Patria Investments: 20% Annual Return Prospects & 50% Upside Potential

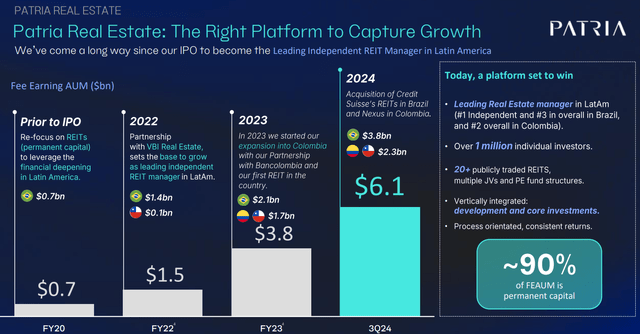

Patria Investments (PAX) is the "Blackstone of Latin America." It is the leading alternative asset manager in the region and is enjoying rapid growth in its assets under management. Most notably, it is rapidly expanding its REIT asset management business. Already managing ~20 REIT vehicles in Brazil, it is now bringing the concept to other Latin American countries. We have previously highlighted it as one of our Top 5 Picks for 2025 and built it into one of our largest investments.

If you are not familiar with the company, we recommend that you read our full investment thesis before reading today's update.

In today's update, I want to share some highlights from the company's recent earnings call.

Here are my main takeaways:

The market initially reacted positively to the results, sending the shares about 10% higher in just a few days. The main reason for this seems to be the strong realization of performance fees in the past quarter. They generated $41 million of performance-related earnings and reaffirmed their guidance to generate another ~$100 million by 2027 and even that won't exhaust all of their accrued but unrealized performance fees. This is very significant given that the company's market cap is today just $1.7 billion and this comes as a bonus on top of their regular fee-related income.

While this is good news, the biggest takeaway for me from the call was the strong optimism coming from the management. They reiterated time and time again that they feel confident in their 3-year guidance to grow their fee-related earnings by 15% annually, all while paying at least $0.6 of annual dividend, resulting in a ~5.4% yield at today's share price. This is key to our thesis as this would result in ~20% average annual total returns even ignoring any upside from multiple expansion or further realization of performance fees.

Even better, they think that they can achieve this all while deleveraging their balance sheet, buying back shares, increasing their dividend, and increasing the overall quality of their business. All of that should warrant a higher valuation multiple. As a reminder, today, PAX trades at just 8.8x its fee-related earnings, which is less than half of what its larger global peers are trading at. This huge discount makes no sense to us given that PAX already has less leverage, enjoys better growth prospects, and earns most of its revenue in hard currencies despite focusing on Latin American markets.

We think that as PAX's business continues to grow in size and improve its quality, it will eventually be rewarded with a materially higher valuation multiple. Its business will only get better diversified, and it will have an even stronger balance sheet and a higher exposure to permanent capital. This will eventually attract the attention of investors, especially if it remains this cheap.

We also think that the company's share buybacks will increase greatly in the near term. By the end of this year, we expect the company's leverage to drop below its target of 1x, which should free up additional cash flow for buybacks and a potential dividend increase in 2026. This will also set the company's new dividend growth policy, helping its market sentiment.

As a reminder, management is the biggest shareholder of the company, owning about 60% of the equity. Years ago, Blackstone offered them a buyout, but they turned it down because they knew they could significantly grow the platform's value in the years ahead. They are well-aligned with shareholders and play the long game.

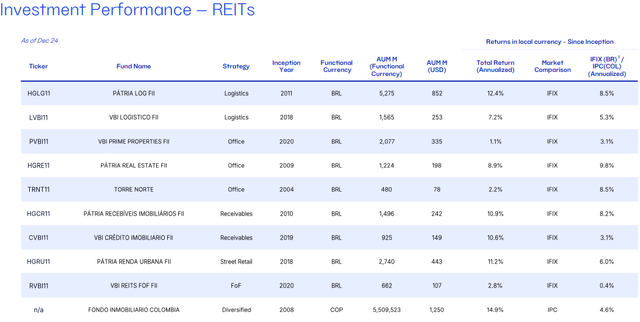

The final thing that I was pleased to see in their earnings presentation was the performance of their various REIT vehicles. They have all far outperformed their sector benchmarks, which puts them in a strong position to keep raising capital in the coming years. This is key to increasing the quality of the business because all of this capital is permanent and deserving of a higher valuation multiple:

Closing Note

I think that Patria is finally starting to get the attention of more investors. I recently came across the following post on X from a REIT investor that I follow:

"$PAX is the leading latam alt asset manager with long track record of good performance, aligned and capable management (own majority of the company) and an increasingly permanent capital base (through smart m/a of reit structures in the region). large and valueable clients like sovereign wealth funds in the ME they've delivered on everyhting they promises at the IPO. stock just didn't work because multiple derated. today it trades at 5.7x next years's FRE, which is ridicolously low. (calculated as EV minus accrued performance fee divided by low end of guidance for 26) but even if they never re-rate, they credibly project a 15% CAGR in FRE for the next couple of years which together with a currently 5% dividend yield (will probably increase later this year) and share buybacks provides >20% IRR potential for the stock without any re-rating. why does the opty exist: most likely because they are prcieved as brazilian company and brazil is just out of favour (look at the country index which has a 6% dividend yield) and also people worry about FX risk. However majority of their mgt. fees are in USD (I think 2/3) so FX exposure is low. moreover their platform is becoming more global so brazil gets lower and lower as a % of their assets. maybe people also worry about competition from global players in alts space, but historically they rather provided exits opportunities for investments of $PAX. so they are rather complementary (blackstone was invested in patria for many years and is still cooperating with them)"

It nicely recaps our investment thesis. I would just add that the upside potential could be more than 50% if and when they reprice at a more appropriate multiple, and this would still price them at a steep discount to their global peers.

That's on top of the ~20% annual return potential from the growth and dividend.

We like the risk-to-reward and expect to maintain a large position as part of our International Portfolio. It is our favorite company to gain diversified exposure to Latin America.

Finally, please note that we exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.