PORTFOLIO REVIEW - Q1/2025

PORTFOLIO REVIEW - Q1/2025

Table of Contents

Opening Notes

Notable Changes to Our Portfolio Holdings

Notable Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

1- Opening Notes

After a multi-year bear market in publicly traded real estate stocks, there now appears to be light at the end of the tunnel.

In 2023-2024, real estate investment trusts ("REITs") have endured strong headwinds from sharply rising interest rates and an all-consuming market obsession with Big Tech stocks.

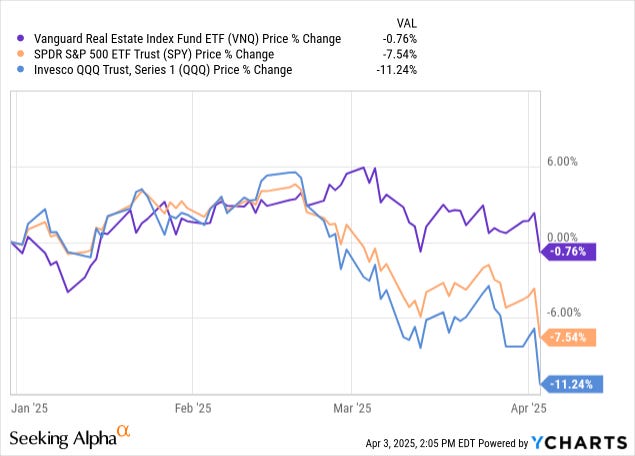

So far this year, that fever appears to be breaking. The clouds are parting, and the sun is starting to shine on REITs again. In fact, as I write this, the broader market is selling off amid fears of trade wars, yet REITs have remained largely unaffected—leading to significant outperformance in early 2025.

In what follows, we'll dispel a myth about REITs, show how they're outperforming this year, and discuss a historical pattern that may be repeating.

Taking The Long View of REITs

A lot of people think of REITs as nothing more than bond alternatives—basically fixed income in equity form.

And indeed, REITs have traded at a high correlation to bonds (negatively correlated to interest rates) over the last several years. When bond prices rise, so do REITs'. When bond prices fall, REIT prices fall with them.

But in the long run, this narrative is overly simplistic.

REITs are just as capable of growth as any other dividend-paying company.

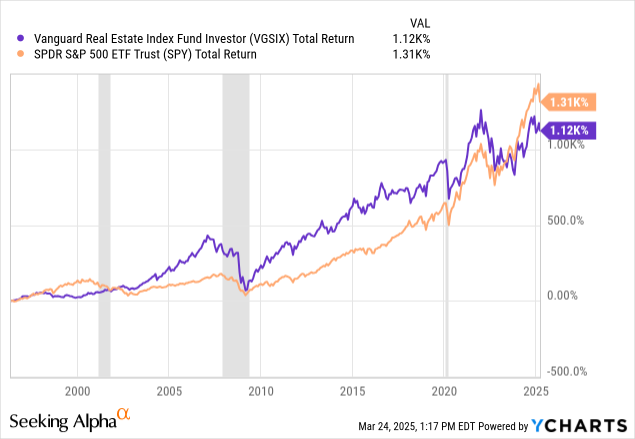

Let's zoom out to look at almost the entire modern REIT era, which began in 1994. The Vanguard Real Estate Index Fund (VGSIX) has been around since 1996, and when we compare its total returns to those of the S&P 500 (SPY) during this period, we find that REITs have spent most of the last 3 decades outperforming the market:

Only in two periods in the last three decades has the S&P 500 significantly outperformed REITs: the Dot Com bubble of the late 1990s and the AI euphoria of 2023-2024.

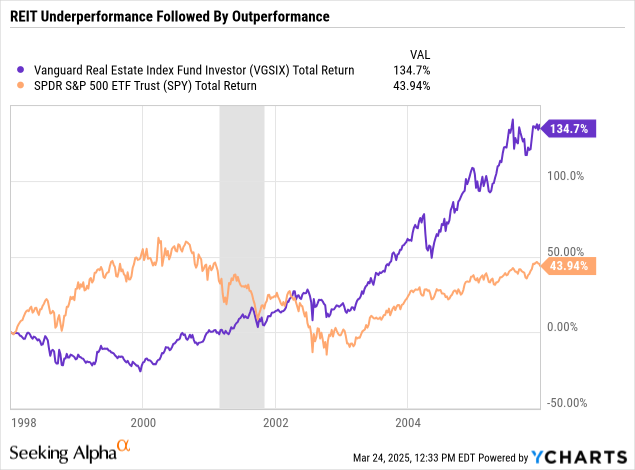

In the late 1990s, REITs underperformed less for fundamental reasons and more simply because investors found them boring and uninteresting compared to the exciting Internet-related stocks that dominated the S&P 500.

But as you can see, around the turn of the century, REIT performance began to pick up momentum, and shortly thereafter, the tech-heavy SPY began to lose steam. For the next 6 years, REITs massively outperformed the market as solid, reliable, non-speculative fundamental value came back into vogue.

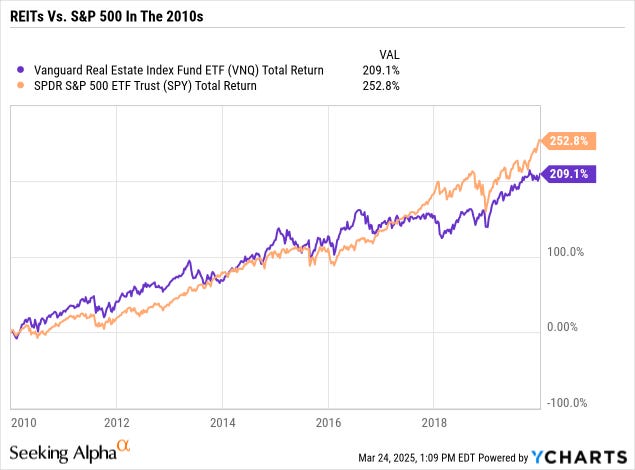

Switching to the ETF version of Vanguard's real estate index (VNQ), we find that during the 2010s, REITs spent most of the decade outperforming the market, only slipping in 2018 when the Fed signaled that it would keep tightening on "autopilot."

Being sensitive to interest rates, REITs did not like the Fed's hawkishness in 2018, nor did they benefit as heavily from the Tax Cuts and Jobs Act passed in 2017.

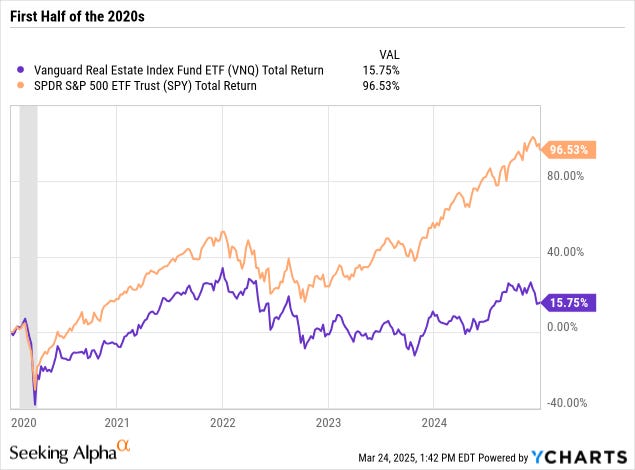

Almost immediately after entering the 2020s, the pandemic struck, which disproportionately hurt any REIT that owns properties with experiential or in-person components. Hence REITs' underperformance in 2020-2021 even amid ultra-low interest rates.

Of course, we all know what happened in 2023-2024. The world became enamored with artificial intelligence, and the primary driver of stock market performance became the mega-cap tech companies that dominate the S&P 500 index.

That brings us to this year.

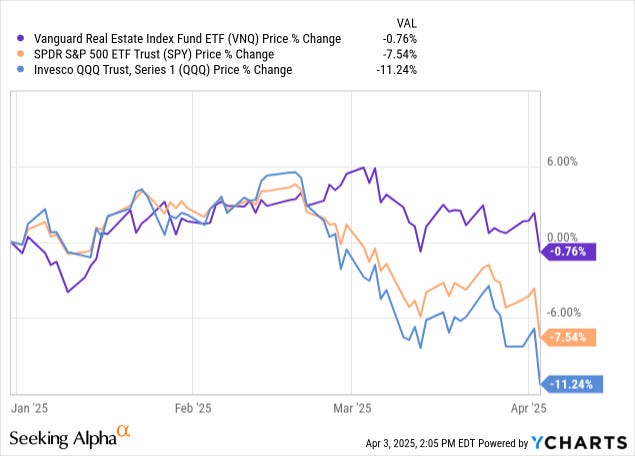

After the announcement of the Chinese AI chatbot DeepSeek raised awareness that the major American AI players may have more international competition than previously thought, the shine has been slowly coming off the Big Tech giants in the SPY.

Meanwhile, interest rates have come down amid fears that tariffs will hurt economic growth, which has boosted the fortunes of REITs.

Over the last month, REITs, and especially the ones in the S&P 500 (XLRE), have meaningfully outperformed both the S&P 500 and the Nasdaq index (QQQ).

Is this a temporary blip, or could it be the beginning of another multi-year run of REIT outperformance like the early 2000s?

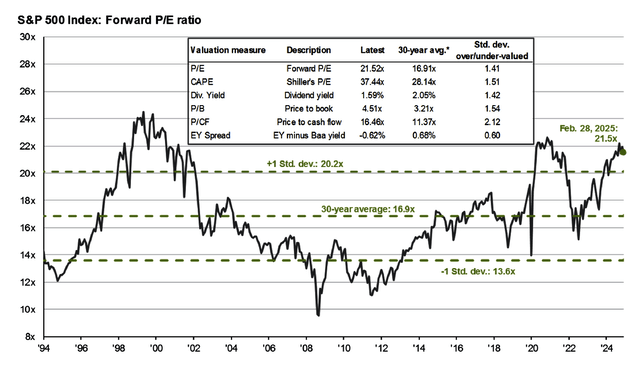

Consider that the real estate index's average price-to-FFO (the REIT equivalent to price-to-earnings) ratio is about 16x right now, compared to 21.5x for the SPY:

The valuation spread between REITs and the broader market isn't quite as extreme today as it was in 2000, but it is still at one of its widest points in the last three decades.

The most likely scenario, in our view, is that REITs do outperform the market over the next several years but by less than they did in the early 2000s during the bursting of the Dot Com bubble. They are undervalued relative to the market, boast solid fundamentals, and should remain resilient through almost any economic scenario.

The key will be to be selective.

At High Yield Landlord, we will continue to focus primarily on recession-resistant property sectors that generate steady and growing cash flows.

With that in mind, you won't see us buy hotels, billboards, or offices.

Rather, we will keep focusing on things like medical office buildings, grocery stores, net leases, life science, cell towers, and affordable housing for the most part.

In April, we also expect to increase the concentration of our portfolios, focusing more on our highest-conviction positions to maximize gains in a future recovery.

We have several ideas in mind, but before making any major decisions, we expect to conduct many REIT CEO interviews over the coming weeks. This includes:

VICI Properties (VICI)

Agree Realty Capital (ADC)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Easterly Government Properties (DEA)

Gladstone Land (LAND)

Modiv Industrial (MDV)

Kite Realty (KRG)

H&R REIT (HR.UN:CA)

Safehold (SAFE)

EPR Properties (EPR)

Some of these interviews may even be in video. If you have any questions for these REIT CEOs, let us know, and we will include them.

==============================

2- Notable Changes to Our Portfolio Holdings:

We have had four "Trade Alerts" since our last Portfolio Review:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.