My Largest Investment: Interview With RCI Hospitality (Strong Buy Reaffirmed)

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on September 9th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

My Largest Investment: Interview With RCI Hospitality (Strong Buy Reaffirmed)

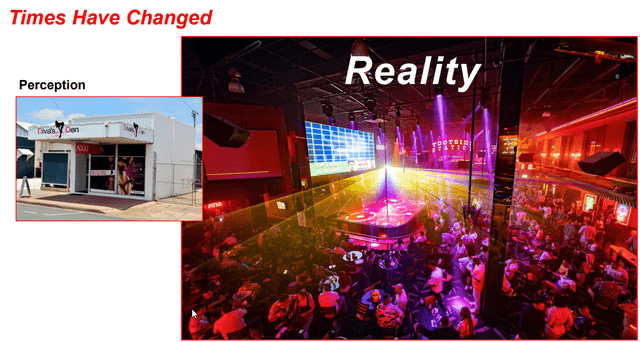

RCI Hospitality (RICK) is the only publicly listed company that specializes in the ownership and management of adult nightclubs. It owns a portfolio of 56 high-quality clubs, mostly located in rapidly growing markets like Miami:

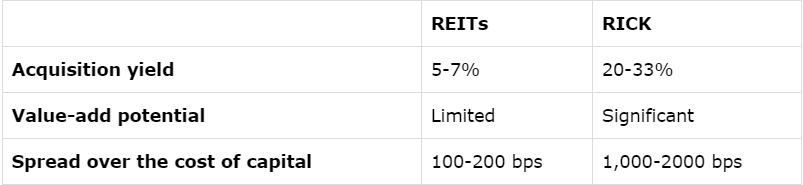

I have previously described it as a "REIT on steroids" because it is able to buy clubs at 20-33% cash flow yields, resulting in massive spreads over its cost of capital. Most REITs are happy to buy properties at 5-7% cap rates, earning far smaller spreads in comparison.

Moreover, RICK has a major competitive advantage in that it is the only acquirer of clubs with large scale and access to public capital markets, and this happens to be a very fragmented sector with lots of owners approaching retirement.

It puts RICK in a great position to consolidate this highly rewarding and inefficient sector that has many potential sellers, but few buyers due to the social stigma and unique complexities of managing such assets.

RICK can use retained cash flow, seller financing, and raise equity and invest it at 20-33%, pocketing the huge spread in between. Even better, most of these clubs have significant value-add potential. RICK is commonly able to boost the cash flow of its new acquisitions by another 15-20% by simply changing their menu, pricing strategy, implementing management best practices, and reducing some costs thanks to their economies of scale:

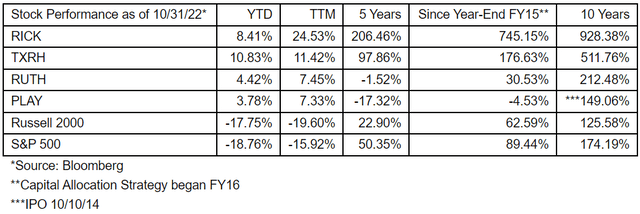

This has historically allowed the company to grow its FCF per share by ~20%+ annually, and this rapid growth coupled with some multiple expansion has already earned investors a little fortune. The shares of RICK 10x:ed investor's capital over the past 10-year period ending in 10/31/2022:

And I believe that it is still just getting started.

RICK today owns only 56 clubs, but there are 500+ clubs in the US that fit its acquisition criteria, and each new acquisition has a major impact on its bottom line because of it is still relatively small in size.

Therefore, I think that the company is likely to keep growing its cash flow at a rapid pace for many more years to come.

Despite that, it is today priced at just 7x its FCF, which is exceptional for a sector leader with such rapid growth prospects.

This is why I am so heavily invested in the company. I just don't know many other stocks that offer as much growth potential for such a cheap price and I expect it to result in exceptional returns over the long run.

What's the catch?

Well, the catch is that the company's business is much more volatile than that of a typical REIT so if you are going to invest in it, you need to be patient and be willing to endure long periods of high volatility.

There is no long-term lease to protect the cash flows and the past 4 years have been especially volatile because of the pandemic. It led to a lot of bumpiness with its same-property performance first surging at the reopening as everyone was looking forward to having fun and had stimulus checks to spend. Moreover, international borders had not reopened yet so people were traveling domestically and Miami was doing especially well. That's where some of RICK's biggest clubs are located.

This strong performance coupled with some major acquisitions caused the company's share price to surge.

But unfortunately, this exceptional performance was not sustainable. Stimulus checks eventually ran out, people returned to international travel, and consumer behavior normalized.

This caused the same property performance of its clubs to suffer in this post-covid normalization period of 2023 and 2024. It also prevented the company from acquiring new clubs because sellers were asking for too much, basing their valuations on the exceptional years of the reopening.

So we saw a boom, then a correction, and we are now in the stabilization phase.

This is also well reflected in the share price of the company. I started buying shares at around $15 in 2020, I then saw it rise all the way to $90, and it is now back down to $45.

I think that we are now likely at an inflection point, which could mark the beginning of a new multi-year bull run for the company.

We reached out to the CEO of the company, Eric Langan, to learn more about all of this. Eric built the XTC Cabaret nightclub brand and later merged it into RICK in 1998, which is when he became the CEO of the company. Two decades later, the company is still owner-operated and Eric is still the second largest shareholder of the company. In a previous call, he told us that he has 87% of his net worth in RICK stock and has no plans to sell any of it. His stake is today worth about $32 million:

We first provide a summary of all the main takeaways. We then also share a transcript of our call. Please note that the conversation was nearly an hour long so some parts of the call were deleted and some responses were slightly edited for better clarity.

In case you haven't already, we recommend that you start by reading our investment thesis by clicking here.

My Main Takeaways

They expect to close new acquisitions very soon. One of them could be as early as next month. They are in negotiations with several club owners right now and seemed confident that at least one or two deals will close in the next quarter and that this should get the ball rolling for many more acquisitions in 2025 and 2026. This is very good news given that club acquisitions are the #1 reason why RICK has been so rewarding over the long run. The lack of acquisitions is also one of the main reasons why its stock has suffered in the last two years.

They have a lot of drag right now which is lowering their true cash flow generation potential. They have 7 locations in various phases of redevelopment or construction, which is costing them money, but as these locations come online they will start to contribute significant cash flow in the coming years.

They plan to release a new 5 year plan later this year. In short, they expect to nearly double their FCF per share by acquiring new clubs and buying back shares. They think that their assumptions are conservative and that this target is very achievable.

As part of this 5-year plan, they also expect to monetize Bombshells and fully refocus on the club side of the business. If they cannot find new clubs to acquire, they will simply buy back shares even if the yield is not that attractive. The intention is to keep it simple and remain patient if and when new clubs cannot be acquired.

What are the catalysts for multiple expansion? Monetizing Bombshells, refocusing on clubs, returning to steady acquisitions and growth, greater club diversification, more consistent buy backs, and dividend growth. As the company builds a longer track record and further solidifies its business and strategy, I would expect the multiple to expand a lot higher as it doesn't make sense for such a rapidly growing company to trade at such a low valuation multiple. The upside potential is significant.

Buying RICK today reminds me of what it felt buying it in 2020. It was hated for a number of reasons different from today, but it was then my best investment in the following years. I expect patience to be once more rewarded in the coming years.

The main takeaway is that it seems increasingly likely that we will see a return to club acquisitions already in the near term. RICK has been volatile to the downside in recent years due to the lack of acquisitions, but this could soon reverse back to the upside.

Interview Transcript

Jussi: My first question is on club acquisitions. Our investment thesis heavily centers on your ability to acquire clubs at high initial yields, earning large spreads over your cost of capital. Lately, though, we haven’t seen many acquisitions. I understand that it’s not really your fault—club owners have been asking for too much, as you’ve explained in your conference calls. But now we’re in 2024. It’s been a few years since, if I understand correctly, club owners were basing their valuations on the strong numbers from 2021. How likely is it that we will soon see a return to more consistent acquisitions?

We’re working on one right now. I’m hoping to close something in the next quarter. We’ve found a couple of clubs that have run into licensing issues, so we’re getting some very favorable deals on two clubs we’re trying to buy, provided the cities issue us the necessary licenses. We’re going through that process now. Both licenses are currently suspended, not revoked, and both cities have told the owners that if they sell to an approved operator—so, of course, they both called us immediately.

One deal we’re working on is incredibly favorable. We’re hardly putting any money down, paying over seven years, and we’re also getting the property. The other deal is interesting— the previous owner had sold it for several million more than what we’re paying. They had collected a down payment and started receiving payments from an operator.

However, that operator hired a felon who wasn’t supposed to be working in the building. This person then shot someone, and his girlfriend, who was the manager, erased all the security footage. As a result, the city revoked their license. The property owner is now working with the mayor, and hopefully, the license will be reinstated, provided they sell the property to an approved operator, which would be us. It’ll be a cash transaction, and we’re essentially getting the property for the remaining balance on the note.

After the down payment, it works out to about $900,000 less than the appraised value of the real estate, and we’re also getting the business for free, basically. Of course, the business is currently a mess, but all the furniture, fixtures, and equipment are still in the building. It should be a smooth transition for us to reopen—we’ll rebrand it as Rick's Cabaret and move forward with that.

We’re also looking at a larger acquisition in Detroit. I don’t know if you’ve seen my posts on X (Twitter), but we’ve been up there scouting a number of locations. We have a Letter of Intent (LOI) and are working on finalizing documents for one of the three locations we’re interested in. We’ve also been in talks with two other groups, and a third has just reached out to us, but we’ll see how that progresses.

One of the locations is an urban club, and we’re unsure if we want to get into the urban market there yet, as we don’t know that market well enough to decide. But it does feel like we’re finally in a position where we’ll be able to start acquiring clubs again soon, especially with more reasonable pricing.

We had been seeing multiples of around five times for clubs plus real estate, but now we're back down to about four times plus real estate. The conversation has shifted to, “Hey, if this recession worsens, you might end up accepting five times anyway." Or we tell them, “If you hold out, four times is soon going to feel like three times what you're making now. So why take the risk?" And people are becoming more receptive to that.

There's also a lot of talk about higher capital gains and corporate taxes, which is motivating some owners to retire early before these taxes come into play. So, we'll see. I think the next 16 months will be very active for us. I expect 2025 will be particularly busy for acquisitions.

That’s where our core focus is right now: buybacks and acquiring clubs. Other than that, we’ll just sit on our hands and do nothing, I guess—if that's what people want. No problem. We'll continue operating our existing clubs. We’re also planning to liquidate some non-income-producing properties, and like we did in 2017, maybe sell off a few underperforming properties.

COVID threw a wrench in everything, you know. We had a great year in 2022, but things slowed down in 2023, and now in 2024, we’re seeing some declines in our smaller clubs and markets. These clubs might not be what's best for us. Small clubs in small markets aren’t really our specialty. We’ll find someone else interested in them, spin them off, and focus on what we’re best at.

That seems to be what the market wants. In the meantime, we own the real estate. We probably won’t sell that when we sell these smaller clubs. We’ll remain the landlord, and that gives us more control over the license. We can create favorable deals or carry papers for the right operators.

As long as we take properties that are barely cash-flowing or are in the red and turn them into assets that provide higher returns than what we'd get from buying back our stock, that’s the key for us right now. Speaking of buybacks, I think our stock will probably return close to 18%.

Jussi: That was actually going to be one of my questions because I remember a few years ago, you mentioned a $65 threshold for stock buybacks. I assume that represented about a 10% free cash flow yield at the time. Right now, we’re in the low forties, so why not get more aggressive with the buybacks?

Yes, cash flow has declined a little, but I don't think that's a permanent issue. I believe it’s temporary. If we shift our focus from customer quality to customer quantity, using different discounting and promotions to move people from the ground floor to VIP, I think we'll see improvement. Before, VIP was full all the time, so we didn’t need to offer discounts. Over the next 16 to 24 months, we'll continue with this discounting strategy, pushing people into VIP.

Another challenge is that we have a lot of drag right now. We have seven locations under construction or undergoing remodels. We're paying property taxes and other expenses without generating any revenue from those locations until they open. We expect to open three, maybe four, of those between October and December. One is opening this Thursday, leaving only two. Of those, one is a location with an insurance claim, so we’ll be collecting money and rebuilding it with those proceeds. The other is the new club we're building on the west side of Fort Worth, and by January, that will be our only remaining construction project.

This is significant because we currently have around $1 million in drag from these projects. Once they’re operational, we’ll potentially turn that into $2 million in gain, resulting in a $3 million swing in cash flow compared to the previous year. In reality, the number is likely much higher, considering the costs of seven locations with all the associated expenses and construction.

Once that construction cash flow stops going out, it’ll sit on our balance sheet, allowing us to either buy back more stock, especially if it stays in the $40 range, or pursue other opportunities. In December, we’ll be rolling out a 5-year plan based on generating $250 million in free cash flow. This plan assumes no growth, just five years of current operations. After debt service, we’ll allocate 10% to dividends, 40% to stock buybacks, and 50% to acquiring new low-digit cash-flow properties. Over the five-year period, we expect to add around $7 million in EBITDA annually to our existing operations.

Basically, we believe we can reach around $75 million in free cash flow, with only 7.5 million shares outstanding. That would amount to about $10 per share in free cash flow, which represents significant growth over a five-year period. Right now, we’re at around $52 million, so if you divide that by the current 9 million shares outstanding, we’re at about $5.77 per share. So, we’d be moving from $5.77 to $10 per share over the next five years.

The reality is, depending on how things unfold, we could hit that target in as little as three years, or it might take six. But I don’t think either timeline would be a stretch. Five years seems like a reasonable, straightforward goal. If you look back at what we did from 2015 to 2019, it’s similar. We had that same rate of growth before COVID disrupted everything.

The world got a bit strange, but I think it’s starting to normalize again. There will still be some macro-level challenges to face over the next five years, but that’s why we’re planning with the assumption of no growth. While we do plan for growth, we’ve set expectations so that even with no growth, this would be the worst-case scenario. I think that’s a clear way for people to understand the potential.

There’s no way we’ll be stuck at $50 million a year. If that happens, our projections would be way off, and you’d see much more upside than what we’re already telling you.

Jussi: You just made a strong case for buying on this dip. It’s odd how the market hasn’t understood that this post-COVID normalization was expected. The numbers from 2021 were unsustainable due to all the stimulus money and restricted travel. Even though you’ve explained the post-COVID normalization many times, it seems people still don’t get it. Looking at the share price today, investors are still worried, despite the fact that club sales have stabilized. Many people seem concerned that things could get much worse for us.

Yes, that’s what we’re seeing too. People think we’re going to keep declining. We had one good quarter, but I always say that one quarter doesn’t define the numbers. We had some bad storms that caused a lot of lost days—Houston had floods, and Miami was hit as well. There was about $1.2 million in lost revenue between July and August due to closed operations from storms. Now, we have a hurricane headed towards Louisiana that could affect Houston on Wednesday or Thursday. Unfortunately, those are our busiest days—Thursday, Friday, and Saturday—so any impact on those days is particularly tough.

Still, I think we’re doing a good job of cutting costs and keeping things in line. Over the next three weeks, we’re going to conduct some strong reviews and get ready to open new locations. We have two openings in Denver—Cabaret in Central City should open in November, and Bombshells in Denver will open sometime in October. After that, we’ll open in Lubbock, Texas, in November or December, and a month later, we’ll open in Rowlett. All of our Bombshells locations will be up and running.

We also gave the San Antonio location back to the franchisee. They’re responsible for the leases and guarantees. We told them, “You got $1.5 million out of us, but we can’t make this work.” There were construction issues, and the store had many problems. We walked away, and they decided to keep it. They got six months of no fees, and then they’ll resume paying.

They have an operator back in place now—he had some personal issues, but he’s returned and is ready to take over again. I think this arrangement will work out well for both parties.

Hopefully, we’ll get the concept to a high enough standard where we can find a strategic partner to either sell the operation entirely or let them operate it so we can refocus on our core business.

Jussi: If I understand correctly, that’s part of your 5-year plan: refocusing on the clubs, optimizing their performance, potentially acquiring more, and possibly monetizing Bombshells?

Definitely. That’s the plan. We need to figure out what to do with Bombshells, whether that’s getting an all-cash deal or selling to an operating partner who can build it, grow it, and eventually monetize it. We could sell 50% to them and then monetize the remaining 40% after they’ve scaled it up. Whatever we do, the goal is to take that cash and buy back more of our stock.

We’re in a much better position, even with Bombshells. The stock is in the low forties, and the yield is high, so it makes sense to be more aggressive with the buybacks right now. We’ve got quite a bit of cash on the balance sheet. In the past, we used that for acquisitions, and we’re currently working on three Letters of Intent (LOIs), although none are definitive contracts yet. So, there’s no guarantee they’ll close, but these deals have limited options elsewhere, and we’re in discussions with four other operators. These are smaller deals, more like base hits compared to the big acquisitions we’ve done recently.

Our goal is to get these locations open and bring our debt-to-EBITDA ratio back down to 2.5 or 2.7. Once we achieve that, we can look at pursuing another big deal if it comes up. Some of the bigger players we’re talking to still have unrealistic expectations regarding their valuations. They think they’re worth as much as our previous acquisitions, but their EBITDA is only $7 million compared to $11 million. So, we tell them, “You’re not worth $66 million or $70 million; you’re worth closer to $40 million.”

There’s a lot of ego in this industry. Some want to be the biggest deal we’ve ever done, but the reality is their clubs just aren’t performing at that level. Reputation doesn’t drive our decision—we’re buying cash flow and EBITDA, and the numbers don’t lie.

Interestingly, six months later, they come back to the table and lower their prices. We’ve been negotiating with a group in Florida for over two and a half years now. They started with a crazy price but have gradually become more reasonable. We’re about $2 million apart on the deal, which is a significant transaction. They’re trying to bring us back to the negotiating table, but we’ve made it clear we’re not budging. We’ve given them our final price and told them to call us when they’re ready to accept it.

They’ve suggested meeting in a couple of weeks, and one of our guys is going to fly out and talk to them. They’re still playing games, trying to squeeze every last dollar out of the deal. But we’ve sharpened our pencil as much as we can. We’ve already increased our offer twice—small adjustments each time—but there’s no room left.

I believe they’ll come around. After two and a half years, if they’re still calling me, it’s clear they haven’t found anyone else willing to pay what we’re offering.

I will look at it, and we stick to our guns. We have to continue doing that. If there’s one thing we do right, it’s buying clubs wisely. We don’t overpay and we avoid getting into jams. Since 2015, we’ve had nearly a 100% success rate on every acquisition. Our big mistake was in Las Vegas in ’09—not that the club itself was a mistake, but the timing and our lack of understanding of the market were.

We’ve learned from those mistakes. We're not looking to enter highly competitive markets or pay high multiples. If we're in a super competitive market, we’re considering maybe three times on a deal. We are very conservative and mindful of the paper we carry.

As part of our new five-year plan, we will focus on what we do best and not worry about anything else, while also buying back our stock. Even if the yield on our stock is 8% we might continue buying back stock—it’s not fantastic, but it’s better than paying down our low-interest debt.

One important thing about our stock is that we need a consistent buyer, even if that has to be us. The market gets it wrong so often. We’ve proven that when our stock is priced well, we can use it to make quality acquisitions. It makes sense for the company to enhance our stock price, which we can then utilize for acquisitions. If the market doesn’t reward us post-acquisition, that’s fine; we’ve saved $10 million on the 700,000 shares we issued in our last two acquisitions.

While we paid $88.66, we effectively got a $10 million discount when we bought back our stock.

Jussi: It seems the market dislikes inconsistency and prefers a steady rise in cash flow through consistent acquisitions. One reason for the current decline is that we haven’t had acquisitions recently, and your cash flow on a same-store basis has decreased. As a result, the stock was heavily penalized. Sometimes I wonder if it would be worth it to slightly overpay for clubs—let's say paying five or six times—to secure steady wins and continue acquiring more clubs, achieving the consistency the market seeks.

We’ve done this with larger acquisitions when we knew there was significant upside. I’m not afraid to pay six times for the right acquisition. However, if I were to follow what VCG Holdings did back in 2007 or 2008—buying at those high multiples on a single club location and then failing—I would end up in a difficult situation. It just doesn’t make sense to acquire something for the sake of it.

The market needs to understand that short-term snapshots don’t work for our company. If you look back over any five- or ten-year period, we’ve shown consistent, steady growth at a high rate, even compared to the S&P 500. We might not meet expectations in the short term, but we can rebound and have a couple of excellent years. I believe 2025 and 2026 have strong potential for that.

After 2022, I thought 2023 and 2024 would be strong years, but I couldn't predict the rapid increase in interest rates and the many macro changes. Then everyone started going on vacations. Nobody was traveling in 2022, but by 2023, many rushed to Europe.

I think we’re now on a more normalized pace. We saw a rebound from March; our worst period was between December and February, but March was typical for recovery. I anticipate that October, November, and December will be fantastic for us. Typically, we’ll experience some minor slowdowns—November, February, and mid-April—as is usual in our business.

However, this usually leads to a surge in December when people compensate for November’s cutbacks, which can result in increased club attendance during holiday parties.

Jussi: You've addressed many of my questions, which has been very helpful. To recap, you had a few exceptionally good years after reopening, followed by a post-COVID normalization. It was challenging to acquire clubs as owners were asking for too much, but you believe they are now becoming more reasonable, particularly for smaller, single-club acquisitions. The larger deals may still be overpriced, but you think there’s a good chance of returning to bigger deals soon as well. You also mentioned a five-year plan with the goal of nearly doubling your free cash flow per share through acquisitions and share buybacks. Anything else?

When we announce the first acquisition, it should signal to other owners that we’re interested in single clubs too. We’re currently discussing multiple acquisitions, including multi-club deals, and reassuring small club owners that we want to buy from them.

Our approach needs to be clear. During the expo, Adam Wyden emphasized the need to buy 100 clubs, which may have made smaller operators feel overlooked. This year, we made a targeted pitch at the expo, encouraging club owners to consider us.

We are definitely engaging with more potential sellers than before. Closing even one deal could significantly improve market sentiment and reset expectations for club owners. Seeing that first deal come through would help get the ball rolling again.

Hopefully, we’ll have some news to share very early in October. We’re nearing the end of September, and with the fiscal year wrapping up, we want to avoid complications with audits. Even if it’s a subsequent event, we’re looking at October 1st as a key date.

As we open locations in Denver, the influx of new revenue will make a big difference.

============================

Refer a Friend and Earn Rewards

If you find our research valuable, please show your support by sharing High Yield Landlord with friends and family. You will earn rewards for your referrals.

============================

Access Our Course to REIT Investing

Don't forget to take our 10-Module Course on REIT investing! The entire course is available to members for free as part of your membership.

============================

Access Our Portfolios Via Google Sheets

Our three portfolios are available through Google Sheets. These sheets provide detailed information on position sizes, risk ratings, and key metrics to help you make well-informed investment decisions:

============================

Access Our REIT Market Intelligence Sheet

This exclusive tool includes a list of all equity REITs grouped by property sector, providing all the information you need to make better decisions: FFO multiple, dividend yield, payout ratio, credit rating, and much more.

============================

Access Our Portfolio Tracker

The HYL Portfolio Tracker is a Google Spreadsheet designed specifically for members of High Yield Landlord. It helps you track all your HYL investments in one place with a simple format. It is very easy to use, so don't miss out on this free feature!

============================

Access Our Live Chat

Our live chat room is where the HYL community comes together to share market news, discuss investment ideas, and help new members get started. Members can post questions and receive prompt answers from other real estate investors and our team.

============================

Finally, feel free to contact us anytime. You can send me a direct message on the chat or email me at jaskola@leonbergcapital.com

Sincerely,

Jussi Askola

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.