PORTFOLIO REVIEW - November, 2024

PORTFOLIO REVIEW - November, 2024

Table of Content

Opening Notes

Notable Changes to Our Portfolio Holdings

Notable Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

1- Opening Notes

In this month's portfolio review, we are going to answer a question that I often get from new members:

Why risk it with REITs when the S&P500 and Tech Stocks have been so rewarding?

After the last few years, it would be understandable to think of REITs as a poor place to invest your money. Might as well just stick it in an index fund!

But what if we told that after the amazing performance of the broad-based indexes and the poor performance of REITs, the latter is more likely to outperform the former going forward?

We think that's exactly what will happen. We think REITs are likely to outperform the broader market and big tech stocks such as the Magnificent 7 over the next few years.

Let's discuss why. Afterward, we'll look at our watchlist for new potential REIT investments in November.

Why The S&P500 Is A Bad Investment Right Now

History doesn't repeat, but it sometimes does rhyme.

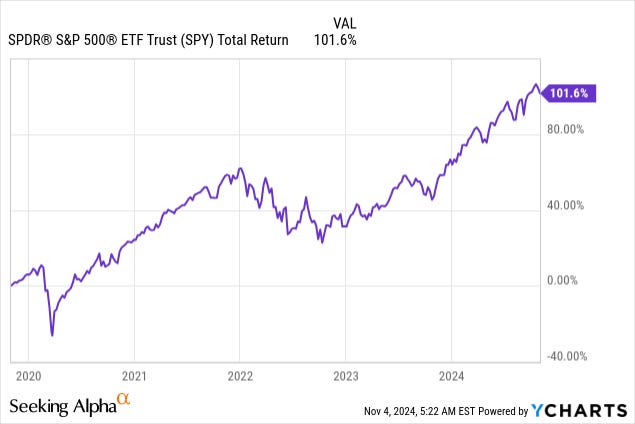

Right now, the S&P 500 (SPY) has only rarely been as highly valued throughout history. To be clear, there are periods in history that the S&P 500 has sported even higher valuations, such as the Dot Com bubble of the late 1990s, when the forward price-to-earnings ratio of the index topped 24x.

But today's nearly 22x forward P/E ratio marks the current market as one of the more richly valued ones in modern history, especially given that interest rates are still at near 5%.

In fact, as you can see in the table of the above image, the current market is more richly valued than its 30-year average in virtually every measurable way. By earnings, cash flow, dividend yield, or book value, today's stock market is pricier than it has been for most of history.

What has forward performance typically been for the S&P 500 when the index has been valued this high in the past?

The answer is: Pretty poor.

The chart on the left shows forward 1-year returns when the S&P 500 has been the same P/E ratio it is today, while the chart on the right shows 5-year forward annualized returns.

Both are basically 0%.

The relatively high average valuation for the stock market is primarily because of the richly valued tech stocks within the S&P 500 and especially the more tech-heavy Nasdaq 100 index (QQQ).

Currently, the SPY's trailing 12-month P/E ratio sits at 24.7x, while the QQQ sports a P/E ratio of 32.1x.

Now, we don't doubt the innovativeness or growth potential of these fantastic tech companies. But there have been many innovative, high-growth public companies throughout modern history that have become overvalued and ended up as poor investments for many years.

Think of the "Nifty Fifty" back in the late 1960s and early 1970s, or the exciting Internet-related stocks during the late 1990s.

We are not technology analysts and can't say with confidence whether these richly valued tech stocks that heavily weight the major indices will be able to grow into their valuations or will suffer mediocre returns for a while.

But given the gravitational pull of valuations back toward their long-term averages over time, we would much rather bet on something with below-average valuations than something (like big tech) with above-average valuations.

What out there in the market has below-average valuations today?

We're so glad you asked.

REITs Are Still Very Cheap

We have always liked publicly traded REITs.

We think the model is ideal for high-quality, growth-oriented owners of high quality real estate. It offers the broadest array of capital sources while simultaneously offering shareholders a regular source of income from the required dividend payout (at least 90% of taxable income).

But though we have liked REITs for a long time, we think now is still one of the best times in years to buy them.

The simple fact is that REITs are cheap!

Right now, the REIT index sports an average price to funds from operations ("FFO" -- the most widely used earnings metric for REITs) ratio of about 18x. That's on a forward basis.

That is about 4 turns cheaper than the SPY's forward P/E ratio of about 22x.

Here's a chart illustrating this valuation difference, although its data is from the end of August 2024, so it is already a bit dated:

In any case, a 4-point discount between REITs and the SPY is historically huge and typically seen only during or shortly after recessions.

It is odd to see REITs trade at such a discount during a non-recessionary economy.

We think the concern over the negative impact of higher interest rates has been overblown for most REITs. After all, most REITs have very strong balance sheets with well-laddered debt maturity schedules. The average debt to market asset value for REITs is about 35%.

How have REITs historically performed on a forward basis when they have been priced at such a discount to the broader stock market?

The answer is: Pretty well!

Over the last 20 years, when REITs have been this discounted relative to the market, they have outperformed during the next 1-year, 2-year, and 3-year periods.

Most of the outperformance typically happens in the first two years.

Here's how the Vanguard Real Estate Index (VGSIX), which is over 90% REITs, performed against the SPY during the three year period from 2004 through 2006:

Now here's how REITs performed coming out of their discount to the broader market during the Great Financial Crisis from 2009 through 2011:

To be fair, REITs did not outperform the market from 2020 through 2022, but that is entirely due to the abnormal circumstances surrounding the COVID-19 pandemic.

Under normal conditions, REITs almost always outperform over the next few years after reaching this large of a discount to the broader stock market.

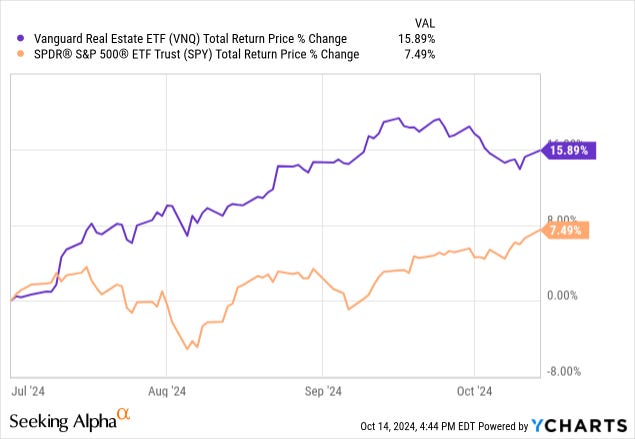

That's why REITs generally make a great buy today, despite outperforming since the beginning of July.

We think that this outperformance should continue for at least a few years as REIT valuations gradually get back in line with those of the broader stock market, aided by cuts to interest rates. The Fed already cut rates once by 50 basis points and it is expected to cut them by another 25 points later this week.

At High Yield Landlord, we will continue to capitalize on this opportunity because the low valuations essentially allow us to buy good real estate at a discount to its fair value and we then get the added benefits of professional management, diversification, liquidity, and limited liability on top of that.

Over the coming weeks, you can expect us to release regular Trade Alerts as we continue to execute our accumulation strategy, which we have outlined in a separate article that you can read by clicking here.

Below we highlight our current watchlist for potential sales and additions:

Watchlist for Potential Sale

Most of our investments are today undervalued and we are not interested in selling them. However, there are a few companies that we are considering to sell, not because we are bearish, but because we may have a better use for that capital:

Simon Property Group (SPG): Our first purchase took place in 2020 at around $50 per share and it has roughly tripled our money since then. We believe that its stock is now fairly valued and are considering to sell it to double down on its smaller peer, Macerich (MAC), which is still heavily discounted due to its higher leverage. We think that its new CEO is doing a good job at unlocking value for shareholders and hope to soon interview him for members of High Yield Landlord. Let us know if you have any questions for him.

Essential Properties Realty Trust (EPRT): Our biggest holding has also been one of our best performers and it is now approaching fair value. We would gladly hold on to it for the long run, but we have identified a new opportunity in the net lease sector and we are considering to sell half of EPRT to take advantage of this new opportunity.

Outfront Media (OUT): We are not ready to sell just yet, but Outfront has strongly recovered over the past year and if it surges over $22 per share, we would likely sell it. We never intended to hold on to OUT forever because it is a cyclical company with quite a bit of leverage and we would rather avoid owning it through the next downcycle. It was a covid recovery play that got delayed by the surge in interest rates, but as rates come back down and it recovers, we will likely move on to something else.

Watchlist for Potential Addition

We plan to make additions to some of our existing positions over the coming weeks. Here are some names that we have high on our list: