TRADE ALERT - Core Portfolio March 2025

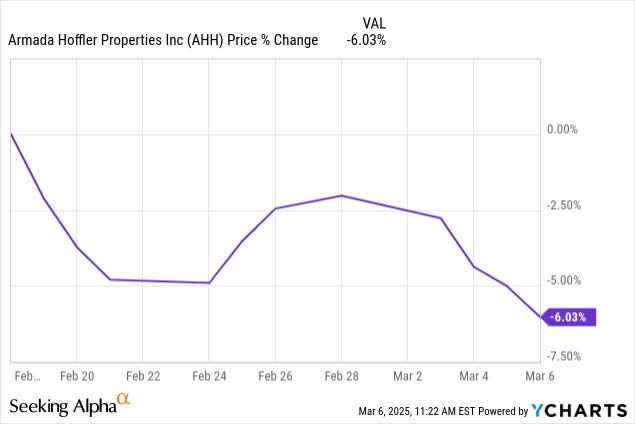

Armada Hoffler Properties (AHH) recently released its fourth-quarter results last Thursday, and its stock dropped by 6% as a result of it.

That's after it had already dropped significantly in recent months.

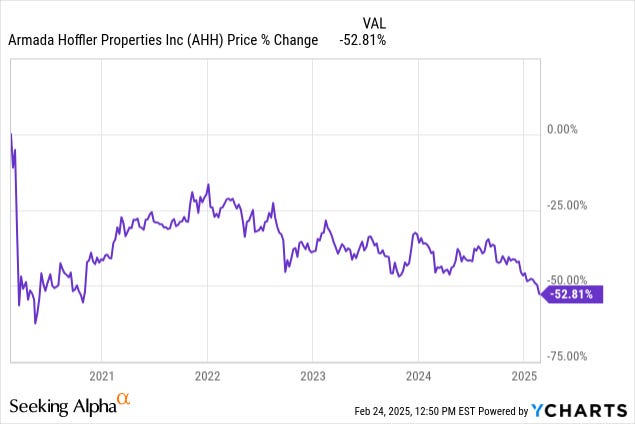

As a result, it now trades again at near its lowest level since the pandemic.

It is down 53% since February 2020, which is when most office REITs first crashed due to fears of remote work:

We think that this is yet another opportunity to add to our small but growing position. We just bought another 570 shares of the company, increasing our position size by about 20%:

If you are not familiar with the company, I recommend that you start by reading our investment thesis by clicking here.

In short, AHH is the only REIT that focuses on mixed-use properties, typically combining residential, retail, and office under one roof. We believe that these properties are particularly desirable because they enjoy superior long-term growth prospects, but the market is still pricing them at a low valuation, largely due to office fears, higher leverage, and uncertain near-term prospects.

So why did the stock drop further in recent days?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.