Meeting With Realty Income's CFO - EPRA ReThink Conference (Buy Rating Reaffirmed)

Recently, I got to meet Realty Income's CFO, Jonathan Pong, at the EPRA ReThink Conference in Berlin, Germany:

We had a brief discussion about what I view as the pros and cons of the company from the perspective of an investor.

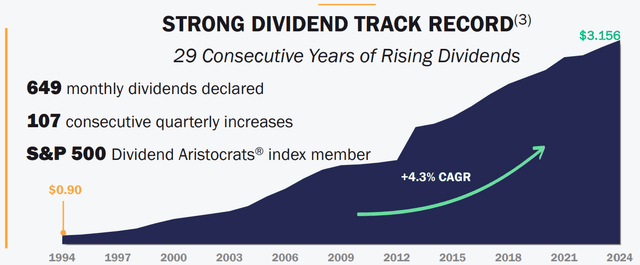

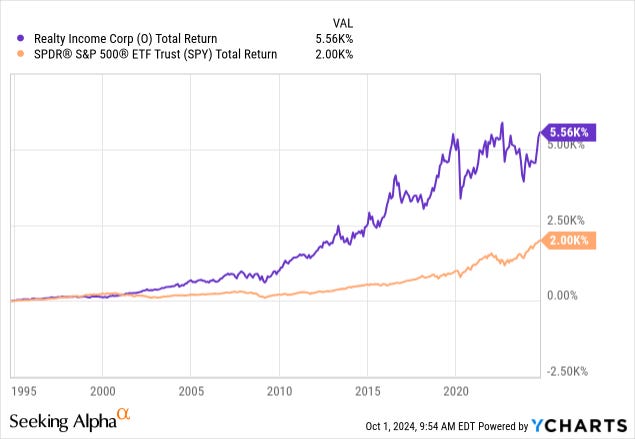

On one hand, Realty Income is quasi-indestructible. It has a great balance sheet with an A- credit rating, it has massive scale, owning 15,000+ properties, and it has one of the best track records in the entire REIT sector, having managed to grow its dividend for ~30 years in row:

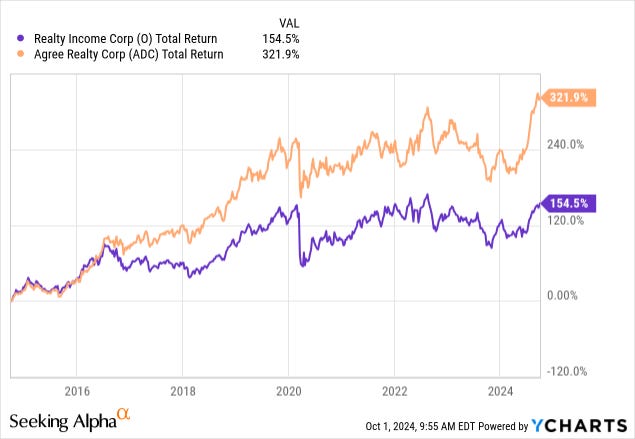

On the other hand, I think that the main issue facing Realty Income is that it might have become too big for its own good and this will likely slow down its growth going forward.

Slower growth would then likely result in lower returns and potentially lead to underperformance relative to its smaller peers like Agree Realty (ADC). This has already been happening for the past decade:

Therefore, I have previously argued that Realty Income was a great REIT for retirees and income-oriented investors since it offers a very defensive and growing 5% dividend yield. But we have also noted that its smaller peers would likely make better picks for total return oriented investors, unless they could buy Realty Income at a steep discount to make up for the growth disadvantage.

But Realty Income's CFO had an interesting counter argument to this that I had not previously considered.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.