Important Note

Before going into today's article, I wanted to let you know that we will soon conduct interviews with the management teams of the following REITs:

Farmland Partners (FPI)

NewLake Capital Partners (OTCQX:NLCP)

BSR REIT (HOM.U:CA / OTCPK:BSRTF)

Canadian Net REIT (NET.UN:CA)

Let me know if you have any questions for them, and I will make sure to ask them for you. You can put your questions in the comment section below.

Thanks!

=============================

MARKET UPDATE - Warren Buffett's Strategy Is Key In Today's REIT Market

Warren Buffett needs no introduction.

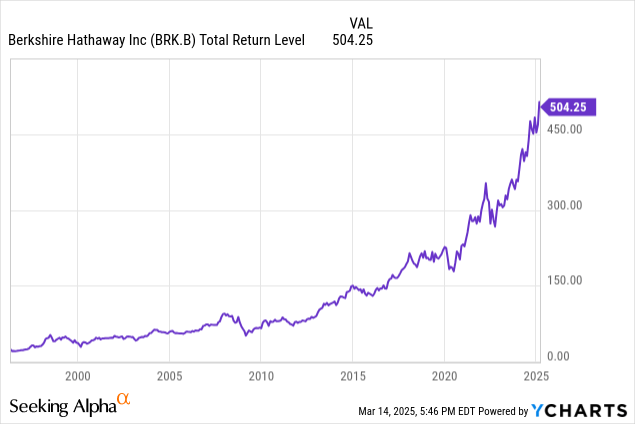

He is the world’s most successful investor, having managed to compound the returns of Berkshire Hathaway (BRK.B) at 20% per year on average for 56 years in a row. At one point, he was even the world’s richest man on earth, and he achieved that consistently beating the market.

So when he talks, we listen.

He has shared a lot of valuable insights about his investment philosophy over the years, and we think that REIT investors (VNQ) specifically could gain a lot today by taking a moment to review some of Buffett's most important lessons.

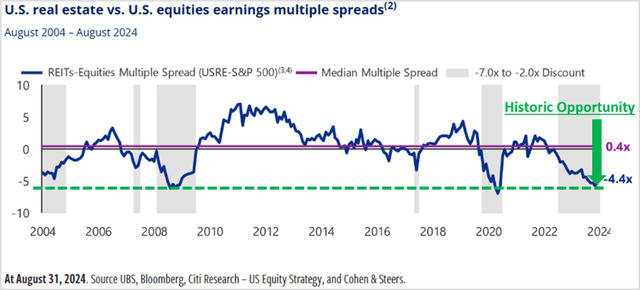

If you aren't aware, REITs are hated by the market today.

They have been in a 3-year-long bear market that began with the surge in interest rates, and as a result, they now trade at decade-low valuations:

As a result, many investors are now losing patience and selling REITs due to their poor recent performance.

But that's precisely what Warren Buffett would recommend against doing.

He has famously said that:

“The best chance to deploy capital is when things are going down.”

He has also said that:

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful."

And that's the REIT sector today! There is a lot of fear going around, and as a result, valuations are at a historic low.

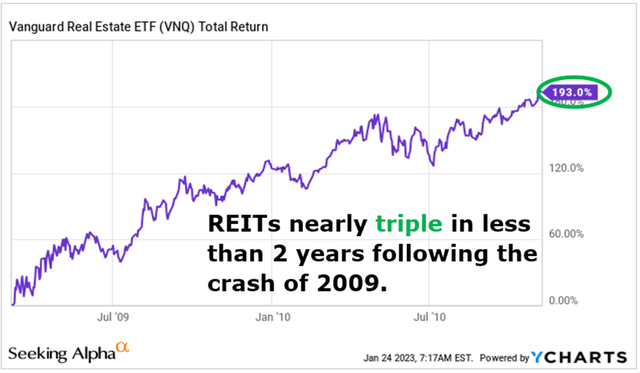

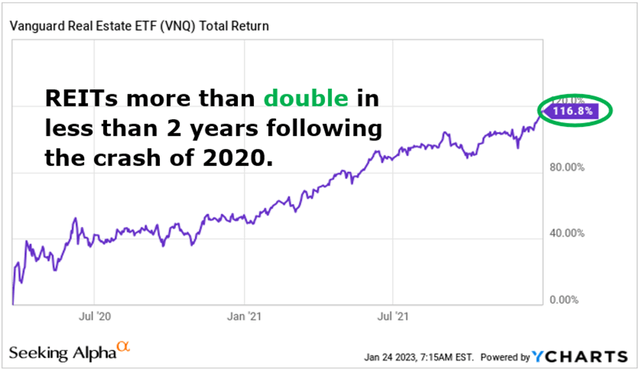

The last two times REITs were this cheap, they then more than doubled in value in the following years as they recovered.

Following the crash of the great financial crisis, REITs tripled in just two years:

And following the crash of the pandemic, they more than doubled in just over one year:

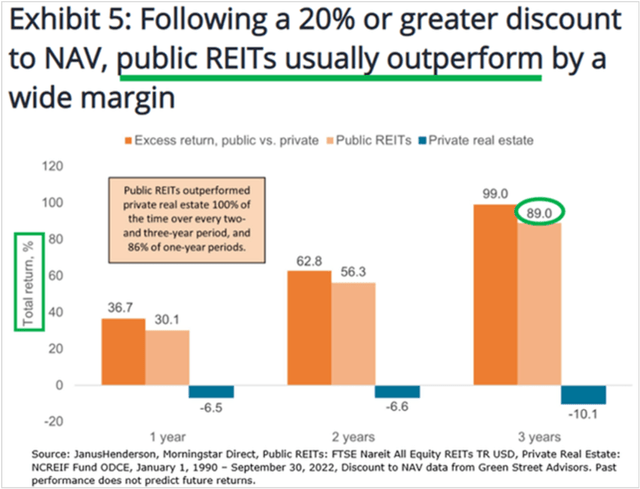

Looking at more historic data, the investment firm, Janus & Henderson, finds that whenever REITs have been so cheap in the past, they have strongly outperformed in the following years, roughly doubling investors' money in the next three years as they recovered, on average:

This shows you clearly that the REIT market has the tendency to overreact to negative news, such as the surge in interest rates, and this will often cause REITs to become undervalued, setting them up for a strong recovery once conditions improve.

But I already hear some of you saying: but what if prices drop even lower??

Well, no one has a crystal ball, and Buffett would advise accepting it and buying anyway:

“Don’t pass up something that’s attractive today because you think you will find something better tomorrow.”

Yes, buying REITs may have felt like buying falling knives in recent years, but if you want to set yourself up for big gains in the recovery, you must be patient and accept that timing the market isn't possible.

Now, let's apply these lessons in practice and look at an example:

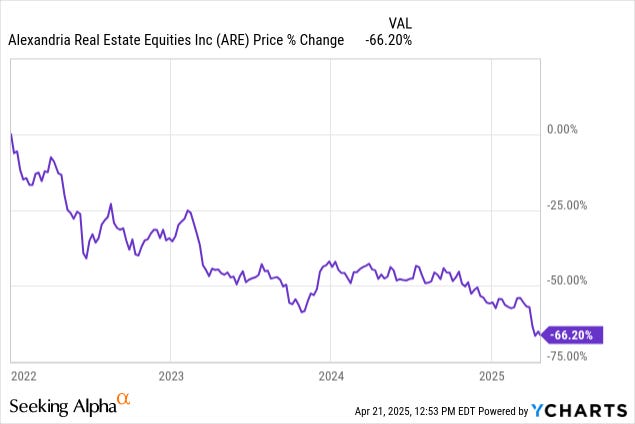

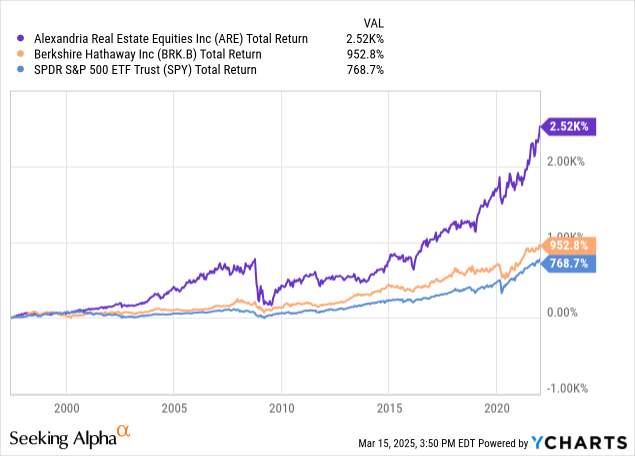

Alexandria Real Estate (ARE) is a blue-chip investment-grade rated REIT that focuses on life-science properties. It has historically been one of the best-performing REITs, beating even Warren Buffett's Berkshire Hathaway. Yet, it has seen its share price drop by 66% over the past three years even as it grew its cash flow by another 20% at the same time. This means that it has seen its valuation drop to just 1/5 of what it used to be:

The valuation is the lowest it has been since the great financial crisis.

Clearly, there is a lot of fear... Is now the time to sell or to buy?

If you read the comment sections of some Seeking Alpha articles, it would seem that the sentiment is very negative, with investors staying far away from it or selling it after losing patience.

But Buffett would advise the opposite, assuming that Alexandria is a high-quality business:

“Our advantage, rather, was attitude: we had learned from Ben Graham that the key to successful investing was the purchase of shares in good businesses when market prices were at a large discount from underlying business values.”

Naturally, if the market is pricing the company at such a low valuation, it probably means that the company is going through some type of crisis.

The key here is to buy high-quality businesses that are severely discounted due to a temporary crisis.

It is the case here.

Alexandria, like many other REITs, has crashed because of the surge in interest rates coupled with oversupply in its property sector.

But this is all temporary.

Interest rates have already come down significantly and are expected to be cut another three to four times later this year. The rate hikes were a temporary solution to a temporary burst in inflation, which was caused by the pandemic. Alexandria is not heavily impacted anyway since it has a BBB+ rated balance sheet with just 35% leverage and ultra-long maturities at 13 years on average.

The oversupply also won't last for much longer. The pandemic and low rates that followed it led to a boom in new construction activity for life science space in 2022 and 2023. That new supply is now hitting the market and slowing down rent growth. However, the surge in rates and high inflation in construction costs have now put most new projects on hold, and this will lead to a significant drop in new development activity in 2026 and even more so in 2027, setting up the sector for a strong recovery. Real estate has always been cyclical, with times of oversupply commonly followed by times of undersupply. This is not the first, nor the last time we see this play out.

Ignoring these temporary issues, Alexandria is one of the highest-quality businesses in the REIT sector. It owns amazing assets, has a fortress balance sheet, and one of the best track records of any publicly listed company:

Therefore, we think that it is a mistake to price the company at such a huge discount due to what we perceive as a temporary issue.

The market has simply overreacted to short-term negative news because most investors are excessively focused on the next quarter or year, not understanding that real estate should be valued based on decades of expected future cash flow.

Warren Buffett explains that investors with the right temperament can take advantage of the market's impatience and we think that it applies well to REITs today:

“The stock market is a device for transferring money from the impatient to the patient... The most important quality for an investor is temperament, not intellect.”

It is just common sense that buying good real estate at a huge discount with clear catalysts is likely a good opportunity.

High-quality REITs like Alexandria have existed for decades, and they have always recovered from every single crisis and richly rewarded investors in the recovery.

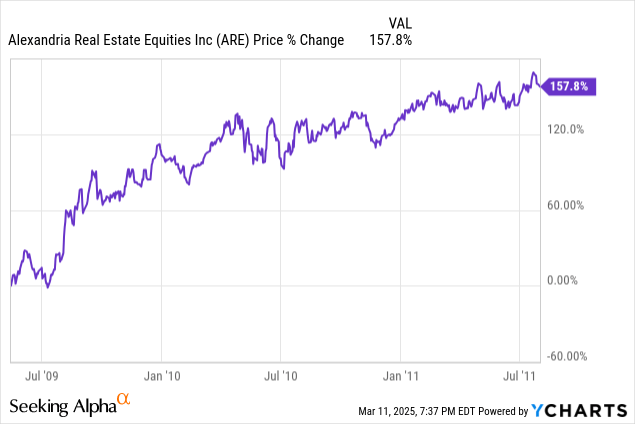

The last time it was this cheap was following the great financial crisis, and it nearly tripled investors' money in the next two years:

This explains why the private equity giant Blackstone (BX) is buying REITs hand over fist today. They have bought $10s of billions worth of REITs in recent years. This brings me to the last piece of advice from Warren Buffett:

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble”

We don't know how much longer this opportunity will last.

In fact, it seems that the window of opportunity is already closing. Many REITs are up significantly since the Fed began to cut interest rates.

But for now, REITs remain cheap, and we are aggressively accumulating them while fear remains high and valuations are low.

This strategy won't be popular on investment forums, but then again, we are not chasing the approval from the crowd.

“Beware the investment activity that produces applause; the great moves are usually greeted by yawns.”

Finally, please note that we have exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

One of the many reasons I like HYL is the alignment of values with those of Buffet, Graham, Munger and many other value investors. That's the type of investor I aspire to be. HYL helps greatly to identify attractive opportunities in the REIT sector, which I could not do on my own.

Most fund managers look to next quarter or next year, is because their clientele demands yearly gains. Failing that, fund managers best have their excuses ready. I'm quoting a fund manager: "As a fund manager, I cannot afford NOT to be invested in Nvidia".

Since fund managers manage a lot of capital, I suspect this is the primary reason why the short term is the dominant driver of markets.