PORTFOLIO REVIEW - December, 2024

PORTFOLIO REVIEW - December, 2024

Table of Content

Opening Notes

Notable Changes to Our Portfolio Holdings

Notable Changes to HYL Ratings

The Core Portfolio (Our Main Portfolio)

The Retirement Portfolio (Our Secondary Portfolio)

The International Portfolio (Our Optional Portfolio)

1- Opening Notes

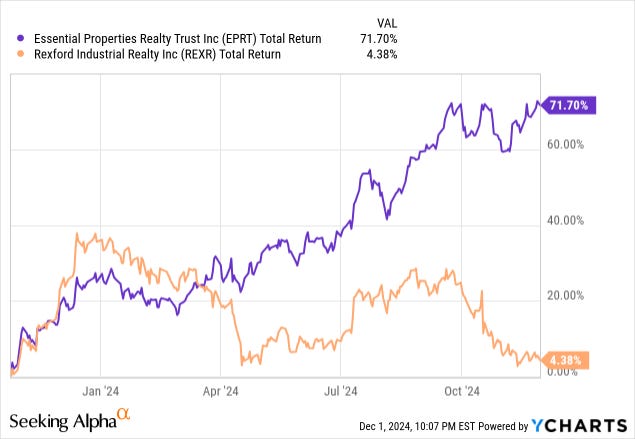

REITs have enjoyed an impressive rally over the past year, surging by 44% on average.

But the interesting thing is that this rally has been very uneven.

Some REITs like our biggest holding, Essential Properties Realty Trust (EPRT), surged by 72% while as some of our other positions like Rexford Industrial Realty (REXR) practically missed out on the rally:

And Rexford is far being an exception.

Many other REITs have seen only modest gains or have entirely missed out on the recent rally. Examples include:

Vesta REIT (VTMX)

W.P. Carey (WPC)

Canadian Net REIT (NET.UN:CA)

StorageVault (SVI:CA)

Big Yellow (BYG)

International Workplace Group (IWG)

RCI Hospitality (RICK)

Tallinna Sadam (TSM1T)

Crown Castle (CCI)

Alexandria REIT (ARE)

Etc.

You will note that these REITs are typically smaller and lesser-known companies that are facing some headwinds from oversupply and/or some other temporary issue.

We think that these companies present exceptional investment opportunities because we now have the benefit of hindsight, knowing how strongly they will likely recover in the coming years once they fix whatever temporary issue that they are dealing with.

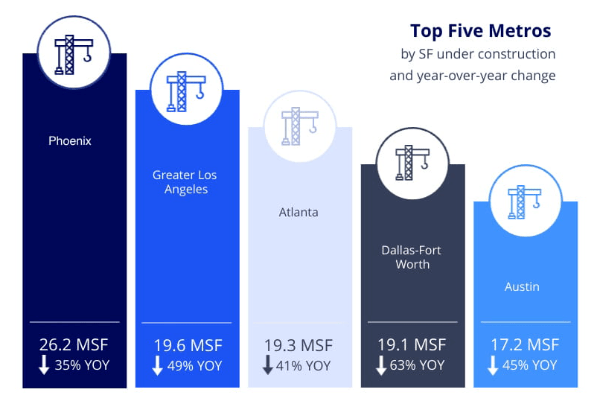

Rexford, as an example, is dealing with oversupply right now with record deliveries in 2024, but new supply should fall off a cliff in 2025 and even more so in 2026, likely leading to a strong acceleration in its rent growth.

As the oversupply gets absorbed, I predict that Rexford will strongly recover as it catches up to the rest of the REIT sector. There is no world in which it makes sense that Essential Properties Realty Trust is up 72% but Rexford is flat given that they enjoy similar long-term growth prospects.

Rexford simply missed out on the recent rate-cut driven rally because the negative headlines of oversupply overshadowed the rate cuts. However, real estate is cyclical and as these oversupply headlines shift to undersupply in just 1-2 years from now, I expect a strong catch-up rally from Rexford and other REITs in similar positions.

This explains why we haven't stopped accumulating more shares in recent months.

Yes, most REITs are up a lot, but not all of them.

There is a segment of the market that missed out on the recent rally and have now become even better investment opportunities. With interest rates already cut, these assets have become even more undervalued, especially when compared to the rest of the market.

With that in mind, you can expect us to keep accumulating more shares of these REITs in the last weeks of the year.

We are getting more selective following the recent rally, but there are still lots of opportunities if you know where to look.

Companies like Rexford are only discounted because the market is excessively focused on short-term prospects and forgetting about the bigger picture.

But REIT investors who can think like landlords rather than traders are still presented a historic opportunity to buy high-quality real estate at a discount.

The window of opportunity is still open, but likely not for much longer. If you missed out on the recent rally, these REITs could be your second chance.

Stay tuned for many more Trade Alerts, with the first one expected to be posted later this week.

==============================

Important Announcement:

I am headed back to Ukraine in December and I need your help. I am fundraising to buy trucks for military units in desperate need.

I am putting a lot of money and time into this and I hope that you will support me. In my mind, this is the best kind of charity because all of the volunteers work for free, we take all the risks ourselves, and we even top up donations with our own money. Thank you so much for your consideration!

You can learn more and donate by clicking here.

==============================

2- Notable Changes to Our Portfolio Holdings:

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.