TRADE ALERT - Core & Retirement & International Portfolio December 2024 (Portfolio Recycling)

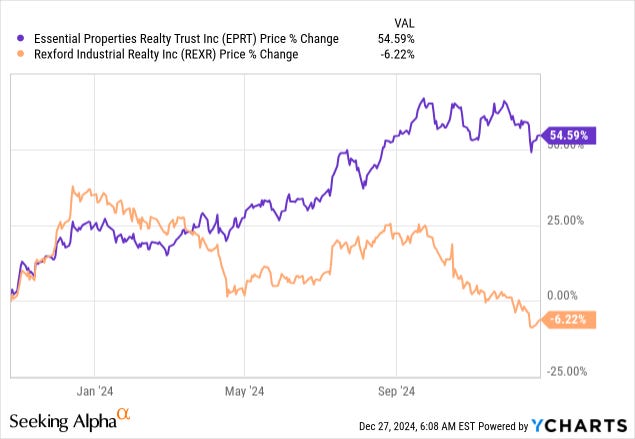

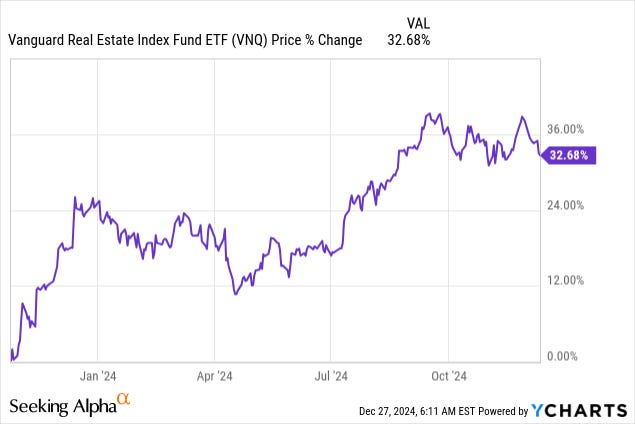

In our most last Portfolio Review article, we explained that the recent REIT market rally had been very uneven, with some REITs recovering strongly while others were left stagnating behind.

A great example is our largest holding, Essential Properties Realty Trust (EPRT), which surged near all-time highs even as other REITs like Rexford Industrial Realty (REXR) completely missed out on the rally:

This presents an opportunity for us to do some capital recycling, selling some winners to reinvest in some of our recent underperformers.

We think that some of the REITs that failed to recover as interest rates were cut are today presenting an exceptional investment opportunity because we now have the benefit of hindsight, knowing how strongly they will likely recover in the coming years once they fix whatever temporary issue that they are dealing with.

Today, we take advantage of this by selling a few positions that have nicely recovered and redeploying the proceeds into companies that remain heavily discounted.

You will also note that we also kept some cash aside as we are preparing to potentially invest in a few new opportunities.

Core Portfolio:

Sell Simon Property Group (SPG)

Retail was once out of favor due to the rise of e-commerce, but it has gained renewed appreciation thanks to the limited addition of new supply. This serves as a reminder of how quickly the narrative can change in the REIT market. Our first purchase took place in 2020 at around $50 per share and it has roughly tripled our money since then. We believe that its stock is now fairly valued and there is little upside left. The company will still likely deliver average REIT sector returns, but we aim to do better. It hurts to book such a big gain as it will result in a big tax bill for me, but there are better options in today's market for our capital. We sold our entire position.

Sell half of Essential Properties Realty Trust (EPRT)

Our biggest holding has also been one of our best performers and it is now approaching fair value. I still want to hold some of it because I think that it will still likely deliver slightly above-average returns with below average risk, but the upside from repricing is limited from here, and at 10% of our Portfolio, our position size is too big. Therefore, we are selling half of it to redeploy in other opportunities with more upside potential:

Sell Outfront Media (OUT)

Outfront has doubled from its lows 14 months ago and now trades fairly close to its fair value. I think that it still offers some upside from here, but some other REITs offer even more upside, despite also being safer. We never intended to hold it forever because it is a cyclical company with quite a bit of leverage and we would rather avoid owning it through the next downcycle. It was a covid recovery play that got delayed by the surge in interest rates, but as it has now finally recovered, we are happy to move on to something else. Note that we will still receive the special dividend of $0.75 per share, payable on December 31st to shareholders of record at the close of November 15.

Buy List

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.