Top Picks For 2025: Honorable Mention #4

A Quick Message from Jussi for free tier subscribers:

You can learn more by clicking here.

==============================

Top Picks For 2025: Honorable Mentions

Over the past weeks, we shared our Top 5 Picks for 2025. You can access each of our articles by clicking the links below:

These companies provide some of the best risk-to-reward opportunities in today’s market, in our opinion.

That said, there are many other compelling opportunities available in the current environment. One of our members made the following comment on our live chat:

Hello Jussi. I thought the Top 5 Series was one of the best things you have provided us. Each one of the Top 5 make sense to me. And I have acted upon your recommendations. Of course, diversification is important. With that in mind, would you be comfortable providing a few investments that you would call your HONORABLE MENTIONS? User 51106315

We already shares one "honorable mention:

Today, we present the fourth one:

Honorable Mention #4: Vesta REIT (VTMX)

The Mexican industrial REIT, Vesta, is arguably the most undervalued REIT out of those that are growing rapidly in today's market.

It wasn't added to the top 5 picks list because its focus on Mexico makes it somewhat less predictable, especially following Trump's victory, but that is precisely why it is also so cheap right now.

We have previously explained that we don't expect Trump's victory to change the long-term trend of nearshoring, but it could lead to greater volatility in the near term.

In any case, the REIT just recently held its 2025 Investor Day and it guided to grow its FFO per share by 10% annually through 2030:

Best of all, they think that it can achieve this mostly organically without having to raise equity. You will see in the chart below that only 10% of the funding is expected to come from either capital recycling or equity raises:

Typically, for a REIT to grow so fast, it would need to raise significant equity and reinvest it at large positive spreads, but Vesta is in a unique situation in that it can achieve this rapid growth organically, making it less dependent on the capital markets.

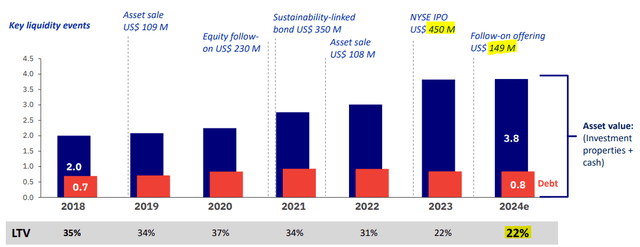

They are in this great position today because they did their IPO on the NYSE last year and raised a total of $600 million at a relatively low cost. This capital went temporarily towards paying off debt, reducing their LTV to just 22%, which is way below their 40% target:

Now they can take on new debt to fund highly accretive development projects.

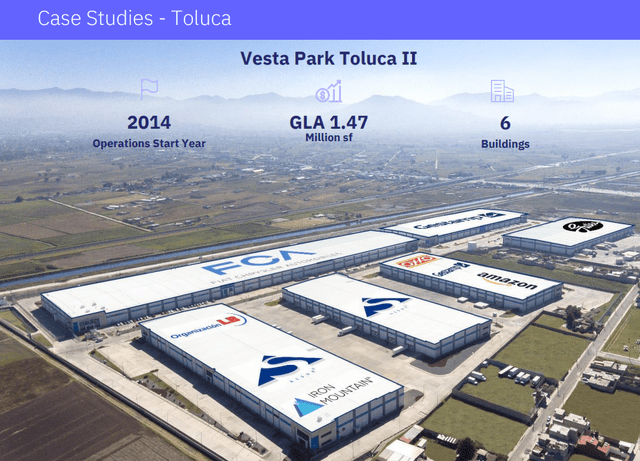

The demand for industrial properties in Mexico is growing rapidly, and Vesta is here to deliver it. It currently has a large pipeline underway and it is expecting to earn 10%+ initial yields on these new investments, resulting in massive spreads over its cost of capital.

In addition to that, its rents are also growing and the REIT retains more than half of its cash flow to reinvest in growth.

Therefore, we think that the 10% annual growth outlook is realistic and attainable. Historically, they have managed to grow even faster and that's despite not having access to the US capital markets.

So here we have a REIT with an amazing track record, rapid growth prospects, a strong balance sheet, and yet, it has seen its share price drop significantly even as most other REITs recovered a decent bit over the past year:

As a result, it now trades at a historically low valuation. For many REITs, this would be a problem if they needed to raise equity to grow, but as we already discussed, this is not the case of Vesta.

Therefore, Vesta is one of just a few REITs that provide both: a low valuation and rapid growth combined together.

The low valuation is largely due to Trump fears, but as Vesta proves the market wrong, the narrative will change again, and this could result in up to 50% upside from here.

Not long ago, Vesta was loved by the market as it was seen as a risk-mitigated play on the rapid growth of nearshoring.

It is risk-mitigated because it earns most of its rents in USD from major multinational companies, it trades on the NASDAQ, has access to US capital, it is well diversified across the country, and owns mostly modern new assets that it has developed itself.

I think that the narrative will shift again in the future and now is our chance to accumulate a large position in this rapidly growing REIT while it is feared by others.

While we wait for the upside, we earn a 3% dividend yield and the company will keep creating about 10% of additional value each year.

The yield is so low but that's only because they retain most of their cash flow to reinvest in growth. I view this as a positive because it makes Vesta less dependent on the capital market and it also increases the tax-efficiency of our investment.

Finally, please note that we exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial to access the rest of this series.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.