PORTFOLIO REVIEW - January, 2025

PORTFOLIO REVIEW - January, 2025

Table of Content

Opening Notes

Notable Changes to Our Portfolio Holdings

Notable Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

1- Opening Notes

Happy New Year!

It’s hard to believe this marks the sixth New Year since launching this service. What began in 2018 has now brought us to 2025—time truly flies!

Looking back, it’s safe to say these years have been anything but uneventful for REITs.

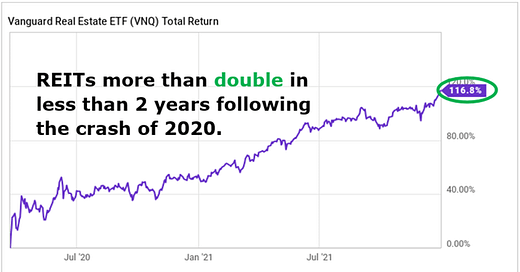

In 2020, the pandemic triggered a major market crash, sending shockwaves through the sector. However, REITs staged a remarkable recovery, more than doubling in value during the rebound. Thanks to the strategic investments we made during that bear market, we were able to reap substantial rewards.

Then, just as REITs were finally climbing back to new all-time highs, they entered another bear market in 2022. This time, the downturn was driven by a historic surge in interest rates coupled with oversupply pressures in several property sectors.

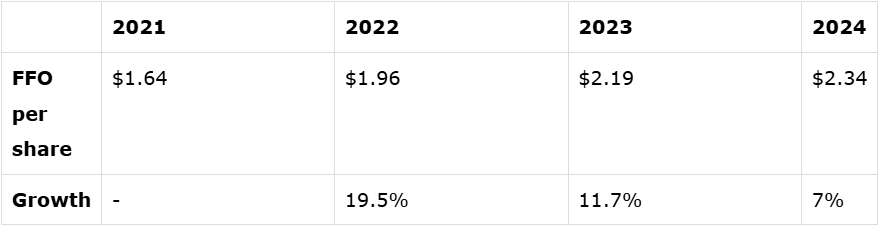

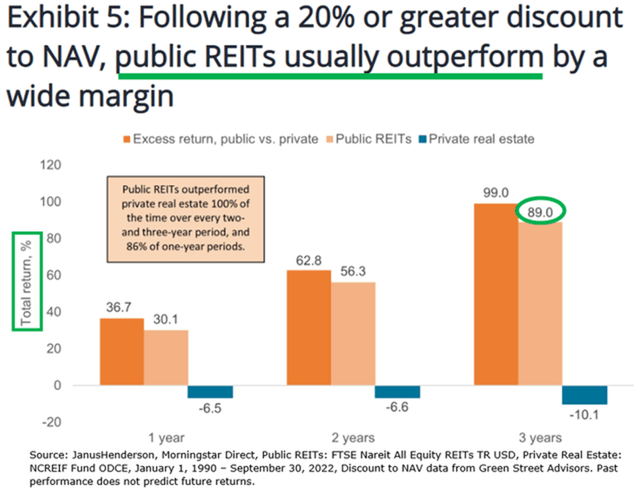

As a result, many high-quality REITs are now trading at valuations even lower than during the depths of the pandemic crash, presenting investors with yet another compelling opportunity to capitalize on a potential future recovery.

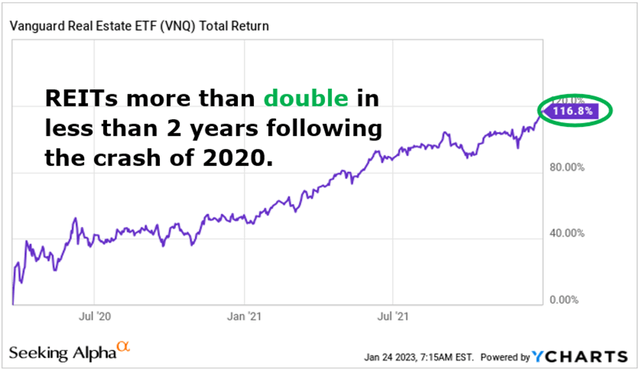

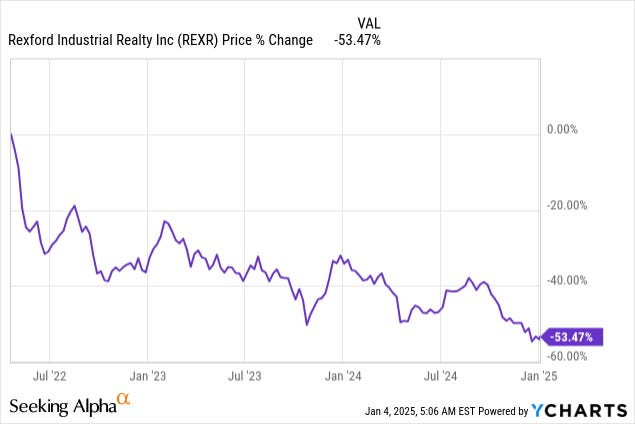

Consider the example of Rexford Industrial Realty (REXR): its current share price ($39) is slightly above the pandemic low of $35, but its FFO per share has grown by approximately 40%. This means REXR is now trading at a valuation ~25% lower than it was at its lowest point in 2020. In fact, I have never seen REXR valued this attractively in my entire REIT investing career. Remarkably, this trend extends to several other high-quality REITs, making the current market an exceptional opportunity for long-term investors.

This time, the recovery has been slower to materialize. In fact, as you can see in the chart above, Rexford Industrial Realty (REXR) has experienced a steady decline for three consecutive years. This persistent downturn has occurred despite REXR consistently growing both its cash flow and dividend each year throughout this bear market:

This has truly been a test of patience for many REIT investors...

But that’s exactly why the opportunity today is so compelling.

Historically, REITs have always recovered from every bear market—without exception—and their highest returns have typically been achieved after periods of significant undervaluation. This moment could very well be another one of those rare opportunities.

We can't predict when exactly this recovery will take place, but the investment firm, Jefferies, believes that 2025 could be the year when REITs finally recover amid widest discounts since the Great Financial Crisis.

The reason why they think that 2025 could be the year is because REITs enjoy two powerful near-term catalysts.

Firstly, we are likely to get at least two more rate cuts, bringing interest rates down to 3.75%. Long-term rates have remained stubbornly high so far, but eventually as we move past the uncertainty caused by the new administration, we expect long term rates come back down, especially as short-term rates are cut down further, and this alone could push REITs a lot higher.

Secondly, the rate cuts are happening right as rent growth is also expected to accelerate in the back half of 2025. Many property sectors including industrial, residential, and life science are currently oversupplied and this has led to declining rent growth in 2024. The good news is that the surge in interest rates has brought most new development projects to a halt. As a result, new supply is expected to decrease significantly in 2025, which should lead to an acceleration in rent growth in the near term.

Jefferies thinks that:

Declining interest rates + Rising rent growth = Higher valuations

It could completely flip the narrative on REITs already this year and lead to significant upside.

Right now, few investors other than sophisticated private equity players are accumulating REITs. The likes of Blackstone, Brookfield, and Starwood know that REITs are cheap and they are investing in them as a way to buy real estate at a discount.

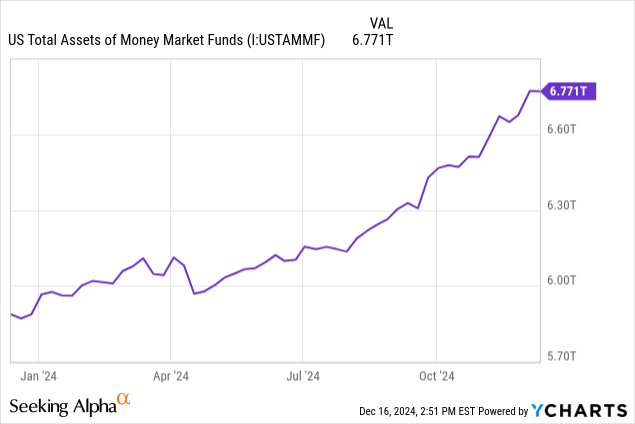

But soon already, a lot more investors could again become interested in owning REITs. Right now, there is a record ~$7 trillion of dry powder sitting in money-market funds, but as rates cut down further and rent growth accelerates, REITs will become much more attractive to the masses, and all it takes for REITs to surge is a tiny portion of this capital to make its way back to the REIT market.

With that in mind, our plan for 2025 is to remain patient and to keep accumulating more shares of discounted REITs, month-after-month.

We have seen this play out before and know that patience is richly rewarded in the REIT sector. The pandemic caused REITs to decline by an average of 40%, but they more than doubled the following year. This highlights just how inefficient the REIT market can be in the short term, creating incredible opportunities for patient value investors to build substantial wealth.

2025 could be the year and we want to be well-positioned to maximize gains in this long-awaited recovery.

In January, we will carry on with our recent portfolio recycling, selling winners to double-down on the most discounted REITs.

We already did some of that in December and we will do more of it in January so stay tuned for our Trade Alerts.

==============================

2- Notable Changes to Our Portfolio Holdings:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.