New Opportunity: Independence Realty Is Merging With Steadfast REIT (Incl. Trade Alert)

New Opportunity: Independence Realty Is Merging With Steadfast REIT (Incl. Trade Alert)

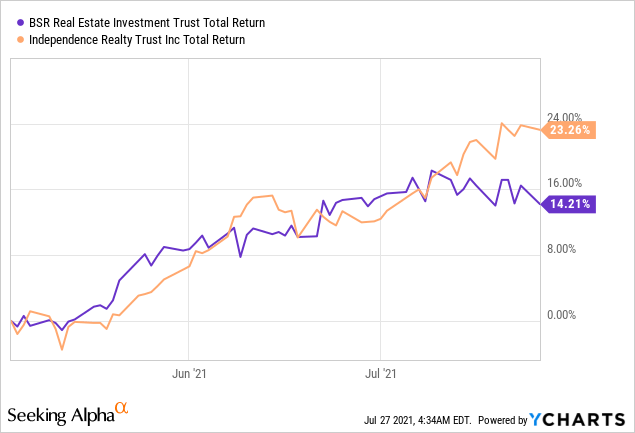

On May 4th, we sold Independence Realty Trust (IRT) for an 82% total return and reinvested the proceeds into BSR REIT (BSRTF), a close peer that was more opportunistic at the time.

Looking back, this was a mistake and we left money on the table. IRT rose by another 23% in the following months and outperformed BSR:

If there were no material news, this disparity would reinforce our thesis.

But IRT just dropped a bombshell that changes everything.

It is set to merge with Steadfast REIT and it is a game-changer for the IRT:

It will more than double its size.

Expand its portfolio to new sun-belt markets.

Reinforce its balance sheet.

Improve its growth prospects.

And help its market sentiment.

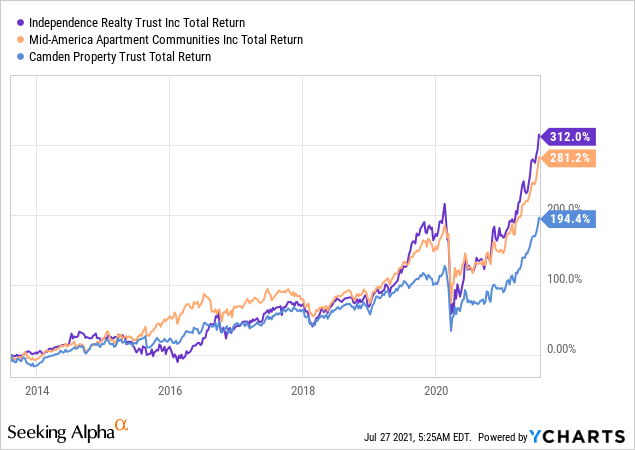

It will position IRT as a large sunbelt-focused apartment REIT that's directly comparable to Mid-America Apartment (MAA).

Is there some upside left for investors?

Yes, there is.

Shortly after this was announced, R. Paul Drake made the following comment on our chat board:

IRT just solved their need for scale and markedly improved their balance sheet, assuming this goes through. Should presage a big drop in interest costs. Good for them!

Depending how the price reacts, IRT might be worth a look here. Valuation (P/FFO) should go up 10% to 20% from scale and leverage and FFO should go up 10% to 20% from reduced interest cost. They will have to boost the dividend to get traction on that but they probably now will be able to.

Because IRT is issuing shares at a premium to NAV, the transaction is expected to immediately increase the FFO per share by 11%. If you add to that all the other synergies such as interest expense savings, the accretion could be up to 15-20%.

So assuming that IRT maintained the same valuation multiple, it would have 15-20% upside potential thanks to this deal.

But since IRT has now become a higher-quality REIT (with larger scale, better portfolio diversification, a stronger balance sheet, improved growth prospects, a lower cost of capital, and a demonstrated track record of value creation), it deserves a higher valuation multiple that's comparable to that of MAA.

Since MAA is currently priced at a 10% higher valuation multiple, it adds another 10% of upside potential. An argument could also be made that IRT deserves an even higher valuation multiple than MAA because it may have faster growth prospects and its track record is even stronger:

Depending on where its FFO multiple lands, the deal could add 10-20% of upside potential, bringing the total to 25-40%.

Finally, IRT dropped by 10% when the news came out because investors fear large equity issuances. This adds another ~10% of upside to fair value.

So in total, this deal could unlock up to ~50% upside potential for shareholders if everything goes well. That's very attractive for a high-quality sunbelt apartment REIT in today's market and for this reason, we are reinitiating a position in the company.

We just bought 300 shares at $17.95 per share. You can see the details of our transaction below:

Given that there is a lot of demand for sunbelt apartment REITs right now, it would not surprise us if IRT quickly repriced at higher levels. If that happens, we may not hold IRT for the long run, but we keep you posted as the thesis evolves.

Good investing from your HYL Research Team,

Jussi Askola