Module #2 - Different Categories Of REITs

Please Note: This article is part of our 10-module Course on REIT investing. We make it available to members of High Yield Landlord for free as part of your membership.

This article is Module #2 – Different Categories of REITs – in which we discuss:

All the different categories of REITs

Which we prefer

Which we avoid

To access all the other modules, you can click the below links:

Theoretical Modules:

Practical Modules:

===============================================

Module #2 - Different Categories of REITs

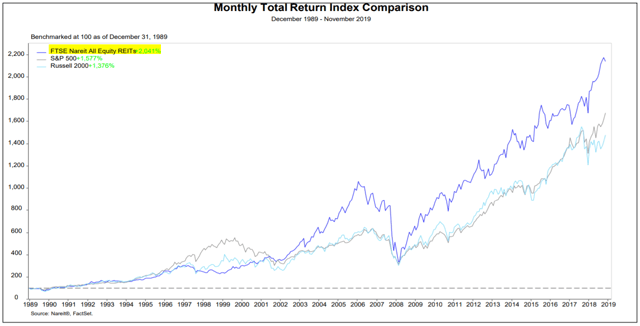

REITs have done very well on average over the long run:

But this does not mean that every REIT did well!

The is a vast and versatile sector with about 200 companies in the US and nearly 1,000 REIT-like entities worldwide, and the disparities in performance from one REIT to another have been massive.

Just consider the following example:

If you had invested in Wheeler REIT, you would have lost almost everything, but if you had invested in Innovative Industrial Properties, you would have made a fortune.

This shows you that just because two companies are structured as REITs does not mean that they have anything in common:

Wheeler was poorly managed, overleveraged, and invested in struggling retail properties.

Innovative had a great management team that had developed a unique strategy that allowed them to create significant value for shareholders.

Therefore, it is very important to be selective when investing in REITs.

My selection process starts by putting REITs in different categories and I can then screen for those that I like more than others.

In this chapter, we identify 10 different categories of REITs and explain which I like and which I don’t and why:

Listed vs. unlisted REITs

Equity vs. Mortgage REITs

Internally vs. Externally Managed REITs

Conservatively vs. Aggressively Financed REITs

Diversified vs. Specialized REITs

Specialty vs. Traditional REITs

Small-cap vs. Large-cap REITs

Growth vs. Value REITs

Discount to NAV vs. Premium to NAV REITs

Cyclical vs. Defensive REITs

The goal is that after this reading, you can better screen through the list of REITs and know how to categorize different companies.

#1 - Listed vs. Unlisted REITs

We favor: listed REITs

We avoid: unlisted REITs

Most REITs actually aren’t listed on a public market.

They are similar to the publicly listed REITs in their corporate status, but they are typically smaller in size, offer higher yields, and market themselves as the more rewarding alternative.

But in reality, it is typically the opposite.

The unlisted REITs are similar to private real estate funds in that they are typically externally managed, charge high fees, and suffer significant conflicts of interest. They are also illiquid, and you may need to pay significant commissions / transaction fees when investing in them and/or when exiting your investment.

The selling commissions and the management fees are the reason why there is an army of financial advisors pushing these unlisted REITs instead of listed REITs.

But nine times of ten, the publicly listed REITs are better investments and we discussed why in the Chapter #5 of this book.

The most obvious advantage of being publicly listed is the liquidity and the low transaction costs.

But there are many other advantages.

They are internally managed, which does a better job of aligning the interests of the manager and shareholders. The internal management structure coupled with larger size also leads to considerable economies of scale. The access to public capital markets is also a major advantage as it allows them to more efficiently raise capital to invest in their growth.

It then shouldn’t come as a surprise that publicly listed REITs have historically outperformed unlisted REITs in most cases.

There are two potential downsides to publicly listed REITs and they are both greatly exaggerated.

The first one is that being listed may at times lead to greater volatility. It is true that the stock market can be very volatile over the short run. But the equity value of a highly leveraged, small, and obscure unlisted REITs is probably even more volatile. You just decide to ignore this volatility.

The second potential downside is that the dividend yields of publicly listed REITs are typically lower. But again, there is a good explanation for this. Unlisted REITs will typically take on a lot of debt, buy higher yielding properties, and set a very high payout ratio to manufacture a high yield that would lure in a lot of unsophisticated investors. Publicly listed REITs will typically be more prudent and focus on long-term total return prospects rather than near-term dividend income. As a result, they will use less leverage, invest in lower yielding, but safer and faster growing properties, and finally, they will set a low payout ratio to retain a lot of cash flow to reinvest in growth.

If you adjust for these factors, the dividend yields of unlisted REITs would actually be lower than those of listed REITs because they enjoy lower economies of scale and charge high fees.

#2 - Equity vs. Mortgage REITs

We favor: equity REITs

We avoid: mortgage REITs

REITs are commonly divided into two categories: Equity REITs and Mortgage REITs.

Equity REITs – Most REITs are equity REITs. They own and operate income-producing real estate investments. The market often refers to equity REITs simply as REITs or eREITs.

Mortgage REITs – They provide debt financing to other real estate investors and also invest in mortgage-backed securities to earn interest income. As such, their business model is closer to that of a “bank” than a property investment. They earn profits by sourcing capital at cost x, lending it at rate y, and attempting to earn the spread in between. The market often refers to mortgage REITs as mREITs.

A lot of investors are lured into mortgage REITs, or mREITs, because they offer very high dividend yields. Just to give you a few examples, AGNC Investment Corp. (AGNC) offers an 16.4% dividend yield, Arbor Realty Trust (ABR) yields 14%, and Annaly Capital Management (NLY) yields 14.6% as of November 25th.

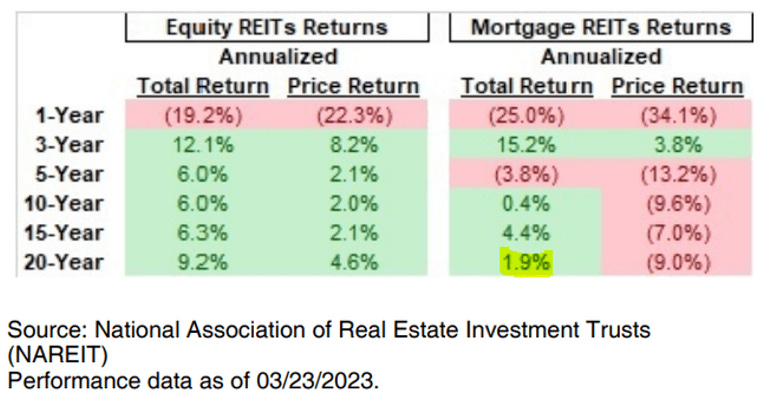

But despite offering these high dividend yields, most mortgage REITs have been very poor investments over the long run. In fact, their track record is amongst the worst in the entire financial market:

They only earned a ~2% total return over the past 20-year period, which shows you that the high dividends were really just a mirage as they came at the cost of declining share prices.

I believe that this is because most mREITs are too heavily dependent on external macro factors that are out of their control. Small changes in interest rates or spreads can have a significant impact on their businesses, and predicting these factors is very challenging.

A good chart to illustrate this point is the dividend track record of Annaly Capital Management, which is one of the most popular mREITs:

Source: Annaly Capital Management

I would much rather invest in a lower-yielding equity REIT like Realty Income (O) that grows slowly but steadily. The risk-to-reward is a lot more compelling in my opinion because the business model of a real landlord is less dependent on these macro factors:

Source: Realty Income

#3 - Internally Managed vs. Externally Managed REITs

We favor: internally managed REITs

We avoid: externally managed REITs

REITs are often also categorized by their management structure, which can be internal or external.

Today, most REITs are internally managed.

What this means is that the management is hired as employees of the REIT and their sole focus should be the REIT itself and not some other vehicles.

Moreover, this also means that the managers won't earn "fees" that are based on the volume of assets under management. Instead, they will earn salaries, which are typically based on key performance indicators. As an example, the compensation of executives at VICI Properties (VICI) depends on two things: (1) their ability to grow their funds from operations ("FFO") per share by at least 6% per year over a 2-year rolling period; and (2) reaching at least 10% compounded annual total returns for shareholders over a 3-year period.

This does a great job of aligning the interests of the shareholders and managers, and this is why most REITs are today internally managed.

However, there are still many REITs that are externally managed, which essentially means that the management is outsourced to an external asset management company that's hired to take care of the management.

This leads to much greater conflicts of interest because:

For one, the manager will typically also manage other vehicles with competing interests. As an example, they may take care of the REIT but also manage 3 different private funds that focus on the same property sector. Which vehicle then gets the best deals?

For two, the compensation of the manager will typically be a fee that's based on the volume of assets under management and not the performance of the REIT itself. This will then lead to a "growth at all costs" mentality. The REIT will issue as many shares as it can to buy more assets even if the deals are dilutive just because it would lead to greater compensation for the manager. It will also push the manager to take more debt because higher leverage would lead to more assets and higher fees.

As a result of these conflicts, the performance of externally managed REITs has been a lot worse than that of internally managed REITs.

Here are some examples of externally managed REITs that I would avoid at all costs. They always seem to be cheap, but cheap often gets cheaper...

Office Properties Income Trust (OPI)

Global Net Lease (GNL)

Industrial Logistics Properties Trust (ILPT)

Service Properties Trust (SVC)

Diversified Healthcare Trust (DHC).

And there are many others.

If a REIT has an external management structure, probably stay away from it. There are a few exceptions, but generally speaking, they are not worth the risk.

#4 - Conservatively vs. Aggressively Financed REITs

We favor: conservatively financed REITs

We avoid: aggressively financed REITs

Charlie Munger has famously said that "there are only three ways a smart person can go broke: liquor, ladies, and leverage."

During good times, it can be very rewarding to use a lot of leverage. As an example, if you buy a property at a 7% cap rate and finance it with 80% debt at a 5% interest rate, you will earn a …% cash-on-cash return without even accounting for the potential for growth and appreciation.

But then when the cycle reverses you get crushed because your losses are also amplified by leverage. If the value of your property drops by just 20%, your entire equity gets wiped out and there is no point in earning great returns for 5 years if you then lose it all when the cycle turns, or a black swan hits the market.

This is important to recognize because there are huge disparities in balance sheet quality from one REIT to the other.

Some REITs are highly leveraged, while others are more conservatively financed, and historically, REITs with strong balance sheets have outperformed REITs with more aggressive balance sheets.

This is because they earned more consistent returns over the full cycle and were able to act opportunistically during down cycles when others were getting crushed.

So high leverage does not equate to higher returns over a full cycle. In fact, in the case of REITs, it has historically been the opposite. The benefit of avoiding dilutive equity raises and being able to buy properties at low prices from distressed sellers outweigh the benefits of higher leverages during the good years.

So moderate leverage is good, but being greedy may actually hurt long-term performance.

#5 - Diversified vs. Specialized REITs

We favor: specialized REITs

We avoid: diversified REITs

Another way to categorize REITs is by their strategy.

REITs may follow two different strategies for portfolio construction.

They may invest in several property sectors. We call these “diversified REITs”.

Or they may specialize in only one specific property sector. We call these “specialized REITs”.

Both approaches have pros and cons.

Diversified REITs lower risk through diversification. If one property sector is performing poorly, it is not catastrophic to them since they are also invested in other ones. They are not putting all their eggs in one basket. Moreover, the greater flexibility of their mandate may allow them to look for investments across a larger universe of opportunities since they are not restricted to just one property sector, which may become overpriced or risky.

On the other hand, because they lack specialization, these REITs won’t have an edge over other players in any niche. They are acting as “Jacks of all Trades” which limits their ability to really create value through active management. You cannot be an expert in office, industrial, retail, and residential all at the same time.

Specialized REITs aim to be the absolute best at one thing and then they stick to it. They use their superior knowledge and relationships as a competitive advantage to find the best deals in their niche and are in a better position to really create value for shareholders.

Therefore, investors typically prefer when REITs stick to one niche and develop competitive advantages. There is no need for REITs to diversify across many property sectors because investors can take care of the diversification themselves by owning a portfolio of REITs.

Today, most REITs are specialized and the minority of REITs that remain diversified typically trade at large discounts relative to specialized REITs.

#6 - Specialty vs. Traditional REITs

We favor: specialty REITs

We avoid: traditional REITs

REITs can also be categorized by the type of properties that they are buying.

Traditional property sectors include office, industrial, retail, hotels, and residential properties.

The issue with these traditional property sectors is that they are highly competitive with lots of investors chasing the same assets and as a result, valuations are generally high and it is harder for the REITs to create value.

Moreover, many of these traditional property sectors are today facing long-term headwinds. Amazon is hurting malls. Airbnb (AIRB) is stealing business from hotels. And the growing trend of remote work is disrupting office buildings.

We believe that the best opportunities exist today in what we call specialty property sectors. Good examples are data centers, farmland, cell towers, billboards, casinos, etc.

In recent years, there has been an emergence of new specialty REITs targeting such assets and we believe that they typically have more to offer than traditional REITs.

They focus on less competitive sectors and as a result, they are in a better position to develop competitive advantages that would lead to superior risk-adjusted returns. They will commonly also enjoy stronger bargaining power with property sellers and tenants, leading to higher cap rates, stronger rent growth, and stronger leases.

EPR Properties (EPR) is the perfect example of that. Its focus on specialty net lease properties such as movie theaters and golf complexes has paid off handsomely for its shareholders over the long run:

For this reason, I invest heavily in specialty REITs than traditional REITs. I believe that they are generally in a better position to outperform over the long run. Note that we discuss the pros and cons of each REIT property sector in Chapter #9.

#7 - Small-Cap vs. Large-Cap REITs

We favor: small cap REITs

We avoid: large cap REITs

REITs are often also categorized by their size.

Small-cap REITs have a market cap that’s lower than $3 billion, and large-cap REITs have a market cap in excess of $3 billion. Some investors will also reference the middle ground of companies with a $3-6 billion market cap as mid-cap REITs.

There are today far more small-cap REITs than large-cap REITs, but despite that, most investors blindly invest in large-cap REITs just because they are famous and regularly covered by numerous analysts.

The downside is that you are likely paying a large premium because these larger REITs typically trade at far higher valuations than the smaller and lesser-known REITs.

As of the time of this writing, large-cap REITs trade at 20x FFO, but small-cap REITs are priced at just 12x FFO or a 40% discount to their larger peers.

In practice, what this means is that each dollar invested in smaller REITs will earn you far more cash flow. Moreover, the smaller size of these REITs may allow them to grow at a faster pace because each new acquisition will have a larger impact on their bottom line, and they will be in a better position to be selective about their new investments.

To illustrate this point, you can consider the case of net lease REITs.

The largest net lease REIT is Realty Income (O). It is very popular and has during most times in recent years traded at a premium valuation relative to its peer group. But despite trading at a higher valuation, it has actually grown at a slower pace because its huge size has made it harder for it to grow. In comparison, smaller peers like Essential Properties Realty Trust (EPRT) have been able to grow at a faster pace and generated far higher returns for shareholders:

A lower valuation, a higher dividend yield, and faster growth prospects are a recipe for higher returns and for this reason, we will generally favor smaller and lesser-known REITs.

But this does not mean that larger and more expensive REITs are poor investments. Quite often, a premium may be warranted because larger REITs will typically maintain stronger balance sheets, have better access to capital, and also enjoy greater economies of scale.

But the magnitude of this premium may get excessive, and this often creates an opportunity to earn higher returns by owning smaller REITs.

#8 - Growth vs. Value REITs

We favor: quality value REITs

We avoid: value and growth REITs

REITs also get categorized by their valuation, dividend yield, and growth prospects.

Some REITs are priced at 30x FFO, large premiums to their net asset value, and a low 2 % dividend yield. Others may be priced at just 5x FFO, large discounts to their net asset value, and offer a 15% dividend yield.

Which are better investments?

There are two schools of thought here:

Growth investors will argue that the more expensive low yielding REIT could be a better investment because of its rapid growth prospects.

Value investors will argue that the cheaper higher-yielding REITs will likely do better because they earn far more cash flow for each dollar invested and do not need to achieve much growth to achieve strong returns. Moreover, its valuation may expand over time, leading to additional upside.

We believe that the truth is somewhere in the middle.

The 2% yielding REIT may be a bit pricey, but the 15% yielding REIT is probably risky and its dividend may not be unsustainable. I think that the best opportunities in the REIT sector typically fit in the middle ground. They are priced at 8-15x FFO, a moderate discount to their net asset value, pay a ~5-8% dividend yield, and can grow consistently by ~3-5% per year, which sets it for double-digit total returns.

I call this “quality value”. It fits between “growth” and “value” REITs.

They are typically good companies that are temporarily discounted because they are going through some temporary issues that are solvable over time. This topic is discussed in more detail in chapter #7.

It does not mean that all growth or value REITs are unattractive, but according to our experience (and academic studies), it is harder to outperform buying the top or the bottom of the market.

REITs trading at very high valuations may do well as long as they manage to grow at a rapid pace, but all it takes is a small hiccup in growth and the valuation could come crashing down.

On the other hand, REITs that are extremely cheap are typically cheap for a good reason. The market may not be perfectly efficient, but it is not stupid either.

So generally speaking, I tend to stay away from the top or the bottom of the REIT market. Instead, I tend to focus on the middle ground, which I call quality value REITs.

Summary

We typically focus on:

Listed REITs

Equity REITs

Internally REITs

Conservatively Financed REITs

Specialized REITs

Specialty REITs

Small-Cap REITs

Quality Value REITs

We typically avoid:

Unlisted REITs

Mortgage REITs

Externally managed REITs

Aggressively financed REITs

Diversified REITs

Traditional REITs

Large-Cap REITs

Value and growth REITs

Note that exceptions exist. For instance, a diversified, externally managed REIT may become opportunistic at the right price. Similarly, a large-cap trading at a premium to NAV may be attractive if its growth prospects are truly exceptional.

But nine times out of ten, we believe that investors would be better off sticking to listed internally managed equity REITs that specialize in one property sector, are conservatively financed, own good properties, and are priced at a reasonable valuation.

To access all the other modules, you can click the below links:

Theoretical Modules:

Practical Modules: