MARKET UPDATE - Why The First CPI Report Of 2025 Is Less Scary Than It Looks

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on February 4th, 2025, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

============================

MARKET UPDATE - Why The First CPI Report Of 2025 Is Less Scary Than It Looks

January CPI disappointed the market and caused a selloff by coming in ever so slightly above expectations.

The month of January is the most likely to deliver an upside surprise. The primary reason for that is that companies disproportionately put price hikes into effect at the beginning of the calendar year. It appears that this was especially the case for car insurance premiums. This may be one reason why the CPI came in slightly hotter than expected.

But the biggest reasons why consumer inflation measurements continue running above the Fed's 2% target are (1) the way shelter/housing is calculated, (2) a temporary spike in used car prices due to the destructive wildfires in Southern California, and (3) rising egg prices due to avian flu.

None of these represent secular inflationary trends. None of them signify that inflation is making a sustained rebound, despite how it may appear on the chart above.

So while the January 2025 CPI report naturally triggered a raft of scary headlines about "hotter than expected" or "sticky" inflation, the truth is that the underlying disinflationary trends within the CPI continue.

Using real-time changes in residential costs rather than the lagged shelter metrics compiled by the Bureau of Labor Statistics, real-time inflation has been at or below 2% for the last year and a half. Real-time inflation did continue to tick up in January, following its rebound over the last few months.

But that rebound is almost entirely due to the prices of used cars, eggs, and car insurance.

Meanwhile, disinflationary trends continued in shelter (~34% of the CPI basket), food at home excluding meat & eggs (~12% of the CPI), food away from home (~6% of the CPI), electricity (~2.5% of the CPI), and motor vehicle maintenance and repairs (~1% of the CPI).

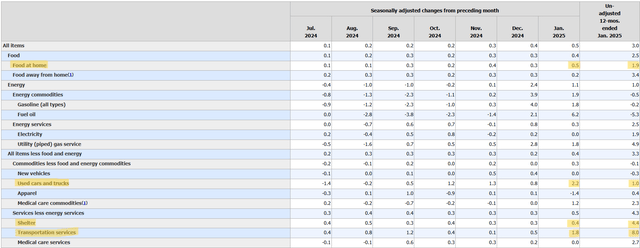

Here's the basic breakdown of CPI items for the month of January (click on the image to enlarge it on your screen):

We've highlighted several noteworthy items to dig into. As we'll explain below, all items within the CPI experiencing spikes right now are due to temporary factors rather than sustained or secular factors.

Food Inflation Rebound?

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.