Please note that this is a free article of High Yield Landlord. If you find it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more.

TRADE ALERT - Core Portfolio April 2024

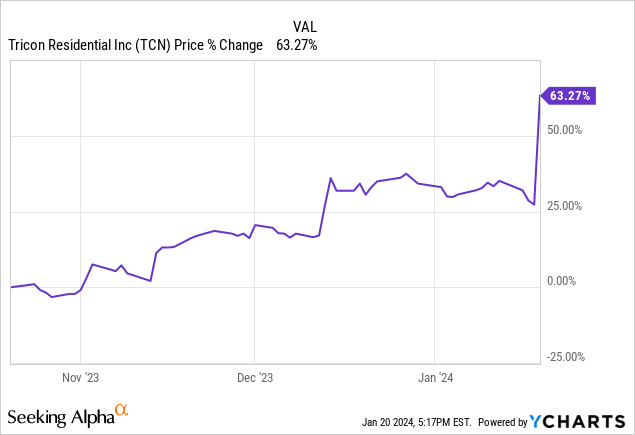

Last October, we bought mores of Tricon Residential (TCN) and speculated that Blackstone may attempt to buy it out. Here is what we said:

"Blackstone is the company that eventually bought out American Campus Communities, and today, they already have a $300+ million investment in Tricon, representing about 12% of the company's market cap. They even have a seat on the board. Blackstone has aggressively grown its portfolio of single-family rentals in the past years. It bought a $6 billion portfolio in 2021 at a ~3.5% cap rate."

Just a few months later, Blackstone (BX) announced that it would acquire Tricon, resulting in a nice gain for us:

We then decided to use some of these proceeds to initiate a new position in Apartment Income REIT (AIRC) which at the time of our purchase was arguably the best deal in the residential sector. Again, we suspected that Blackstone could be interested in buying out the company and made the following comment:

"AIRC is today one of the biggest investments of Land & Buildings, which is one of the REIT activist REIT investment firms. Recently, they pushed Tricon Residential (TCN) to put itself on the market to unlock value, and ultimately, Blackstone bought it out at a 30% premium. Could AIRC be next in line? It wouldn't surprise me. Not only are they the cheapest, but also the best performing, and they are the ideal size for a buyout with their ~$5 billion market cap."

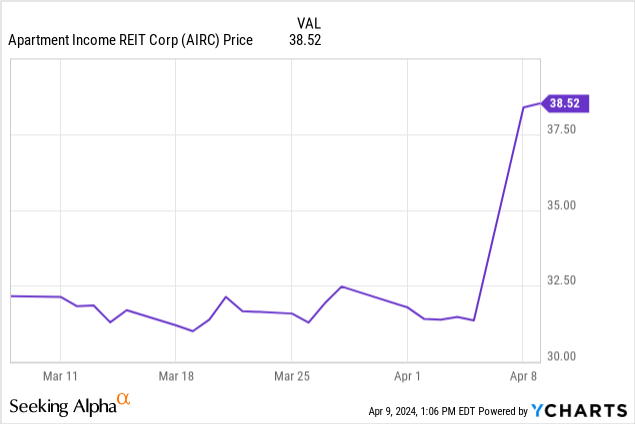

Well, here we are again… One month has passed and Blackstone just announced that it would acquire AIRC in a $10 billion dollar transaction, paying a 25% premium to its latest share price:

This means that the capital that was invested in Tricon in January has nearly doubled in value following these 2 buyouts from Blackstone.

I of course shouldn’t take a victory lap as we have also suffered our fair share of losses in this REIT bear market, but it is still pleasant to get these occasional winners as it helps us to mitigate the impact of these losses.

It is also encouraging to see that:

(1) We have consistently been able to identify potential acquisition targets. This was our 4th buyout from Blackstone alone in the last 3 years (ACC, PSB, TCN, AIRC), adding considerable alpha to our portfolio. We know what characteristics these private equity players are looking for and we can consistently benefit from such transactions.

(2) Secondly, this is also a strong vote of confidence for the REIT sector. This is a massive $10 billion dollar deal. Blackstone is one of the most sophisticated real estate investors in the world and they are quite literally buying REITs hand over fist. That tells me that we are doing something right.

But what now? Should you sell AIRC following this buyout offer? Or should we wait and hope for an even better offer?

I was doing some work on this yesterday and I have decided to sell. I think that Blackstone is getting a good deal, paying a ~5.7% cap rate, which is too high for these assets even in today’s market in my opinion.

Therefore, I initially thought that a competing offer from another private equity player was plausible. But the problem is that there just aren’t many buyers that can pull $10 billion in today’s market and for this reason, I don’t think that there will be another bidder.

We could wait and hope for another deal to come along, but given that other REITs are today even more heavily discounted, I prefer the risk-to-reward of redeploying that capital elsewhere.

For this reason, we just sold our entire position, unlocking $24,000 of capital.

What are we buying with it?

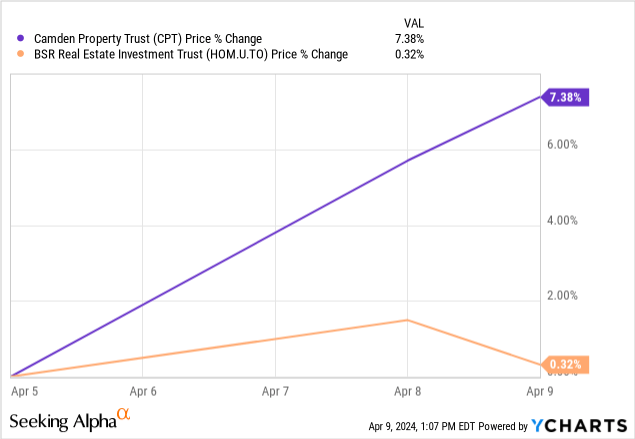

Firstly, I am making a small addition to BSR REIT (HOM.U:CA) because it is the cheapest apartment REIT and the most likely buyout target in my opinion. We just bought another 900 shares for ~$10,000, increasing the size of our position by 28%:

Yesterday, most apartment REITs rose by ~5% when AIRC’s buyout was announced, but BSR only rose by less than 1%, likely because it is primarily listed in Canada and this often leads to short term disparities in performance between BSR and its US peers:

As a result, BSR is today still priced at a near 40% discount to its net asset value, and an implied cap rate in the high 6s.

That’s an exceptionally low valuation for high quality apartment communities in rapidly growing Texan markets and we are glad to get to buy a bit more of it.

As a reminder, BSR’s biggest shareholder is its management, which owns about 40% of the equity, and they have been aggressively buying back shares to take advantage of this low valuation. In the last quarter alone, they bought another $33 million worth of shares, which is very significant for a company with a $600 million market cap.

If they cannot get the market to recognize the fair value of their real estate, I would expect them to eventually liquidate the portfolio and/or privatize the company. After all, they own a huge chunk of the equity, it is expensive to be a public company, and there is no benefit in it for them if they keep persistently trading at a large discount to their NAV. Right now, they are happy to essentially buy out their partners at 60 cents on the dollar, creating value for themselves, but their patience will eventually run out.

After this purchase, we still have another $14,000 to redeploy and I will do that later this month.

I am currently doing research on a few potential buyout targets that could attract the attention of Blackstone. I will have more to share with you soon.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

Let me know if you have any questions.

Also, if you thought that this article was useful, please click the like and restack buttons to help the algorithm. Thank you so much in advance!

Jussi