Top Picks For 2025: Honorable Mention #3

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on December 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Merry Christmas

Merry Christmas from our family to yours! Tomorrow, we plan to do some portfolio recycling, so stay tuned for our Trade Alert. In the meantime, here’s one more “honorable mention” to share with you.

Top Picks For 2025: Honorable Mentions

Over the past weeks, we shared our Top 5 Picks for 2025. You can access each of our articles by clicking the links below:

These companies provide some of the best risk-to-reward opportunities in today’s market, in our opinion.

That said, there are many other compelling opportunities available in the current environment. One of our members made the following comment on our live chat:

Hello Jussi. I thought the Top 5 Series was one of the best things you have provided us. Each one of the Top 5 make sense to me. And I have acted upon your recommendations. Of course, diversification is important. With that in mind, would you be comfortable providing a few investments that you would call your HONORABLE MENTIONS? User 51106315

We already shares one "honorable mention:

Today, we present the third one:

Honorable Mention #3: Big Yellow Group

Some REIT business models are just superior to others.

Certain REITs enjoy competitive advantages that allow them to consistently earn superior returns with less risk.

Big Yellow Group (BYG / BYLOF) is a great example of that.

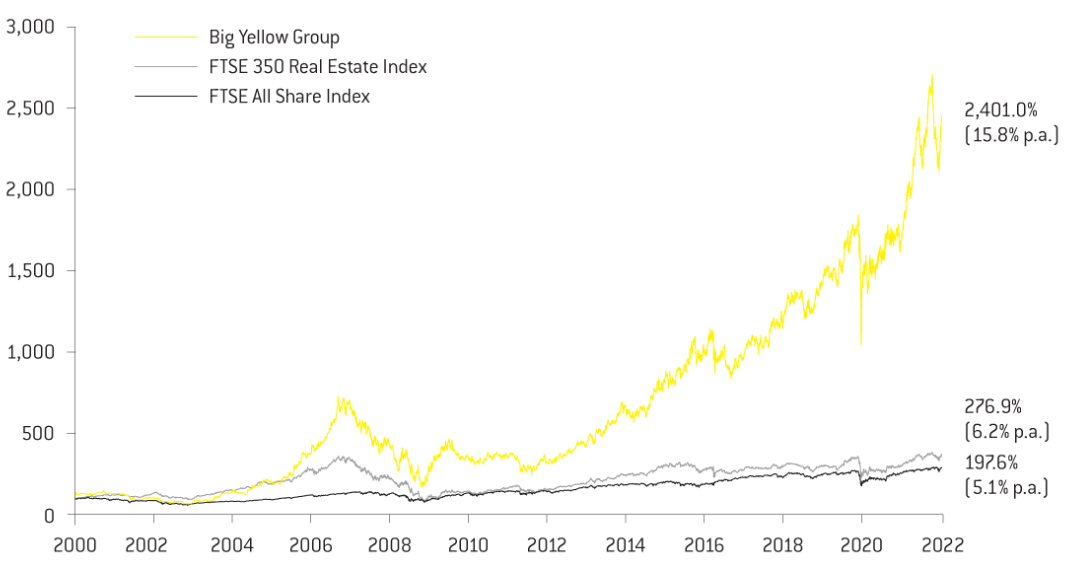

It went public in year 2000 and it has since then managed to earn a ~15% average annual returns and that's despite suffering a major set back during the great financial crisis when banks stopped working. Adjusted for that extraordinary period, its average annual total returns would have been closer to 20% per year:

These high returns were the result of the REIT's rapid growth.

It has managed to grow its FFO per share by 13% per year on average since 2004. Add to that the dividend and you get to 15-20% average annual total returns.

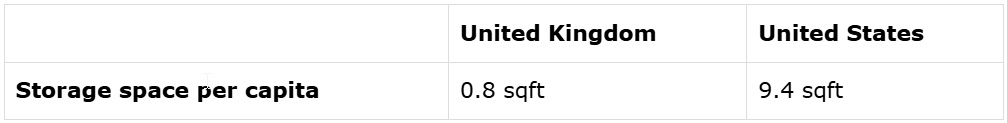

Best of all, we think that the REIT can keep generating similar strong returns for another decade or two because the REIT is still small in size and the self-storage market is still at its infancy in Europe with less than 1 square foot of storage space per capita compared to ~10 in the US:

But the concept is now rapidly growing in popularity.

The same demand drivers exist in Europe (divorce, death, downsizing, relocation, etc.), but people live in even smaller residences in more densely populated cities.

Moreover, the pandemic was a huge catalyst for the sector, especially in Europe, because people suddenly wanted to make space for a home office, and many businesses decided to downsize their offices, often leading to demand for storage space, at least temporarily.

As a result, today over half of Big Yellow's tenants are first-time users.

The concept of self-storage is finally becoming more mainstream in the UK and Big Yellow is one of just a few investors of scale in this space that's capable of developing new properties to bring additional supply to the market.

Today, it has 13 projects underway, which should expand its portfolio size by ~20% in the coming years.

Historically, it has managed to earn an 8-10% stabilized yield on its new development projects, which represents a huge spread over its cost of capital.

And I think that it will be able to keep developing new properties for a long time to come, resulting in significant growth for many more years.

Typically, when a REIT enjoys such strong growth prospects, the market prices it accordingly with shares trading at high valuations.

This has been true for Big Yellow for most its history with shares commonly trading at 25-35x FFO. This is not unreasonable for a REIT with rapid growth prospects, a defensive business, and low leverage.

Yet, today, it trades at just 16x FFO. Its valuation multiple has been cut in half since 2022 because its share price has dropped by ~40% even as it grew its cash flow by 20%. Interestingly, its valuation compressed even as its leverage also dropped from 22% down to an all-time low of just 11%, which would normally warrant a higher multiple.

We think that this is an opportunity.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.