Please Note: This article is part of our 10-module Course on REIT investing. We make it available to members of High Yield Landlord for free as part of your membership.

This article is Module #1 – All the Basics About REITs – in which we discuss:

What are REITs?

Why invest in REITs?

How to invest in REITs?

How much to invest in REITs?

How are REITs Taxed?

Glossary of important terms

To access all the other modules, you can click the below links:

Theoretical Modules:

Practical Modules:

===============================================

Module #1 - All The Basics About REITs

The term Real Estate Investment Trust, or REIT in short, was originated in 1960 by the United States Congress and has since been adopted all around the world to describe a special tax-advantaged vehicle for collective real estate investments.

Just like mutual funds, they allow investors of all kinds to invest in real estate without actually having to go out and buy, manage, and finance properties themselves. Besides, a lot of REITs are publicly traded on a stock exchange and allow investors to participate in the ownership of large-scale, well-diversified real estate portfolios in the same way investors would invest in any other industry - through the purchase of stocks.

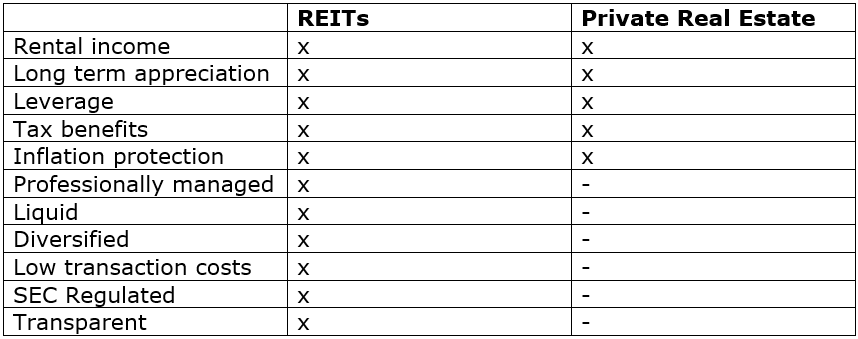

As such, REITs provide a unique vehicle to gain exposure to real estate in a liquid and cost-efficient manner, combining the positive attributes of real estate…

Rental income

Long term appreciation

Leverage

Tax benefits

Inflation protection

… with the benefits of stocks:

Professional management

Liquidity

Diversification

Low transaction cost

Regulated and transparent

Not surprisingly, the concept of REITs has gained great popularity over the years. Just 30 years ago, US REITs only owned ~$10 billion worth of assets, but today, they own over $4 trillion of properties (yes, trillion with a “T”).

There are over 200 publicly listed REITs in the US alone and they invest across every different property sector.

Some of the most common REIT categories include:

Industrial REITs

Apartment REITs

Single-family rental REITs

Manufactured Housing REITs

Net lease REITs

Cell tower REITs

Shopping center REITs

Mall REITs

Office REITs

Specialty REITs

Hotel REITs

Healthcare REITs

Diversified REITs

Data center REITs

Self-storage REITs

Infrastructure REITs

Mortgage REITs

Timberland REITs

Farmland REITs

And many more…

On top of that, there are now over 40 countries that have adopted REIT-like regimes, and so in total, there are nearly 1,000 REITs or REIT-like entities throughout the world. Some of the biggest REIT markets outside of the US include:

Canada

Australia

Japan

Singapore

Hong Kong

United Kingdom

France

Germany

South Africa

Note that we will discuss every property sector and foreign REITs in other modules of this course.

For now, you should keep in mind that the REIT market is vast and versatile, and with so many different REITs to choose from, there are always opportunities somewhere and investors have the luxury of building extremely diversified portfolios.

REITs’ track record

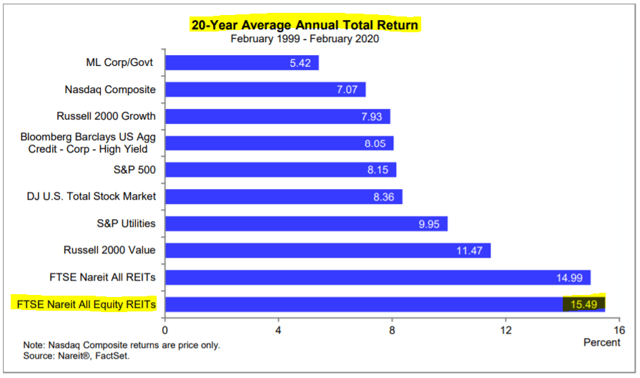

Over the past 20-year period ending with the pandemic crash, REITs earned a 15.49% average annual total return, easily beating the returns of the S&P500, growth stocks, bonds, and gold:

If you extend the time period and include the two recent REIT market crashes (the pandemic in 2020 and the historic surge in interest rates of 2022/2023), their performance comes down, but it still remains ahead of other investment alternatives over the past 50-year time period:

This is especially impressive when you consider that REITs achieved these results, despite being safer than most stocks and paying a lot more dividend income.

Moreover, this is just the “average” performance of the REIT sector. It includes the good, the average, and the bad REITs, meaning that active investors could have done a lot better if they knew how to wide out the worthwhile from the wobbly.

As an example, the entire self-storage peer group has earned nearly 20% average annual total returns for the past ~30 years:

Finally, there are several studies that conclude that REITs also earn 2-4% higher average annual returns than private real estate investments and we have good reasons to believe that this outperformance will continue. Note that we have an entire module dedicated to this topic: “Module#3: REITs vs. Private Real Estate."

So, in short, REITs offer highly competitive total return prospects, and in addition to that, they also offer significant income, inflation protection, and diversification benefits to a portfolio.

How to Invest in REITs?

Investing in real estate can be costly and time-consuming. You have to deal with brokers, contractors, lenders, tenants, and property managers. The entire process, from due diligence to closing a deal, can take several months, with transaction costs typically ranging from 5-10% of the purchase price.

REITs simplify this process, making it much easier, cheaper, and faster. All you need is a brokerage account, and with just a few clicks, you can start investing in REITs on the public stock exchange, just like any other stock.

Transaction fees are minimal, often just a few dollars, and trades are executed almost instantly. I personally use Interactive Brokers for all my REIT investments. They offer access to all REIT common shares, preferred shares, and international REIT investments with low transaction costs. I have been with them for many years and highly recommend their services.

But most other brokers will do too. Some of our members use Fidelity, E*TRADE, Charles Schwab, TD Ameritrade, and others. If you want to open an Interactive Brokers account, you can use my referral link to get up to $1,000 of free stock: click here

How Much of a Good Thing Do You Want?

REITs are my favorite investment in the entire financial market, and I allocate a large portion of my net worth to them.

However, it is important to remain well-diversified and not put all your eggs in one basket.

How much you decide to invest in REITs depends on three key factors:

Your return objectives

Your ability to take risks

Your willingness to take risks

Since we do not know your specific situation, we cannot provide individualized advice.

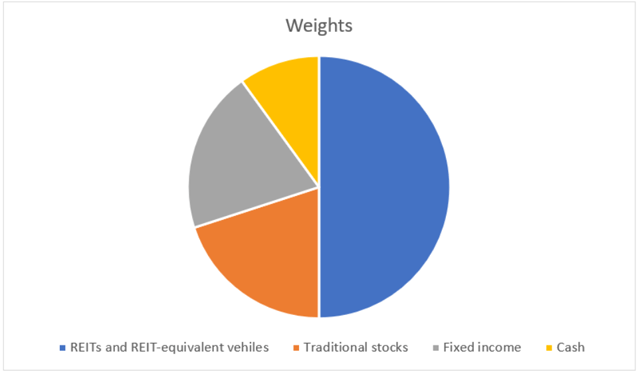

Personally, I invest about 50% of my net worth in the REITs and other opportunities presented at High Yield Landlord. However, I am younger than most of you, have a higher risk tolerance, do not mind volatility, and target superior total returns. As a specialist REIT analyst, it is natural for me to put my money where my mouth is.

A rough illustration of my personal portfolio allocation:

Most members of High Yield Landlord would likely benefit from investing less in REITs and seeking greater diversification. One downside to publicly traded REITs is their often wild share price volatility. This can unsettle inexperienced investors, leading them to panic and sell their shares too early during market declines, resulting in long-term underperformance or outright losses.

A well-diversified portfolio that includes REITs, stocks, bonds, cash, precious metals, and other asset classes can help mitigate this volatility.

David Swensen, the legendary manager of the Yale endowment fund, recommends investing around 20% of your portfolio in REITs. His track record makes him a superstar among institutional managers, with much of his success attributed to real estate investing.

Other financial advisors commonly suggest a 15-30% exposure to real estate investments, which we believe is a reasonable recommendation.

Ultimately, it comes down to your personal investment objectives and what you feel comfortable with.

How REITs are Taxed?

REITs are structured as corporations, but unique to them is that they are exempt from corporate income taxes. This removes the double taxation issue that impacts the returns of regular stocks (taxes are paid by the corporation and shareholder).

REITs generally pay higher dividends than most other stocks. These dividends are distributed as either ordinary income or return of capital, each of which is taxed at different rates. REITs are required to provide shareholders with information clarifying how the prior year’s dividends are to be allocated for tax purposes, but the majority of dividends are generally allocated as ordinary income.

What this means from an investor standpoint is that dividends allocated as ordinary income are taxed at the taxpayer’s marginal rate. However, REIT dividends also enjoy a 20% deduction, which reduces the top tax rate on REIT dividends from 39.6% to 29.6% for a taxpayer in the highest tax bracket. The 20% rule on pass-through income can be deducted even if the taxpayer does not itemize.

Therefore, REITs are quite tax-efficient and can be held in any type of account. Our CPA holds large exposure to REITs within his 401K along with his taxable account. We believe that a balanced approach works well for most people.

However, if you want to protect against paying taxes on the gains you would lean more towards owning REITs in a retirement account, such as a 401K or an IRA. We always recommend you consult with a professional tax advisor to review what works best for you.

Please note that Foreign REITs are taxed slightly differently and we will discuss this topic in greater detail in Module #10: "Investing in Foreign REITs".

For our non-US members: note that US REITs will charge you a withholding tax. This tax is automatically withheld by the broker when you receive dividends and the rate is 15% for most countries (You can review the different tax rates for each country by clicking here). This is not, however, lost income. You can use it as a tax credit in your home country to avoid double taxation. I am not a US resident and I still invest heavily in US REITs as they are very tax-efficient for me.

Glossary of Important Terms and Metrics

The following is a glossary of some important terms and metrics that are commonly used by REIT investors. Many of these terms and metrics will be discussed in greater detail in the following modules.

If you are looking for the definition of one specific term or metric, you can use the CTRL + F shortcut to open the search bar.

FFO: The most commonly accepted and reported measure of REIT operating performance is FFO, or Funds From Operation. Equal to a REIT's net income, excluding gains or losses from sales of property and adding back real estate depreciation. source

AFFO: Adjusted Funds from Operation (AFFO) refers to a computation made by analysts and investors to measure a REIT's recurring FFO after deducting capital improvement funding (capex*). AFFO is usually calculated by subtracting from FFO:

(1) normalized recurring expenditures that are capitalized by the REIT and then amortized, but which are necessary to maintain a REIT's properties and its revenue stream (e.g., new carpeting and drapes in apartment units, leasing expenses, and tenant improvement allowances) and

(2) the adjustment to GAAP revenue to "straight-line" rents.

There is no standardized definition of AFFO; therefore, financial statement users should understand how the measure is defined by the company. source

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization. source

NOI: Net operating income (NOI) is a calculation used to analyze the profitability of income-generating real estate investments. NOI equals all revenue from the property, minus all reasonably necessary operating expenses. source

Same Store NOI: Measures the growth of NOI for an identified property or portfolio of properties. NOI can be grown by raising rents, growing the occupancy rate, or cutting property expenses.

NAV: The market value of all the properties after subtracting all its debt. Note that NAV is based on estimates of private market value, which is different from Book Value.

P/FFO: This is a cash flow multiple that is used to evaluate how many times the FFO (cash flow) the company is trading at. Most REITs have historically traded at a P/FFO multiple of 15-20x. The lower the multiple, the better the value (ceteris paribus).

P/NAV: Is a comparison of the public market valuation of the REIT and the underlying value of the properties. Most REITs have historically traded at a P/NAV multiple of 0.95-1.05. The lower the multiple, the better the value (ceteris paribus).

Cap Rate: The capitalization rate (also known as cap rate) is used in the world of commercial real estate to indicate the rate of return that is expected to be generated on a real estate investment property. This measure is computed by dividing NOI by the property asset value and is expressed as a percentage. source

CEF: A closed-end fund (CEF*) is a portfolio of pooled assets that raises a fixed amount of capital through an initial public offering (IPO*) and then lists shares for trade on a stock exchange. Like a mutual fund, a closed-end fund has a professional manager overseeing the portfolio and actively buying and selling holding assets. Similar to an exchange-traded fund, it trades like equity, as its price fluctuates throughout the trading day. However, the closed-end fund is unique in that, after its IPO, the fund's parent company issues no additional shares. Nor will the fund itself redeem—buy back—shares. Instead, like individual stock shares, the fund can only be bought or sold on the secondary market by investors. source

ETF: An exchange-traded fund (ETF*) is a type of security that involves a collection of securities—such as REITs—that often tracks an underlying index, although they can invest in any number of industry sectors or use various strategies. ETFs are in many ways similar to mutual funds; however, they are listed on exchanges, and ETF shares trade throughout the day just like ordinary stock. A well-known example is the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index. source

VNQ: Is the Vanguard Real Estate ETF, the largest REIT ETF in the world with $40 billion of assets under management.

Cost of Capital: The cost to a company, such as a REIT, of raising capital in the form of equity (common or preferred stock) or debt. The cost of equity capital is the implied cap rate at which the REIT is trading. The cost of debt capital is merely the interest expense on the debt incurred. source

LTV: The Loan to Value (LTV) is the amount of debt in relation to either equity capital or total capital. source

Debt to EBITDA: This is a ratio measuring the amount of income generated and available to pay down debt before covering interest, taxes, depreciation, and amortization expenses. Debt/EBITDA measures a company's ability to pay off its incurred debt. A high ratio result could indicate a company has a too heavy debt load. source

Interest Coverage Ratio: A debt ratio that's used to determine how easily a company can pay the interest on its outstanding debt. source

Market Cap: The market value of all outstanding common stock of a company. source

Payout Ratio: The percentage of cash flow paid out to shareholders as dividends.

Equity REIT: The majority of REITs are equity REITs. Equity REITs own and operate income-producing real estate investments. The market often refers to equity REITs simply as REITs.

Mortgage REIT: Provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities and earning income from the interest on these investments.

Hybrid REITs: A REIT that combines the investment strategies of both equity REITs and mortgage REITs.

Specialty REIT: This is any REIT that does not own traditional properties, which include office, industrial, retail, hotel, and apartments. Examples of specialty REITs are Healthcare REITs, Self Storage REITs, Farmland REITs, and many others.

Internally managed REITs: Hire their management as employees of the REIT. It lowers conflicts of interest and it is the preferred management structure.

Externally managed REITs: Outsource the management to an external asset management company. Exceptions exist, but generally speaking, externally managed REITs suffer from greater conflicts of interest, have greater G&A costs, and shareholder returns have been significantly lower over time.

G&A: stands for general and administrative expenses. It includes the expenditures related to the day-to-day operations of a business.

NAREIT: NAREIT (National Association of REITs) is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets. NAREIT advocates for REIT-based real estate investment with policymakers and the global investment community. source

Sales per square foot: Sales per square foot is one of the best metrics you can use for gauging the performance of brick-and-mortar retail stores. It can give insights into the quality of the retail property. source

Triple net lease: A triple net lease (also known as a NNN lease) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property including real estate taxes, building insurance, and maintenance. These payments are in addition to the fees for rent and utilities, and all payments are typically the responsibility of the landlord in the absence of a triple net lease. source

Internal growth: this is the organic growth in the cash flow of the portfolio.

External growth: this is the growth that's achieved by acquiring new properties at a positive spread over the cost of capital.

Spread investing: The ability to raise funds (both equity and debt) at a cost that is lower than the initial returns that can be obtained on real estate transactions. source

Straight-line: This term typically refers to the fact that leases have many years and pre-agreed rent increases. The straight line is the average annual rent over the term of the lease, but not the real cash rent collected.

To access all the other modules, you can click the below links:

Theoretical Modules:

Practical Modules:

Great article! I have two comments, both stemming from the comparison of private real estate vs. REITs.

1) An attribute of private real estate not available to REIT investors is direct control of the asset. With a REIT the decisions are made for you, for privately held real estate you get to (have to) make all of the decisions. For investors who want control, REITs require letting go of that control.

2) information asymmetry of REITs (and equities in general) vs. private real estate. With private real estate you can know everything there is to know, with REITs there is much less transparency, flow of information, and much longer time lags with information known by the REIT vs. information known by the investor. This is a real concern as the average investor often has little insight into the values, ethics, executive compensation packages, appetite for risk, workplace climate, integrity of the management team, etc. Nobody wants to be holding shares of a company when a scandal breaks or a risky bet goes bad, but protecting from these types of risks is very difficult given the information asymmetry of the investor vs. the company.