Prime Sunbelt Real Estate At 50 Cents On The Dollar - 5% Yield And 60% Upside Potential

As landlords, we know just how much location matters.

It explains why some tiny houses sell for millions in Silicon Valley, while comparable homes struggle to sell for a few thousand dollars in some areas of Detroit.

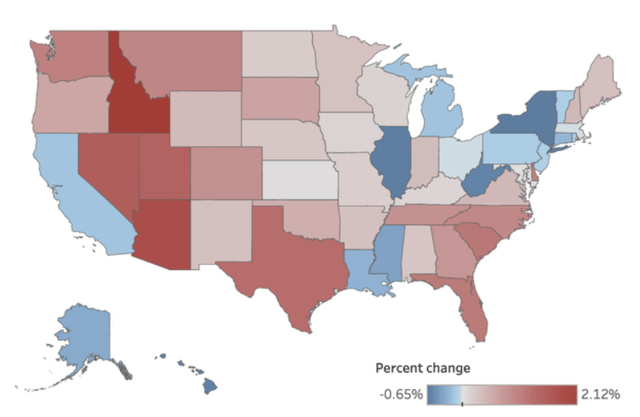

Today, some of the best locations for real estate investing are sunbelt markets like Austin, Texas, Phoenix, Arizona, and Miami, Florida.

That's because increasingly many companies are relocating there to lower their taxes and costs of doing business.

This trend existed already before the pandemic, but it accelerated further as a result of it. Celebrities Joe Rogan and Elon Musk are now openly talking about their recent move to Texas, and millions of people and businesses are listening and taking inspiration:

Hewlett Packard Enterprises (HPE) is moving its HQ from California to Houston, Texas.

Oracle Corp (ORCL) is moving its HQ from California to Austin, Texas.

Co-founder of Palantir Technologies (PLTR) Joe Lonsdale and his venture capital firm 8VC are moving from California to Austin, Texas.

Charles Schwab (SCHW) is relocating its HQ from California to the Dallas/Fort Worth area.

McKesson Corp (MCK) is moving from California to the Dallas/Fort Worth area.

Toyota (OTCPK:TOYOF) moved from Califonia to the Dallas/Fort Worth area already back in 2017.

Elliott Management, a major investment firm, is moving to West Palm Beach, Florida

Billionaire investor Carl Icahn is also relocating his asset management firm to Florida.

Goldman Sachs is reportedly on the verge of moving its asset management division to Florida.

Jamie Dimon, the CEO of JP Morgan Chase, recently said he was open to moving the company's headquarters down south to Miami.

Today, information spreads faster than ever before, and moving is also easier than it has ever been.

When a person like Elon Musk moves from California to Texas and talks about it on podcasts to 10s of millions of people, it incites a lot of other people and companies to move as well.

In a weird way, when companies move to these lower-cost/lower-tax markets, other companies are pushed to follow just to remain competitive. It results in a self-reinforcing feedback loop that forces more and more people and companies to consider making the move.

That's an opportunity for real estate investors.

The issue here is that because this trend is well-known to the market, most sunbelt-focused REITs have repriced at much higher valuations.

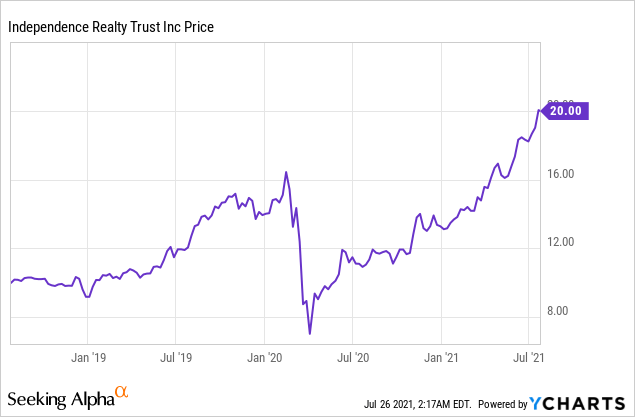

Just take a look at Independence Realty Trust (IRT), our sunbelt-focused apartment REIT, which rose to new all-time highs over the past year. That's mostly because it is heavily invested in strong sunbelt markets:

The same is true for most other sunbelt-focused REITs, but one exception remains, and it is called:

Whitestone REIT (WSR)

We mentioned the opportunity in early July and finally initiated a position a few days ago. To give credit where it is due, Dane Bowler, another Seeking Alpha author, was faster than us in covering the company. He posted an interesting article last week and it helped us as part of our due diligence.

In what follows, we present their investment portfolio, valuation, catalysts, upside potential, and risks to consider.

Whitestone REIT: Sunbelt-Focused Shopping Center REIT

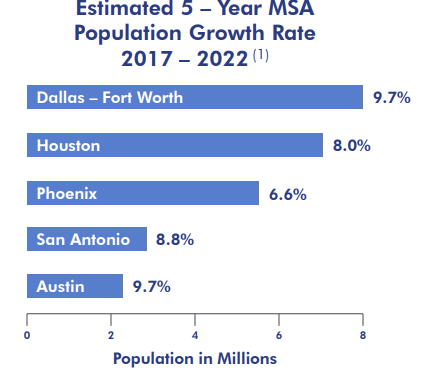

After a multi-year portfolio repositioning, Whitestone REIT (WSR) is now fully invested in some of the fastest-growing metropolitan statistical areas ("MSAs") in the United States: Phoenix, Austin, San Antonio, Dallas, and Houston. Around 99% of its rental revenue comes from these five markets:

Moreover, WSR does not simply pick strong markets.

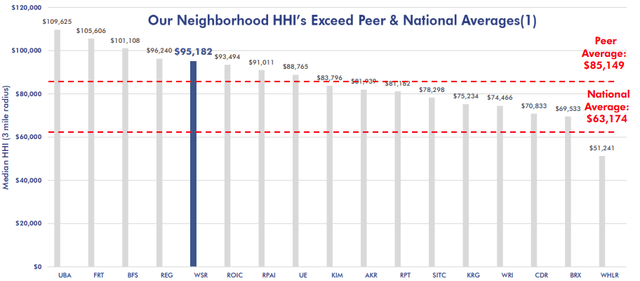

It also picks strong sub-markets within these markets.

Its properties are strategically located in neighborhoods that are densely populated and enjoy high household incomes. This is important because it means that (1) there are barriers in place to mitigate future construction, and (2) that's where the rich Californians and New Yorkers are moving when they arrive in Phoenix, Austin, San Antonio, Dallas, and Houston. They are used to a higher cost of living and can afford to live in the more expensive neighborhoods of these cities.

If you compare WSR's properties relative to its peers in terms of neighborhood household income, you find that WSR is doing a lot better than average, and if you adjust for the fact that the salaries, taxes, and costs of living are lower in its market (vs. REG, FRT, UBA, and BFS), WSR may actually own the very best assets:

So from a location perspective, it is hard to beat WSR.

It owns properties in premier locations in high-growth markets.

Beyond the locations, WSR is very picky about the type of properties it buys.

WSR targets mainly open-air, grocery-anchored, service-oriented shopping centers. Think about your local grocery store for a second. You may have gone there for years or even decades, very consistently, week after week. The property owner has been earnings rent check after rent check, cycle after cycle, and most likely will still be there decades from now.

That's mainly what WSR owns. Below we highlight a few of their properties:

BLVD Place | Whole Foods Grocery, North Italia, True Food Kitchen, One Medical Anchored Shopping Center, Houston, Texas:

Eldorado Plaza | Trader Joe's, Starbucks, Chipotle, Bed Bath & Beyond Anchored Shopping Center, McKinney, Texas

Market Street at DC Ranch | Safeway Grocery Anchored Shopping Center:

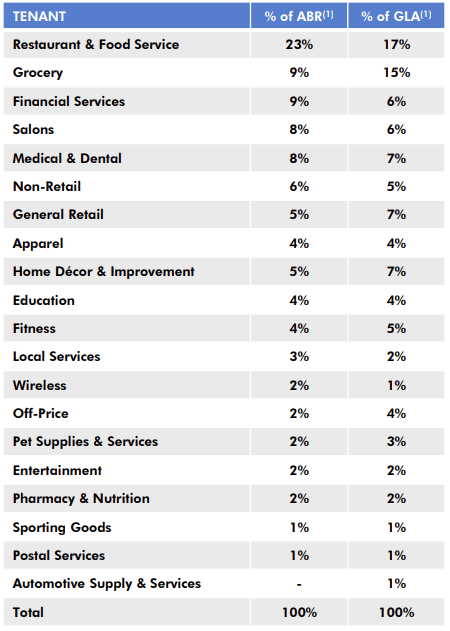

We like these properties because they are resilient to e-commerce and essential to the communities they serve, even through recessions.

The grocery store brings consistent traffic through the full cycle and the service-oriented retail businesses (nail salon, barbershop, restaurant, etc…) are Amazon-proof. In fact, Amazon is even a tenant of these properties through its Whole Foods subsidiary.

If you look at WSR's rent roll, you see that food and services dominate, and only a minority is traditional retail, which is fine because it benefits from the traffic that's provided by all the other uses:

These are not high-growth properties, but they generate resilient cash flow with low volatility, which is exactly what investors need in today's yieldless world.

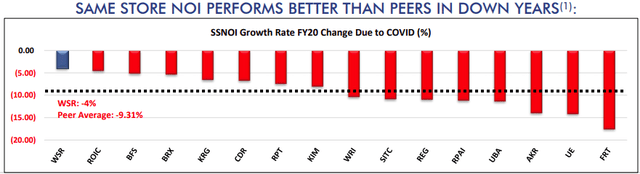

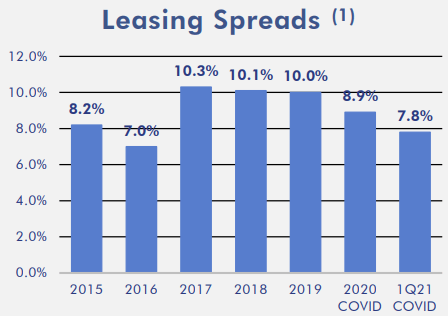

This is well reflected in how they performed during the pandemic. Their properties demonstrated resilience in same-property NOI growth and they also managed to maintain positive releasing spreads:

Apartment communities are commonly perceived to be the "safe-haven" of commercial real estate, but these essential retail properties share similar defensive characteristics, and when well-located, they enjoy long-term growth potential.

The Cheapest Sunbelt-Focused REIT

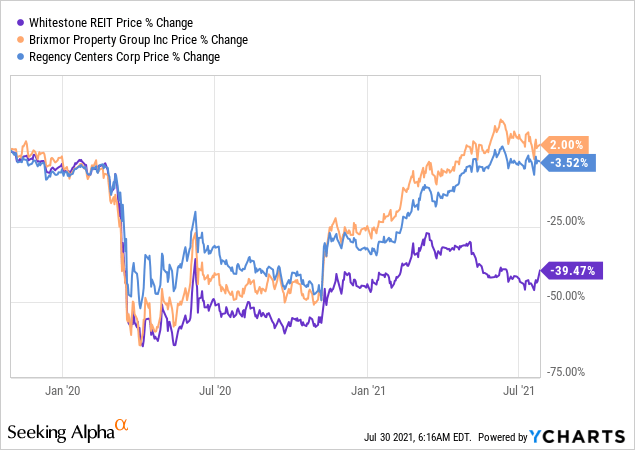

By now, most shopping center REITs have fully or near-fully recovered from the crash that occurred in early 2020. This makes sense because the pain was temporary and the long-term prospects of these properties remain mostly unchanged.

Beyond that, most REITs that are heavily invested in sunbelt markets are today priced at much higher levels than prior to the pandemic. This also makes sense because these markets benefited from the pandemic.

With that in mind, you would expect WSR to have at least kept up with its shopping center peers and recovered from the pandemic. But against all odds, it is still priced at a near 40% discount:

You could explain this discount if WSR suffered a lot more from the pandemic, but that isn't the case. Contrary to that, WSR actually outperformed its peers in terms of rent collections, same property NOI growth, leasing spreads, and property value growth.

You could argue that WSR owns some of the best assets in its peer group, and yet, it is now priced at one of the steepest discounts to pre-covid levels.

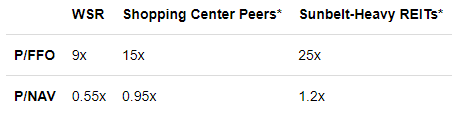

WSR is today priced at 9x depressed FFO, an estimated 45% discount to NAV, and it pays a 5% dividend yield with a low 45% payout ratio.

That's exceptionally cheap relative to its close peers, and particularly those that are heavily invested in sunbelt markets.

(*approximate figures)

Why so cheap then?

I think that it is simply misunderstood and underfollowed. WSR is a very small REIT with a $370 million market cap and up until fairly recently, it was still repositioning its portfolio towards sunbelt markets.

Beyond the potential mispricing of the market, there are two main risks that are likely to hold WSR down. These are the (1) excessive management compensation and (2) the high leverage of the company.

But while these are risks, they are also potential catalysts if WSR can fix things up because it will remove any reasons investors may have for discounting the company.

Risks & Catalysts

#1 - Management Compensation

For a long time, we have stayed away from WSR because we thought that its management was conflicted.

The company has often been criticized for overpaying its managers because its G&A as a percentage of revenue has been twice as high as many of its peers.

While some criticism is well-deserved, it is worth noting that the management has a lot of skin in the game as they own 7% of the equity, and they have actually done a pretty good job. They invested heavily in the right markets at high cap rates before they became popular. They outperformed peers during the pandemic. And if you look at total returns over the past 5 years, they have done better than the average of their peer group.

So the high G&A is a risk, but it does not necessarily mean that the company is managed for the sole purpose of enriching its management team.

Most importantly, the company has a plan to bring its G&A to a more reasonable level within the coming 2-3 years. Management compensation has already been reduced and as they continue to lease-up assets (89% occupancy rate) and buy new ones with retained cash flow (45% payout ratio), the management compensation will become more reasonable:

#2 - Balance Sheet Leverage

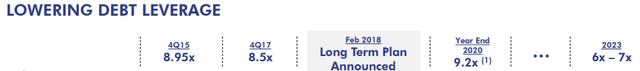

WSR has tried to scale faster than it probably should have, and as a result, they are now quite heavily leveraged at 9x Debt/EBITDA.

While that's a lot higher than some of their peers, the debt is still quite reasonable when you consider that these are defensive properties with good growth potential, and WSR maintains a very low payout ratio, which leaves a lot of liquidity to work with.

The Debt/EBITDA will naturally come down as they lease up vacancies that occurred during the pandemic, selectively dispose of highly leveraged properties, and finance future acquisitions with lower debt.

They think that they can reach 6-7x Debt/EBITDA by 2023, which would be a major improvement:

Upside Potential

These two risks existed already prior to the pandemic and it did not prevent the company from trading at $14 per share. That was a quite reasonable share price when you consider that its properties (net of debt) are worth $17.58 per share based on a 6% cap rate.

Today, its markets have gotten even stronger, and therefore, we don't see any reasons why it wouldn't get back to at least $14 per share. This would unlock 60% upside and the company would still trade at a discount to NAV.

But if WSR can fix these two things (management compensation & leverage), then the company will deserve an even higher valuation. Sunbelt REITs commonly trade at large premiums to NAV. It is not inconceivable that WSR earns its premium over the coming years if its markets remain strong and everything else goes according to plan.

If it repriced at a 10% premium to today's NAV, the share price would need to more than double from here. That's not our base case scenario, but it shows that the reward potential is well worth the risk.

Why It is a Prime Buyout Target

We think that WSR will see its share price recover closer to NAV on its own over the coming years.

But if it fails to do so, then it could become a prime buyout target. That's because:

Most of its peers would gladly increase their exposure to WSR's markets.

Its size isn't too big or too small. It is just ideal for a lot of buyers.

Even a small discount would make the transaction immediately accretive.

The CEO is getting old, the management owns 7% of the equity, and they sure wouldn't say no to a golden parachute.

Finally, if they cannot earn a more reasonable valuation, there is little point in remaining a publicly listed company.

Recently, we saw two of WSR's peers, RPAI and KRG, merge together. WSR is a prime target for a similar transaction.

Bottom Line

WSR is arguably the cheapest shopping center REIT and also the cheapest sunbelt-focused REIT. If you are bullish on these markets, then it is a no-brainer at the current price.

We think that the risks are overblown, and the company will ultimately recover, just like its peers already have. If it doesn't, we would expect it to get bought by one of its peers or a private equity player.

The main risk to our thesis is that the management turns out to be more conflicted than we thought and they attempt to grow at all costs by issuing a bunch of shares at steep discounts to NAV. While we don't expect that to happen, it is something that should be closely monitored to mitigate risks.

The ultimate upside is anywhere between 60% and 120% depending on how well the management can fix issues and how strong its markets remain.

While you wait for the upside, you earn a 5% dividend yield that's safely covered.

We give it a Strong Buy rating.

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.