PORTFOLIO REVIEW - September, 2024

PORTFOLIO REVIEW - September, 2024

Table of Content

Opening Notes

Notable Changes to Our Portfolio Holdings

Notable Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

1- Opening Notes

Our investment thesis is now finally starting to play out.

Interest rates are expected to return to lower levels and REITs are surging in anticipation of that.

They have now risen by 34% since November 2023:

And that's just the average of the REIT sector.

Many of the most beaten-down REITs have already risen by over 50%.

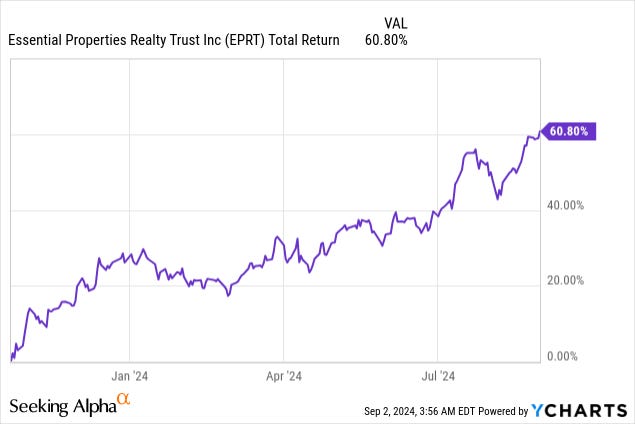

As an example, our single biggest investment, Essential Properties Realty Trust, (EPRT) is up 60% since then.

This is yet another example of how important it is to remain patient when investing in REITs. Timing the market isn't possible and prices can recover just as fast as they dropped.

Most members of High Yield Landlord understand this and stuck to the strategy, accumulating real estate at a discount during this bear market.

But unfortunately, there is a always minority of people who abandon their strategy, sell at the bottom, and give up significant upside as a result of their impatience.

But the good news is that it is not too late to jump back on the train.

Rate cuts have not even started yet and REITs are already surging.

So just imagine what 200 basis point lower interest rates could do to them.

There is a big difference between earning a 5% yield on your cash versus earning just 3%, and it seems inevitable to me that a lot more of this cash will makes it way back to higher yielding alternatives like REITs over the next year.

This is particularly true because REIT valuations remain reasonable.

Even following the rally, REITs are still down 20% since 2022 and their cash flows have also grown by about 10% since then, which means that valuations are still down about a third:

And again, this is just the average of the sector, which is dominated by large investment grade rated REITs.

If you are selective, you can still find a lot of smaller and lesser-known REITs and REIT-like entities that are far cheaper than this.

We acted on many such opportunities in August.

Early into the month, we initiated a position Caesars Entertainment (CZR), noting that the real estate ownership of the company was heavily mispriced following the crash in its share price. We think that its share price could triple as it sells its real estate, buys back shares, and pays off some debt in the coming years:

Then we doubled down on RioCan (REI.UN:CA), which is arguably the best opportunity in the retail property sector right now. It owns prime real estate in Toronto, enjoys steadily growing rents, but trades at a steep discount relative to its weaker peers due to its slightly higher leverage. But it is now focused on paying down its debt and the rate cuts should be particularly beneficial to its market sentiment since it is still so heavily discounted:

After that, we took the opportunity to upgrade the quality of our portfolio by selling Global Medical REIT (GMRE) and reinvesting the proceeds into a new listing called Sila Realty Trust (SILA). It is cheaper, safer, and enjoys far better growth prospects - a clear market inefficiency for active investors.

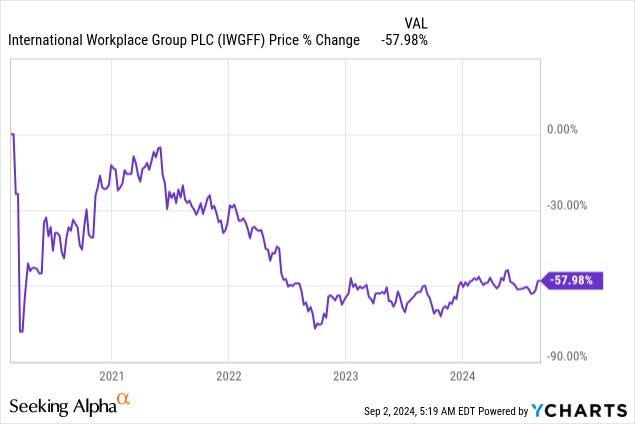

Finally, we also initiated a new position in International Workplace Group (IWGFF), which is yet another REIT-like entity that still trades at a huge discount to our estimate of its fair value. Its share price never recovered following the COVID crash, likely because of the false perception that it is just another office landlord. But in reality, its business has fully recovered and it is enjoying its fastest growth ever right now as more and more office landlords sign deals with IWG to manage their office footprint. We think that IWG could be a multibagger in the coming years.

Going into September, you can expect more of the same.

We will be very active because we are seeing significant movements in this rapidly evolving market.

You can expect us to act on at least one new investment opportunity in September, and we also expect to sell one or two more holdings to consolidate capital towards our favorite opportunities. Stay tuned for our Trade Alerts.

Finally, due to popular demand, we plan to soon launch a new 'Top 5 Picks' series on High Yield Landlord, where I will discuss our favorite strategies to maximize gains in this recovery. In the meantime, let us know if there's anything else we can assist you with.

==============================

2- Notable Changes to Our Portfolio Holdings:

We had five "Trade Alerts" since our last Portfolio Review:

#1 TRADE ALERT - August 7th, 2024 (Core Portfolio)

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.