MARKET UPDATE - The Impact Of Higher Tariffs On Consumers, Retailers, And Retail REITs

Dear Landlords,

I want to extend a warm welcome to all our new members! We recommend that you start by reading our Welcome Letter by clicking here. It explains why we invest in real estate through REITs and how to get started.

As a reminder, our most recent "Portfolio Review" was shared with the members of High Yield Landlord on October 4th, 2024, and you can read it by clicking here.

You can also access our three portfolios via Google Sheets by clicking here.

New members can start researching positions marked as Strong Buy and Buy while taking into account the corresponding risk ratings.

If you have any questions or need assistance, please let us know.

==============================

MARKET UPDATE - The Impact Of Higher Tariffs On Consumers, Retailers, And Retail REITs

How would a dramatic increase in tariff rates affect major American consumers, retailers, and retail REITs?

While both the Republican and Democratic parties have shifted toward protectionism and industrial policy in recent years, Donald Trump's marquee tariff proposals represent a far more significant shift away from the long predominant global trade system.

Trump's proposal includes:

10-20% tariffs on all imports, regardless of origin country

60% tariffs on all imports from China

Ad hoc tariffs levied on any US company that attempts to outsource production to a foreign country

These proposals make the 2018-2019 tariffs levied on China (maxing out at 25% for most types of goods) as well as Canadian and European steel and aluminum look relatively minor in comparison.

In my view, one of the areas of the US economy most threatened by this new tariff regime would be goods-importing retailers.

Whether tariffs hurt consumers via price increases or retailers via margin compression depends a lot on the strength of the consumer at the time the tariffs are implemented.

As we'll discuss below, we see this most clearly in the dollar store space. In 2018-2019, dollar stores' lower-income customers were not particularly strong, and therefore the tariffs largely hit the retailers' margins. It wasn't until 2021, when lower-income consumers were cash-rich due to fiscal stimulus programs, that dollar stores were able to raise prices meaningfully enough to repair their margins.

But for retailers that cater to middle-income or upper-income customers, such as Target, the tariffs caused only a temporary hit to margins because the retailers were able to quickly raise prices to offset tariff costs.

In lieu of a cash-rich consumer environment such as we had in 2021-2022, I think retailers that (1) serve low-income consumers, (2) have ample competition against large peers, and (3) are unable to source low-cost inventory from non-Chinese suppliers will suffer a major blow if Trump's proposed tariffs are implemented.

In what follows, we'll dig into this topic. It is a comprehensive discussion, so bear with us.

Afterward, we'll look at what retail REITs are most exposed to the highest-risk area of retail in a higher tariff scenario. This could have a major impact on some of our near-term investment decisions depending on the election outcome.

Ground Zero: Dollar Stores

The first thing to emphasize is that dollar stores overwhelmingly serve a lower-income customer base.

Over 60% of dollar store sales derive from households that earn less than $35,000 per year.

In the last five or so years, a handful of factors have coalesced into a perfect storm of pain for dollar stores -- or at least a certain type of dollar store.

The biggest and arguably most successful dollar store chain is Dollar General (DG), which typically locates its stores in rural areas and small towns with minimal competition from big box stores and (at least until recently) e-commerce giants like Amazon (AMZN).

Meanwhile, both the Dollar Tree and Family Dollar brands are owned by Dollar Tree (DLTR), and both are typically found in urban or suburban areas. The upside of this type of location is access to a much larger customer base. The downside is that stores face much greater competition from big box stores and rapid delivery from e-commerce retailers.

The "perfect storm" dollar stores, especially DLTR's two brands, have faced over the last five years has multiple parts:

The tariffs on Chinese goods introduced in 2018-2019 squeezed margins, as DLTR could not successfully negotiate input price reductions nor could it raise prices sufficiently to maintain margins.

The surge of inflation experienced in the wake of COVID-19 forced dollar stores to raise prices above $1 for the first time, starting in 2021. They have also had to raise prices on a per-unit basis in other ways, such as shrinkflation, which has diminished their appeal to lower-income consumers.

In the years after the pandemic, an epidemic of retail theft caused significant shrink issues for certain retailers, especially urban dollar stores.

Over the last year or so, lower-income consumers have become increasingly strained under the weight of the last several years' inflation and are being forced to cut back on consumption.

Competition for lower-income consumers' spending power is heating up, including from major players like Walmart (WMT) and Amazon.

On that last point, here's a quote from a recent article in the Wall Street Journal:

Now Amazon is beefing up its delivery to far-flung parts of the U.S., threatening dollar stores’ corner on convenience. And investments by big-box retailers to integrate their in-person and online shopping services are paying off, with Walmart outperforming earnings and revenue expectations this year as its e-commerce sales grow.

On top of that, dollar stores have basically no online sales platforms and little desire to create them. Margins are already razor-thin for brick-and-mortar sales and would be negative for e-commerce sales, if dollar stores offered them. Instead, Family Dollar has partnered with Instacart for certain food deliveries, while Dollar General has partnered with DoorDash.

But given that online sales remain extremely minimal for dollar stores, the primary area of importance is winning customers at the in-store space.

That's exactly where both Dollar General and Dollar Tree are struggling.

As prices at dollar stores have soared from $1 to a range of up to $7 in recent years, customers are less and less motivated to frequent them instead of going to Walmart or shopping online.

The area of discretionary merchandise has been particularly hard hit.

Once a haven for party and Halloween shoppers as well as inexpensive home decor, dollar store prices on these items have converged with those offered at Walmart and discount stores like Ross (ROST) and T.J. Maxx (TJX), diminishing their low-cost advantage.

It doesn't help that big box retailers like Walmart have actually lowered prices on a range of goods this year.

What happened? How did dollar stores lose their definitive low-cost advantage?

To answer that question, we have to look at the supply side.

In no small part, dollar stores have been losing their competitive advantage because of tariffs on Chinese imports.

“We will do everything we can to minimize the impact of tariffs on our customers," said Dollar General's CFO John Garratt in 2019, "but even with these efforts, we believe our shoppers will be facing higher prices as 2019 progresses."

In 2018, the Trump administration imposed a 10% tariff on a wide variety of goods from China, and then tariff rates increased to 25% in the Spring of 2019.

Retailers basically have five possible options for how to deal with tariffs on imported goods:

Raise prices

Reduce package or unit sizes (shrinkflation)

Absorb costs by allowing margins to decline

Try to negotiate lower prices with foreign suppliers

Switch to domestic suppliers

All but #3 and #4 involve consumer inflation. The most common ways of dealing with tariffs is a combination of #1 and #2, with some of #3 and #4 also part of the solution. The 5th option -- to domesticate production -- is often prohibitively expensive.

And when foreign suppliers do agree to lower prices, it is usually not without some impact on product quality.

To quote from a 2020 Forbes article:

To save money, suppliers will make sacrifices around material composition and quality, and they’ll also tweak designs to reduce costs. In fact, many manufacturers will reduce the length of pants pockets or push short-sleeved designs to save on material.

Why not simply switch from a Chinese supplier to a non-Chinese supplier? Well, it's not always so simple.

While geographic diversification approaches sound like an easy fix, the ramifications and risks involved are significant. One challenge is around planning and capacity. These new geographic partners might not have the factory space, capabilities or raw material to support the needs of a major retailer’s production runs.

Not to mention the fact that even if quality standards are adequate, the costs of production in these non-Chinese countries may be meaningfully higher.

In 2018, when the tariffs on Chinese imports were first introduced, dollar store executives initially stated their desire to negotiate with their suppliers or switch to non-Chinese suppliers to avoid consumer price increases. But over the course of 2019, dollar stores did gradually roll out price hikes for wide swathes of products.

It turned out that, in many cases, the only suppliers with the specific production equipment and machinery required to make dollar store products were located in China. Given the scarcity of similar specialized equipment in other countries, these Chinese suppliers refused to meaningfully lower their prices, which meant that US dollar stores could not push the cost of the tariffs onto their Chinese suppliers.

Hence the actions taken to effectively raise prices.

Back in 2019, the average customer may have scarcely noticed the moves dollar stores were making behind the scenes. There was some shrinkflation and minor price hikes, but virtually all products remained priced at $1.

You can't really see the effect of tariffs -- or inflation, for that matter -- on same-store sales:

The revenue side has been impacted far less than operating income and profits.

That's especially true for Dollar Tree, which faces greater competition and is more reliant on discretionary product sales than Dollar General.

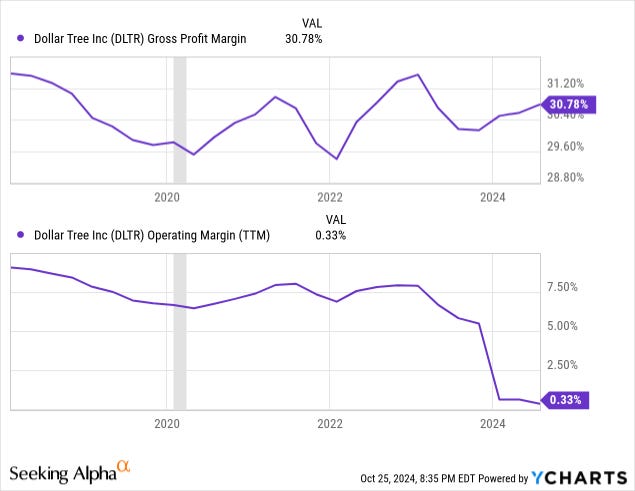

Starting in 2018 but especially 2019, you can see the major impact that the tariffs had on DLTR's operating income and profits:

Of course, looking at totals doesn't give the clearest picture of how the tariffs affected DLTR's margins.

When we look specifically at DLTR's gross profit and operating margins, we find that they very clearly declined (and quite considerably so) as the tariffs were ramped up in Q4 2018 and over the course of 2019:

Margins only began to rebound in 2021 when DLTR raised prices.

Fortunately for the dollar stores, the sheer amount of consumer-focused fiscal stimulus spending (stimulus checks, enhanced unemployment benefits, etc.) in 2020 and 2021 allowed them to raise prices sufficiently enough to fully restore margins.

Supply chain kinks as well as the need to mark down prices to clear oversupplies of inventory lead DLTR's margins to swing wildly after initially repairing them in 2020 and 2021.

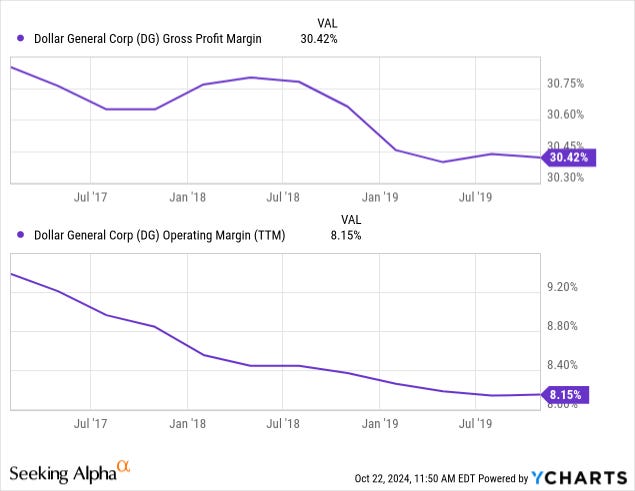

Meanwhile, since Dollar General has less competition and focuses more on essential, consumable products, it has been a bit more successful at passing on input cost increases to customers in the form of price hikes and/or shrinkflation.

The chart above is a bit deceptive, though, because total revenue, operating income, and net income includes the effect of new store openings.

If we instead look at Dollar General's gross profit and operating margins, we find that both declined in the wake of the tariffs.

As for DLTR, though, Dollar General's margins rebounded in 2021 when the retailer began raising prices.

To be fair, though, after initially repairing its margin in 2021, Dollar General's lower-income customer base began materially weakening in 2022 and after, which has diminished the retailer's ability to raise prices even as inflationary cost pressures remain. Hence the drop in Dollar General's margins over the last year or two as well:

With tariffs still in place on Chinese imports and lower-income consumers still strained, it is unclear what could turn around this downward trend in Dollar General's margins.

Five Below

Likewise, fellow dollar store / deep-discounter Five Below (FIVE) also imports a huge portion of its inventory from China, much of it discretionary, and has struggled to maintain an edge with customers in the post-COVID inflationary era.

According to FIVE executives in the Q3 2019 earnings conference call, FIVE's gross margin declined 120 basis points from Q2 to Q3 2019 because of the tariffs, and operating income decreased 18.4% QoQ even including offsetting corporate expense cuts.

Over the following quarters, FIVE fully restored its gross margin, which came mostly from price increases along with some cost saving measures.

Just as for Dollar Tree and (to a lesser degree) Dollar General, these price increases have played a role in FIVE losing its competitive edge against Walmart, big box discounters, and Amazon.

FIVE has seen some of the margin compression that DLTR and DG have seen over the last year or so, but given its higher starting price point, it has been better able to pass higher input costs along to customers in the form of incremental price increases.

Proposed Tariff Hikes Vs. Dollar Stores

If a potential future Trump administration does implement the tariff rates that have been proposed, including a 10-20% tax on all imports and a 60% (or higher) tax on all Chinese imports, how would dollar stores be able to deal with it?

The best case scenario is one in which dollar stores manage to shift their product offerings away from imported goods and more heavily into non-imported consumables.

Presumably, the USMCA trade deal will still be in effect over the next four years, and Mexican manufacturers might be able to step in to produce certain goods while avoiding tariffs. (Although Trump has threatened tariffs even on imports from Mexico.)

The worst case scenario would be that dollar stores are forced to deal with the new tariffs in a combination of the 5 options discussed above, largely passing costs onto customers and/or eating the costs and allowing margins to be compressed. That is exactly what happened to DLTR in 2018-2019.

This worst case scenario would also see the low-cost advantage traditionally enjoyed by dollar stores slip further away, as Amazon, Walmart, and other big box discounters with their own supply channels increase their competitive edge against dollar stores.

Alternatively, if lower-income customers are unable or unwilling to absorb price increases like they were in 2021, dollar store margins could be sustainably compressed. And this margin compression would be significantly worse if all imports are subject to 10-20% tariffs while Chinese imports are tariffed at 60% or more.

Which scenario is most likely?

Honestly, the most likely outcome would probably be somewhere between these two polar extremes.

Walmart

We have talked a lot about Walmart (WMT) so far, but how exactly would the retail giant handle the proposed tariffs?

First of all, consider that nearly 60% of Walmart's sales come from groceries, wherein it is easier to pass increased input costs on to consumers. If blueberries imported from Peru become 10-20% more expensive, they will still probably be the cheapest at Walmart.

Just as across-the-board inflation has benefited Walmart's "everyday low prices" as consumers trade down from higher-priced stores, inflation triggered by across-the-board tariffs would likely have a similar effect.

In 2018, Walmart executives warned that tariffs would spur the company to raise prices, as 26% of their inventory was imported from China at the time. (That was actually lower than Target's 34%.)

NPR tracked a basket of various goods sold at Walmart and found a range of price hikes in the year after the tariffs were imposed:

Despite the range of price increases on a variety of products, Walmart's gross margin declined over the course of 2019 as the company largely chose to absorb the tariff costs instead of raise prices to fully offset them.

As for other retailers, it wasn't until 2021, when consumers were cash-rich and eager to spend, that Walmart repaired its margins through price hikes.

Surely another round of tariff hikes would have a similar effect -- either sustained margin compression or price hikes, depending on the financial state of the consumer.

It also must be said that as the largest retailer in the world, Walmart is better positioned than any other American retailer or business to pressure foreign suppliers to lower their prices to offset tariff costs. Even this wasn't enough to prevent Walmart's gross margin from declining in 2019, but if anyone is able to blunt the blow by forcing suppliers to share the costs, it's Walmart.

Target

Although Target (TGT) initially insisted that it would not shoulder the financial burden of the tariffs, telling suppliers that it would "not accept any new cost increases related to goods imported from China," CEO Brian Cornell ended up admitting on the Q3 2019 earnings conference call that Target bore about $240 million of annualized costs from the tariffs. Most of that was passed on to customers in the form of price increases.

Target was very quickly able to rebuild its gross profit and operating margins via price hikes, returning them to pre-tariff levels by the end of 2019:

Like Walmart, Target has shifted its supply channels and vendor mix over the last several years to become significantly less reliant on China.

Tractor Supply Company

Back in 2018-2019, the tariffs caused a small but noticeable hit to Tractor Supply's margins, but the retailer began raising prices almost immediately after the pandemic began to take advantage of suddenly elevated consumer demand.

But today, Tractor Supply has made changes to its supply chains to be more resilient to potential future tariffs.

Here's how TSCO's CFO Kurt Barton responded to a question about the potential for higher tariffs at the Goldman Sachs 2024 Global Retailing Conference:

For the last five years, we've done a lot since the first round of tariffs to really mitigate the risk and move inventory out of a primary country, such as China, into other Asian countries, Mexico, et cetera. And ultimately, we're probably more insulated by that exposure than most retailers, where only about 12% of our product is purchased direct sourced overseas. So, we're a bit insulated with a heavy domestic purchase company, but we've also mitigated that over the last few years, and really feel like while we managed well the previous round of that, if this were to come, it's a scenario that we're planning for, and we feel like we can manage it well.

Although it has sometimes led to higher priced product offerings than its retail peers, TSCO's movement away from imports (especially Chinese) over the last few years should be beneficial in a higher tariff environment.

T.J. Maxx

What about the strong and fast-growing off-price/discount chains owned by T.J. Maxx (TJX)?

TJX's inventory sourcing is widely varied, from unsold products handed off from US department stores to specially made "outlet store"-style goods largely sourced from foreign producers.

This varied sourcing model made the hit to margins relatively minor for TJX in the second half of 2018 and 2019:

As for the other retailers discussed above, TJX managed to rebuild its margins in 2021 and 2022 through price hikes.

Bottom Line

American retailers are a mixed bag, so to speak, when it comes to insulation from tariffs.

Some, like Target, Tractor Supply, and T.J. Maxx, are either able to pass higher costs along to customers in the form of price hikes or can shift their supply lines to minimize the damage.

But retailers that serve lower-income customers, have lots of competition from other low-cost providers, and have little ability to source cheaper goods from elsewhere in the world are the worst positioned to handle Trump's proposed tariffs.

Dollar stores appear to be in the weakest position of all.

In the worst case scenario, a higher tariff regime could halt virtually all dollar store brick-and-mortar expansion and lead to a wave of store closures. Dollar stores already have very thin profit margins, and pushing up their cost of goods sold via high tariffs during a time when their customers are unable to absorb price increases would undoubtedly make a certain portion of their stores unprofitable.

All else being equal, this makes us less positive toward exposure to dollar store real estate.

That is not to say that these buildings are not fungible and could not be re-leased to other tenants. But the most logical type of tenant to backfill a dollar store would be another dollar store operator. If dollar stores are hurting from high tariffs, it is unlikely that another dollar store would backfill the space.

This increases the risk of extended vacancies, higher rent concessions, and larger capital expenditures to reposition properties.

Here are the REITs with the most exposure to dollar stores:

As you can see, the two REITs with greatest exposure to dollar stores are NetStreit and Alpine Income Property Trust. We think double-digit percentages of dollar store exposure is too high and too much risk.

Even Agree Realty and Realty Income's shares of dollar stores present some risk, but we believe that in the worst plausible scenario, they would be able to manage their risks and vacancies.

Please click the ♡ button and share to help us grow. Thank you!

============================

Refer a Friend and Earn Rewards

If you find our research valuable, please show your support by sharing High Yield Landlord with friends and family. You will earn rewards for your referrals.

============================

Access Our Course to REIT Investing

Don't forget to take our 10-Module Course on REIT investing! The entire course is available to members for free as part of your membership.

============================

Access Our Portfolios Via Google Sheets

Our three portfolios are available through Google Sheets. These sheets provide detailed information on position sizes, risk ratings, and key metrics to help you make well-informed investment decisions:

============================

Access Our REIT Market Intelligence Sheet

This exclusive tool includes a list of all equity REITs grouped by property sector, providing all the information you need to make better decisions: FFO multiple, dividend yield, payout ratio, credit rating, and much more.

============================

Access Our Portfolio Tracker

The HYL Portfolio Tracker is a Google Spreadsheet designed specifically for members of High Yield Landlord. It helps you track all your HYL investments in one place with a simple format. It is very easy to use, so don't miss out on this free feature!

============================

Access Our Live Chat

Our live chat room is where the HYL community comes together to share market news, discuss investment ideas, and help new members get started. Members can post questions and receive prompt answers from other real estate investors and our team.

============================

Finally, feel free to contact us anytime. You can send me a direct message on the chat or email me at jaskola@leonbergcapital.com

Sincerely,

Jussi Askola & Austin Rogers

Analyst's Disclosure: I/we have a beneficial long position in the shares of all companies held in the CORE PORTFOLIO, RETIREMENT PORTFOLIO, and INTERNATIONAL PORTFOLIO either through stock ownership, options, or other derivatives. High Yield Landlord® ('HYL') is managed by Leonberg Research, a subsidiary of Leonberg Capital. All rights are reserved. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The newsletter is impersonal and subscribers/readers should not make any investment decision without conducting their own due diligence, and consulting their financial advisor about their specific situation. The information is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. The opinions expressed are those of the publisher and are subject to change without notice. We are a team of five analysts, each contributing distinct perspectives. Nonetheless, Jussi Askola, the leader of the service, is responsible for making the final investment decisions and overseeing the portfolio. We do not always agree with each other and an investment by Jussi should not be taken as an endorsement by other authors. Past performance is no guarantee of future results. Our portfolio performance data is provided by Interactive Brokers and believed to be accurate but its accuracy has not been audited and cannot be guaranteed. Our portfolio may not be perfectly comparable to the relevant index. It is more concentrated and may at times use margin and/or invest in companies that are not typically included in REIT indexes. Finally, High Yield Landlord is not a licensed securities dealer, broker, US investment adviser, or investment bank. We simply share research on the REIT sector.