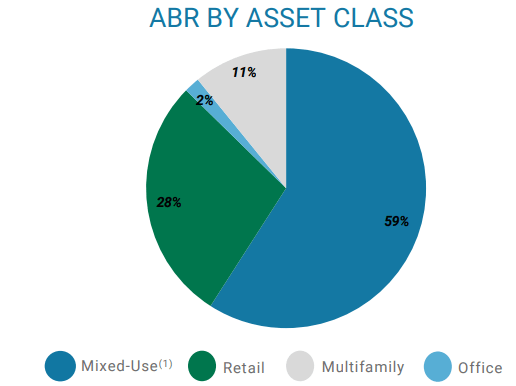

AHH owns mostly Class A mixed-use properties with 2/3 of its rental income coming from residential and service-oriented retail properties.

I love that they recently reclassified their asset type as "mixed use" in their investor material because this is underappreciated by the market.

These mixed use properties combine retail, residential, and office all together.

Below is an example owned by AHH:

These properties are very desirable because there are significant synergies between the different uses. It makes the environment more lively, walkable, and convenient, and as a result of that, these "live-work-play" properties tend to command significant rent premiums and enjoy faster growth.

They are in high demand, but limited in supply, resulting in significant barriers to entry. AHH's CEO explains in a recent interview that "its mixed-use strategy, live-work-play developments stay full virtually through any sort of economy"

Mixing various uses within a single area is a common characteristic of urban development in Europe. In contrast, in the U.S., different functions are often segregated into distinct parts of a city, leading to several disadvantages.

Everything is built around the car. Nothing is walkable. The commutes are longer. It is ultimately less convenient and kind of boring. The video below highlights the downsides of American urban planning (Note that I don't agree with everything in this video, but I still find it interesting):

But the move to a hybrid work setting is a revolution for real estate, and especially for office space, and I expect it to lead to a lot more demand for such mixed-use properties. It will help businesses attract and retain top talent and it will improve the lifestyle of residents.

This puts AHH in a great position to drive above average organic rent growth over the long run. But despite that, it is today priced at just 8.7x its FFO, which might be the lowest multiple of any REIT that owns Class A properties in sunbelt markets.

At its peak, analysts estimated that its NAV per share was nearly $20 per share, and yet, it trades just today at just $11. Its NAV has come down somewhat as cap rates expanded, but we estimate that it still trades at a ~30% discount today.

Finally, its 7.6% dividend yield is well covered with a 65% payout ratio.

Why is it so cheap?

It is perceived to be a small diversified REIT with office exposure and higher leverage than average and it is keeping a lot of investors away from it. REITs that lack focus tend to trade at a discount and the office exposure and higher leverage surely don't help in this environment.

But AHH is in the process of transforming its image.

It is rebranding itself as a "mixed use REIT" and it is reducing its leverage. As it delivers more mixed use projects and sells some of its other assets, we expect the mixed use exposure to only grow larger in the coming years.

It will take time for perceptions to change and in the meantime, we earn a 7.6% dividend yield and the REIT will keep growing its net asset value.

We find it hard to believe that AHH wouldn't eventually catch up to other REITs in this recovery. The valuation spread is just too large and if interest rates keep dropping and AHH keeps producing strong results, we think that it is just a question of time before it recovers 30-50% from here.

Finally, please note that we exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.