Office Comeback: A Win For Alexandria And Healthcare Realty

The pandemic reshaped the way we live and work. Few sectors have felt its impact as deeply as office real estate. As the world transitioned to remote work, office buildings emptied, and vacancy rates soared. According to industry data, office vacancy has surpassed 20% and reached an all-time high. This has largely been driven by the rise of hybrid and fully remote work models, where employees now spend 1-2 days or more each week working from home.

But is the tide finally starting to turn?

Increasingly, many prominent companies are announcing plans to bring their employees back to the office full-time. Notably, successful and highly respected businesses like Amazon, Tesla, Disney, JP Morgan Chase, and Goldman Sachs are taking the lead. Elon Musk, CEO of Tesla, famously declared that employees unwilling to return to the office could "pretend to work somewhere else." Similarly, Amazon recently ended its hybrid work policy and now requires corporate employees to work full-time in the office, five days a week. These policies are indicative of a growing sentiment among leaders that being in the office is essential for maximizing productivity.

Adding to this momentum, President Trump recently signed an executive order mandating that federal employees return to the office full-time. This move from the highest levels of government underscores the importance of in-person work and sets an example for other organizations to follow.

Why Returning to the Office Matters

The push to return to the office stems from the belief that in-person work fosters greater collaboration, innovation, and productivity. The benefits of working in the office can be likened to working out in a gym with a personal trainer compared to exercising at home. While home workouts are convenient, they often lack the intensity, structure, and accountability of a gym session with a professional trainer. Similarly, working in the office allows employees to benefit from the immediate feedback, guidance, and collaboration of their managers and colleagues. These factors are critical for maximizing efficiency and ensuring alignment on company goals.

This shift back to office-centric work is undoubtedly good news for office REITs, which own and operate office buildings and have struggled to adapt to the remote work revolution.

High-profile companies like Amazon and Tesla are setting an example for other businesses, and with the federal government now requiring in-person work, the movement could gain even more momentum. If more organizations follow suit, it could reignite demand for office space and help stabilize the sector.

This shift would be particularly beneficial for Class A office buildings, which typically cater to high-profile tenants. These properties offer amenities and prime locations that appeal to companies seeking to entice employees back to the office. As demand for office space recovers, REITs owning high-quality portfolios may see improved leasing activity and higher rental rates.

That said, I would like to set realistic expectations.

The recovery of the office sector is still in its early stages, and there are plenty of hurdles to overcome. 20% of office space is today sitting empty and it will take many years to refill this space. All this vacant space will lead to greater competition among landlords and will likely force them to heavily reinvest in their properties for them to stand out, give out large tenant improvement packages, and reduce their pricing power.

This higher capex and poor rent growth prospects coupled with rising interest rates, uncertain workplace preferences, and economic uncertainty will continue to pose challenges for office REITs and for this reason, we will continue to avoid them. Their valuations are low, but so are those of other REITs.

But there's a silver lining.

I think that this renewed emphasis on in-person work could have ripple effects on other sectors of the real estate market, such as life science and medical office buildings.

Positive Impacts on Life Science and Medical Office REITs

Over the past few years, some office landlords have opted to convert struggling office properties into MOBs or life science facilities. While this has been a creative solution to mitigate losses, it has also increased competition in these sectors, adding downward pressure on rents and occupancy rates.

If demand for traditional office space now increases, or is at least expected to increase, then landlords will be much less inclined to pursue such conversions.

They are expensive and risky. Their returns are very uncertain and only come after significant investments.

Therefore, these conversions are typically a solution of last resort that only make sense if you think that the struggles of the office sector are permanent.

But if you now think that the office sector will bounce back, then investing all this money and time to redevelop a property into another use becomes a much worse choice. By the time your property is ready, the office sector may have bounced back already.

Put differently, the risk-to-reward of simply waiting for a recovery improves while that of converting a property deteriorates.

I expect this to significantly reduce the influx of new supply into the MOB and life science markets, alleviating some of the pressure on these REITs. As a result, these sectors will likely benefit indirectly from the office recovery.

The Opportunity

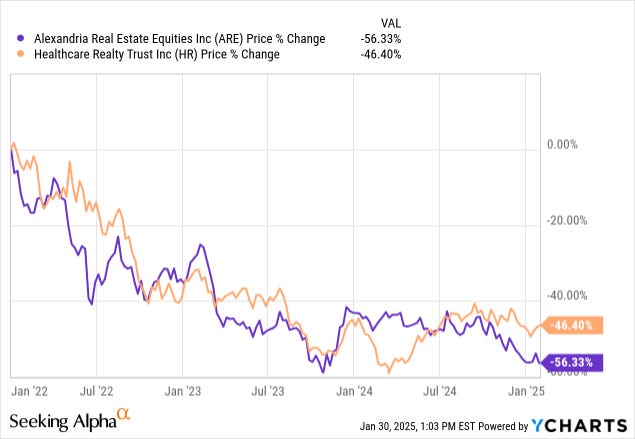

The leading life science REIT, Alexandria Real Estate (ARE), and the leading medical office building REIT, Healthcare Realty (HR), have both crashed in recent years and trade at historically low valuations at the moment:

This is not just because of fears of office conversions, but it certainly has had an impact. It has slightly increased the new supply, hurting their fundamentals, and it has also negatively impacted their market sentiment as both REITs are often associated with the office sector.

But things are now changing for the better.

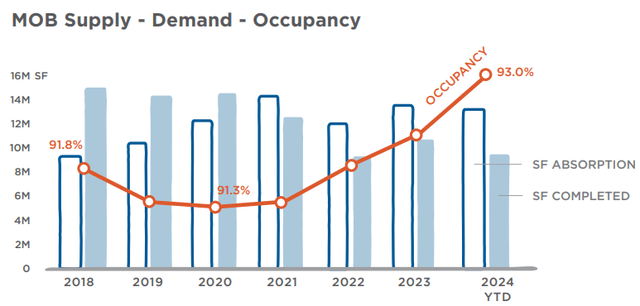

The fundamentals of medical office buildings have already bounced back with demand growth outpacing the new supply, leading to lower vacancy rates and higher rents:

And we expect the same to happen to life science buildings sometime in 2026 as new supply drops off and the vacant space gets absorbed.

Ignoring the temporary oversupply, both of these property sectors enjoy strong secular demand tailwinds that should result in sustainable long-term growth in their rents and property values.

This is particularly true for ARE's and HR's Class A properties.

We think that both REITs will enjoy significant upside in the coming years and expect to keep accumulating larger positions for our Portfolio.

Finally, please note that we exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.