Important Update:

This market update was written before President Trump announced the 90-day tariff pause on most countries, except China. However, this does not change the main takeaways from the article. China is now being imposed a huge 125% tariff, while the rest of the world is currently at 10%. This will still significantly impact the global economy.

MARKET UPDATE - The Silver Lining For REITs

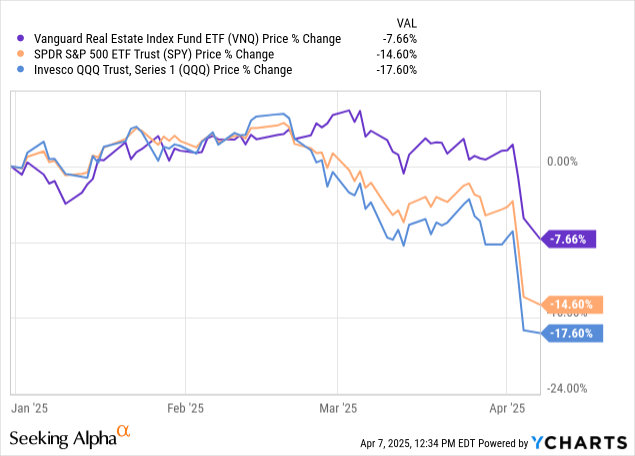

So far, in the current tariff-induced stock market crash, REITs (VNQ) have held up better than the rest of the market (SPY), especially Big Tech stocks (QQQ):

To be sure, if the proposed tariffs go into effect and stay in effect, it will be severely negative for real estate just as it will be for other sectors.

Tariffs will hurt all sorts of tenants, from residential to retail to industrial and, yes, even data centers.

The US exports a lot of technology services (think of SaaS, for example) to other countries. If foreign countries retaliate against US tech companies, American leadership and investment in AI could be dented.

In a general sense, there are few tenants in any sector of real estate who would benefit from the slower growth, higher inflation, and lower corporate profit margins that would come from sustained tariffs.

But there are some positive sides of this situation to highlight.

1. REITs Are Mostly Domestically Focused

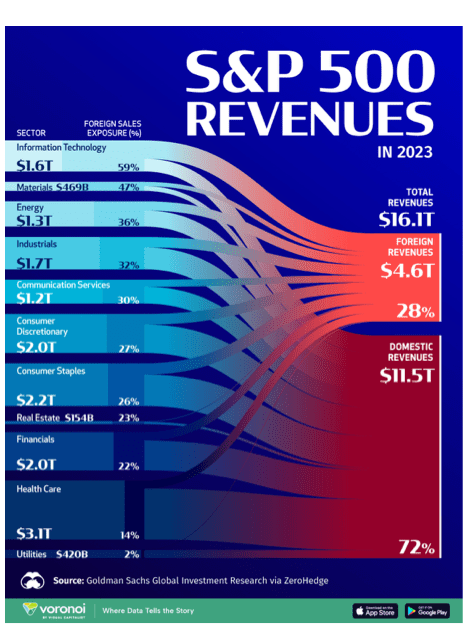

First of all, the real estate sector derives among the lowest level of revenue from foreign markets of any sector:

According to this illustration from Visual Capitalist, the US real estate sector derives 23% of total revenues from foreign markets. REITs like Prologis (PLD) and Simon Property Group (SPG) do own significant amounts of real estate in foreign markets.

But there are many REITs that derive virtually all revenue domestically.

To give an example, Whitestone REIT (WSR) owns retail centers in just five Sunbelt cities. Many of its tenants will be affected by tariffs, which is why WSR has sold off along with the rest of the market. But none of WSR's revenues are directly impacted by trade.

2. Higher Construction Costs Will Limit New Developments

An arguably bigger positive for REITs is the fact that tariffs will make (and in some cases, have already made) construction costs much higher, which in turn will reduce developments of new properties that would compete with REITs' existing portfolios.

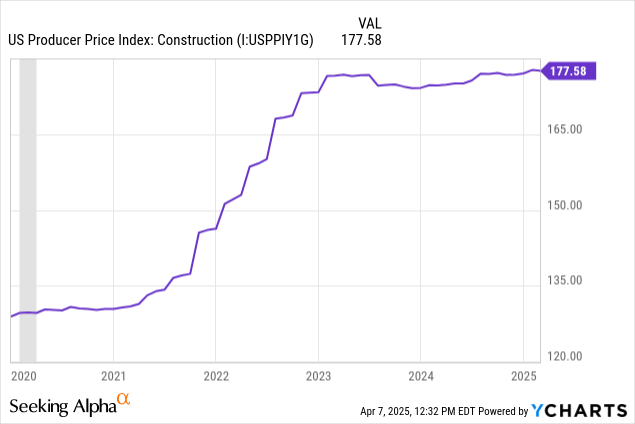

Construction costs have already increased significantly over the last five years as a result of COVID-related shocks. From 2021 to 2023, construction costs surged about 35%.

They plateaued in 2023 and 2024 as high mortgage rates cooled down homebuyer demand, but they have been creeping back up this year.

A recent survey of homebuilders found that the average US home is expected to increase in price by $9,200 as a result of Trump's tariffs. Whether it's softwood lumber, gypsum for drywall, or steel nails, countless inputs into residential construction are impacted by import taxes.

Think also about the light fixtures and appliances made in Asian countries or the flooring and stone imported from Latin America.

The same logic applies to commercial buildings.

Industrial buildings, for example, tend to use lots of steel and other metals.

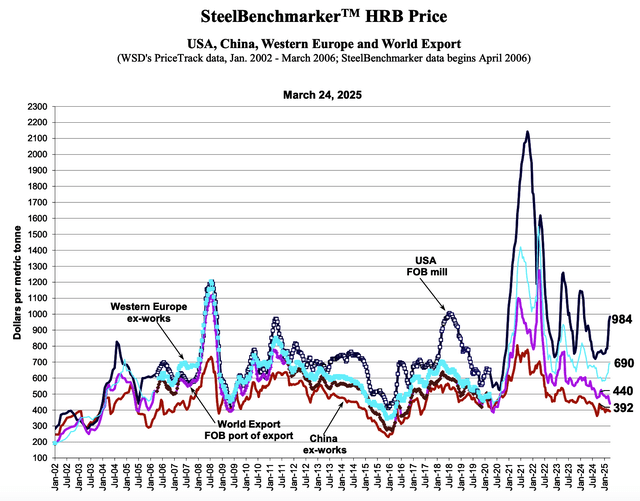

According to SteelBenchmarker's most recent pricing report, the average world export price of steel as of March 24th was $440 per ton. In the US, the average price per ton was $984.

Buyers of steel in the US are currently paying more than double the average buyer around the world is paying.

Tariff protections on the US steelmaking industry have given ample coverage for US producers to hike prices. So, whether using American-made steel or imported steel, the price has surged in recent months.

Not only can you see the spike in US steel prices from the last few months, but you can also see a similar spike in US steel prices after steel and aluminum tariffs were imposed in 2018. This is the inevitable effect of tariffs.

You can also see the massive spike in steel prices as the economy emerged out of the lockdown period of the pandemic. A huge surge in demand for steel coincided with supply chain breakdowns that acted in a similar (but worse) way to tariffs. Some foreign steel simply couldn't make it into the US, and some critical inputs into US steelmaking were unavailable as well.

In short, input costs for all sorts of materials used in construction are going to get meaningfully more expensive, which will decrease the number of development projects that make sense to pursue. This, in turn, will diminish the amount of new buildings that come to market and compete with REITs' existing portfolios.

3. The Fed Makes Bad News Good News

Finally, consider the fact that bad economic news translates into good monetary policy news.

In other words, all else being equal, weaker economic data makes the Federal Reserve more likely to cut rates sooner and to engage in more total cuts this year.

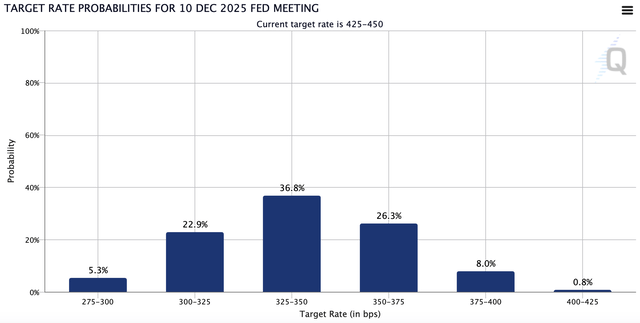

Two months ago, the consensus was that the Fed would cut rates 2-3 times this year.

Now the most likely outcome, according to CME's Fedwatch, is for 4 cuts over the course of this year.

The range of probable outcomes is between 3 and 5 cuts this year.

This is not primarily because of good inflation data. Fed chairman Jerome Powell recently stated the Fed's view that tariffs should cause inflation to increase this year.

Instead, these cuts are motivated by projections for economic weakness to come from the restriction of international trade.

So far, those Wall Street analysts who are forecasting a recession are only expecting a mild one. It could always spiral into a self-reinforcing cycle and become a more severe recession, but few experts are predicting that at this time.

If this turns out to be the case, then bad news really is good news for REITs, because the bad news (economic downturn) isn't that bad while the good news (Fed rate cuts and lower interest rates) is very good for REITs.

Bottom Line

Right now, we are in the midst of an uncertainty-fueled and indiscriminate market selloff. REITs are caught up in the selling, even though we would argue that they shouldn't be.

Before this selloff, REITs were one of the cheapest sectors of the stock market despite having one of the most positive fundamental outlooks, given falling inflation and interest rates as well as a shrinking construction pipeline.

In the wake of the tariff news, we would argue that REITs have become even more attractive relative to most of the market. Their existing portfolios are less impacted by tariffs than the average business. They should face significantly less competition from future developments. Higher construction costs mean higher replacement costs, which (all else being equal) means higher property values. And weaker economic growth should also translate into lower interest rates, as it has already been doing.

Yes, to the degree that tariffs hurt the entire economy, they will hurt REITs also.

But from a fundamental standpoint, REITs are a relative winner here. And the selloff is making some REITs' valuations extraordinarily compelling.

We will continue to update our members on the most compelling opportunities we see in the REIT space. Finally, please note that we exceptionally posted this article without a paywall. If you found it valuable, consider joining High Yield Landlord for a 2-week free trial.

You will also gain immediate access to my entire REIT portfolio, real-time trade alerts, exclusive REIT CEO interviews, and much more. We are the largest and highest-rated REIT investment newsletter online, with over 2,000 paid members and more than 500 five-star reviews.

We spend thousands of hours and over $100,000 per year researching the market for the most profitable investment opportunities, and we share the results with you at a tiny fraction of the cost.

Get started today - the first 2 weeks are on us:

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.

I am already a subscriber of high yield landlord. Can’t sign in. You keep sending me half articles.?