Top Picks For 2025: Honorable Mention #2

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on December 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Top Picks For 2025: Honorable Mention #2

Over the past weeks, we shared our Top 5 Picks for 2025. You can access each of our articles by clicking the links below:

These companies provide some of the best risk-to-reward opportunities in today’s market, in our opinion.

That said, there are many other compelling opportunities available in the current environment. One of our members made the following comment on our live chat:

Hello Jussi. I thought the Top 5 Series was one of the best things you have provided us. Each one of the Top 5 make sense to me. And I have acted upon your recommendations. Of course, diversification is important. With that in mind, would you be comfortable providing a few investments that you would call your HONORABLE MENTIONS? User 51106315

We already shares one "honorable mention:

Today, we present the second one:

Honorable Mention #2: Rexford Industrial Realty (REXR)

We bought more shares of Rexford Industrial (REXR) just yesterday. Today, we dive deeper in the bear and bull cases for the company. As you will see, we think that this is a case of short-term pain for long-term gain.

---------------

Why has the former Wall Street favorite, Rexford Industrial (REXR), fallen out of favor with the market over the last few years?

To answer that question, we have to turn back the clock five years.

We first have to understand that before COVID-19 began, the infill industrial real estate market in SoCal was already tight.

In Q4 2019, REXR's total portfolio occupancy stood at 95.2%, while stabilized same-store portfolio occupancy was 98.2%.

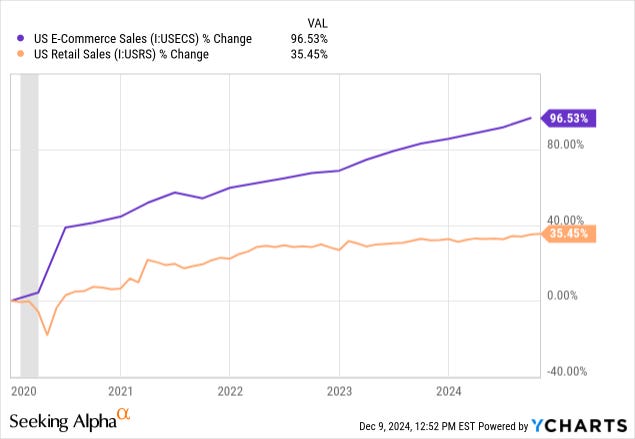

Then the pandemic began, and demand for industrial space surged higher due to the combination of fiscal stimulus and a shift from brick-and-mortar to e-commerce sales:

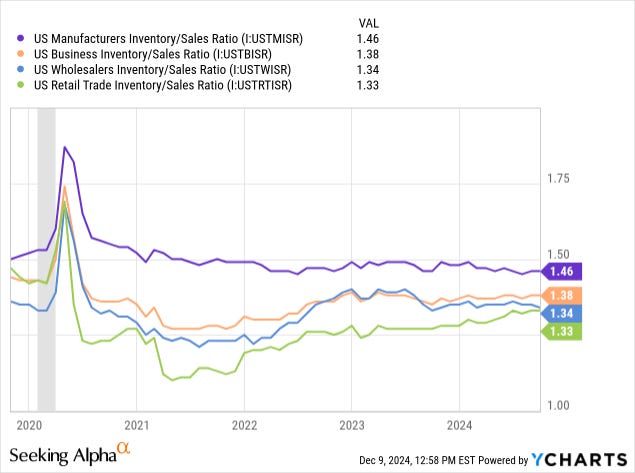

During the initial months of COVID-19, the economy virtually froze. Inventories across all parts of the economy soared higher as most economic activity ceased.

The inventory surge at the beginning of the pandemic was especially pronounced in Southern California, where most overseas imports make their first stop before being distributed out across the country.

To quote CRE broker Allan Buchanan from the OC Register:

The uptick in inventories led to historically low vacancy rates in industrial spaces, especially in logistics hubs. As a result, rents and sale prices for warehouse space soared, and smaller retailers began relying heavily on third-party logistics providers (3PLs) to manage distribution. These 3PLs also scrambled to lease more space to meet the growing needs of their customers.

REXR's small-format, multi-tenant logistics facilities also experienced above-average demand because the urban environment of Los Angeles and Orange County saw stricter lockdowns and social distancing than most of the country, triggering even more e-commerce adoptions and demand for logistics space.

This scramble for space generated incredible growth rates for REXR.

At the end of 2021, occupancy reached 99%. Rents were soaring higher. Core FFO per share grew by over 32% in Q4 2021, facilitating a dividend hike of 31%.

But even in the most supply-constrained industrial market in the nation, the red-hot conditions in 2021 and 2022 spurred developers to build more infill space.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.