MARKET UPDATE - The US Election's Impact On REITs

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on November 6th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

MARKET UPDATE - The US Election's Impact On REITs

The decisive electoral victory of Donald Trump and the Republican Party sent an immediate shock wave through the stock market as investors quickly priced in the new reality awaiting us in 2025 and beyond.

To assess the impact of the election outcome on commercial real estate and REITs, we will start with the macroeconomic view and then zoom in to perform a sector-by-sector analysis.

Macro: Interest Rates & Inflation

One of the biggest shifts in the market from the Republican sweep was a ~20 basis point jump in long-term interest rates.

In fact, despite increasing certainty in multiple Fed rate cuts to come, the 10-year Treasury rate has been sharply rising since Trump's odds of electoral victory began materially rising in mid-September:

To be clear, other factors were also in play since mid-September. Economic strength diminished the odds of a coming recession, which in turn reduced the amount of expected Fed rate cuts in the near-future.

Also, the Fed executed a jumbo, 50-basis point cut on September 18th, which coincides with the rebound in the 10-year rate.

Even with these other factors at play, though, the various data from high-quality polls to betting markets increasingly pointing to a Republican sweep fueled the rise in rates.

Why?

Well, the second likeliest outcome of the election was divided government, wherein Kamala Harris won the presidency while Republicans took control of the Senate. The market deemed this scenario to be a continuation of the status quo, including the current disinflationary trends that were expected to result in lower interest rates as well.

That's why long-term interest rates fell when some data emerged appearing to show a last-minute shift in the electorate toward Harris.

In contrast, the market deems Trump's policy platform as being pro-inflationary and pro-growth, which are likely to exert upward pressure on interest rates and result in fewer Fed rate cuts in 2025 and beyond.

The non-partisan Peterson Institute estimates that US year-over-year CPI could increase by a range of 4-7 percentage points above where it would otherwise be if Trump implements all of his stated policy goals:

We doubt that Trump's policies would increase inflation by anywhere near 7 percentage points, but any increase above the Fed's 2% target would likely result in a reaction from the Fed.

To quote Jon Siegel, CIO of Railfield Partners (via GlobeSt):

"I would expect Trump's election to be a bad thing for those who are rooting for interest rate cuts. Powell says that their decisions are data driven and so I would expect them to continue on their current path of easing rates in the short term, but Trump's proposed policies could drive more inflation and so I would expect the fed to be more hawkish on rates in the long run."

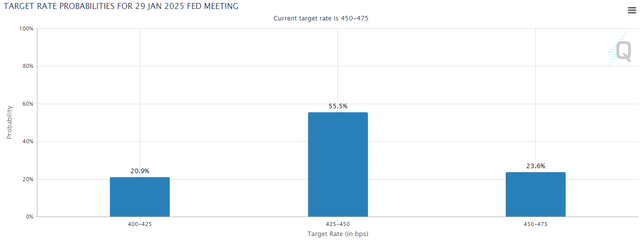

We basically see Siegel's outlook showing up in the projections for Fed rate cuts. While the market is still betting on another 25-basis point cut in December, the largest probability for January 2025 is a Fed pause.

The market currently assigns a roughly 1 in 5 chance that the Fed will cut again in January. That would put the Fed Funds Rate at about 4.35%, where it may stay for a period of time as the Fed waits to see the economic reaction to Trump's policies.

Then again, predicting the forward path of the Fed Funds Rate is extremely difficult to do with any measure of accuracy.

Market forecasts are very often wrong:

Fortunately, though, Fed Chairman Powell recently reiterated the independence of the Federal Reserve from political influence by issuing a reminder that the president cannot fire him, nor would he resign if asked to do so by the president.

This is a beneficial reassurance that the Fed will remain neutral and data-dependent during Trump's second presidential term.

On the other hand, it also likely means that any inflationary response to Trump's policies will be met with both higher long-term interest rates and a higher Fed Funds Rate.