Rexford Industrial Realty: Low Yield But High Upside Potential

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 3rd, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Rexford Industrial Realty: Low Yield But High Upside Potential

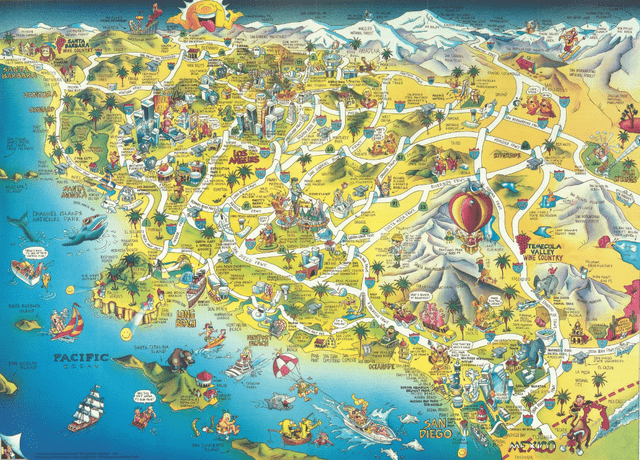

Rexford Industrial Realty (REXR) is an industrial REIT focuses 100% on infill properties in the crowded and supply-constrained Southern California market. It owns 422 properties leased to over 1,600 individual tenants:

Historically, Southern California has been a phenomenal place to own real estate, especially industrial, because of its geographic supply constraints.

With the Pacific Ocean to its East, mountains flanking its North and West, and the border to its South, there is simply no room to expand the urban sprawl in any direction.

When REXR's management calls the supply constraints in SoCal "virtually incurable," this is what they mean.

When demand grows much faster than supply, this is generally an excellent setup for landlords, who can push rents higher for their mission-critical, irreplaceable buildings.

The situation is even better for industrial real estate owners in particular, because SoCal has been steadily demolishing or redeveloping older industrial spaces into multifamily, retail, or other uses. In many sub-markets, supply isn't just flat; it's shrinking.

We initiated our position just two months ago and it is up 10% already.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.