MARKET UPDATE - The June CPI Report Sparks A REIT Rally

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on July 3rd, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

Important Note:

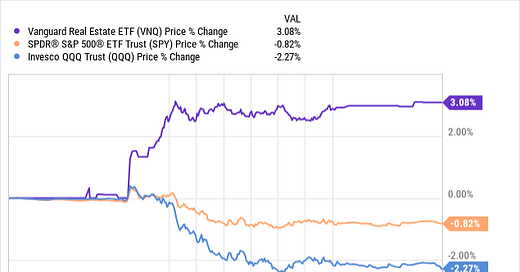

I was preparing to post a Trade Alert, but then the CPI report came out and it fueled a strong rally across the REIT sector. Many of the smaller and more heavily leveraged REITs like Safehold (SAFE), RCI Hospitality (RICK), etc. rose by over 10% in a single day.

Therefore, we will wait for next week and reevaluate what's the best REIT to buy right now. In the meantime, here is an update on the latest CPI report and why we think that this rally is likely to continue over the coming years.

=============================

MARKET UPDATE - The June CPI Report Sparks A REIT Rally

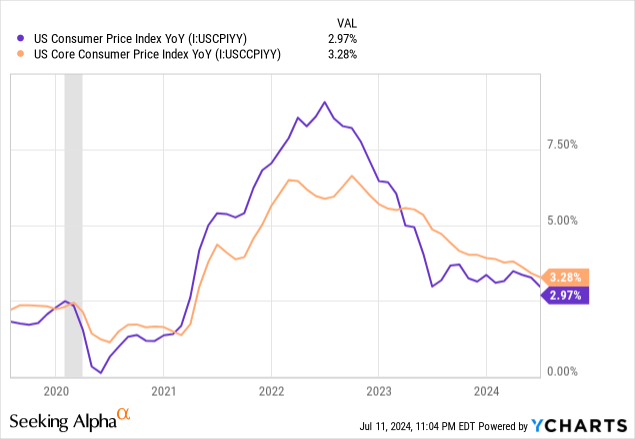

The June CPI report showed a continuation in the past few years' disinflationary trends.

While the headline CPI rate came in under 3% YoY for the first time since 2021, the core CPI metric (which omits food and energy and therefore puts a heavier weighting on the lagged shelter metrics) dropped only to 3.28%.

Of course, both the headline and core CPI measurements are polluted with severely lagging housing inflation metrics put out by the Bureau of Labor Statistics.

If you look at either the CPI ex shelter or Truflation's US consumer inflation metric, you'll find that they both put inflation at a mere 1.8% YoY.

As we have been saying for months, inflation has been defeated, and it is only a matter of time before it shows up in the official CPI and PCE metrics.

Keep reading with a 7-day free trial

Subscribe to High Yield Landlord to keep reading this post and get 7 days of free access to the full post archives.