PORTFOLIO REVIEW - June 2024

======================

Important Note

The newsletter “High Yield Landlord” recently migrated from the platform “Seeking Alpha” to “Substack.” As a result, some links in older articles may redirect you to the Seeking Alpha website. Please refer to our latest Portfolio Review article for the correct links. Additionally, the formatting of some older articles may occasionally be off. For accurate information, please refer to our latest Portfolio Review article.

======================

PORTFOLIO REVIEW – June, 2024

Table of Content

Opening Notes

Notable Changes to Our Portfolio Holdings

Notable Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

Closing Notes

1- Opening Notes

Lately, there has been a lot of conflicting news on the state of the economy, inflation, and where interest rates are headed.

This has prompted many of you to ask us:

What if interest rates remain higher for longer?

It appears that our macro research on interest rates has led some of you to think that our REIT investment thesis relies on interest rates returning to lower levels.

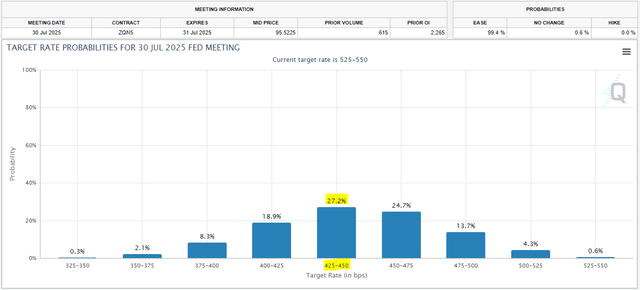

It is true that we expect interest rates to be cut over the next year and think that this will be a strong catalyst for the REIT sector. REITs crashed due to rising interest rates, and therefore, we expect declining interest rates to have the opposite effect. Note also that this is not just our prediction: the debt market is today pricing ~100 basis point lower rates a year from now, and historically, the debt market has been quite accurate at predicting future cuts.

However, even if I thought that interest rates would remain "higher for longer", I would still be buying REITs today.

Obviously, the near-term upside potential wouldn't be quite as large and we likely wouldn't see a V-shaped recovery from this bear market.

But REITs are still offering far better value than most other investments and we really don't need anything exceptional to happen for REITs to deliver strong total returns over the long run from here.

Let's compare REITs to stocks, bonds, treasuries, and private real estate.

REITs vs. Stocks

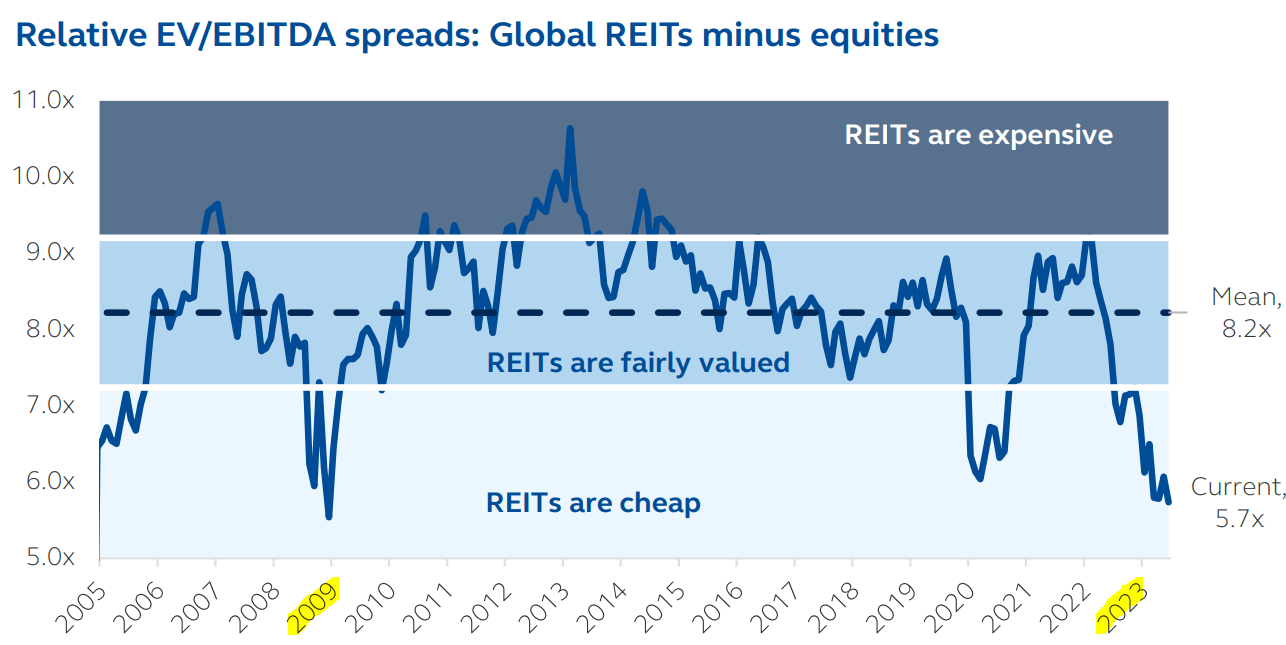

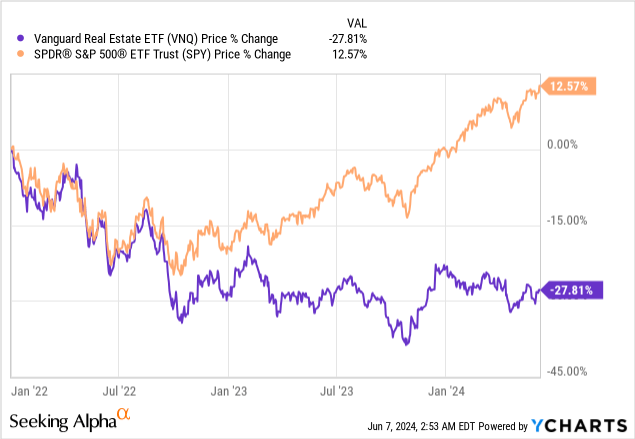

REITs have crashed even as the broader stock market kept advancing higher, and as a result, REITs are now priced at their lowest valuations relative to regular stocks since 2008.

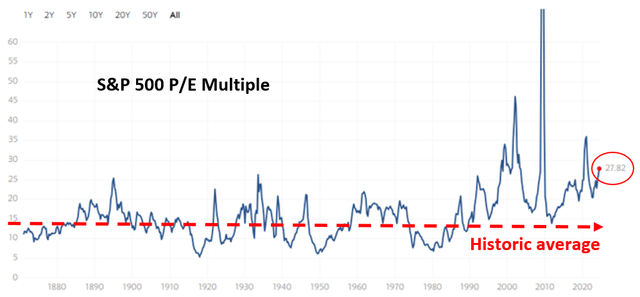

REITs are priced on average at 12.5x FFO, whereas the S&P500 is priced at 28x EPS. Historically, the spread has been far smaller with REITs sometimes even trading at higher multiples than the S&P500, but somehow, the market has decided to punish REITs as if they were the only investments that were sensitive to interest rates.

This of course makes no sense.

All investments are sensitive to interest rates. If interest rates rise, then discount rates in valuation models need to be adjusted higher, which lowers the value of future cash flows. Therefore, the companies that should be the most heavily affected are those that generate little profits today but are expected to generate a lot of profits in the future since the discounting of the cash flow has a particularly large impact on those future years.

REITs generate a lot of profits already today, they use little leverage, they benefit from inflation, and they are generally not priced at high multiples based on lofty growth expectations.

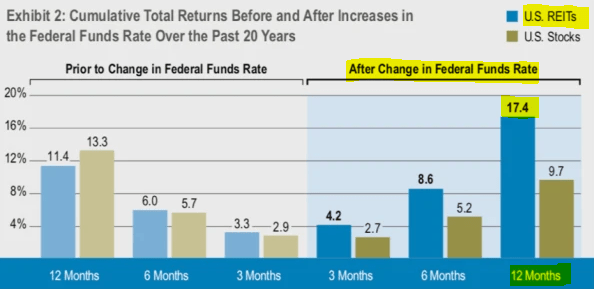

Therefore, you could make the argument that REITs should be less sensitive to rising interest rates, and historically, this has been the case as REITs have outperformed the broader stock market during most time periods of rising interest rates:

I think that this time was an exception because the 0% interest rate policy had pushed a lot of fixed income investors into REITs to seek yield in a yieldless world.

These investors then sold their REITs, regardless of their fundamentals, as soon as they could earn a decent yield from bonds and treasuries.

This explains why REITs crashed even as lower-yielding growth stocks kept rising. The end result is that stocks are now priced at a historically high valuation multiple even as we are in a higher interest rate environment.

Would I want to buy stocks at 27x EPS?

Or would I prefer to buy REITs at 12.5x FFO?

I think that the question is easily answered.

With REITs, I am earning an ~8% cash flow yield so very little growth is required to reach to reach double-digit total returns. Most REITs use little leverage, have long debt maturities, and will enjoy strong rent growth over the next 5-years because the higher rates and inflation have stopped most new development projects. I also like to think that REITs enjoy stronger margin of safety given that they have already crashed and are priced at historically low valuations relative to most other asset classes. Inventors also enjoy upside optionality if and when interest rates finally return to lower levels as it would push the same income investors to buy back into REITs. To take the example of VICI Properties (VICI), it is today priced at an 8% cash flow yield and it is expected to keep growing slowly even if interest rates remain at today's levels. You also enjoy good margin of safety since the company is already priced at a large discount relative to the replacement cost of its trophy assets and its valuation could expand significantly in the future in the event that rates are cut and its growth accelerates.

Stocks, on the other hand, only offer a ~3% yield based on today's earnings, their growth prospects are arguably less predictable, and they are at much greater risk of seeing their earnings multiples deflate on the first setback given that they are priced at historically high valuations relative to interest rates. They are also unlikely to enjoy much upside even if interest rates are cut because the surge in interest rates has not had any significant impact their valuations. Therefore, I think that the risk-to-reward of most stocks is materially worse than that of REITs at this time.

REITs vs. Bonds/Treasuries

A lot of investors appear to think that now is a great time to invest in bonds and treasuries.

They offer a historically high yield with Treasuries offering a ~5% interest rate and corporate bonds offering closer to ~6-7%.

Why would you then risk it with REITs when you could earn a similar yield with Bonds and Treasuries?

There are three key reasons:

1) Firstly, the yields of REITs are actually quite a bit higher than those of most fixed income investments. Investors are making the mistake of comparing REIT dividend yields to the yields of Treasuries, not understanding that REITs retain a significant portion of their cash flow to reinvest in growth. But what you are actually earning as a shareholder is the cash flow yield. As we noted earlier, REITs are today priced at 12.5x FFO on average, which essentially means that they pay an ~8% cash flow yield. If Treasuries offer a 5% yield, then that's a 300 basis point spread, which will make a huge difference over the long run.

2) Secondly, inflation is still historically high and could accelerate again in the future, but fixed income investments offer no protection against that. Yes, you are getting a 5% yield, but remove 3% for inflation and you are left with just a 2% real-return. Then remove taxes and you are left with just ~1% of your initial 5%. You are not really getting ahead. You are simply preserving your purchasing power.

3) Thirdly, and perhaps most importantly, if and when interest rates are cut, your income will go down and you will face significant reinvestment risk. Most other investments, including REITs, will likely surge in value and it will then be too late to invest in them. You will have missed your chance to buy REITs at large discounts and high yields simply because you wanted the safety of Treasuries. That's a big price to pay in terms of opportunity cost if you have a long term horizon.

To get back to VICI, between the yield and the growth, you can expect to earn roughly ~10% average annual total returns over the long run even if interest rates remain at current levels. That's a lot better than what you would get from Treasuries. Even assuming that interest rates aren't cut, a $100,000 investment in VICI would then result in over 4x larger sum of money over 30 years because of the faster compounding.

So yes, fixed income can make sense if you are in the later years of your life, have a relatively short time horizon, and want to maximize safe income.

But for most of us, REITs are a far better opportunity even if interest rates remain at high levels in my opinion.

REITs vs. Private Real Estate

This is really where the value of REITs is the most evident.

REITs are real estate investments, but the difference is that REITs are public listed, liquid, diversified, professionally-managed, and investors also enjoy other advantages such as economies of scale, better access to capital, and limited liability.

Therefore, it makes sense that REITs would trade at a small premium relative to the value of their real estate during most times.

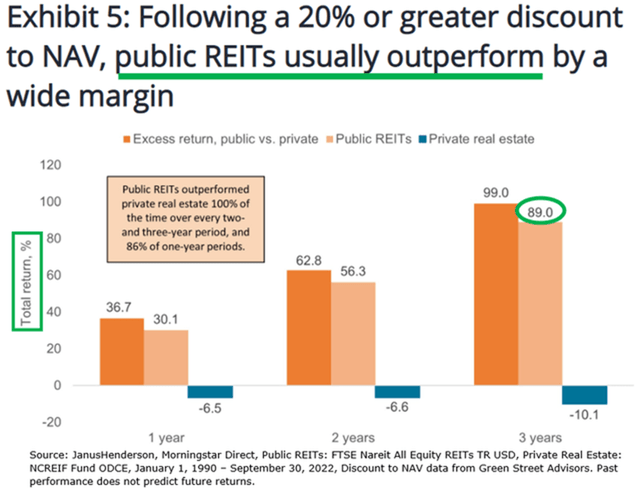

But today, it is the opposite as you can buy REITs at large discounts. It is not unusual for REITs, especially the smaller ones, to trade at 30-50% discounts relative to the fair market value of their assets, and this explains why increasingly many private real estate investors have now started to accumulate REITs instead.

Blackstone (BX), which is the biggest real estate investment firm in the world, has now bought $17 billion worth of REITs this year alone, and nearly $50 billion since the beginning of 2022.

They are accumulating REITs because they essentially allow them to buy real estate at a large discount to its fair value.

To give you an example: Camden Property Trust (CPT) owns apartment communities that would likely sell in the private market at a 5-5.5% cap rate. However, it currently trades at a ~6.5% implied cap rate, which represents a near 30% discount to its fair value, and we are here talking about an A-rated blue-chip with an excellent reputation so you can imagine that many of the smaller REITs would trade at even lower valuations.

The Best Time to Invest is After a Crash

At the end of the day, it comes down to this simple idea: the best time to invest in real estate is after a crash when valuations are low.

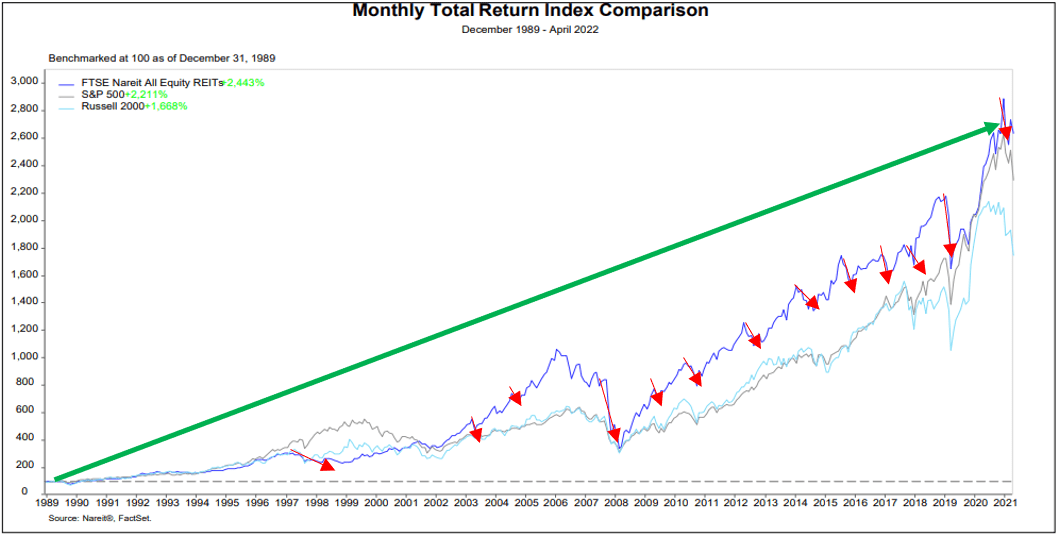

There are always reasons for why real estate would be discounted, but if you look back at the history, it has always been a good idea to buy good real estate through REITs whenever they have been offered at a discount.

They have suffered countless crashes but have always eventually recovered...

And the returns have typically been exceptionally strong for those investors who had the courage to buy REITs when they were priced at large discounts:

This is exactly what Blackstone discussed on their most recent conference call: [emphasis added]

"So, if you went back to the financial crisis, in the summer of 2009, asset values bottomed. And for the next three years, you had lots and lots of negative headlines of troubled assets that came through the system. But if you are an investor, you wanted to start deploying capital then, which we started doing in earnest. And I think there are a lot of similarities to what we're seeing right now...

...So, is there still plenty of bad news and headlines that will come through the system? Yes. But in the spot market, has the impact of what's happened in the office sector, has the impact of higher rates, is that now reflected in real estate values? Yes. And so, what you see us doing is making some very large announcements. We bought a bunch of senior loans. We did the Signature Bank transaction. We announced yesterday buying $1 billion of loans from a German bank. We've announced two public to privates in the rental housing space. $17 billion of enterprise value since the year started.

Now, I'm not saying this is some sort of sharp V-shaped recovery. But as you get to this bottoming period, what you want to do is try to deploy capital into this. And most people are going to be very cautious because they're going to keep reading a lot of negative headlines from the past, and those are going to continue."

They are essentially repeating what Warren Buffett has been saying for decades and applying it to real estate and REITs:

'Be fearful when others are greedy and greedy when others are fearful'

We all know this... and yet, few investors end up following this advice because it is so hard to take action when there is so much negativity about a particular sector. But Blackstone is not just blindly buying REITs. They explain that:

"We have a clear view of what gives us confidence... One, new supply has now started to come down pretty dramatically. So, new construction of warehouses down 75%, new construction of rental housing is down 40%. Two, the cost of capital started to come down. We were in a period where we thought the Fed was raising rates, now it's a debate when they cut. And we've begun to see spreads tighten a bunch, too. So, spreads for commercial real estate borrowings probably tighten 100 basis points. CMBS activity is up five-fold in the first quarter. And so, you're seeing those early signs of recovery."

So to recap:

Valuations are low due to fears of rising interest rates.

But interest rates have now began to decrease.

Meanwhile, new construction activity is down significantly.

As a result, rent growth is set to accelerate.

And the combination of low valuations + interest rate cuts + accelerating rent growth = powerful catalyst for the REIT sector.

We of course cannot predict when exactly this recovery will take place, but we are allocating most of our capital into high-quality REITs that can withstand a higher for longer environment and still deliver strong returns over the long run.

Yes, it is true that we also hold some speculative positions like Uniti Group (UNIT) and Medical Properties Trust (MPW), but these are generally small investments and if you look at where most of our capital is going, these are solid REITs like Essential Properties Realty Trust (EPRT), BSR REIT (HOM.U:CA) and First Industrial (FR).

So no, I am not particularly worried about us potentially facing a "higher for longer" environment. It would lead to faster long-term rent growth and likely give me a larger window of opportunity to accumulate more REITs at these discounted valuations. That's precisely what I expect to do and as I make new investment decisions, you will be the first to know here at High Yield Landlord.

==============================

Important Announcement:

I want to thank all of you who donated to our recent fundraiser to help Ukraine. Thanks to your generosity, we blew past our initial fundraising target to buy 2 trucks and bought 6 instead! I am leaving to Ukraine next week to deliver the trucks along with three members of High Yield Landlord who made big donations. You can learn more here:

The cost of freedom and democracy is undeniable. If Russia succeeds in Ukraine today, other European states and Taiwan will likely face similar challenges, and this will also have a huge impact on the USA. We cannot afford to remain passive in the face of authoritarian regimes seeking to undermine our fundamental values.

Click here to here to visit our website

==============================

2- Notable Changes to Our Portfolio Holdings:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.