My Single Largest Non-REIT Investment Revealed

What's your idea of a perfect investment?

It depends who you ask, of course. But those looking for market-beating returns will want to own businesses that enjoy:

A strong moat

Rapid growth potential

At a value price

Not everything needs to be perfect, but if an investment enjoys a mixture of these characteristics, it is likely to be a big winner in the long run. Obviously, it is very rare to find such opportunities, because if a business is really that great (without major caveats), it will likely trade at a high valuation.

“If only,” you might say, you could invest in such a company before it earns a high valuation. Well, read on. That is exactly what we are here for.

RCI Hospitality (RICK) offers all these characteristics and it has been my largest non-REIT investment since the beginning of the pandemic.

Why didn't I discuss it earlier with members?

Back then, our sister service, High Yield Investor, didn't exist yet, and given the nature of the business, it wasn't a good fit for High Yield Landlord. You will understand why as you keep reading.

But better late than never. Today, the company remains my largest holding, and think that it is more opportunistic than ever.

Why am I so bullish on RICK?

To understand why I am so bullish on RICK, I need to first give you some background on what I am typically looking for in a REIT investment.

As a REIT analyst, I am always looking for opportunities that offer:

Consistent and predictable cash flow from moated assets.

Steady long-term growth via rent increases and/or new acquisitions.

Additional repricing potential via multiple expansion and/or buybacks.

A great example of that would be something like VICI Properties (VICI). Its trophy casinos are irreplaceable assets that generate steady and predictable cash flow from long-term leases. Moreover, its rents rise each year by the greater of a fixed ~2% bump or the CPI (with some caps), and the company also keeps issuing new equity and debt to buy additional casinos.

Source: VICI Properties

These new acquisitions create significant value for shareholders because its average cost of capital is about 5%, but its acquisitions enjoy high cap rates, reaching up to 8%. This positive spread then results in rapid growth on a per share basis, despite the expanding share count.

The larger the spread, the faster the growth, and VICI happens to have some of the best spreads out of all REITs.

Its spreads are superior because it operates in a sector that's less crowded. It is a sin industry. Casinos require specialized expertise. And they are very big-ticket investments that require $10s of billions to diversify properly.

The lack of buyers for these assets gives VICI a competitive edge as it is able to buy great assets at higher cap rates that result in larger spreads over its cost of capital. That's why it has done so well for investors and also why we like it so much.

Now, you might ask yourself:

How is this relevant to RICK?

RICK is an extreme version of VICI.

It has a similar business model, but its economics are even better. Far better!

It also operates in a sin industry that lacks buyers, and it allows it to acquire moated assets at extremely compelling returns that result in large spreads over its cost of capital.

RICK is the only publicly-listed company that specializes in the acquisition and management of gentleman's clubs, also known as strip clubs.

After the recent acquisition of 12 additional clubs, RICK will own more than 40 clubs, including some of the biggest clubs in the nation like Tootsie's Cabaret in Miami, but also smaller local clubs like Rick's Cabaret in Dallas:

Tootsie's Cabaret, Miami:

Rick's Cabaret, Dallas:

These clubs are essentially local monopolies because it is very difficult or impossible to open new ones. You need licenses to operate a strip club, and you also need additional licenses for the alcohol, and those are tied to the underlying real estate. Since no one wants a new club in their backyard, and zoning laws restrict where and how many clubs can be opened, the existing clubs enjoy quasi-monopolies in their local markets.

You would think that such resilient, monopoly-like businesses would sell for high multiples, but because there are no buyers for them, RICK is able to acquire them at very compelling valuations.

Why aren't their buyers for strip clubs?

There are three main reasons.

Requires highly unique expertise: Firstly, owning and operating strip clubs requires specialized expertise that most people don't have and probably don't want to have. You need to be able to detect things like drug dealing and prostitution to avoid getting in trouble. You also need to be able to identify how club sellers may attempt to inflate numbers for a few years prior to selling. Finally, you need to know how to deal with authorities and occasional legal troubles that are a normal part of this business. Running a strip club is a lot different from managing a restaurant and most investors don't have the skills for it.

Requires Significant Capital: Secondly, because these clubs generate so much cash, they are worth a lot of money to their owners even when sold at relatively low multiples. Buying one club is not a problem, but to achieve proper diversification, you would need significant capital. This is especially true since you commonly need to buy the real estate with the club (licenses are tied to the real estate) and these assets are difficult to finance. It keeps away many of the smaller private equity firms that wouldn't otherwise care for ESG.

Significant Reputational Constraints: Finally, and perhaps most importantly, even if you had the capital and the expertise, you probably can't buy these assets due to the reputational issues of being associated with strip clubs. If you are a private equity firm, you most likely have at least some limited partners that don't want you to buy strip clubs. If you are a wealthy local business owner, your wife or husband probably doesn't want you to buy a strip club. And if you are a publicly-listed company that operates in a related hospitality sector, you probably don't want to add strip clubs to the mix because it could cause your market sentiment to suffer as ESG-funds sell your stock, and don't want to deal with the other headaches that come with managing strip clubs.

That puts RICK in a very strong competitive position because it is the only publicly-listed strip club owner of scale and one of the very few natural buyers for these assets.

They are a few other groups of buyers, but you get the point: there is very little competition for these assets as compared to traditional real estate investments for instance, and because of that, strip clubs command low valuation multiples, despite being strong businesses relative to the price that you pay for them.

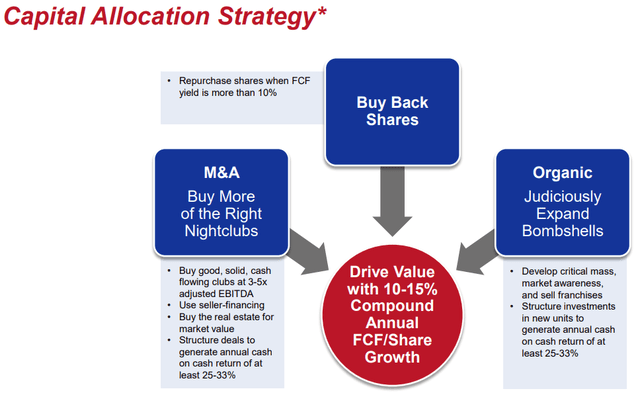

RICK commonly buys strong cash-flowing clubs at 3-5x EBITDA and earns 25-33% cash-on-cash returns when you add some seller financing and a mortgage on the real estate.

Best of all, this is a very fragmented sector and a lot of strip club owners are in their 50s or 60s and will look to retire and sell in the coming years. Even as one of the largest owners of strip clubs in the nation, RICK only has a 2% market share, which means that it can keep consolidating these assets for decades to come.

That's the opportunity!

It has access to capital at a ~6-8% average cost, and it is buying these clubs at 20%+ returns, resulting in enormous spreads.

Remember that VICI had ~300 basis point spreads and we considered that to be exceptionally good. Well, RICK has 1000+ basis point spreads and it is also much smaller in size with a $580 million market cap, which means that its runway of rapid growth is much longer. Moreover, it has even fewer competitors bidding for these assets, and since none of them are public listed, they don't have access to public equity markets to accelerate the roll-up of the industry.

All in all, RICK has guided for 10-15% annual growth in free cash flow per share, but realistically, we think that they can actually do 20%.

When asked in conference calls about why only set a 10-15% annual growth rate target, the CEO, Eric Langan, answers that:

Eric Langan: Double check, that's our minimum, that's our minimum goal. What they say, under promise over deliver, that's we tried to do, but if I tell you 20%, do 19% oh, everybody wants to cut my head off. But I'll stick with my 10% to 15% growth, and I keep pushing 22% and everybody's happy. I just I don't see any snags in the plan, at least not in the foreseeable future.

So he does not want shareholders to complain if he does less in one year, but if you look back, from 2015 to 2019, they more than doubled free cash flow per share, and in all likelihood, we expect this rapid growth to continue as they keep consolidating the industry.

If they can keep growing at 20%+ per year, this could be a $400+ stock in a decade from now, without even any repricing in its multiple.

If the story ended here, I would be interested and probably invest in the company as long as the valuation was reasonable... but I wouldn't build such a large position based on that alone. So what's more to it?

The management is also one of the biggest shareholders and given its unique background and experience, I expect them to manage the business exceptionally well going forward.

Its new Bombshells division could add significant value to the whole platform as it begins to sell franchises, growing the FCF per share even faster.

Its Admireme website is a free call option on an OnlyFans-type business that could be worth a lot of money already in a few years from now.

Finally, the valuation of the company makes little when you take all of that into account.

Below we discuss all these elements in more detail:

Poorly Managed in the Past,

But Very Well Managed Going Forward

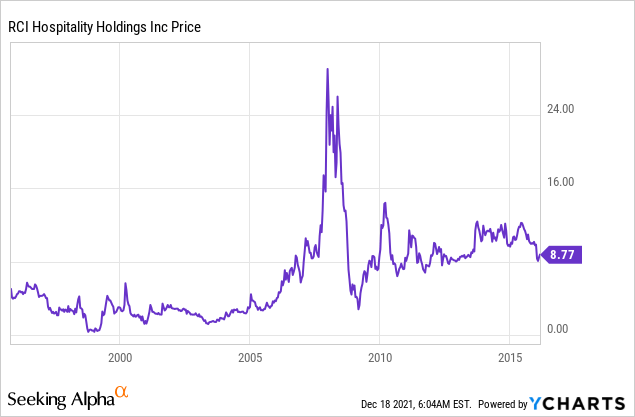

RICK went public a long time ago, but for most of the past 25 years, the company's share price did little for shareholders, growing from $4.4 per share in 1995 to just $8.77 by 2016:

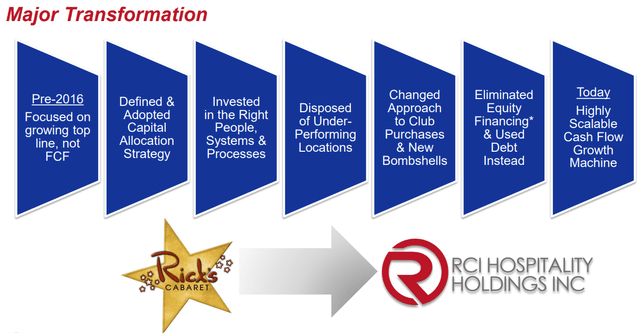

But then suddenly, the share price took off in 2016. That's when the management finally began to focus on growing free cash flow on a per-share basis. Until then, the company was the victim of "growth-at-all-cost" as the management sought to grow top-line revenue even if it meant diluting shareholders in the process.

That's when a major shareholder approached the management and pushed for major changes. Yaron Naymark from 1 Main Capital explains this background in a recent Podcast. To quote him:

Yaron Naymark: The way I describe Eric (CEO of the company) is that he didn't go to Wharton, he went to the school of hard-knocks and learned over decades. He built this business from his early 20s and he has made mistakes along the way, but he admits those mistakes. He will tell you when he messes up. He listens to his shareholders. He does not repeat his mistakes. And he has a very good business head over his shoulders...

...He thought that for a public company you needed to have a revenue and EBTDA growth story. He never understood that free cash flow per share is what investors care about. He had all these advisors come to him and tell him to grow grow grow the business, not grow grow grow the cash flow per share and so the stock was doing nothing for a long period of time.

Then a big shareholder came to him and said that "hey you have these super stable local monopolies that are very cash generative and you trade at a single digit free cash flow multiple. Just stop shooting yourself in the foot, literally do nothing, and if your stock stays here, and you cannot buy great clubs at 4-5x EBITDA, buy back your stock and I promise your share price will go up.

He listened to that shareholder. He put thoughts into it. He read books on the topic. And he put out this very thoughtful capital allocation philosophy and since he has done that, free cash flow per share has grown at 20%+ per share.

Now, in every company conference call, Eric Langan, CEO of the company, spends a moment explaining this capital allocation strategy to new shareholders. In short, if the shares are priced at a 10%+ FCF yield, he buys back stock, and only if they can grow FCF on a per share basis, would they consider making new investments.

I appreciate this background because it taught the management what not to do going forward, and it also shows that the management is shareholder-friendly and willing to admit mistakes and make drastic changes as needed.

Eric Langan is to this day the second-largest shareholder of the company, owning $45 million worth of stock (7.4% of the company), and he didn't sell a single share even as the value of his stake rose substantially following this transition.

With a clear capital allocation policy in place, a clear focus on per share growth, valuable lessons from past mistakes, and a lot of skin in the game, I believe that RICK is now exceptionally well managed.

Bombshells Franchise Opportunity

Nearly a decade ago, RICK created a new military-themed restaurant and sports bar concept called Bombshells to supplement its club acquisition strategy:

For the first 5+ years, the management took a lot of criticism because the new venture wasn't doing particularly well and investors argued that the management should just focus on club acquisitions instead.

I was in that camp too. It was easy to criticize them when the company wasn't getting much credit for its clubs and this venture took so much attention away from them.

The management still argued that this venture made sense because they cannot always find the right clubs to acquire. Some years, they have many acquisition opportunities, but in other years, their pipeline may be dry. This was particularly true in recent years when their equity was steeply discounted and they couldn't access equity capital for larger multi-club acquisitions. Moreover, they also argued that growing this business could provide cost and management synergies to the clubs, and accelerate their growth prospects via franchising in a capital-light manner once they have reached critical mass.

In hindsight, the management deserves all the credit for not giving up when everyone was telling them to throw the towel. After years of learning through trial and error, they finally figured the right recipe to make the numbers work. Today, these sports bars generate even higher returns than the clubs, ranging from 25% to 50%, depending on whether the property is owned or leased. Granted, these bars don't enjoy the same moat as clubs (licenses) but with these exceptional returns, the initial investment is paid back in just a few years, and if the numbers prove to be sustainable, then it adds substantial value to the company.

What makes these locations so rewarding?

All locations are in rapidly growing Texan markets: Dallas, Houston, Austin.

In these strong markets, they select excellent sites. One of the early mistakes that they made is that they chose cheaper sites in secondary markets when in reality, the concept works best in superior locations.

The military-theme decor and menu work particularly well in Texas.

Veterans always get discounts and eat for free on veterans day. Since everyone knows a veteran or two, this is smart marketing that leads to word-of-mouth.

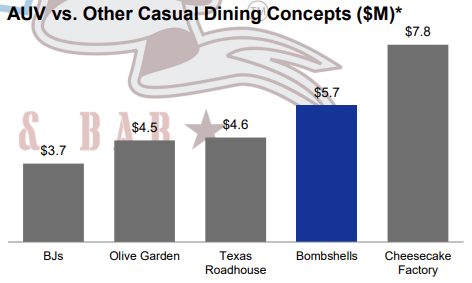

They have a much higher liquor mix than your regular restaurant, resulting in much greater average margins.

Each location has a scratch kitchen, serving much better food than what you would get from a regular sports bar.

Each location also has a large patio, which is unique for a sports bar.

The window of sales is much longer than your regular sports bar with a strong lunch, happy hour, dinner, after dinner sports entertainment, and even a nightclub-like atmosphere with DJs after sports events.

Essentially, it is a restaurant, bar and, nightclub all in one with a nice and unique atmosphere, great food and drinks, in a superior location, resulting in exceptional average unit volumes, rivaling even the likes of BJs, Olive Garden, Texas Roadhouse and Cheesecake Factory:

RICK has now opened 10 locations and it expects to open the next 10 in the coming 2-3 years. It just opened a new location in Arlington, Texas and it is already under contract for three additional locations.

At the same time, RICK has now begun to franchise the concept. Its first franchisee-owned location will open in early 2022, and the same franchisee is already looking for its second location.

RICK is already in talks with many more franchise partners and we expect new partnerships to be announced in the coming quarters. They think that they can open 100+ locations and if the economics prove to be sustainable, this would be massive for the company.

So there is significant upside in this venture if they can quickly grow it via franchising (I think they can), but even if they fail, and the concept stagnates, there is limited downside since most of the company's profits come from clubs, and the Bombshells locations are quickly paid off and RICK owns the underlying real estate, which is rapidly appreciating in these specific markets.

Admireme App

You might have heard about OnlyFans, which allows creators to monetize their content via subscriptions, one-time tips, and pay-per-view features. The website has 2 million-plus content creators and nearly 150 million users.

The service is particularly popular among sex workers. That's what got it off the ground. But today, the company trying to remove that stigma and replace the sex workers with fitness experts, musicians, athletes, YouTubers, and other creators.

Earlier this year, they even tried to ban sex-related content after they couldn't secure investments. Most VC funds are prohibited from investing in adult content, per limited partnership agreements, and this is a big issue for OnlyFans, which needs capital to expand.

Today, OnlyFans is highly successful and attempting to transition out of the sex-related content to replicate Snapchat's success, which is now valued at $70+ billion, despite having begun as a way for a lot of people to share nudes.

RICK saw an opportunity in this. As OnlyFans moves away from adult content, RICK's new mobile-friendly website, Admireme, is here to take over some of that business.

After all, many content creators have realized that they are the stars, and they don't need to be on the OnlyFans platform to attract customers. All they need is a good site that provides the digital infrastructure to monetize their content, and paying 20% of all revenue to OnlyFans is a lot of money left on the table.

RICK's Admireme is going after this business, and unlike other competitors of OnlyFans, Admireme has one major advantage.

RICK owns 40+ strip clubs and can incentivize its own dancers to go on the Admireme platforms and directly promote it to their customers. There could be significant synergies as dancers get their clients on subscriptions to build stronger relationships, earn additional revenue, and brings them back to the clubs more regularly. RICK can also partner with other major club owners to replicate this growth strategy elsewhere.

At this point, Admireme is not even launched yet, so its success is highly uncertain, but I like to think that we have a free call option on a business that could be very valuable someday in the near future and also boost the organic growth prospects of its clubs.

Just for context, OnlyFans was created in 2016, and today, it is already valued at over $1 billion. The value creation could be substantial if RICK has success and the market suddenly starts seeing RICK as a disruptor to OnlyFans.

Value Multiple on a Growth Company

All in all, we have a fantastic growth story. RICK is the only publicly listed company that focuses on strip clubs, which are essentially local monopolies, and it is getting them at very low multiples and extremely large spreads over its cost of capital.

This fragmented sector is ripe for consolidation as many existing owners plan to retire in the coming 10 years, and RICK is still small in size, giving it a multi-decade runway of rapid growth potential.

Meanwhile, it is also growing a successful sports bar concept with significant upside potential if they can franchise it successfully, and its Admireme platform could someday be worth more than the clubs themselves.

The company also has fantastic management that learns from its mistakes, has significant skin in the game, and a clear capital allocation policy that's specifically designed to maximize shareholder value.

Finally, the company also owns most of its real estate, some of which is very valuable, providing additional margin of safety, and inflation protection.

The company has been growing at 20%+ per year ever since it changed its capital allocation strategy, and we expect this rapid growth to continue for many years to come.

How much would you be willing to pay for such a business?

I would say a lot. A company with moated assets and a predictable path to rapid growth prospects, in a low interest rate world, is worth a lot of money.

Yet, RICK is currently priced at just ~8x estimated free cash flow, or put differently, a 12.5% free cash flow yield. We suspect that it is so cheap due to a number of reasons.

Sin stock discount: The first reason is obvious. RICK is a sin-stock. A lot of investors don't want to own it because of the nature of its business. That is a fair point. I would argue however that RICK is quite good from an ESG standpoint. That's because I would much rather have a large, professional, and highly scrutinized company manage strip clubs than small mom-and-pop shops. RICK is likely to do a much better job at sniffing issues like drug dealing, prostitution, human trafficking, racketeering, etc. If they don't control these things, they will get in trouble much faster because of their size, large following, and scrutiny. Overall, RICK-managed clubs are likely to be safer for everyone involved, which is a very good thing. They bring professional management to an otherwise complicated sector, and Forbes has named RICK one of America's 200 Best Small Companies since 2008. Over time, as RICK continues to post rapid growth, and the management keeps educating the market about the good they are doing to the sector, I expect more investors to feel comfortable about holding the investment. With that, the sin discount could decrease over time. The casino sector went through the same cycle and they are today largely accepted by the investment community. Finally, I also think that RICK is a perfect stock for the Reddit / Wallstreetbets crowd. I am not counting on it, but there are increasingly many channels covering RICK as another meme stock due to the nature of its business. If they could add $10+ billion to AMC's market cap, just think what they could do a much small company like RICK. This could remove the sin discount or even turn it into a sin premium over time.

Pandemic discount: It is understandable that the market fears RICK due to the pandemic. Many strip clubs still suffer from restrictions that temporarily hurt RICK's profitability, but it does not affect its long-term prospects. Also, what the market appears to have missed is that the typical client of a strip club does not really care for the pandemic, and since most of RICK's locations are in states like Texas and Florida, it suffers less from restrictions. As we move past the pandemic, we expect RICK's multiple to expand as the pandemic discount disappears.

Bombshell discount: As noted earlier, RICK was for a long time criticized by investors who disapproved of the management's decision to invest in new Bombshells locations. Many feared that the management was essentially burning the profits from the clubs and destroying shareholder value. But with Bombshell's recent successes, the management is now proving everyone wrong, and the Bombshell discount could soon turn into a large premium. The division earns very compelling returns, it is growing faster than ever, and the franchising opportunity is just beginning. As the company announces new franchise locations, I expect the sentiment of the stock to improve because franchising businesses deserve higher multiples.

Recent legal challenges and short attacks continue to hurt the company: Finally, the company was still recently in a much more uncertain situation. Back in 2018, RICK was hit with a major short attack that hurt the company's sentiment. Much of that short attack was proven wrong (share price has more than 3x since then), but it lead to significant uncertainty for the next few years as it prompted the SEC to launch an investigation, led to late filings, and the replacement of its auditor. I won't go into the details, but some of the main allegations included things like improper use of company aircraft, and for a long time, shareholders feared the worst and wondered if financial statements would need to be restated. In the end, the whole thing led to much more fear than warranted. The expenses were properly reflected in the financial statements, nothing needed to be restated, the management settled with the SEC and paid their fines. The expenses in question were not significant and the whole thing was blown out of proportion. Yet, it continues to hurt the company's sentiment to this day because the settlement was just one year ago, and many look at this story, and quickly conclude that the company is poorly managed. In reality, this whole thing mainly originated from a somewhat predatory and self-interested short attack. We think that as the management continues to execute what worked so well in the past years, they will regain the trust of increasingly many investors in the coming years. Also, if you want more background on this whole story, you can listen to the podcast linked below. Go to the section 11:10 to 18:30:

I bought my first shares in the $10-20 range when the pandemic was causing enormous uncertainty and we didn't know what would come out of the SEC investigation.

Back then, RICK was an extremely speculative investment and that's why I think that RICK is actually a better investment today at $63 per share. These are not just empty words as I have been buying more shares all the way up as good news came out. I have paid as little as ~$15 per share and as much as $75 for the company as I accumulated a larger position.

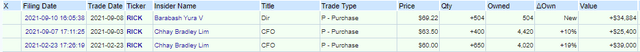

Today, most of this uncertainty is gone, RICK is doing better than ever, but it is still priced at just 8x estimated normalized FCF, which is way too cheap for a company of this quality. So don't get afraid by the chart that may scream "overvalued". The share price was depressed due to extraordinary issues that are now resolved and the management has kept adding to their positions even in the $60-70 range:

RICK just had its fourth-quarter conference call and as usual, the management had an open conversation with its largest shareholder, Adam Wyden from ADW Capital, about the company's discounted valuation:

Adam Wyden: I don't want to sound like a broken record, although I often do. With a market cap of $564 million and -- or maybe it's a little bit more with -- another $564 million and $100 million of EBITDA, I mean, you're trading cheaper than pretty much any restaurant or hospitality company out in the marketplace. I mean what are you guys doing to kind of narrow the gap on the cost of capital in terms of getting the market to see the value? I mean maybe buying back shares at these prices makes more sense than M&A. I mean obviously, at 3x EBITDA, maybe not. But I mean at 5.5x, whatever you want to call it, that's a pretty high bar.

Eric Langan: Yes, I agree. And that's why I said I think we're well within our buying range right now... However, we are seeing some great opportunities to expand Bombshells as well as additional club purchases with opportunities to earn cash-on-cash returns of 25% to 50%. We have been letting our cash build. Once cash gets to a point beyond what we feel we can deploy quickly at these great returns, our plan is to use excess cash to buy stock in the open market if the stock price continues to stay in the current range of $60 to $65 per share. And we would be more aggressive the better the yield becomes, under $60 per share.

Adam is the biggest shareholder of the company (representing 20%+ of his hedge fund), has been very vocal about the opportunity, and enormously successful with it. Yet, he thinks that this is just the beginning for the company:

Adam Wyden: Well, obviously we own 10% of the company plus or minus, we're obviously on board... I am still on the belief that this can be $8 billion, $9 billion, $10 billion in market cap. So look Rome was not built in a day, but obviously, you guys are taking the right steps to build the corporation.

The management is telling us that they may just buy back stock because it is priced at a 10%+ FCF yield, which is their hurdle to buy shares.

Given the company's growth profile and the quality of its assets, I think that it should trade at much closer to 20x FCF, or more than double its current share price. Best of all, we have major catalysts that should lead to multiple expansion already in the near term:

Major Catalysts

New club acquisitions: As RICK's share price recovered to more reasonable levels, it regained access to the equity markets and in July, they announced one of their biggest deals ever. They are acquiring an 11 club portfolio across six states for $88 million, a massive deal for a company with a $580 million market cap. They paid 5x EBITDA, including the real estate, and the transaction is immediately accretive as it was paid for with $26 million in cash, $21.2 million seller financing at a 6% rate, $10.8 million with a real estate loan at 5.25%, and the remaining $30 million with common stock. The day this deal was announced, the stock rose 14%, which shows that these acquisitions are strong catalysts. Following this deal, the management noted that they have been getting a lot more inquiries from potential sellers, and so we expect more large acquisitions in the coming years.

Opening of first franchise and announcement of additional franchise agreements: The first franchise in San Antonio will open in early 2021 and start producing franchise fees for RICK. The management took a lot of time to open this first franchise because they wanted to make sure that it is a big success. As new franchisees are announced, I expect the stock price to rise as it will accelerate its growth prospects and franchise businesses trade at higher multiples.

Growth of Admireme: Right now, this venture is valued at zero because it has not even been launched. But if it gains even little traction, it could quickly gain a lot of interest and materially impact the company's market sentiment.

Buy backs: The management noted in the recent earnings call that they may just start buying back stock, especially if the price dips below $60. This creates more value for shareholders and provides some cushion during times of volatility.

Declining cost of capital: RICK's average interest rate is fairly high at 6.24%. However, it was 7.23% back in 2016, and we expect it to keep declining as the company grows in size, gains in reputation, and sellers are more comfortable providing seller financing at lower rates.

End of the pandemic: Eventually, the pandemic will come to an end. This will boost RICK's profitability and remove one of the main risks, which should help its market sentiment.

Reddit crowd: Finally, as noted earlier, RICK is becoming increasingly popular on various forums of individual investors and it makes sense when you think about it. It is the type of business around which you can post funny memes and on top of that, the investment thesis is very compelling.

Risks

As with every investment, there are some risks to consider. RICK is not an exception in that regard:

Regulation: There is always the possibility that new laws ban or restrict strip clubs. We view it as unlikely, especially in business-friendly states like Texas and Florida where RICK operates most of its businesses. Moreover, since RICK has geographic diversification, it has some protection.

Litigation: Litigations are a normal part of RICK's business. You just don't operate 40+ clubs without ever getting your hands dirty. RICK's management has decades of experience in this line of business and knows how to deal with litigations.

Bad press: Occasionally, bad press is also inevitable. A Bombshells customer who takes the wheel while being intoxicated... A nightclub dancer that gets caught for prostitution... These things are inevitable, regardless of how well you manage the business. RICK does a great job at mitigating these risks, but it is not possible to eliminate them entirely and it could lead to times of increased volatility.

Recession: Clubs and sports bars belong to discretionary spending, which is cyclical. Today, the economy is strong, households have more money than ever before, and clubs benefit from it. However, profits decline during recessions and RICK's market sentiment could also take a hit. On the flip side, because RICK has a strong balance sheet (only $164 million of debt, mostly long-term mortgages, and seller-financing), it may be able to deploy capital at even better return and buy back stock on the cheap during recessions.

Bombshell's potential failure: Right now, Bombshells is doing great, but its future is a lot more uncertain than that of its clubs. Their cash flow may not be sustainable in the long run. It would hurt RICK's sentiment and slow down its growth, but in the end, I think that we would still earn a nice return in the long run.

Declining desirability of strip clubs: Finally, the biggest risk in my opinion is that strip clubs, as a concept, decline in desirability over time. However, I am less worried about RICK specifically because it owns high-quality clubs in strong markets with population and job growth. Moreover, there are great potential synergies between strip clubs and Admireme to drive growth. Today's younger generations also tend to marry a lot later, which benefits strip clubs. Finally, increasingly many people, especially among younger generations favor experiences over things, and this should be particularly true as we come out of the pandemic.

It is important to remember that all of these risks are also opportunities for RICK because it makes it harder for its potential competitors to enter the space. It is at least partly because of these risks that RICK is today the only publicly listed strip club company in the country.

Bottom Line

RICK is my largest non-REIT investment. It is so large because I bet big on it when it was priced at $10-20 and kept buying more of it all the way to $75 per share.

Today, I continue to accumulate more shares at $63 because I strongly believe that ten years from now, RICK will be a lot more valuable as it keeps consolidating the strip club sector, franchising the Bombshells, and eventually, earns a much higher multiple.

I think that RICK could justify a 2x higher share price today, but this is a 10+ year play for me, and I wouldn't be interested in selling even if you offered me $100+ per share. I just don't know anything else that offers such a clear and predictable path to 20%+ annual returns over the coming decade.

Finally, please note that this is a free article from High Yield Landlord. If you found it valuable, consider joining our service for a 2-week free trial. You'll gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.